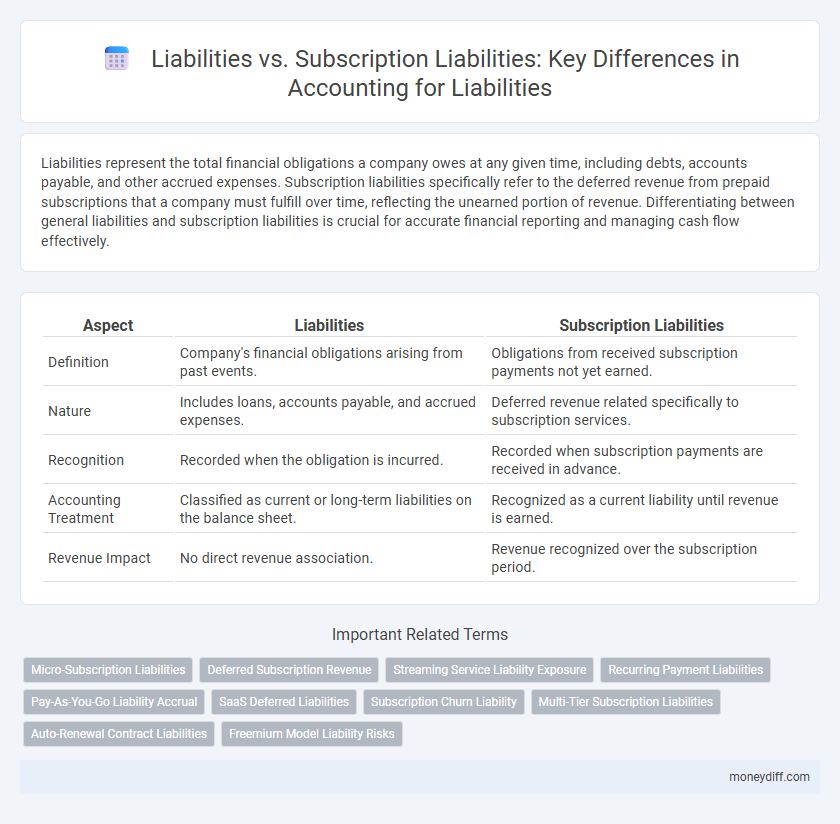

Liabilities represent the total financial obligations a company owes at any given time, including debts, accounts payable, and other accrued expenses. Subscription liabilities specifically refer to the deferred revenue from prepaid subscriptions that a company must fulfill over time, reflecting the unearned portion of revenue. Differentiating between general liabilities and subscription liabilities is crucial for accurate financial reporting and managing cash flow effectively.

Table of Comparison

| Aspect | Liabilities | Subscription Liabilities |

|---|---|---|

| Definition | Company's financial obligations arising from past events. | Obligations from received subscription payments not yet earned. |

| Nature | Includes loans, accounts payable, and accrued expenses. | Deferred revenue related specifically to subscription services. |

| Recognition | Recorded when the obligation is incurred. | Recorded when subscription payments are received in advance. |

| Accounting Treatment | Classified as current or long-term liabilities on the balance sheet. | Recognized as a current liability until revenue is earned. |

| Revenue Impact | No direct revenue association. | Revenue recognized over the subscription period. |

Understanding Liabilities in Money Management

Liabilities refer to financial obligations or debts owed by an individual or organization, while subscription liabilities specifically arise from recurring payment commitments for services or memberships. Understanding liabilities in money management involves recognizing both fixed debts and ongoing subscription commitments to maintain accurate financial records and cash flow projections. Proper tracking and categorization of these liabilities ensure effective budgeting and debt management strategies.

What Are Subscription Liabilities?

Subscription liabilities represent the obligations recorded on a company's balance sheet when customers pay in advance for goods or services not yet delivered, contrasting with general liabilities that encompass all present financial obligations. These liabilities reflect deferred revenue, highlighting the company's responsibility to fulfill the subscription terms before recognizing the revenue. Understanding subscription liabilities is crucial for accurately matching income with delivery periods and maintaining transparent financial reporting.

Key Differences: General Liabilities vs Subscription Liabilities

General liabilities encompass broad financial obligations a company owes, including loans, accounts payable, and accrued expenses. Subscription liabilities specifically refer to deferred revenue from prepayments or subscriptions that a business has yet to earn by delivering goods or services. Understanding the distinction helps in accurately classifying short-term versus long-term obligations and managing cash flow timing in financial reporting.

Impact of Liabilities on Financial Health

Liabilities, including both general liabilities and subscription liabilities, play a crucial role in determining a company's financial health by representing obligations that affect liquidity and solvency ratios. Subscription liabilities specifically refer to deferred revenue from customer subscriptions, impacting cash flow timing and revenue recognition. High levels of overall liabilities can increase financial risk, while well-managed subscription liabilities often indicate stable, predictable income streams supporting long-term financial stability.

How Subscription Liabilities Affect Cash Flow

Subscription liabilities represent deferred revenue from advance customer payments, impacting cash flow by providing immediate liquidity without recognizing revenue until delivery. Unlike general liabilities, which are owed obligations such as loans or accounts payable, subscription liabilities enhance short-term cash inflows by locking in customer commitments. Managing subscription liabilities effectively ensures steady cash flow while aligning revenue recognition with service fulfillment.

Managing Traditional Liabilities Effectively

Managing traditional liabilities requires a comprehensive understanding of obligations such as loans, accounts payable, and accrued expenses, ensuring accurate recording and timely settlements. Subscription liabilities specifically refer to deferred revenue from advance customer payments, necessitating precise revenue recognition aligned with service delivery. Effective management distinguishes general obligations from subscription-based liabilities, optimizing cash flow and maintaining financial statement integrity.

