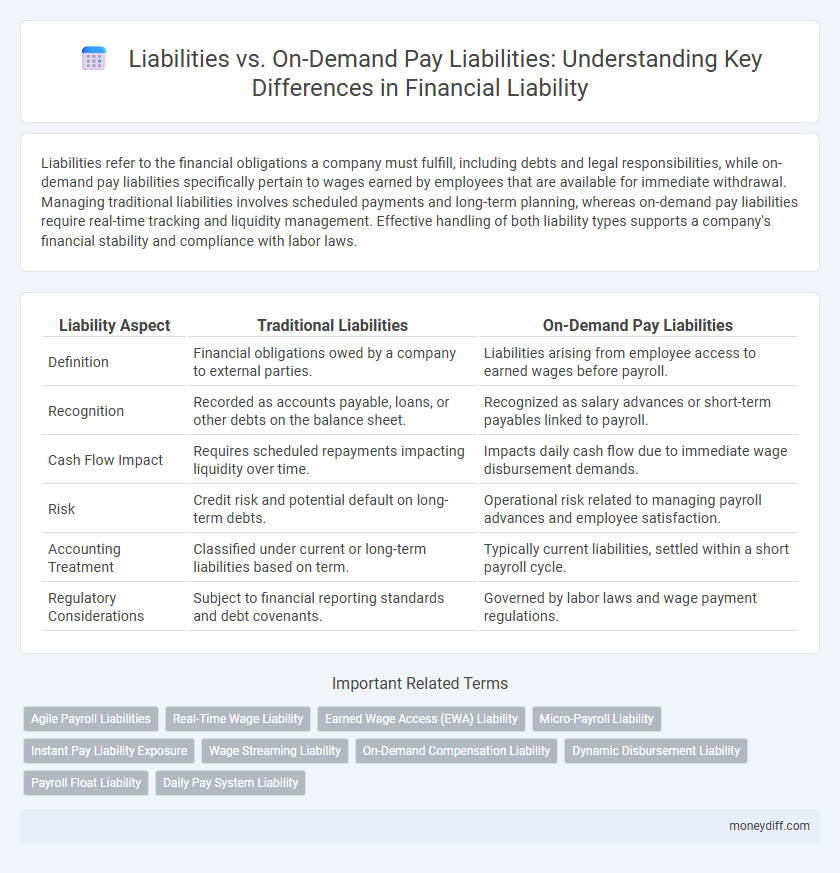

Liabilities refer to the financial obligations a company must fulfill, including debts and legal responsibilities, while on-demand pay liabilities specifically pertain to wages earned by employees that are available for immediate withdrawal. Managing traditional liabilities involves scheduled payments and long-term planning, whereas on-demand pay liabilities require real-time tracking and liquidity management. Effective handling of both liability types supports a company's financial stability and compliance with labor laws.

Table of Comparison

| Liability Aspect | Traditional Liabilities | On-Demand Pay Liabilities |

|---|---|---|

| Definition | Financial obligations owed by a company to external parties. | Liabilities arising from employee access to earned wages before payroll. |

| Recognition | Recorded as accounts payable, loans, or other debts on the balance sheet. | Recognized as salary advances or short-term payables linked to payroll. |

| Cash Flow Impact | Requires scheduled repayments impacting liquidity over time. | Impacts daily cash flow due to immediate wage disbursement demands. |

| Risk | Credit risk and potential default on long-term debts. | Operational risk related to managing payroll advances and employee satisfaction. |

| Accounting Treatment | Classified under current or long-term liabilities based on term. | Typically current liabilities, settled within a short payroll cycle. |

| Regulatory Considerations | Subject to financial reporting standards and debt covenants. | Governed by labor laws and wage payment regulations. |

Understanding Liabilities in Money Management

Liabilities represent financial obligations a company owes, including loans, accounts payable, and mortgages, which impact overall money management and cash flow planning. On-demand pay liabilities refer specifically to short-term debts incurred through employee wage advances that must be managed promptly to maintain liquidity. Effective understanding of these liabilities ensures accurate financial forecasting and helps balance immediate cash needs with long-term debt responsibilities.

