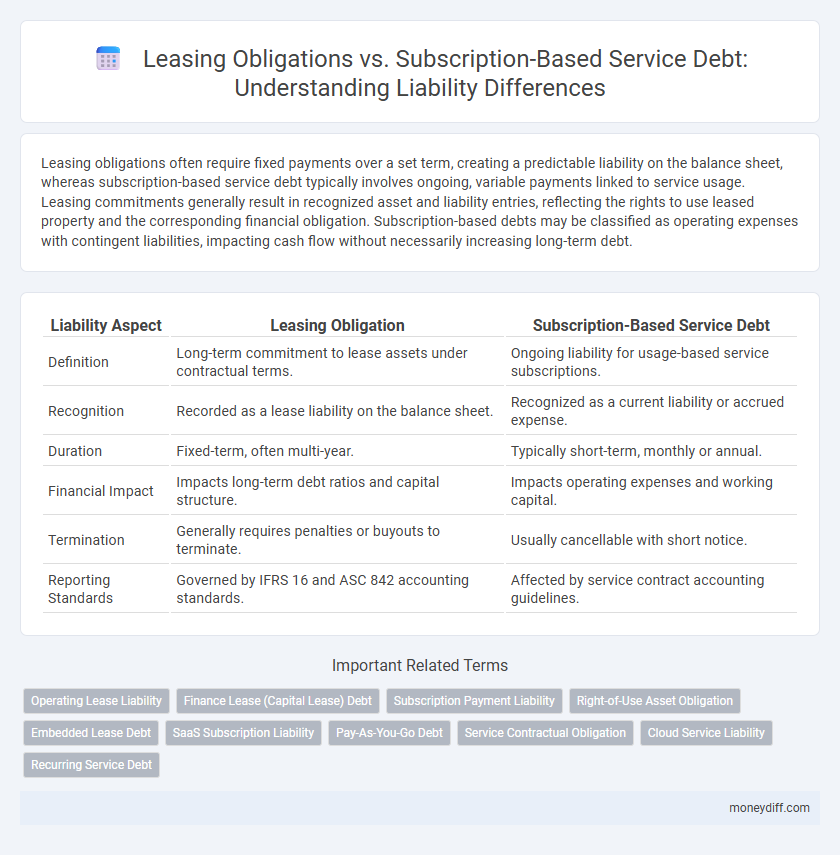

Leasing obligations often require fixed payments over a set term, creating a predictable liability on the balance sheet, whereas subscription-based service debt typically involves ongoing, variable payments linked to service usage. Leasing commitments generally result in recognized asset and liability entries, reflecting the rights to use leased property and the corresponding financial obligation. Subscription-based debts may be classified as operating expenses with contingent liabilities, impacting cash flow without necessarily increasing long-term debt.

Table of Comparison

| Liability Aspect | Leasing Obligation | Subscription-Based Service Debt |

|---|---|---|

| Definition | Long-term commitment to lease assets under contractual terms. | Ongoing liability for usage-based service subscriptions. |

| Recognition | Recorded as a lease liability on the balance sheet. | Recognized as a current liability or accrued expense. |

| Duration | Fixed-term, often multi-year. | Typically short-term, monthly or annual. |

| Financial Impact | Impacts long-term debt ratios and capital structure. | Impacts operating expenses and working capital. |

| Termination | Generally requires penalties or buyouts to terminate. | Usually cancellable with short notice. |

| Reporting Standards | Governed by IFRS 16 and ASC 842 accounting standards. | Affected by service contract accounting guidelines. |

Understanding Leasing Obligations in Financial Liabilities

Leasing obligations represent long-term financial liabilities arising from contractual agreements to use an asset over a specified period, typically recorded on the balance sheet under lease liabilities. These obligations differ from subscription-based service debts, which are often classified as short-term liabilities related to periodic service fees without asset ownership. Understanding the distinction is crucial for accurate financial reporting and compliance with accounting standards such as IFRS 16 or ASC 842.

