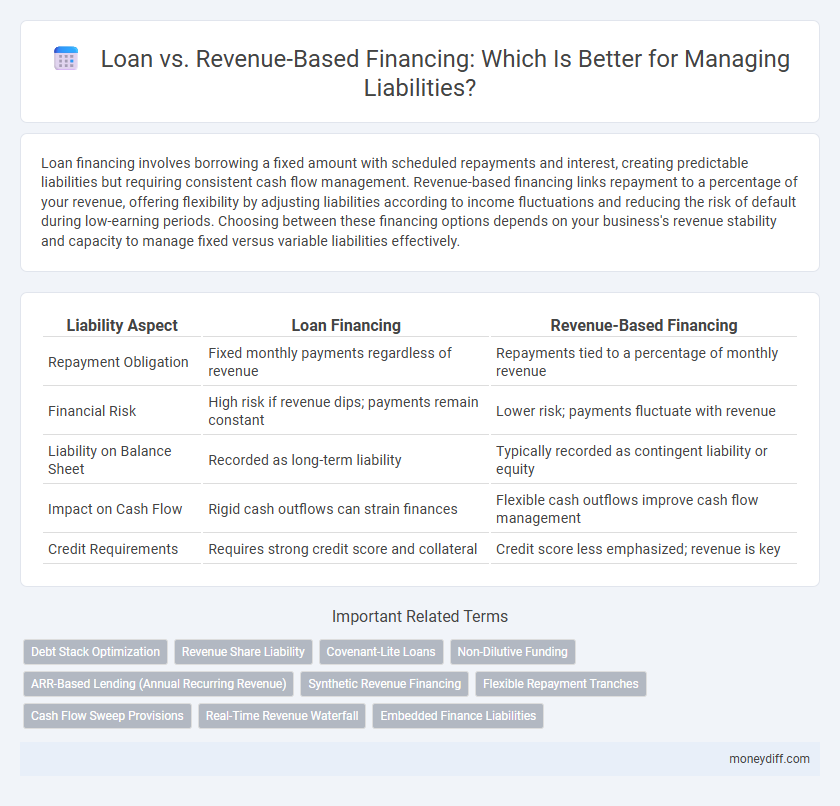

Loan financing involves borrowing a fixed amount with scheduled repayments and interest, creating predictable liabilities but requiring consistent cash flow management. Revenue-based financing links repayment to a percentage of your revenue, offering flexibility by adjusting liabilities according to income fluctuations and reducing the risk of default during low-earning periods. Choosing between these financing options depends on your business's revenue stability and capacity to manage fixed versus variable liabilities effectively.

Table of Comparison

| Liability Aspect | Loan Financing | Revenue-Based Financing |

|---|---|---|

| Repayment Obligation | Fixed monthly payments regardless of revenue | Repayments tied to a percentage of monthly revenue |

| Financial Risk | High risk if revenue dips; payments remain constant | Lower risk; payments fluctuate with revenue |

| Liability on Balance Sheet | Recorded as long-term liability | Typically recorded as contingent liability or equity |

| Impact on Cash Flow | Rigid cash outflows can strain finances | Flexible cash outflows improve cash flow management |

| Credit Requirements | Requires strong credit score and collateral | Credit score less emphasized; revenue is key |

Understanding Liability: Loans vs Revenue-Based Financing

Loans create fixed liabilities with scheduled repayments impacting cash flow and credit obligations, making them less flexible for unpredictable revenue cycles. Revenue-based financing ties repayments to a percentage of monthly revenue, reducing fixed liabilities and aligning liability repayment with business performance. Understanding these distinctions helps businesses manage financial risk and maintain balanced liabilities.

Key Differences in Liability Structures

Loan financing creates a defined liability with fixed repayment schedules and interest obligations recorded as long-term or short-term liabilities on the balance sheet. Revenue-based financing links repayments directly to a percentage of future revenue, resulting in a variable liability that fluctuates with business performance and is often treated as contingent or off-balance-sheet liability. Understanding these key differences in liability structures impacts financial risk assessment, cash flow management, and balance sheet presentation for businesses.

Impact on Balance Sheet: Loan vs Revenue-Based Financing

Loans increase liabilities on the balance sheet as fixed debt obligations, impacting debt-to-equity ratios and potentially affecting creditworthiness. Revenue-based financing appears more flexible, often classified off-balance sheet or as contingent liabilities, minimizing immediate impact on reported debt levels. This distinction influences financial ratios, risk assessment, and borrowing capacity for businesses managing liabilities.

Repayment Terms and Liability Implications

Loan repayment terms typically involve fixed monthly payments with a clear schedule, creating predictable liability obligations reflected on the balance sheet as debt. Revenue-based financing requires payments as a percentage of monthly revenue, resulting in flexible liability exposure tied to business performance without fixed debt classification. This structure affects financial liability risk management and influences how creditors and investors view the company's obligations.

Risk Exposure: Traditional Loans versus RBF

Traditional loans create fixed liabilities with scheduled principal and interest payments, increasing risk exposure through cash flow obligations regardless of business performance. Revenue-Based Financing (RBF) aligns repayment with revenue fluctuations, reducing the risk of default during low-income periods but potentially increasing total cost if revenues grow. Understanding these differences is critical for managing financial risk and optimizing liability structures in business financing.