Defining Traditional Liabilities

Traditional liabilities represent financial obligations recognized on a company's balance sheet, including accounts payable, loans, and accrued expenses payable within a set timeframe. These liabilities require scheduled payments and are recorded based on contractual terms or statutory requirements, impacting the company's liquidity and creditworthiness. In contrast, on-demand pay liabilities allow employees immediate access to earned wages before the regular payroll cycle, shifting the short-term liability management to dynamic, real-time payouts instead of fixed-period obligations.

What Are On-Demand Pay Liabilities?

On-demand pay liabilities represent employer obligations to advance earned wages to employees before the regular payroll date, creating immediate short-term financial responsibilities. Unlike traditional liabilities, these require real-time tracking of accrued but unpaid wages, impacting cash flow management and necessitating robust accounting controls. Businesses must accurately account for on-demand pay liabilities to ensure compliance with labor laws and maintain transparent financial reporting.

Key Differences: Liabilities vs On-Demand Pay Liabilities

Liabilities represent general financial obligations owed by a company, including loans, accounts payable, and accrued expenses, recorded on the balance sheet. On-demand pay liabilities specifically reflect employee earnings available for immediate withdrawal before the regular payday, creating a distinct short-term liability category. Key differences lie in their nature and timing: traditional liabilities are scheduled and often long-term, while on-demand pay liabilities are flexible and short-term, linked directly to payroll management.

Impact of On-Demand Pay on Business Liabilities

On-Demand Pay (ODP) introduces a dynamic shift in business liabilities by accelerating wage disbursement, resulting in increased short-term liabilities on financial statements. Unlike traditional liabilities, ODP creates fluctuating payroll obligations that require careful cash flow management to avoid liquidity issues. Businesses leveraging ODP must optimize liability tracking systems to ensure compliance and maintain financial stability amid the real-time pay processing environment.

Financial Reporting for On-Demand Pay Liabilities

On-demand pay liabilities require careful financial reporting to accurately reflect the company's obligations related to employee earnings accessed before regular payroll cycles. These liabilities must be classified separately from traditional liabilities to provide clarity on liquidity and cash flow risks associated with instant wage access. Proper disclosure ensures compliance with accounting standards and helps stakeholders assess the financial impact of on-demand pay programs.

Risk Assessment: Traditional vs On-Demand Pay Liabilities

Traditional liabilities often involve fixed repayment schedules and fixed interest rates, which can lead to predictable but rigid risk exposure for businesses. On-demand pay liabilities introduce variable risk factors due to their flexible, immediate payout structure, increasing liquidity risk but enhancing payroll cash flow management. Risk assessments must weigh the stability of traditional liabilities against the adaptive but potentially volatile nature of on-demand pay liabilities.

Managing Cash Flow with On-Demand Pay Liabilities

On-demand pay liabilities offer businesses enhanced cash flow management by aligning payroll expenses with actual wage disbursement timing, reducing the need for large upfront liability reserves compared to traditional liabilities. This approach minimizes idle cash and improves liquidity, enabling companies to reinvest working capital more efficiently. Utilizing on-demand pay liabilities transforms payroll obligations into flexible, real-time liabilities that adjust dynamically based on employee pay activity.

Regulatory Requirements for On-Demand Pay Liabilities

On-demand pay liabilities involve regulatory scrutiny to ensure compliance with wage laws and consumer protection standards, often requiring adherence to federal and state labor regulations. Financial institutions offering on-demand pay services must implement robust reporting mechanisms and maintain transparent records to meet regulatory auditing standards. Failure to comply can result in penalties, emphasizing the importance of aligning on-demand pay liability management with evolving regulatory frameworks.

