When considering liability in property ownership, a mortgage typically places full responsibility on the borrower for repayment, increasing individual financial risk. Shared equity arrangements distribute liability between parties, reducing the burden on a single individual while aligning interests in property value changes. Choosing between a mortgage and shared equity impacts legal and financial obligations, influencing long-term liability exposure.

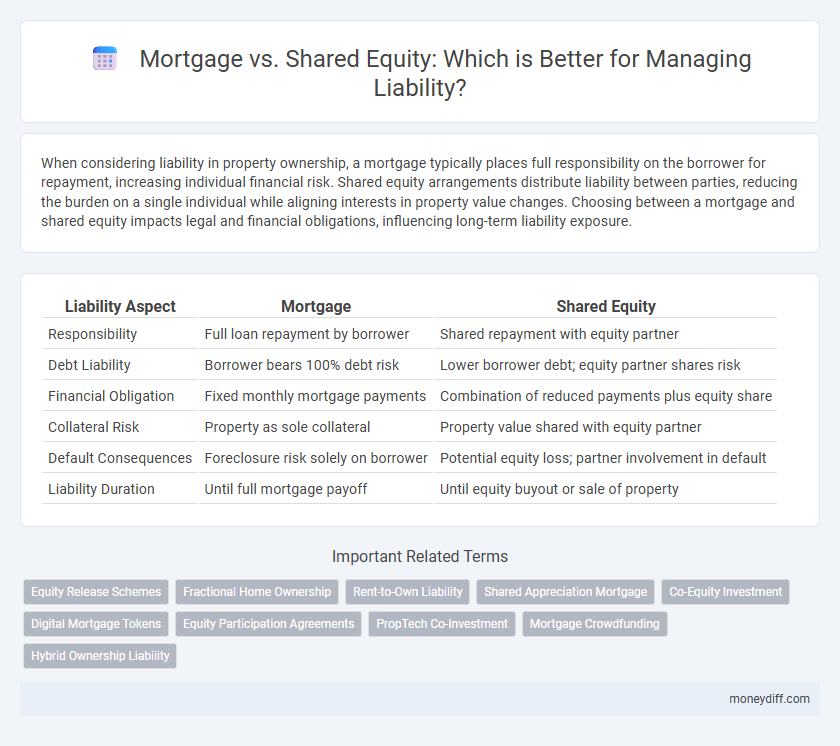

Table of Comparison

| Liability Aspect | Mortgage | Shared Equity |

|---|---|---|

| Responsibility | Full loan repayment by borrower | Shared repayment with equity partner |

| Debt Liability | Borrower bears 100% debt risk | Lower borrower debt; equity partner shares risk |

| Financial Obligation | Fixed monthly mortgage payments | Combination of reduced payments plus equity share |

| Collateral Risk | Property as sole collateral | Property value shared with equity partner |

| Default Consequences | Foreclosure risk solely on borrower | Potential equity loss; partner involvement in default |

| Liability Duration | Until full mortgage payoff | Until equity buyout or sale of property |

Understanding Liabilities: Mortgage vs Shared Equity

Mortgage liabilities involve a borrower owing the full loan amount secured against property, creating a direct financial obligation with fixed repayment terms and interest rates. Shared equity arrangements distribute liability between the homeowner and investor, reducing individual debt burden but linking repayment to property value changes. Understanding these liabilities is crucial for assessing long-term financial risk and ownership responsibilities in property investment decisions.

Defining Mortgage Liability: Key Concepts

Mortgage liability refers to the legal obligation of a borrower to repay the loan secured by real property, typically involving fixed or variable interest payments over a specified term. Shared equity liability, however, involves a proportional financial obligation linked to property value fluctuations, where the lender holds a stake in the property's equity rather than receiving regular interest payments. Understanding these key concepts helps clarify the distinct financial risks and responsibilities inherent in mortgage versus shared equity agreements.

Shared Equity Explained: How It Impacts Your Finances

Shared equity arrangements reduce your liability by dividing ownership and financial responsibility between the buyer and the investor, limiting the amount of debt you personally incur compared to traditional mortgages. Unlike a mortgage that requires full repayment plus interest, shared equity agreements involve paying back only a portion of the property's appreciated value, which can mitigate the risk of financial strain if property values decline. This model shifts some financial liability away from the borrower, impacting credit exposure and long-term financial obligations.

Financial Risks: Comparing Mortgage and Shared Equity

Mortgages involve fixed or variable interest rates, creating predictable monthly payments but exposing borrowers to potential liability if property values decline or income decreases. Shared equity agreements reduce upfront borrowing but transfer part of property appreciation risk to the homeowner, potentially leading to higher long-term costs if property values rise significantly. Understanding these financial risks is essential for evaluating the extent of liability associated with each financing option.

Debt Burden: Which Option Adds More Liability?

Mortgage loans typically impose a fixed debt burden with consistent monthly repayments and full liability for the loan amount, increasing personal financial risk. Shared equity agreements reduce upfront debt by sharing property ownership but create contingent liabilities tied to future property valuations and profits. Mortgage debt generally adds more direct liability, while shared equity spreads financial risk but may lead to variable long-term obligations.

Asset Ownership and Liability Implications

Mortgage loans grant full asset ownership to the borrower, who assumes complete liability for loan repayment and property obligations. Shared equity agreements involve joint ownership between the borrower and investor, distributing liability and financial risk proportionally to their ownership shares. This structure can reduce personal debt exposure but requires clear terms regarding asset control and future equity division.