Covenants and Restrictions: Liability Considerations

Loan agreements often include strict covenants and financial ratios that impose liability risks for borrowers, requiring adherence to specific conditions to avoid default. Revenue-based financing typically offers more flexible terms with fewer covenants, reducing potential liability burdens but possibly increasing costs based on revenue fluctuations. Understanding the scope and impact of covenants in each financing structure is critical for managing liability exposure effectively.

Flexibility of Liability Repayment

Loan agreements typically involve fixed repayment schedules and interest rates, creating a predictable but rigid liability structure. Revenue-based financing offers greater flexibility by tying repayments directly to business revenue, adjusting liability obligations based on earnings fluctuations. This dynamic repayment model reduces the burden during low-revenue periods, enhancing financial agility in managing liabilities.

Tax Implications of Loan vs RBF Liabilities

Loan liabilities typically generate tax-deductible interest expenses, reducing taxable income and providing a clear tax advantage for businesses. Revenue-Based Financing (RBF) liabilities, however, involve payments tied to revenue percentages that are generally not tax-deductible as interest but treated as operating expenses, affecting tax treatment differently. Understanding these distinctions is crucial for optimizing tax strategies and managing financial liabilities effectively.

Long-Term Liability Management Strategies

Loan financing creates a fixed long-term liability with predictable monthly payments and interest obligations, facilitating structured debt management. Revenue-based financing links repayments directly to business revenue, offering variable liability levels that fluctuate with income but may complicate long-term cash flow projections. Effective liability management requires evaluating repayment predictability, cost of capital, and impact on balance sheet stability to align financing choices with sustainable growth objectives.

Choosing the Right Financing Tool for Sustainable Liabilities

Loan financing involves fixed repayment schedules and interest rates, creating predictable liabilities that aid in long-term financial planning. Revenue-based financing adjusts repayments according to revenue performance, offering flexible liability management aligned with cash flow variability. Selecting the appropriate financing tool depends on a business's revenue stability and risk tolerance to ensure sustainable liability handling.

Related Important Terms

Debt Stack Optimization

Loan financing typically adds fixed liabilities to the debt stack, increasing leverage ratios and impacting covenants, while revenue-based financing ties repayment obligations directly to cash flow, providing flexible liability management that reduces default risk. Optimizing the debt stack involves balancing traditional loans with revenue-based instruments to maintain manageable liabilities, improve credit profiles, and enhance overall capital efficiency.

Revenue Share Liability

Revenue Share Liability in revenue-based financing differs from traditional loan liability by tying repayments directly to a percentage of business revenue, creating a flexible obligation that fluctuates with income. Unlike fixed loan payments that accumulate a predictable debt liability on the balance sheet, revenue share liability adjusts monthly, aligning creditor risk with business performance and impacting cash flow management.

Covenant-Lite Loans

Covenant-lite loans reduce borrower restrictions, increasing liability risk compared to traditional loans usually tied to stringent covenants that protect lenders. Revenue-based financing shifts liability by linking repayment directly to business income, offering flexible cash flow management without fixed obligations typical of standard loan agreements.

Non-Dilutive Funding

Loan financing creates a fixed liability on the balance sheet with set repayment terms and interest, impacting cash flow predictability. Revenue-based financing offers non-dilutive funding by tying repayments to a percentage of revenue, providing flexible liability management aligned with business performance.

ARR-Based Lending (Annual Recurring Revenue)

ARR-based lending leverages predictable Annual Recurring Revenue as collateral, offering flexible repayment terms that align with business cash flow, unlike traditional loans that impose fixed liabilities. This revenue-based financing model minimizes risk by adjusting payments according to actual ARR performance, optimizing capital structure without increasing long-term debt obligations.

Synthetic Revenue Financing

Synthetic revenue financing reduces traditional liability on the balance sheet by structuring loan repayments around a percentage of future revenue, unlike conventional loans that incur fixed debt obligations. This dynamic repayment method aligns cash flow with business performance, minimizing default risk and preserving borrowing capacity.

Flexible Repayment Tranches

Loan agreements typically require fixed repayment schedules with set interest rates, creating predictable but rigid liability obligations, while revenue-based financing offers flexible repayment tranches tied to a percentage of monthly revenue, allowing for variable liability that adjusts with business performance. This flexible repayment structure in revenue-based financing reduces the risk of default during periods of lower revenue by aligning liability obligations directly with cash flow fluctuations.

Cash Flow Sweep Provisions

Loan agreements with cash flow sweep provisions typically require borrowers to use excess cash flow to repay debt promptly, increasing liability reduction pace but potentially straining liquidity. In contrast, revenue-based financing ties repayments to a percentage of monthly revenue, offering flexible liability management without the rigid repayment triggers seen in cash flow sweep clauses.

Real-Time Revenue Waterfall

Loan liability involves fixed repayment schedules that impact cash flow predictability, whereas revenue-based financing liability fluctuates with actual earnings, aligning repayments with business performance. Real-time revenue waterfall tracking enables precise monitoring and management of revenue-based financing liabilities, ensuring timely and transparent adjustments tied to revenue streams.

Embedded Finance Liabilities

Loan liabilities typically involve fixed repayment schedules with interest obligations, impacting embedded finance platforms through predictable cash flow commitments, while revenue-based financing liabilities fluctuate based on borrower revenue performance, introducing variable repayment terms that require dynamic liability management within embedded financial services. Understanding these differences helps optimize embedded finance liability structures by aligning repayment risk profiles with platform cash flow strategies.

Loan vs Revenue-Based Financing for liability. Infographic

moneydiff.com

moneydiff.com