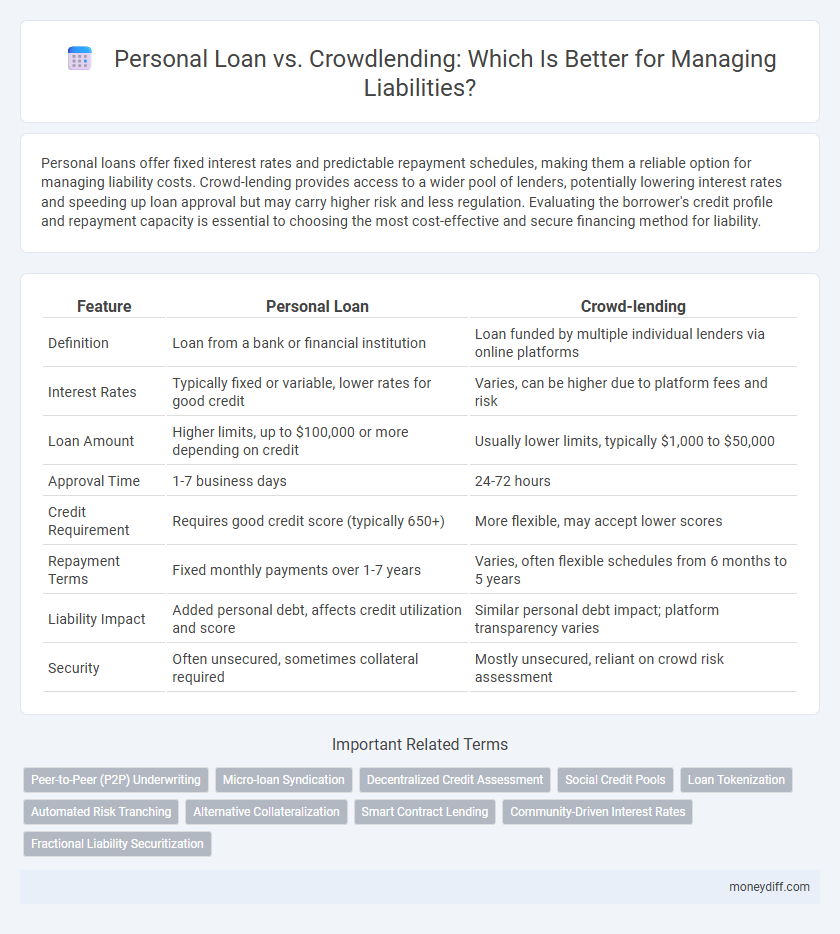

Personal loans offer fixed interest rates and predictable repayment schedules, making them a reliable option for managing liability costs. Crowd-lending provides access to a wider pool of lenders, potentially lowering interest rates and speeding up loan approval but may carry higher risk and less regulation. Evaluating the borrower's credit profile and repayment capacity is essential to choosing the most cost-effective and secure financing method for liability.

Table of Comparison

| Feature | Personal Loan | Crowd-lending |

|---|---|---|

| Definition | Loan from a bank or financial institution | Loan funded by multiple individual lenders via online platforms |

| Interest Rates | Typically fixed or variable, lower rates for good credit | Varies, can be higher due to platform fees and risk |

| Loan Amount | Higher limits, up to $100,000 or more depending on credit | Usually lower limits, typically $1,000 to $50,000 |

| Approval Time | 1-7 business days | 24-72 hours |

| Credit Requirement | Requires good credit score (typically 650+) | More flexible, may accept lower scores |

| Repayment Terms | Fixed monthly payments over 1-7 years | Varies, often flexible schedules from 6 months to 5 years |

| Liability Impact | Added personal debt, affects credit utilization and score | Similar personal debt impact; platform transparency varies |

| Security | Often unsecured, sometimes collateral required | Mostly unsecured, reliant on crowd risk assessment |

Understanding Personal Loans and Crowd-lending

Personal loans involve borrowing a fixed sum from financial institutions with predetermined interest rates and repayment schedules, creating a direct liability for the borrower. Crowd-lending platforms, also known as peer-to-peer lending, connect multiple individual lenders and borrowers, distributing loan risk but potentially resulting in varying interest rates and flexible repayment terms. Understanding these differences is crucial for managing personal liabilities effectively, balancing cost, risk, and credit impact.

