When managing liability expenses, a personal loan offers lower interest rates and longer repayment terms compared to a payday advance, making it a more affordable option. Payday advances often come with high fees and short repayment periods, increasing the risk of further financial strain. Choosing a personal loan helps maintain better credit health and provides a structured approach to covering liability costs.

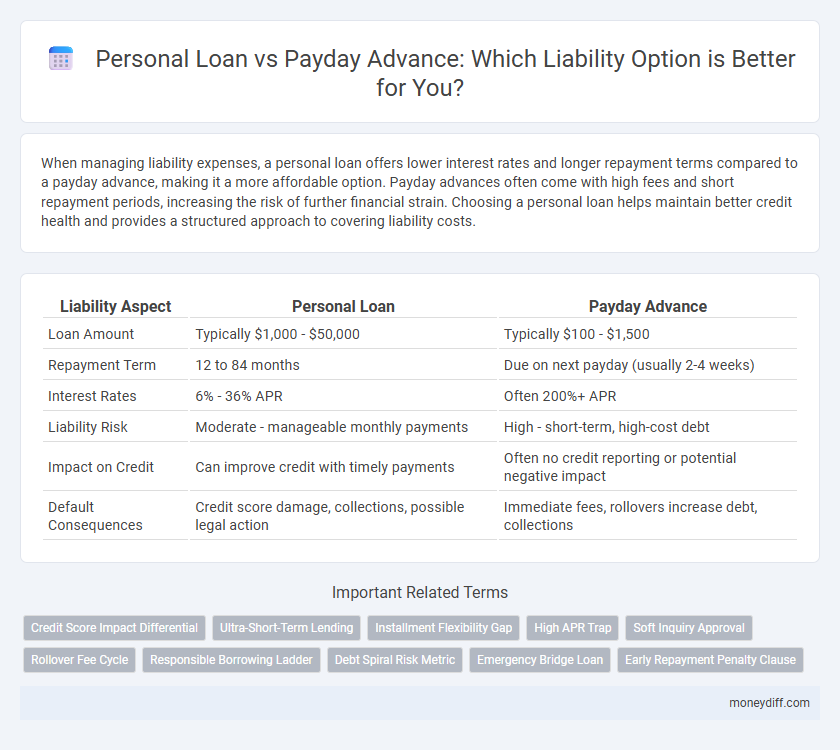

Table of Comparison

| Liability Aspect | Personal Loan | Payday Advance |

|---|---|---|

| Loan Amount | Typically $1,000 - $50,000 | Typically $100 - $1,500 |

| Repayment Term | 12 to 84 months | Due on next payday (usually 2-4 weeks) |

| Interest Rates | 6% - 36% APR | Often 200%+ APR |

| Liability Risk | Moderate - manageable monthly payments | High - short-term, high-cost debt |

| Impact on Credit | Can improve credit with timely payments | Often no credit reporting or potential negative impact |

| Default Consequences | Credit score damage, collections, possible legal action | Immediate fees, rollovers increase debt, collections |

Understanding Liability: Personal Loans vs Payday Advances

Personal loans carry lower liability risks due to fixed interest rates and longer repayment terms, making them more manageable for borrowers. Payday advances present higher liability risks because of skyrocketing fees and short payment windows, increasing the chance of default. Understanding these differences helps in choosing a borrowing option that aligns with financial stability and liability management.

Key Differences in Liability Structure

Personal loans typically carry a fixed liability with a structured repayment schedule, allowing borrowers to manage debt over a longer term with predictable monthly payments. Payday advances impose immediate, high-interest liabilities due on the borrower's next paycheck, increasing the risk of a debt cycle due to short repayment periods. The liability structure of personal loans supports credit building through timely payments, whereas payday advances often exacerbate financial strain and liability risk because of costly fees and rapid repayment demands.

Interest Rates and Their Impact on Borrower Liability

Personal loans typically offer lower interest rates compared to payday advances, significantly reducing the total repayment amount and easing borrower liability. Payday advances carry exceptionally high interest rates that can quickly escalate the debt, increasing the financial burden and risk of default. Choosing a personal loan over a payday advance minimizes liability through more manageable and predictable interest expenses.

Repayment Terms: How They Affect Your Financial Obligations

Personal loans typically offer fixed repayment terms ranging from one to seven years, providing borrowers with predictable monthly payments that help manage financial obligations more effectively. Payday advances demand repayment on the borrower's next payday, often within two to four weeks, which can cause high short-term financial strain due to immediate repayment pressure and increased risk of rolling over debt. Understanding these differing repayment schedules is crucial as they directly impact your liability management, influencing cash flow stability and potential for accumulating additional debt.

Hidden Fees and Liability Risks

Personal loans typically offer transparent fee structures with fixed interest rates, reducing hidden costs and providing clearer liability management for borrowers. Payday advances often carry high interest rates and hidden fees, such as rollover charges, significantly increasing the borrower's financial liability. Borrowers facing payday advance liabilities risk escalating debt cycles due to these concealed fees, while personal loans allow for more predictable repayment planning and legal protections.

