Liabilities in a pet-related context generally include costs such as veterinary bills, pet insurance premiums, and potential damages caused by the pet. Buy Now Pay Later liabilities, while offering immediate access to pet products or services, can accumulate interest and fees, increasing overall financial responsibility. Understanding the difference between traditional liabilities and Buy Now Pay Later obligations helps pet owners manage their expenses more effectively and avoid unexpected debt.

Table of Comparison

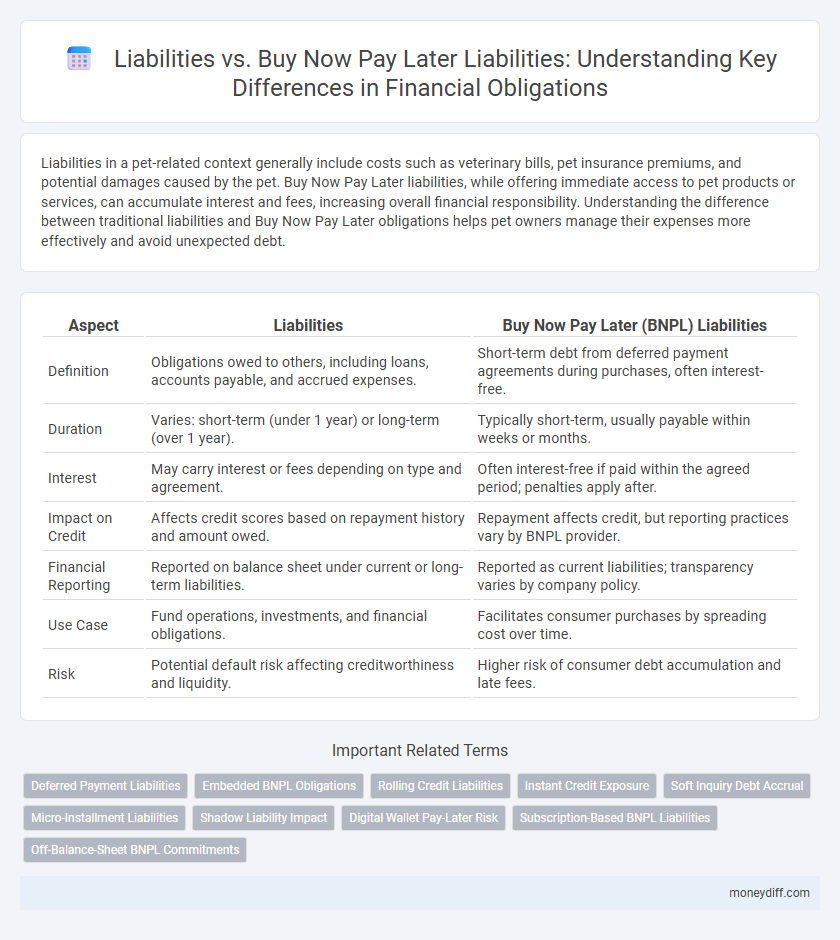

| Aspect | Liabilities | Buy Now Pay Later (BNPL) Liabilities |

|---|---|---|

| Definition | Obligations owed to others, including loans, accounts payable, and accrued expenses. | Short-term debt from deferred payment agreements during purchases, often interest-free. |

| Duration | Varies: short-term (under 1 year) or long-term (over 1 year). | Typically short-term, usually payable within weeks or months. |

| Interest | May carry interest or fees depending on type and agreement. | Often interest-free if paid within the agreed period; penalties apply after. |

| Impact on Credit | Affects credit scores based on repayment history and amount owed. | Repayment affects credit, but reporting practices vary by BNPL provider. |

| Financial Reporting | Reported on balance sheet under current or long-term liabilities. | Reported as current liabilities; transparency varies by company policy. |

| Use Case | Fund operations, investments, and financial obligations. | Facilitates consumer purchases by spreading cost over time. |

| Risk | Potential default risk affecting creditworthiness and liquidity. | Higher risk of consumer debt accumulation and late fees. |

Understanding Liabilities in Money Management

Liabilities represent financial obligations that require future payment, including loans, credit card debts, and accounts payable. Buy Now Pay Later (BNPL) liabilities are a subset of liabilities characterized by short-term installment payments, often used for consumer purchases without immediate cash outflow. Understanding the distinction between general liabilities and BNPL liabilities helps manage debt effectively, prioritize repayment, and maintain a healthy credit score.