Key Differences Between Personal Loans and Crowd-lending

Personal loans typically involve borrowing a fixed amount from a bank or financial institution with a predetermined interest rate and repayment schedule, whereas crowd-lending sources funds from multiple individual investors through an online platform, often offering more flexible terms. Personal loans usually require a thorough credit check and provide higher loan amounts, while crowd-lending may cater to borrowers with varied credit profiles at potentially higher interest rates due to increased risk. The liability for repayment in personal loans remains solely with the borrower, whereas crowd-lending distributes the risk among multiple investors, impacting both the cost and availability of funds.

Interest Rates: Personal Loans vs Crowd-lending

Personal loans generally have fixed interest rates set by financial institutions, often ranging from 6% to 36% APR depending on creditworthiness, leading to predictable monthly payments. Crowd-lending platforms typically offer competitive interest rates between 5% and 15%, influenced by borrower risk profiles and investor demand. Risk-based pricing in crowd-lending can result in lower overall liability costs compared to traditional personal loans, especially for borrowers with strong credit scores.

Eligibility Requirements and Application Process

Personal loans typically require a good credit score, stable income, and thorough documentation for eligibility, while crowd-lending platforms often have more flexible criteria, accepting borrowers with varied credit backgrounds. The application process for personal loans involves formal bank procedures, credit checks, and longer approval times, whereas crowd-lending offers a quicker, digitally-driven process with peer evaluation and transparent funding timelines. Understanding these differences helps borrowers assess liability risks based on eligibility ease and application efficiency.

Risks and Benefits of Personal Loans

Personal loans offer fixed interest rates and predictable repayment schedules, providing borrowers with clear liability management and budgeting advantages. However, personal loans carry the risk of higher interest rates compared to crowd-lending platforms, potentially increasing overall debt liability if not managed carefully. Benefits include established credit building opportunities and protection under federal lending regulations, while risks involve potential default consequences and fees associated with early repayment.

Risks and Benefits of Crowd-lending

Crowd-lending offers diversified risk by pooling multiple investors, reducing individual liability compared to personal loans, which place full repayment responsibility solely on the borrower. Investors in crowd-lending face risks such as borrower default and platform insolvency, but benefit from potentially higher returns and accessible credit options for borrowers with varied credit profiles. Personal loans typically provide fixed terms and rates, while crowd-lending can offer flexible financing solutions with community-driven lending dynamics.

Repayment Terms and Flexibility

Personal loans typically offer fixed repayment schedules with predetermined interest rates, making monthly budgeting predictable but less flexible. Crowd-lending platforms often provide more customizable repayment terms, allowing borrowers to negotiate installment amounts and durations based on their financial situation. This flexibility in crowd-lending can reduce liability stress by accommodating changes in the borrower's income or financial circumstances.

Impact on Credit Score

Personal loans typically have a more direct and significant impact on credit scores due to fixed monthly payments and credit utilization ratios reported to credit bureaus. Crowd-lending, while still impacting credit scores, may offer more flexible repayment options and less frequent reporting, potentially mitigating negative effects on credit. Both financing methods require consistent timely payments to maintain or improve creditworthiness and avoid increasing liability risk.

Liability Considerations for Borrowers

Personal loans typically involve fixed interest rates and set repayment schedules, which offer predictable liabilities for borrowers but may include higher penalties for default. Crowd-lending platforms often present variable interest rates and flexible terms, potentially reducing immediate financial burden but increasing long-term liability uncertainty. Borrowers should evaluate total liability exposure, including interest accumulation and default risks, when choosing between personal loans and crowd-lending options.

