When managing liabilities, choosing between a personal loan and a salary-linked loan requires careful consideration of interest rates, repayment flexibility, and approval speed. Personal loans typically offer fixed interest rates and structured repayment terms, making budgeting easier but sometimes have stricter eligibility criteria. Salary-linked loans leverage your steady income for faster approval and lower rates, yet may limit borrowing amounts based on your monthly salary.

Table of Comparison

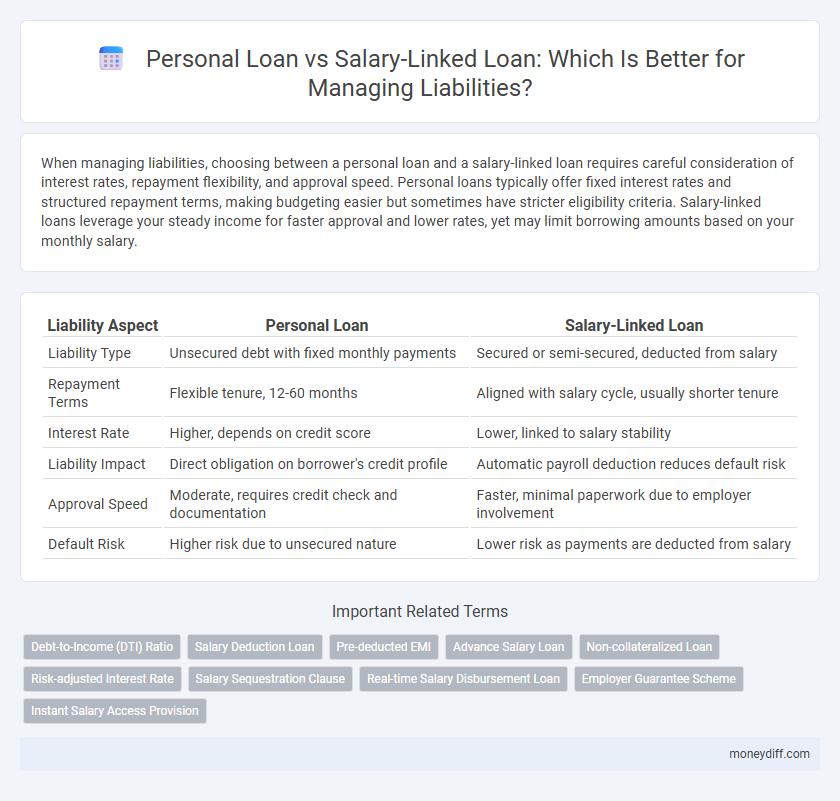

| Liability Aspect | Personal Loan | Salary-Linked Loan |

|---|---|---|

| Liability Type | Unsecured debt with fixed monthly payments | Secured or semi-secured, deducted from salary |

| Repayment Terms | Flexible tenure, 12-60 months | Aligned with salary cycle, usually shorter tenure |

| Interest Rate | Higher, depends on credit score | Lower, linked to salary stability |

| Liability Impact | Direct obligation on borrower's credit profile | Automatic payroll deduction reduces default risk |

| Approval Speed | Moderate, requires credit check and documentation | Faster, minimal paperwork due to employer involvement |

| Default Risk | Higher risk due to unsecured nature | Lower risk as payments are deducted from salary |

Understanding Personal Loans and Salary-Linked Loans

Personal loans are unsecured liabilities with fixed interest rates and flexible repayment terms, ideal for individuals needing lump-sum funds without collateral. Salary-linked loans are secured by monthly income, often featuring lower interest rates and automatic payroll deductions, reducing default risk for lenders. Understanding these distinctions helps borrowers choose a liability option that aligns with their financial stability and repayment capacity.

Key Differences Between Personal Loans and Salary-Linked Loans

Personal loans typically offer fixed interest rates and predetermined repayment schedules, making them suitable for borrowers seeking predictable liability management. Salary-linked loans connect repayment obligations directly to the borrower's monthly salary, allowing flexible EMI amounts that adjust with income fluctuations and reducing default risk. Unlike personal loans, salary-linked loans often require employer consent and provide quicker disbursal, impacting the overall liability profile based on income stability and employment status.

Eligibility Criteria: Who Can Apply?

Personal loans typically require a good credit score, steady income, and minimum age criteria, making them accessible to salaried employees, self-employed individuals, and professionals. Salary-linked loans are generally available exclusively to salaried employees with a verified salary account in select banks or financial institutions. Both loan types assess eligibility based on income stability, employment status, and creditworthiness, but salary-linked loans offer easier approval for those with direct salary deposits.

Interest Rates: Comparing Cost of Borrowing

Personal loans typically carry higher interest rates compared to salary-linked loans, which often offer lower rates due to reduced risk for lenders. Salary-linked loans leverage steady income as collateral, resulting in more favorable borrowing costs and lower interest expenses over the loan term. Borrowers seeking to minimize liabilities should consider salary-linked loans to benefit from decreased interest rates and overall cost savings.

Repayment Terms and Flexibility

Personal loans typically offer fixed repayment terms with a consistent monthly schedule, making budgeting straightforward but less adaptable to financial changes. Salary-linked loans provide flexible repayment options tied directly to the borrower's income fluctuations, allowing adjustments based on salary variations and reducing the risk of default. This flexibility in salary-linked loans can ease liability management, especially for borrowers with variable or irregular income streams.