What Are Traditional Liabilities?

Traditional liabilities refer to financial obligations that a company must settle in the short or long term, including accounts payable, loans, mortgages, accrued expenses, and deferred revenue. These liabilities are recorded on the balance sheet and represent claims creditors have on the company's assets. Unlike Buy Now Pay Later (BNPL) liabilities, traditional liabilities typically involve formal agreements with interest terms and set repayment schedules.

Buy Now, Pay Later: A New Kind of Liability

Buy Now, Pay Later (BNPL) liabilities represent a growing financial obligation for consumers and businesses, differing from traditional liabilities by offering deferred payments without immediate interest. These liabilities impact credit risk assessment as missed BNPL payments can lead to increased debt and credit score deterioration. Financial institutions and retailers must carefully manage BNPL liabilities to balance customer acquisition with the risk of defaults and regulatory scrutiny.

Key Differences: Traditional Liabilities vs Buy Now Pay Later

Traditional liabilities typically involve fixed repayment schedules with predetermined interest rates, reflecting conventional borrowing structures such as loans or credit card debt. Buy Now Pay Later (BNPL) liabilities feature flexible, short-term installment plans that often incur no immediate interest but can result in higher costs through late fees or penalties. The key difference lies in their repayment dynamics and risk profiles, with BNPL liabilities offering convenience and deferred payments at the potential expense of increased consumer financial strain.

Short-Term Consequences of Buy Now, Pay Later Liabilities

Buy Now, Pay Later (BNPL) liabilities often lead to increased short-term financial strain due to deferred payment obligations that accumulate rapidly. These liabilities can elevate the risk of cash flow disruptions and heightened default rates compared to traditional liabilities. Immediate interest charges and fees associated with BNPL programs exacerbate the pressure on consumers' short-term financial health.

Long-Term Financial Impact of Liabilities

Long-term liabilities, such as bonds payable or mortgage loans, significantly impact a company's financial stability by requiring extended repayment periods and accruing interest over time, affecting cash flow and credit ratings. Buy Now Pay Later (BNPL) liabilities introduce short-term obligations that can escalate if not managed properly but typically do not carry the same long-term financial risks as traditional liabilities. Understanding the distinction between these liabilities helps businesses optimize debt management strategies and maintain sustainable financial health.

Credit Scores: Effects of Both Liability Types

Liabilities, including traditional loans and Buy Now Pay Later (BNPL) obligations, both impact credit scores by influencing credit utilization and payment history. Traditional liabilities typically appear on credit reports, affecting credit scores more directly, while BNPL liabilities may not always be reported, potentially reducing their immediate impact on scores. However, missed BNPL payments can lead to collections and damage credit ratings similarly to conventional liabilities, emphasizing the importance of timely repayments in both cases.

Managing Multiple Liabilities Effectively

Managing multiple liabilities requires prioritizing high-interest debt, such as Buy Now Pay Later (BNPL) obligations, which often carry higher risks and fees compared to traditional liabilities like loans or credit card balances. Effective liability management includes tracking payment schedules, consolidating debt where possible, and maintaining clear records to avoid penalties and improve credit scores. Leveraging financial tools and professional advice enhances the ability to balance BNPL commitments alongside other liabilities for optimal cash flow and financial stability.

Financial Risks of Buy Now, Pay Later Schemes

Buy Now Pay Later (BNPL) liabilities create unique financial risks by increasing consumer debt without immediate repayment, which can lead to higher default rates compared to traditional liabilities. These schemes often result in obfuscated credit exposure for both consumers and lenders, as deferred payments accumulate into substantial financial obligations. Consequently, BNPL models challenge conventional liability management by elevating credit risk and complicating cash flow forecasting for financial institutions.

Strategies for Healthy Liability Management

Effective liability management involves balancing traditional liabilities with Buy Now Pay Later (BNPL) obligations to maintain financial stability. Prioritizing timely repayments, accurate liability tracking, and leveraging BNPL's flexible payment terms can optimize cash flow and reduce risk. Implementing clear policies for assessing creditworthiness and setting spending limits further supports sustainable liability management.

