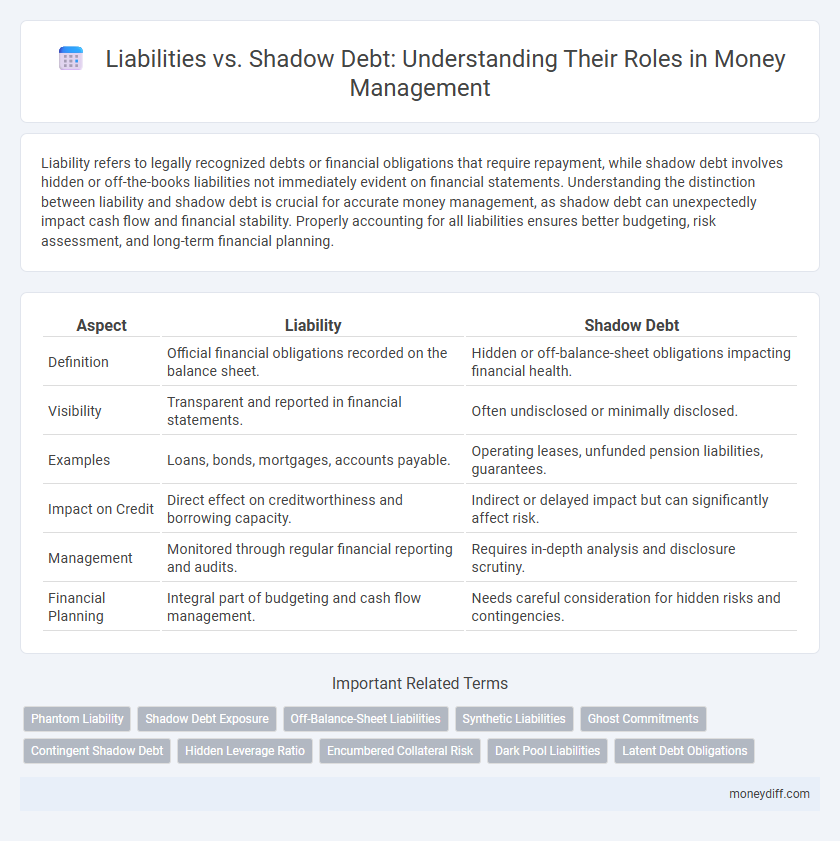

Liability refers to legally recognized debts or financial obligations that require repayment, while shadow debt involves hidden or off-the-books liabilities not immediately evident on financial statements. Understanding the distinction between liability and shadow debt is crucial for accurate money management, as shadow debt can unexpectedly impact cash flow and financial stability. Properly accounting for all liabilities ensures better budgeting, risk assessment, and long-term financial planning.

Table of Comparison

| Aspect | Liability | Shadow Debt |

|---|---|---|

| Definition | Official financial obligations recorded on the balance sheet. | Hidden or off-balance-sheet obligations impacting financial health. |

| Visibility | Transparent and reported in financial statements. | Often undisclosed or minimally disclosed. |

| Examples | Loans, bonds, mortgages, accounts payable. | Operating leases, unfunded pension liabilities, guarantees. |

| Impact on Credit | Direct effect on creditworthiness and borrowing capacity. | Indirect or delayed impact but can significantly affect risk. |

| Management | Monitored through regular financial reporting and audits. | Requires in-depth analysis and disclosure scrutiny. |

| Financial Planning | Integral part of budgeting and cash flow management. | Needs careful consideration for hidden risks and contingencies. |

Understanding Financial Liability: Definitions and Types

Financial liability refers to obligations that require future payment or settlement, including loans, mortgages, and accounts payable. Shadow debt encompasses off-balance-sheet liabilities or contingent obligations not immediately visible in financial statements but impacting cash flow and creditworthiness. Understanding these distinctions is crucial for accurate money management and risk assessment.

What is Shadow Debt? Unveiling the Hidden Financial Burden

Shadow debt refers to financial obligations not officially recognized on a company's balance sheet, such as off-balance-sheet liabilities, contingent liabilities, or hidden borrowing through complex financial instruments. Unlike explicit liabilities, shadow debt remains concealed, posing significant risks to accurate money management by masking true debt levels and potentially leading to underestimated financial exposure. Identifying and managing shadow debt is crucial for maintaining transparency and avoiding unexpected financial strain in business operations.

Key Differences Between Liability and Shadow Debt

Liability represents a legally recognized debt or financial obligation recorded on a company's balance sheet, while shadow debt encompasses off-balance-sheet liabilities not immediately visible in financial statements. Key differences include transparency and risk assessment, as liabilities are disclosed and regulated under accounting standards, whereas shadow debt can obscure a company's true financial health and leverage. Understanding these differences is crucial for accurate financial analysis and risk management in money management strategies.

Impact of Liability on Personal Finances

Liability directly affects personal finances by increasing financial obligations and reducing available capital for savings or investments. Unlike shadow debt, which may be less visible or formally recognized, liabilities such as loans, mortgages, and credit card balances have immediate and measurable impacts on credit scores and debt-to-income ratios. Managing liabilities effectively is critical to maintaining financial stability and avoiding long-term monetary strain.

How Shadow Debt Can Disrupt Your Financial Health

Shadow debt includes overlooked obligations like unpaid bills, deferred taxes, or informal loans that do not appear on your credit report, creating a false sense of financial security. These hidden liabilities can accumulate rapidly, increasing your overall debt burden and potentially lowering your credit score when they surface unexpectedly. Ignoring shadow debt disrupts accurate financial planning, leading to cash flow problems and hindering long-term wealth building.