Impact on Monthly Budget and Cash Flow

Personal loans typically involve fixed monthly repayments that may strain cash flow due to higher interest rates and longer terms, impacting the stability of the monthly budget. Salary-linked loans offer more flexible repayment terms tied to income fluctuations, reducing the risk of default and easing cash flow management. Comparing the impact on liabilities, salary-linked loans provide better alignment with income patterns, minimizing the risk of budget shortfalls.

Risk Factors and Liability Management

Personal loans carry higher risk factors due to fixed repayment schedules and potentially higher interest rates, increasing the borrower's liability if income fluctuates. Salary-linked loans offer better liability management by aligning repayments with salary cycles, reducing default risk and improving cash flow stability. Careful assessment of income consistency and loan terms is crucial for effective risk mitigation and responsible liability management.

Ease of Application and Approval Process

Personal loans typically involve a lengthier application and approval process, requiring extensive documentation and credit checks, which can delay disbursement. Salary-linked loans offer a streamlined approval process with minimal paperwork, as repayment is directly deducted from the borrower's salary, reducing default risk for lenders. This ease of application and faster approval make salary-linked loans a preferable option for borrowers seeking quick access to funds with lower eligibility barriers.

Effects on Credit Score and Financial Future

Personal loans typically require fixed monthly payments that, when consistently met, can improve credit scores by demonstrating reliable repayment habits. Salary-linked loans deduct payments directly from the borrower's paycheck, reducing missed payments and potentially safeguarding credit scores from negative impacts. Choosing between the two affects long-term financial stability, as salary-linked loans offer structured repayment but may limit cash flow flexibility, while personal loans provide more control but require disciplined budgeting.

Choosing the Right Loan for Your Liability Needs

Personal loans offer flexibility with fixed repayment terms and generally higher interest rates, making them suitable for borrowers prioritizing predictable payments. Salary-linked loans provide lower interest rates and faster approval by leveraging your monthly income as collateral, ideal for those seeking affordable and accessible credit. Evaluating your repayment capacity and loan tenure helps choose the right liability management option tailored to your financial situation.

Related Important Terms

Debt-to-Income (DTI) Ratio

Personal loans typically result in a higher Debt-to-Income (DTI) ratio due to fixed monthly repayments, increasing overall liability burden. Salary-linked loans often lower DTI by adjusting repayments based on income fluctuations, offering more manageable liability control.

Salary Deduction Loan

Salary deduction loans offer a lower risk of default due to automatic repayment directly from an employee's paycheck, improving liability management for both lenders and borrowers. Personal loans carry higher liability risk because repayments depend on borrower discipline, unlike salary-linked loans that leverage steady income streams for consistent liability reduction.

Pre-deducted EMI

Salary-linked loans offer the advantage of pre-deducted EMIs directly from the borrower's salary, reducing the risk of default and ensuring timely repayments compared to personal loans, which require manual EMI payments. Pre-deducted EMIs in salary-linked loans streamline liability management by automating debt servicing, enhancing financial discipline without relying on borrower-initiated transactions.

Advance Salary Loan

Advance salary loans offer a liability solution by allowing borrowers to access funds based on their upcoming salary, often with lower interest rates and flexible repayment terms compared to traditional personal loans. This salary-linked loan reduces financial strain by aligning repayments directly with payroll deductions, minimizing default risk and improving cash flow management.

Non-collateralized Loan

Personal loans and salary-linked loans are both non-collateralized liabilities, with personal loans offering fixed amounts and interest rates based on creditworthiness, while salary-linked loans provide flexible repayment terms directly tied to the borrower's monthly income. Salary-linked loans reduce default risk for lenders by automatically deducting installments from salary, making them a preferred option for employees seeking manageable liabilities without asset pledges.

Risk-adjusted Interest Rate

Personal loans typically feature higher risk-adjusted interest rates due to unsecured repayment terms, increasing borrower liability costs compared to salary-linked loans. Salary-linked loans offer lower rates by tying repayments directly to stable income sources, reducing default risk and overall liability exposure.

Salary Sequestration Clause

The Salary Sequestration Clause in salary-linked loans ensures automatic deduction of EMIs directly from the borrower's salary, reducing default risk and providing lenders with enhanced security compared to personal loans, which rely solely on borrower discipline for repayment. This clause significantly impacts liability management by enforcing consistent payment schedules, thereby improving creditworthiness and minimizing potential financial disputes.

Real-time Salary Disbursement Loan

Real-time salary disbursement loans offer immediate access to funds directly linked to an employee's ongoing salary flow, reducing default risk while enhancing liquidity management compared to traditional personal loans. This salary-linked liability model optimizes repayment schedules by synchronizing loan installments with real-time salary credits, ensuring seamless debt servicing and improved financial stability.

Employer Guarantee Scheme

Personal loans typically require higher interest rates and strict credit evaluations, increasing liability risk for borrowers without employer backing. Salary-linked loans under an Employer Guarantee Scheme reduce liability by leveraging guaranteed repayment through employer payroll deductions, enhancing repayment security and lowering default rates.

Instant Salary Access Provision

Personal loans offer fixed repayment schedules without instant access to salary, while salary-linked loans provide real-time salary access, enabling immediate fund availability and flexible liability management. Leveraging salary-linked loans enhances financial agility by aligning loan repayments directly with income streams, reducing default risk and improving cash flow control.

Personal Loan vs Salary-Linked Loan for Liability. Infographic

moneydiff.com

moneydiff.com