Defining Subscription-Based Service Debt

Subscription-based service debt represents a liability arising from contractual commitments to ongoing, periodic payments for access to services rather than ownership of tangible assets. Unlike leasing obligations, which typically involve fixed asset usage rights with identifiable terms and residual values, subscription debt encapsulates future payment obligations without asset ownership or capitalization on the balance sheet. This distinction impacts financial reporting, with subscription liabilities often recognized as operating expenses and requiring detailed disclosure under accounting standards such as IFRS 16 and ASC 842.

Key Differences Between Leasing and Subscription Liabilities

Leasing obligations represent long-term contractual liabilities with fixed payment terms tied to asset usage, typically classified as lease liabilities on the balance sheet under IFRS 16 or ASC 842. Subscription-based service debt involves recurring obligations for access to services without ownership, recognized as service liabilities or deferred revenue rather than capitalized assets. Key differences include the asset control transfer in leasing versus service access in subscriptions, differing recognition and measurement criteria, and the impact on financial ratios due to capitalization of lease liabilities versus off-balance-sheet treatment of many subscription agreements.

Accounting Standards for Leasing Obligations

Leasing obligations are recognized as liabilities under accounting standards such as IFRS 16 and ASC 842, requiring lessees to record a right-of-use asset and corresponding lease liability on the balance sheet. Subscription-based service debt typically falls under operating expenses without creating a capitalized liability, as it represents ongoing service costs rather than ownership rights. The distinction impacts financial ratios and balance sheet presentation, with lease liabilities reflecting future payment obligations tied to asset use, whereas subscription debts remain off-balance-sheet commitments.

Recognizing Subscription Debt Under IFRS and GAAP

Leasing obligations are recognized as liabilities on the balance sheet based on the right-of-use asset and lease liability measured at present value under IFRS 16 and ASC 842, while subscription-based service debts typically do not meet the criteria for liability recognition as they often lack enforceable payment obligations. Under IFRS, subscription contracts are generally treated as service expenses unless the contract conveys a right-of-use asset, whereas GAAP requires careful evaluation of contract terms to determine if subscription payments constitute a liability. Both frameworks emphasize the distinction between lease liabilities and service obligations, ensuring only commitments with enforceable payment obligations are recognized as liabilities.

Liability Impact: Leasing vs Subscription Debts on Balance Sheet

Leasing obligations typically appear as long-term liabilities on the balance sheet, reflecting a fixed commitment to future payments and impacting debt ratios and leverage metrics more significantly. Subscription-based service debts are often considered operating expenses and may not be capitalized, resulting in lower reported liabilities but potentially obscuring the true financial obligations. The classification differences directly influence key financial ratios, investor perception, and compliance with accounting standards such as IFRS 16 or ASC 842.

Long-term vs Short-term Liability Implications

Leasing obligations typically represent long-term liabilities due to fixed lease terms extending over several years, impacting a company's balance sheet and financial ratios more significantly than subscription-based service debt, which usually constitutes short-term liabilities renewed on a periodic basis. Subscription-based service debts often lead to recurring operational expenses with limited long-term financial commitment, enhancing liquidity flexibility but potentially increasing overall short-term liabilities. Effective liability management requires distinguishing these obligations to accurately assess financial health, cash flow projections, and risk exposure.

Tax Treatment: Lease Payments vs Subscription Costs

Lease payments are typically treated as deductible expenses spread over the lease term, allowing businesses to capitalize and amortize the cost according to lease accounting standards. Subscription-based service costs are generally fully deductible as operating expenses in the period incurred, offering more immediate tax benefits. Distinguishing between leasing obligations and subscription debts is critical for accurate liability reporting and optimized tax planning.

Risk Assessment: Default Scenarios for Lease and Subscription Liabilities

Lease obligations often involve long-term fixed payments secured by underlying assets, increasing the risk of default under economic downturns due to inflexible contract terms and potential asset repossession costs. Subscription-based service debt typically presents lower default risk because of shorter contract durations and easier cancellation options, though cumulative liabilities may grow substantially with increased subscriber churn and renewal uncertainties. Effective risk assessment requires evaluating the present value of future payments, asset recovery potential for leases, and the volatility of subscriber retention rates impacting subscription liabilities.