Managing Liabilities: Proven Strategies for Success

Effectively managing liabilities involves prioritizing high-interest debts to reduce overall financial burden and improve cash flow. Shadow debt, often overlooked, includes hidden obligations like unpaid taxes or informal loans that can impact creditworthiness and liquidity. Employing strategies such as detailed debt tracking, regular financial audits, and prudent budgeting ensures both liabilities and shadow debts are controlled, fostering long-term financial stability.

Identifying and Eliminating Shadow Debt

Shadow debt refers to financial obligations not recorded on official balance sheets, often emerging from off-balance-sheet items such as leases or contingent liabilities. Identifying shadow debt requires thorough analysis of contractual agreements, hidden fees, and indirect obligations that can obscure the true financial risk. Eliminating shadow debt improves transparency and financial stability by ensuring all liabilities are accounted for in money management strategies.

Pros and Cons: Visibility of Liabilities vs. Concealed Shadow Debt

Liability offers clear visibility in money management, enabling accurate tracking and planning of financial obligations, which reduces unexpected risks. Shadow debt, while often concealed, can obscure true financial health by hiding potential liabilities, leading to underestimated risks and poor decision-making. The trade-off lies in transparency versus hidden exposure, where liabilities provide accountability but shadow debt may result in unforeseen financial strain.

Tools and Techniques to Track Liabilities and Shadow Debt

Effective money management requires precise tools and techniques to track both liabilities and shadow debt, including advanced debt-tracking software, comprehensive financial dashboards, and automated alerts for payment deadlines. Utilizing spreadsheet models and debt amortization calculators enables accurate monitoring of outstanding obligations and hidden financial risks that typical accounting systems may overlook. Integrating these tools with budgeting apps and credit monitoring services enhances visibility into total debt exposure, facilitating more informed financial decisions and optimized liability management.

Building a Strong Money Management Plan: Tackling Both Liability and Shadow Debt

Effective money management requires addressing both liability and shadow debt to build a stable financial foundation. Liability refers to tangible obligations such as loans or mortgages, while shadow debt includes hidden or informal debts like unpaid bills or overlooked expenses. Confronting and minimizing both types ensures accurate budgeting and long-term financial health.

Related Important Terms

Phantom Liability

Phantom liability, often confused with shadow debt, refers to off-balance-sheet obligations that create hidden financial risks without appearing as formal liabilities, impacting accurate money management and risk assessment. Unlike recognized debt, phantom liabilities arise from contingent events or guarantees, making them critical for comprehensive financial planning and transparent liability tracking.

Shadow Debt Exposure

Shadow debt exposure represents undisclosed or off-balance-sheet liabilities that can significantly impact a company's financial health by increasing risk unnoticed by investors and regulators. Unlike traditional liabilities, shadow debt often arises from contingent obligations or complex financial arrangements, making it crucial for accurate money management and risk assessment to identify and quantify these hidden exposures.

Off-Balance-Sheet Liabilities

Off-balance-sheet liabilities, often referred to as shadow debt, include financial obligations not recorded on a company's balance sheet, such as operating leases and contingent liabilities, posing hidden risks to money management. Proper identification and disclosure of these off-balance-sheet items are crucial for accurately assessing a business's true financial leverage and ensuring transparent risk assessment.

Synthetic Liabilities

Synthetic liabilities represent off-balance-sheet financial obligations created through derivatives and structured products, impacting a company's true debt exposure and financial risk. Unlike traditional liabilities, synthetic liabilities complicate money management by obscuring actual debt levels, requiring advanced risk assessment and transparent reporting for accurate liability measurement.

Ghost Commitments

Liability refers to legally recognized debts or obligations recorded on a company's balance sheet, while shadow debt encompasses ghost commitments that remain off-balance-sheet, representing hidden financial risks. Effective money management requires identifying and monitoring these phantom liabilities to avoid unexpected cash flow strains and ensure accurate financial assessment.

Contingent Shadow Debt

Contingent shadow debt represents potential financial obligations not recognized on the balance sheet but can materialize based on uncertain future events, posing hidden risks in money management. Understanding the distinction between recorded liability and contingent shadow debt is crucial for accurate risk assessment and maintaining fiscal stability.

Hidden Leverage Ratio

Liabilities represent clearly recorded financial obligations on a company's balance sheet, whereas shadow debt includes off-balance-sheet commitments that inflate the Hidden Leverage Ratio, obscuring the true financial risk. Monitoring the Hidden Leverage Ratio is crucial for accurate money management since shadow debt can significantly increase leverage beyond reported liabilities.

Encumbered Collateral Risk

Liability represents a formal financial obligation requiring repayment, whereas shadow debt encompasses off-balance-sheet risks, often stemming from encumbered collateral arrangements that can unexpectedly trigger liquidity constraints. Encumbered collateral risk arises when assets pledged as security limit borrowing capacity and may lead to hidden liabilities, complicating accurate debt assessments in money management.

Dark Pool Liabilities

Dark pool liabilities represent off-balance-sheet obligations arising from unregulated, private trading venues, posing hidden risks compared to standard liabilities clearly reflected in financial statements. Managing shadow debt within dark pools requires enhanced transparency and monitoring to mitigate systemic risks often overlooked in conventional money management strategies.

Latent Debt Obligations

Latent debt obligations represent hidden financial responsibilities not recorded on the balance sheet, contrasting with explicit liabilities that are formally recognized debts. Managing shadow debt requires careful assessment of off-balance sheet arrangements to avoid underestimating the true extent of financial obligations in money management strategies.

Liability vs Shadow Debt for money management. Infographic

moneydiff.com

moneydiff.com