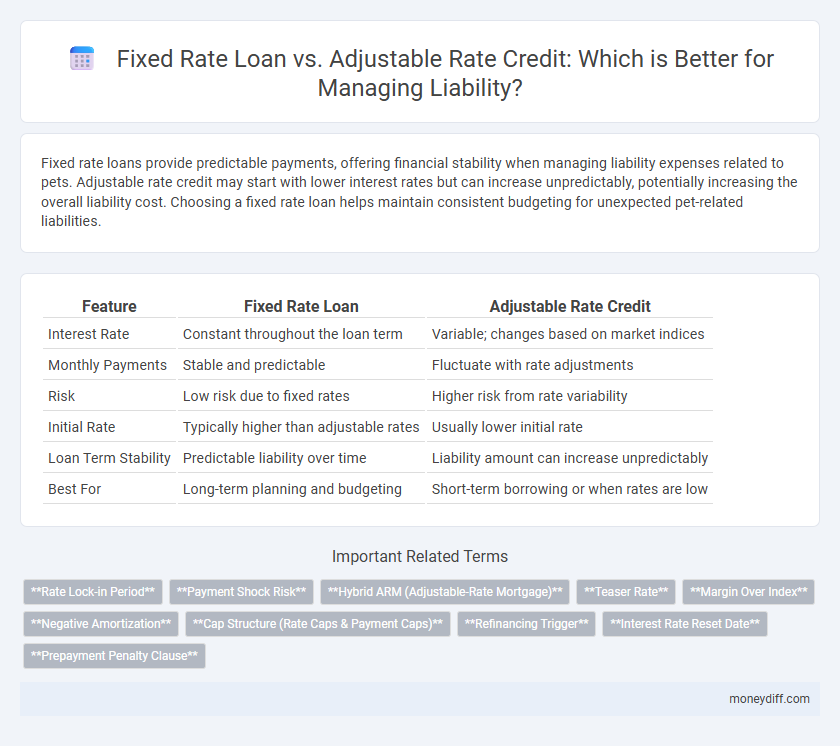

Fixed rate loans provide predictable payments, offering financial stability when managing liability expenses related to pets. Adjustable rate credit may start with lower interest rates but can increase unpredictably, potentially increasing the overall liability cost. Choosing a fixed rate loan helps maintain consistent budgeting for unexpected pet-related liabilities.

Table of Comparison

| Feature | Fixed Rate Loan | Adjustable Rate Credit |

|---|---|---|

| Interest Rate | Constant throughout the loan term | Variable; changes based on market indices |

| Monthly Payments | Stable and predictable | Fluctuate with rate adjustments |

| Risk | Low risk due to fixed rates | Higher risk from rate variability |

| Initial Rate | Typically higher than adjustable rates | Usually lower initial rate |

| Loan Term Stability | Predictable liability over time | Liability amount can increase unpredictably |

| Best For | Long-term planning and budgeting | Short-term borrowing or when rates are low |

Understanding Fixed Rate Loans: Stability in Liability

Fixed rate loans provide predictable monthly payments, ensuring consistent liability management over the loan term. The stable interest rate protects borrowers from market fluctuations, making it easier to budget and plan long-term financial obligations. This reliability reduces the risk of unexpected increases in liability costs compared to adjustable rate credit, which can vary with interest rate changes.

Adjustable Rate Credit: Flexibility and Risk

Adjustable rate credit offers flexibility by allowing interest rates to fluctuate with market conditions, which can lower initial liability costs compared to fixed rate loans. This variability introduces risk as liabilities may increase when rates rise, affecting cash flow predictability and financial planning. Evaluating the potential for rate changes is crucial for managing overall debt exposure and balancing risk against the benefit of lower initial payments.

Key Differences Between Fixed and Adjustable Rate Options

Fixed rate loans maintain a constant interest rate throughout the loan term, providing predictable monthly payments and consistent liability management. Adjustable rate credit features interest rates that fluctuate based on market indices, leading to variable payment amounts and potentially increasing financial liability over time. Understanding the impact of interest rate stability versus variability is crucial for effective liability planning and risk assessment.

Impact on Long-Term Liability Management

Fixed rate loans provide predictability in interest expenses, enabling consistent budgeting and reducing the risk of fluctuating liabilities over time. Adjustable rate credit can initially lower borrowing costs but exposes long-term liability management to interest rate volatility, potentially increasing future repayment obligations. Effective liability management balances stable fixed rates and the flexibility of adjustable rates to optimize debt service and financial risk.

Interest Rate Trends: What Borrowers Need to Know

Fixed rate loans provide borrowers with predictable monthly payments and protection against rising interest rates, making them a safer choice during periods of increasing rate trends. Adjustable rate credit often starts with lower initial rates, but its fluctuating interest payments can increase liability risk when market rates rise unexpectedly. Understanding current economic indicators such as inflation rates, Federal Reserve policies, and bond market movements is essential for borrowers to assess potential changes in their debt servicing costs under each loan type.

Cost Analysis: Fixed vs Adjustable for Liabilities

Fixed rate loans offer predictable liability costs with stable interest payments over the life of the loan, minimizing risk from market fluctuations. Adjustable rate credit often starts with lower initial rates, but the liability cost can increase significantly if interest rates rise, leading to higher overall expenses. Analyzing total cost projections under various interest rate scenarios is crucial for choosing between fixed rate loans and adjustable rate credit for managing liabilities effectively.