Strategic Money Management: Choosing Between Leasing and Subscription Debt

Leasing obligations represent long-term liabilities tied to physical asset usage, reflecting on balance sheets as fixed commitments with potential tax benefits, while subscription-based service debt is often treated as short-term liabilities linked to operational expenses. Strategic money management involves analyzing the cost predictability, cash flow impact, and flexibility differences between capital-heavy leasing contracts and scalable subscription models. Businesses must weigh the financial statement implications, operational control, and long-term liquidity when deciding between leasing assets and subscribing to services.

Related Important Terms

Operating Lease Liability

Operating lease liability represents the present value of future lease payments under non-cancellable lease agreements, classified as a financial obligation on the balance sheet and impacting debt covenants. Subscription-based service debt, in contrast, typically reflects short-term contractual commitments without capitalization, resulting in different liability recognition and financial reporting treatment compared to operating lease obligations.

Finance Lease (Capital Lease) Debt

Finance lease debt, classified as a liability, reflects long-term leasing obligations where lessees assume ownership risks and benefits, requiring recognition of both an asset and a corresponding liability on the balance sheet. This debt differs from subscription-based service obligations, which are typically treated as operating expenses without capitalizing the lease liability.

Subscription Payment Liability

Subscription payment liability represents the obligation to pay for ongoing access to services under subscription-based contracts, classified as current liabilities on the balance sheet. Unlike leasing obligations, which often involve fixed asset usage and recognized right-of-use assets, subscription liabilities typically cover intangible service periods and are recognized based on the subscription period and payment schedule.

Right-of-Use Asset Obligation

Leasing obligations represent liabilities recorded on the balance sheet due to the right-of-use asset, reflecting the present value of lease payments over the lease term under IFRS 16 or ASC 842. Subscription-based service debt, however, is typically accounted for as an operating expense without recognizing a right-of-use asset or corresponding lease liability, impacting liquidity and leverage ratios differently from lease obligations.

Embedded Lease Debt

Embedded lease debt within subscription-based service agreements often requires careful recognition as a liability due to the right-of-use asset and lease obligation under accounting standards like IFRS 16 or ASC 842. Unlike traditional leasing obligations explicitly stated on balance sheets, embedded lease debt can be obscured in service contracts, necessitating detailed contract analysis to accurately assess and report the associated liabilities.

SaaS Subscription Liability

SaaS subscription liability represents a recurring financial obligation that differs from a leasing obligation by being service-based rather than asset-based, typically recorded as deferred revenue until the service is delivered. Unlike leasing obligations that involve fixed asset commitments, SaaS subscription liabilities reflect prepaid or accrued revenue associated with ongoing software service access, impacting both balance sheet classification and revenue recognition standards.

Pay-As-You-Go Debt

Pay-as-you-go debt in subscription-based services typically reflects short-term liabilities tied to usage fees, contrasting with leasing obligations that represent long-term, fixed commitments on the balance sheet. This distinction affects financial ratios and cash flow management, as pay-as-you-go liabilities fluctuate with consumption while lease debts remain constant regardless of usage.

Service Contractual Obligation

Leasing obligations represent fixed contractual liabilities with specified terms and payment schedules, while subscription-based service debt reflects ongoing service contractual obligations recognized as liabilities based on recurring usage and contractual commitment periods. Service contractual obligations in subscription models require companies to account for future service delivery costs and revenue recognition, impacting the balance sheet differently than traditional lease liabilities.

Cloud Service Liability

Leasing obligations typically create long-term liabilities recorded on the balance sheet, reflecting contractual lease payments, whereas subscription-based service debt for cloud services is often classified as operating expenses with limited balance sheet impact. Cloud service liability focuses on recurring subscription fees that represent ongoing service commitments without the capitalized asset or lease-related debt burdens found in leasing obligations.

Recurring Service Debt

Leasing obligations represent fixed, long-term liabilities with predetermined payment schedules, while subscription-based service debt reflects recurring service debt characterized by periodic payments tied to ongoing usage or service access. Recurring service debt under subscription models impacts short-term liabilities and cash flow management, distinguishing it from the often rigid structure of leasing obligations.

Leasing Obligation vs Subscription-Based Service Debt for Liability. Infographic

moneydiff.com

moneydiff.com