Related Important Terms

Deferred Payment Liabilities

Deferred payment liabilities refer to obligations where payment is postponed to a future date, distinguishing them from traditional liabilities that require immediate or scheduled payments. Buy Now Pay Later (BNPL) liabilities specifically fall under deferred payment liabilities, representing short-term financial commitments consumers incur by deferring purchases while the merchant receives instant payment.

Embedded BNPL Obligations

Embedded Buy Now Pay Later (BNPL) obligations are classified as short-term liabilities, reflecting the deferred payment amounts consumers owe to merchants or financial institutions. These BNPL liabilities differ from traditional liabilities by being contingent on consumer purchase behavior and often require dynamic risk assessment and regulatory compliance for accurate financial reporting.

Rolling Credit Liabilities

Rolling credit liabilities, a common feature of buy now pay later (BNPL) services, are recurring debt obligations that accrue interest or fees over time until fully paid off, differentiating them from traditional fixed liabilities with set repayment schedules. Understanding the impact of rolling credit liabilities on overall financial risk is crucial, as they can significantly increase consumer debt and affect creditworthiness if unmanaged.

Instant Credit Exposure

Liabilities represent the total financial obligations a company owes, while Buy Now Pay Later (BNPL) liabilities specifically encompass short-term debts arising from instant credit exposure through deferred payment options. Instant credit exposure in BNPL increases the risk of default and impacts cash flow management by creating contingent liabilities that must be carefully monitored and reported.

Soft Inquiry Debt Accrual

Liabilities represent the financial obligations a company or individual owes, including loans, accounts payable, and accrued expenses, while Buy Now Pay Later (BNPL) liabilities specifically arise from deferred payment agreements that often trigger soft inquiry debt accrual on credit reports, minimally impacting credit scores but increasing outstanding debt levels. Soft inquiry debt accrual in BNPL arrangements indicates tracking of new liabilities without a hard credit check, influencing debt-to-income ratios and affecting future borrowing capacity differently than traditional liabilities reported via hard inquiries.

Micro-Installment Liabilities

Micro-installment liabilities differ from traditional liabilities by allowing consumers to spread payments into smaller, manageable amounts over time, enhancing cash flow flexibility without incurring large debt obligations at once. Buy Now Pay Later (BNPL) liabilities, a subset of micro-installments, are tailored for short-term, interest-free repayment plans, increasing affordability while potentially impacting credit risk assessment and financial forecasting for businesses.

Shadow Liability Impact

Liabilities encompass all financial obligations a company must settle, while Buy Now Pay Later (BNPL) liabilities represent deferred payment commitments that can obscure true debt levels, creating significant shadow liabilities. These hidden BNPL obligations often lead to underreported risk exposure, impacting credit assessments and financial transparency for businesses.

Digital Wallet Pay-Later Risk

Liabilities in traditional finance represent obligations owed by a company, while Buy Now Pay Later (BNPL) liabilities, particularly in digital wallets, introduce unique credit risk due to deferred payments and lack of stringent credit checks. Digital Wallet Pay-Later risks include potential default, increased fraud exposure, and regulatory challenges that can escalate financial liabilities for both providers and consumers.

Subscription-Based BNPL Liabilities

Subscription-based Buy Now Pay Later (BNPL) liabilities represent a distinct category of financial obligations where consumers commit to recurring payments, contrasting with traditional one-time liabilities that are typically settled in full at purchase. These BNPL liabilities impact cash flow and credit risk management by spreading consumer debt across multiple billing cycles, requiring businesses to track ongoing payment schedules and adjust liability accounting accordingly.

Off-Balance-Sheet BNPL Commitments

Off-balance-sheet Buy Now Pay Later (BNPL) commitments represent contingent liabilities that do not appear directly on a company's balance sheet but expose the entity to potential future financial obligations. These commitments require careful risk assessment and transparent disclosure to accurately reflect a company's financial position and potential credit risk exposure associated with BNPL arrangements.

Liabilities vs Buy Now Pay Later Liabilities for liability. Infographic

moneydiff.com

moneydiff.com