Refinance Strategies for Both Loan Types

Refinancing fixed rate loans can stabilize liabilities by locking in lower interest rates, reducing long-term payment obligations and enhancing cash flow predictability. Adjustable rate credit refinancing requires careful assessment of interest rate trends to minimize volatility and adjust payment schedules in alignment with market conditions. Employing tailored refinance strategies for each loan type helps optimize debt management and mitigate financial risks associated with fluctuating interest liabilities.

Suitability: Matching Loan Types to Financial Goals

Fixed rate loans offer predictable monthly payments ideal for borrowers seeking stability and long-term budgeting certainty, effectively minimizing liability risk over the loan term. Adjustable rate credit suits individuals expecting fluctuating income or planning short-term borrowing, as initial rates are lower but entail variable liability due to interest rate adjustments. Choosing between fixed and adjustable rates depends on matching loan structures to financial goals, risk tolerance, and future income projections to optimize liability management.

Risk Mitigation When Choosing Loan Structures

Fixed rate loans provide predictable payment schedules, reducing exposure to interest rate volatility and enhancing financial planning certainty. Adjustable rate credit carries inherent risks of fluctuating repayments, potentially increasing liability costs during periods of rising interest rates. Selecting a loan structure with stable, fixed rates mitigates risk by limiting exposure to market fluctuations and ensuring consistent debt servicing obligations.

Expert Tips for Managing Liability with Loan Products

Managing liability effectively requires understanding the nuances between fixed rate loans and adjustable rate credit. Fixed rate loans provide stable monthly payments, aiding accurate liability forecasting and protecting against interest rate fluctuations, while adjustable rate credit can offer lower initial rates but introduces unpredictability, potentially increasing liability. Experts recommend assessing your cash flow stability and risk tolerance before choosing, ensuring your liability management strategy aligns with your financial goals and market conditions.

Related Important Terms

Rate Lock-in Period

Fixed rate loans offer a stable rate lock-in period, securing consistent liability payments throughout the loan term and reducing exposure to interest rate volatility. Adjustable rate credit features variable rate lock-in periods, leading to fluctuating liabilities as rates adjust based on market conditions.

Payment Shock Risk

Fixed rate loans minimize payment shock risk by maintaining consistent monthly payments throughout the loan term, ensuring predictable liability management. Adjustable rate credit exposes borrowers to potential payment shock risk due to variable interest rates that can significantly increase repayment amounts, complicating financial planning.

Hybrid ARM (Adjustable-Rate Mortgage)

Hybrid ARM (Adjustable-Rate Mortgage) combines a fixed interest rate period with subsequent adjustable rates, providing a balance between predictable payments and potential cost savings in fluctuating interest environments. This structure can mitigate liability risks by offering initial payment stability followed by adjustments tied to market indices, which may affect overall loan liability exposure.

Teaser Rate

Teaser rates in adjustable rate credit offer temporarily low interest that can significantly reduce initial liability costs but may reset to higher rates, increasing long-term financial risk. Fixed rate loans eliminate the uncertainty of fluctuating teaser rates by providing consistent liability payments, allowing clearer budget forecasting and risk management.

Margin Over Index

In liability management, fixed rate loans provide predictability with a constant interest rate, eliminating concerns over margin changes, while adjustable rate credit's primary risk lies in the margin over index, which directly affects the total borrowing cost as it fluctuates with market benchmarks. Careful analysis of the margin over index is crucial since it determines the premium above the base index rate, impacting overall liability expenses in adjustable rate structures.

Negative Amortization

Fixed rate loans maintain consistent payments that prevent negative amortization by ensuring principal reduction over time, while adjustable rate credit can lead to negative amortization if interest rate increases cause payments to fall short of covering accruing interest. Negative amortization in adjustable rate credit increases liability as unpaid interest is added to the principal balance, escalating total debt exposure.

Cap Structure (Rate Caps & Payment Caps)

Fixed rate loans provide predictable liability management with consistent interest payments, while adjustable rate credit involves rate caps that limit interest rate fluctuations and payment caps that prevent sudden spikes in installment amounts, offering controlled risk exposure. Rate caps and payment caps in adjustable rate credit are critical in mitigating potential increases in liability costs, ensuring more stable cash flow despite market volatility.

Refinancing Trigger

Fixed rate loans provide stability by locking interest rates, reducing the refinancing trigger to instances of significant rate drops or financial restructuring. Adjustable rate credit increases the likelihood of refinancing triggers due to fluctuating interest rates that may surpass acceptable liability thresholds.

Interest Rate Reset Date

Fixed rate loans maintain a consistent interest rate throughout the loan term, eliminating exposure to fluctuating rate reset dates and providing predictable liability costs. Adjustable rate credit involves periodic interest rate reset dates, which can increase liability risk due to potential rate spikes tied to market index changes.

Prepayment Penalty Clause

Fixed rate loans often include a prepayment penalty clause to compensate lenders for interest loss, increasing the borrower's liability if the loan is repaid early. Adjustable rate credits typically have lower or no prepayment penalties, offering more flexibility and reduced financial liability in dynamic interest rate environments.

Fixed Rate Loan vs Adjustable Rate Credit for Liability. Infographic

moneydiff.com

moneydiff.com