Tracking and Reporting Subscription Liabilities

Subscription liabilities represent deferred revenue from prepaid customer subscriptions, requiring precise tracking to match revenue recognition with service delivery periods. Unlike general liabilities, subscription liabilities demand detailed reporting systems to monitor recurring monthly or yearly revenue streams and ensure compliance with accounting standards such as ASC 606. Accurate subscription liability tracking enhances financial forecasting accuracy and supports transparent revenue recognition in subscription-based business models.

Reducing Risks Associated with Subscription Liabilities

Subscription liabilities represent a specific subset of liabilities arising from recurring customer commitments, often tied to subscription-based revenue models. Reducing risks associated with subscription liabilities involves accurate revenue recognition, diligent monitoring of contract terms, and proactive management of customer churn to avoid financial discrepancies. Implementing automated systems for tracking subscription obligations enhances compliance and minimizes exposure to regulatory penalties or financial misstatements.

Best Practices for Liability Management

Effective liability management requires a clear distinction between general liabilities and subscription liabilities to ensure accurate financial reporting and risk assessment. Subscription liabilities, often recurring and tied to customer commitments, demand proactive monitoring of payment schedules and contract terms to mitigate default risks. Implementing automated tracking systems and regular reconciliations enhances transparency and supports compliance with accounting standards for both liability types.

Subscription Liabilities: Future Trends and Considerations

Subscription liabilities represent deferred revenue from customer subscriptions, requiring precise recognition aligned with service delivery over time. Emerging trends indicate increased emphasis on real-time revenue tracking driven by AI and automation, enhancing accuracy in financial reporting. Businesses must consider evolving regulatory standards and integrate subscription management platforms to effectively manage and forecast subscription-related liabilities.

Related Important Terms

Micro-Subscription Liabilities

Micro-subscription liabilities represent a specific category of subscription liabilities characterized by small, recurring financial obligations linked to micro-subscription services, differing from general liabilities which encompass all types of financial obligations owed by a company. These micro-subscription liabilities are critical in industries with high-volume, low-value subscriptions, requiring precise accounting to track incremental revenue recognition and ensure accurate financial reporting.

Deferred Subscription Revenue

Deferred subscription revenue represents a specific type of subscription liability where cash is received in advance for services or products to be delivered over time, contrasting with general liabilities that encompass broader financial obligations like loans or accounts payable; this classification ensures accurate revenue recognition and financial reporting by matching income with the service period. Subscription liabilities, including deferred revenue, are crucial for SaaS companies and subscription-based businesses to reflect the obligation to deliver future services, thereby preventing premature revenue recognition and maintaining compliance with accounting standards such as ASC 606.

Streaming Service Liability Exposure

Streaming service liability exposure primarily involves subscription liabilities, where unearned revenue from prepaid subscriptions must be accurately recognized as services are delivered. Distinguishing general liabilities from subscription liabilities ensures precise financial reporting and compliance with revenue recognition standards like ASC 606.

Recurring Payment Liabilities

Recurring payment liabilities represent ongoing financial obligations tied to subscription-based services, where companies must recognize subscription liabilities as deferred revenue reflecting unearned income from customers. Unlike general liabilities, subscription liabilities specifically track anticipated revenue over the subscription period, ensuring accurate matching of revenue with expenses in financial reporting.

Pay-As-You-Go Liability Accrual

Pay-As-You-Go Liability Accrual integrates real-time expense tracking directly into subscription liabilities, contrasting traditional liabilities that represent fixed obligations without dynamic adjustment. This method ensures precise matching of costs with usage, optimizing cash flow management and financial accuracy in subscription-based services.

SaaS Deferred Liabilities

SaaS deferred liabilities represent revenue received in advance for subscription services yet to be delivered, classified as subscription liabilities on the balance sheet. These differ from general liabilities since they specifically track unearned revenue, ensuring accurate matching of revenue and expenses over the subscription period.

Subscription Churn Liability

Liabilities encompass all financial obligations a company owes, while subscription liabilities specifically refer to deferred revenue from recurring customer subscriptions. Subscription churn liability accounts for the potential revenue loss when subscribers cancel, necessitating accurate forecasting to manage cash flow and financial reporting effectively.

Multi-Tier Subscription Liabilities

Multi-tier subscription liabilities represent a complex structure within liabilities, where obligations are segmented into hierarchical levels based on subscription terms and payment schedules. Understanding the differentiation between general liabilities and multi-tier subscription liabilities is crucial for accurate financial reporting and risk assessment in subscription-based business models.

Auto-Renewal Contract Liabilities

Subscription liabilities represent deferred revenue from auto-renewal contracts, reflecting the obligation to deliver services over the contract term, whereas general liabilities encompass broader financial obligations not specifically tied to recurring revenue. Auto-renewal contract liabilities require precise recognition policies to match the subscription revenue with service periods, ensuring accurate financial reporting and compliance.

Freemium Model Liability Risks

Subscription liabilities represent deferred revenue from paid users, whereas freemium model liability risks arise from offering free services that may convert unpredictably, causing challenges in accurately forecasting revenue and recognizing liabilities. Managing freemium model liabilities requires precise tracking of user conversion rates and potential refund obligations to mitigate financial risks and ensure compliance with accounting standards.

Liabilities vs Subscription Liabilities for liability. Infographic

moneydiff.com

moneydiff.com