Best Practices for Tracking and Reducing Liabilities

Effective tracking of liabilities requires implementing real-time accounting systems that differentiate between traditional liabilities and on-demand pay liabilities, ensuring accurate financial reporting and compliance. Utilizing automated reconciliation tools minimizes errors and provides continuous monitoring of outstanding obligations, while predictive analytics help forecast liability trends and optimize cash flow management. Establishing clear policies for on-demand pay liabilities, including caps and timely settlements, reduces risk exposure and enhances overall financial stability.

Related Important Terms

Agile Payroll Liabilities

Agile payroll liabilities streamline the management of both traditional liabilities and on-demand pay liabilities by enabling real-time tracking and settlement of employee wage obligations. This approach reduces financial risk and enhances cash flow predictability by aligning payments closely with workforce activity and payroll cycles.

Real-Time Wage Liability

Real-time wage liability enables businesses to instantly recognize and report wages owed, reducing discrepancies compared to traditional liabilities that accumulate and are reconciled periodically. On-demand pay liabilities require precise, up-to-date tracking to ensure immediate availability of earned wages, minimizing financial risk and enhancing employee payment transparency.

Earned Wage Access (EWA) Liability

Earned Wage Access (EWA) liabilities represent short-term obligations on a company's balance sheet, reflecting wages employees have earned but accessed before the official payday, unlike traditional liabilities which encompass long-term debts and financial obligations. EWA liabilities require precise accounting to ensure accurate payroll reconciliation and regulatory compliance, differentiating them from standard on-demand pay liabilities characterized by immediate withdrawal options without impacting accrued wages.

Micro-Payroll Liability

Micro-payroll liability refers to the financial obligations employers must manage when offering on-demand pay options, which allow employees to access earned wages before the standard payday. Unlike traditional liabilities that accumulate until payroll processing, on-demand pay liabilities fluctuate daily, requiring precise tracking and real-time accounting to ensure compliance and accurate fund management.

Instant Pay Liability Exposure

Instant Pay Liability Exposure differs from traditional liabilities by reflecting real-time wage advances that companies owe employees before regular payroll cycles, increasing short-term financial obligations. This exposure requires precise cash flow management to avoid liquidity risks and ensure compliance with payroll regulations.

Wage Streaming Liability

Liabilities related to wage streaming differ from traditional liabilities by reflecting real-time payroll deductions and advance repayments tied to on-demand pay solutions. On-demand pay liabilities require accurate tracking of immediate wage disbursements and offsets, ensuring compliance with payroll regulations and transparent accounting practices.

On-Demand Compensation Liability

On-Demand Compensation Liability represents a more immediate financial obligation compared to traditional liabilities, as it reflects amounts payable to employees upon request rather than at fixed payroll dates. This liability requires precise tracking of earned but unpaid wages, impacting cash flow management and necessitating real-time accounting adjustments.

Dynamic Disbursement Liability

Dynamic Disbursement Liability in on-demand pay systems represents a flexible, real-time financial obligation that adjusts based on employee-initiated withdrawals, contrasting traditional liabilities which are static and fixed at payroll intervals. This dynamic nature reduces accrued liabilities and improves cash flow management by immediately reflecting wage advances as liabilities rather than waiting for payroll processing cycles.

Payroll Float Liability

Payroll Float Liability represents the temporary obligation a company holds when employee wages are earned but payment is delayed, differing from On-Demand Pay Liabilities which arise from immediate access to earned wages through on-demand pay services. Understanding Payroll Float Liability is crucial for accurate financial reporting and managing cash flow, as it directly impacts a company's short-term liabilities and payroll accounting.

Daily Pay System Liability

Liabilities in a Daily Pay System consist primarily of accrued wages owed to employees, categorized as current liabilities due within a short period. On-Demand Pay Liabilities specifically refer to wages that employees have accessed prior to the scheduled payday, creating an immediate repayment obligation on the company's balance sheet.

Liabilities vs On-Demand Pay Liabilities for liability. Infographic

moneydiff.com

moneydiff.com