Choosing the Best Option for Your Financial Situation

Evaluating personal loans versus crowd-lending for liability management depends on interest rates, repayment terms, and credit impact. Personal loans often provide fixed monthly payments and predictable liability reduction, while crowd-lending can offer flexible terms but may involve higher risks and variable rates. Assessing your credit score, monthly cash flow, and long-term financial goals helps determine the optimal borrowing option to minimize liability burdens effectively.

Related Important Terms

Peer-to-Peer (P2P) Underwriting

Peer-to-peer (P2P) underwriting in crowd-lending reduces personal liability risk by distributing loan approval responsibilities across multiple lenders, unlike traditional personal loans where liability primarily rests on the borrower and a single financial institution. This decentralized risk assessment enhances transparency and potentially lowers default rates, benefiting both borrowers and lenders in liability management.

Micro-loan Syndication

Micro-loan syndication in personal loans offers individual borrowers quick access to funds with fixed repayment terms, whereas crowd-lending pools multiple investors to share the credit risk across micro-loans, increasing loan availability but complicating liability distribution. Understanding the liability structure is crucial for both borrowers and lenders to mitigate defaults and ensure transparent repayment obligations in micro-loan syndication platforms.

Decentralized Credit Assessment

Personal loans typically rely on centralized credit assessments based on traditional financial history, which may limit access for those with incomplete credit profiles. Crowd-lending utilizes decentralized credit assessment models leveraging peer evaluations and blockchain technology to enhance transparency and inclusivity in liability management.

Social Credit Pools

Personal loans often require fixed repayment schedules and higher interest rates, increasing individual liability, while crowd-lending through social credit pools distributes risk among multiple lenders, reducing the borrower's direct financial burden. Social credit pools leverage collective trust and transparency, enabling more flexible terms and potentially lower liabilities for borrowers compared to traditional personal loans.

Loan Tokenization

Loan tokenization in personal loans transforms debt into digital tokens, enabling fractional ownership and increased liquidity in secondary markets. Crowd-lending leverages tokenization to distribute liability across multiple investors, reducing individual risk and enhancing transparency through blockchain technology.

Automated Risk Tranching

Personal loans typically involve fixed liability terms with standardized risk assessment, while crowd-lending platforms utilize automated risk tranching to segment borrowers into distinct risk categories, optimizing liability distribution. This automated approach enhances transparency and efficiency in managing default risk across diverse investor portfolios.

Alternative Collateralization

Personal loans typically require traditional collateral such as property or vehicles to mitigate liability risks, whereas crowd-lending platforms offer alternative collateralization options like digital assets or peer guarantees, broadening access to credit while managing default risk. This alternative collateral model diversifies liability exposure by leveraging non-traditional assets and social trust networks, providing borrowers with flexible funding solutions beyond conventional secured loans.

Smart Contract Lending

Personal loan liabilities typically involve fixed interest rates and traditional credit assessments, whereas crowd-lending through smart contract lending offers automated, transparent contract execution with programmable repayment terms that reduce intermediary risks. Smart contract lending leverages blockchain technology to enforce liability conditions efficiently, enhancing trust and minimizing default risks compared to conventional personal loans.

Community-Driven Interest Rates

Personal loans typically feature fixed interest rates set by financial institutions, whereas crowd-lending platforms leverage community-driven interest rates determined by collective lender demand and borrower risk profiles. This dynamic often results in more competitive rates on crowd-lending options, potentially reducing overall liability for borrowers.

Fractional Liability Securitization

Personal loans typically involve direct liability where the borrower is solely responsible for repayment, whereas crowd-lending employs fractional liability securitization, distributing risk among multiple investors through tokenized loan shares. This division of liability in crowd-lending reduces individual exposure and enhances risk management by enabling investors to hold diversified, fractionalized claims on loan repayments.

Personal Loan vs Crowd-lending for Liability Infographic

moneydiff.com

moneydiff.com