Credit Score Impact: Personal Loan vs Payday Advance

Personal loans typically have a lower impact on credit scores compared to payday advances because they involve scheduled payments reported to credit bureaus, helping to build credit history. Payday advances usually do not affect credit scores directly as they are short-term loans often not reported, but failure to repay on time may lead to collections, severely damaging credit. Responsible management of a personal loan can improve creditworthiness, whereas reliance on payday advances can increase financial liability and risk of credit score decline.

Default Consequences: Navigating Legal Liability

Defaulting on a personal loan typically leads to higher legal liability risks due to longer repayment terms and larger loan amounts, increasing the chance of court judgments and wage garnishment. Payday advances, often short-term with high fees, can escalate into immediate financial strain but usually involve smaller liabilities, though repeated defaults might trigger aggressive collection actions. Understanding the legal consequences and potential liabilities of each option helps borrowers avoid severe financial fallout and navigate debt resolution effectively.

Responsible Borrowing: Minimizing Liability Exposure

Choosing a personal loan over a payday advance significantly reduces liability exposure due to structured repayment plans and lower interest rates. Personal loans offer longer terms that enable manageable monthly payments, minimizing the risk of default and financial strain. Borrowers maintain responsible borrowing habits by assessing affordability and avoiding the high fees and short repayment cycles associated with payday advances.

Choosing the Right Option for Manageable Liability

Personal loans typically offer lower interest rates and fixed repayment terms, making them a more manageable liability compared to payday advances, which often come with high fees and short repayment periods. Choosing a personal loan can help avoid escalating debt and reduce financial stress by providing predictable monthly payments. Evaluating factors like interest rates, repayment flexibility, and total cost is essential for maintaining manageable liability when borrowing.

Long-Term Liability: Building Financial Security

Personal loans offer structured repayment terms that help borrowers gradually reduce long-term liability while building credit history, promoting financial security. Payday advances involve high-interest rates and short repayment periods that can increase debt burden and hinder long-term financial stability. Choosing personal loans over payday advances supports responsible debt management and sustainable financial growth.

Related Important Terms

Credit Score Impact Differential

Personal loans generally have a more favorable impact on credit scores due to longer repayment terms and lower interest rates, allowing borrowers to build positive credit history through timely payments. Payday advances, on the other hand, often lead to higher credit risk and score declines because of short-term high-interest cycles and frequent rollovers, which can result in missed or late payments.

Ultra-Short-Term Lending

Personal loans typically offer structured repayment plans and lower interest rates, reducing liability risks compared to payday advances, which are ultra-short-term loans with high fees and potential for debt cycles. Understanding the liability differences in ultra-short-term lending helps borrowers avoid excessive financial burdens and improve credit management.

Installment Flexibility Gap

Personal loans offer greater installment flexibility by allowing borrowers to choose longer repayment terms, which reduces liability pressure and monthly payment amounts. Payday advances typically require full repayment with a single lump sum on the next payday, creating a significant liability spike that risks borrower default.

High APR Trap

Personal loans typically offer lower APRs compared to payday advances, which can trap borrowers in cycles of debt due to exorbitantly high interest rates exceeding 300%. Understanding the liability risks associated with payday advances is crucial, as their short-term nature and hidden fees often lead to escalating repayment obligations, increasing overall financial burden.

Soft Inquiry Approval

Personal loans typically involve a soft inquiry during the approval process, which does not impact the borrower's credit score, making them a safer option for managing liability. Payday advances often rely on less thorough credit checks and can lead to higher liabilities due to steep interest rates and fees.

Rollover Fee Cycle

Personal loans typically offer fixed repayment terms and avoid rollover fees, reducing the risk of escalating liability compared to payday advances, which often impose high rollover fee cycles that significantly increase borrower debt. Understanding the cost implications of rollover fees in payday advances is crucial for managing short-term liabilities effectively.

Responsible Borrowing Ladder

Personal loans typically offer lower interest rates and structured repayment plans, reducing the risk of escalating liabilities compared to payday advances, which carry high fees and short repayment periods that can trap borrowers in a cycle of debt. Climbing the Responsible Borrowing Ladder involves choosing personal loans for manageable liabilities and avoiding payday advances that amplify financial strain.

Debt Spiral Risk Metric

Personal loans generally carry lower interest rates and fixed repayment terms, reducing the risk of entering a debt spiral compared to payday advances, which often have exorbitant fees and short repayment periods that can exacerbate financial liability. The Debt Spiral Risk Metric highlights that payday advances significantly increase liability due to their compounding costs and likelihood of rollover, escalating borrower indebtedness and financial instability.

Emergency Bridge Loan

Personal loans offer structured repayment schedules with lower interest rates, making them a more manageable liability for emergency bridge financing compared to payday advances, which typically impose higher fees and short-term, high-interest obligations. Emergency bridge loans via personal loans reduce the risk of escalating debt, while payday advances can lead to a cycle of liabilities due to their costly, short-term nature.

Early Repayment Penalty Clause

Personal loans typically have clear early repayment penalty clauses that may charge a fee for settling the balance before the term ends, impacting overall liability. Payday advances often lack formal early repayment penalties but come with higher interest rates that increase total liability if not repaid quickly.

Personal Loan vs Payday Advance for liability. Infographic

moneydiff.com

moneydiff.com