Long-Term Financial Impact: Mortgage vs Shared Equity

Mortgage liabilities involve fixed monthly payments with interest, creating predictable long-term financial obligations and potential equity growth as the principal reduces. Shared equity agreements reduce immediate debt burden by sharing property ownership with an investor, but may lead to variable future costs based on property appreciation and profit-sharing terms. Assessing long-term financial impact requires evaluating interest accumulation, equity appreciation, and potential resale outcomes under each liability structure.

Managing Liability in Home Financing Choices

Mortgage loans create a fixed liability with predictable monthly payments and full repayment obligations, impacting credit scores and debt-to-income ratios. Shared equity agreements distribute ownership risk by linking liability to property value changes, potentially reducing financial strain during market fluctuations. Evaluating liability exposure in each financing option is essential for long-term financial stability and risk management in homeownership.

Exit Strategies: Reducing Liability in Both Models

Exit strategies in mortgage and shared equity models significantly impact liability reduction. Mortgage borrowers maintain full debt responsibility until repayment, while shared equity arrangements shift some financial risk to the equity partner, alleviating personal liability. Structured exit options like property sale, refinancing, or buyout agreements in shared equity models provide flexible paths to limit ongoing liability.

Which Is Right for You? Assessing Liability Based on Financial Goals

Choosing between a mortgage and shared equity involves evaluating your liability exposure relative to your financial goals. Mortgages typically require full repayment of principal and interest, increasing personal liability and long-term debt obligations. Shared equity reduces upfront liability by partnering with an investor who shares ownership risks and returns, aligning with goals that prioritize limited initial debt and collaborative asset appreciation.

Related Important Terms

Equity Release Schemes

Mortgage liability requires borrowers to repay the principal with interest, creating a fixed financial obligation, while shared equity schemes tie liability to the property's value, reducing immediate repayment pressure but risking equity dilution. Equity release schemes under shared equity arrangements enable homeowners to unlock property value without monthly repayments, shifting liability toward future sale proceeds or inheritance impact.

Fractional Home Ownership

Fractional home ownership liabilities differ significantly between mortgage and shared equity models, as mortgage holders bear full repayment responsibility and potential foreclosure risks, while shared equity partners share financial exposure based on their ownership percentage. In shared equity agreements, liability is proportionate, reducing individual risk but requiring clear terms to manage obligations and asset appreciation or depreciation.

Rent-to-Own Liability

Rent-to-own liability arises when a tenant agrees to purchase the property over time, often leading to shared equity arrangements where both tenant and landlord hold financial stakes; unlike traditional mortgage liability, this model mitigates the tenant's immediate debt burden while complicating liability distribution during defaults or property devaluation. Understanding the distinct liability frameworks in rent-to-own contracts is essential for accurately assessing risk exposure and financial responsibility compared to conventional mortgage agreements.

Shared Appreciation Mortgage

Shared Appreciation Mortgages (SAMs) reduce borrower liability by linking repayment amounts to property value increases, minimizing fixed debt burden compared to traditional mortgages. Unlike conventional loans, SAMs shift risk between lender and borrower through equity participation, aligning financial responsibility with actual market appreciation.

Co-Equity Investment

Co-equity investment in shared equity models limits personal liability compared to traditional mortgages, as borrowers and investors share property ownership and financial risk rather than the borrower assuming full debt responsibility. This structure reduces individual exposure to default-related liabilities while enabling joint equity growth aligned with property value fluctuations.

Digital Mortgage Tokens

Digital mortgage tokens reduce liability risks by enabling transparent, immutable ownership records and streamlined asset transfer compared to traditional mortgage liabilities. Shared equity models dilute individual liability by distributing risk among multiple stakeholders, leveraging blockchain technology to enhance security and accountability in digital asset management.

Equity Participation Agreements

Equity Participation Agreements create shared liability between borrower and investor by linking mortgage repayment to property value, impacting financial responsibilities based on market fluctuations. Unlike traditional mortgages where liability is fixed to loan principal and interest, shared equity models distribute risk and potential gains, making liability contingent on the property's future appraisal.

PropTech Co-Investment

Mortgage liabilities typically involve fixed repayment obligations secured against property value, whereas Shared Equity agreements divide both risk and potential appreciation between the homeowner and PropTech Co-Investment partners. PropTech Co-Investment models reduce individual borrower liability by sharing the financial burden, aligning incentives for property value growth and minimizing default risk.

Mortgage Crowdfunding

Mortgage crowdfunding spreads liability among numerous investors, reducing individual financial risk compared to traditional mortgages where liability rests solely on the borrower. Shared equity involves shared risk and reward, creating joint liability that can complicate financial obligations, whereas mortgage crowdfunding provides a more diversified liability structure through multiple stakeholders.

Hybrid Ownership Liability

Hybrid ownership liability in mortgage versus shared equity structures combines the debtor's obligation to repay the full loan amount with the investor's partial risk linked to property value fluctuations, creating a complex liability profile. Mortgage liability typically involves fixed repayment terms and full borrower responsibility, whereas shared equity liability adjusts according to property appreciation or depreciation, spreading financial risk between owner and investor.

Mortgage vs Shared Equity for liability. Infographic

moneydiff.com

moneydiff.com