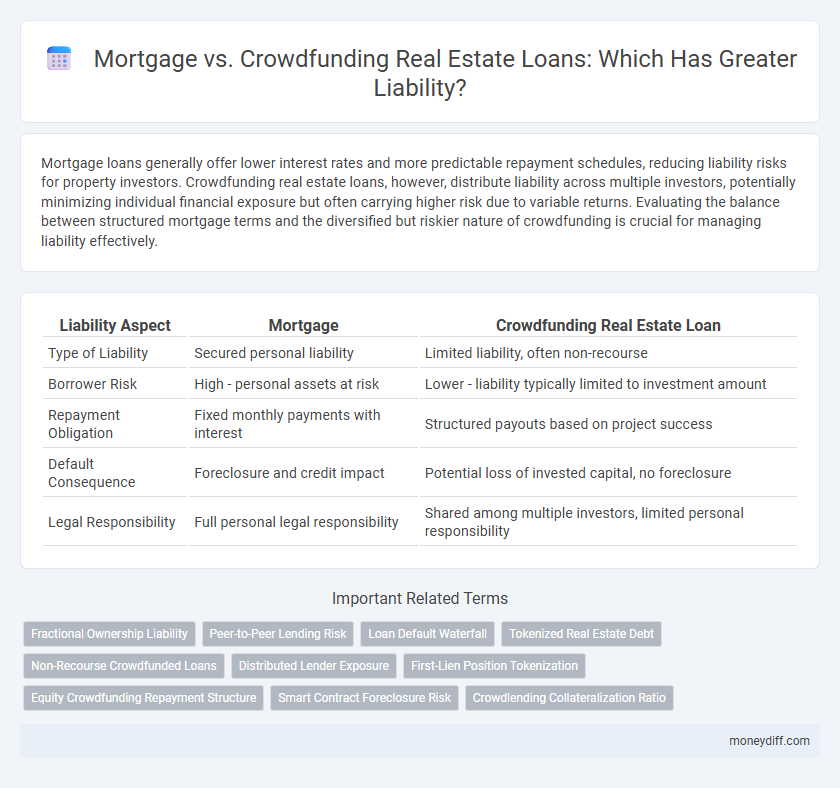

Mortgage loans generally offer lower interest rates and more predictable repayment schedules, reducing liability risks for property investors. Crowdfunding real estate loans, however, distribute liability across multiple investors, potentially minimizing individual financial exposure but often carrying higher risk due to variable returns. Evaluating the balance between structured mortgage terms and the diversified but riskier nature of crowdfunding is crucial for managing liability effectively.

Table of Comparison

| Liability Aspect | Mortgage | Crowdfunding Real Estate Loan |

|---|---|---|

| Type of Liability | Secured personal liability | Limited liability, often non-recourse |

| Borrower Risk | High - personal assets at risk | Lower - liability typically limited to investment amount |

| Repayment Obligation | Fixed monthly payments with interest | Structured payouts based on project success |

| Default Consequence | Foreclosure and credit impact | Potential loss of invested capital, no foreclosure |

| Legal Responsibility | Full personal legal responsibility | Shared among multiple investors, limited personal responsibility |

Understanding Liability in Mortgage Loans

Mortgage loans create a secured liability where the borrower pledges the property as collateral, resulting in the lender having a legal claim in case of default, which can lead to foreclosure. In contrast, crowdfunding real estate loans often involve multiple smaller investments, distributing liability among numerous investors with varying degrees of legal protection depending on the platform and loan structure. Understanding the nature of liability in mortgage loans is crucial, as it directly affects the borrower's financial risk, property ownership rights, and legal obligations under the loan agreement.

Crowdfunding Real Estate Loans: Liability Basics

Crowdfunding real estate loans distribute liability among multiple investors, reducing individual risk compared to traditional mortgage loans where a single borrower holds primary responsibility. Investors in crowdfunding platforms typically face limited liability, meaning their financial exposure is restricted to the amount invested, unlike mortgages that involve full loan repayment obligations. Understanding the liability structure in crowdfunding real estate loans is crucial for assessing potential financial risk and commitment levels.

Key Differences in Borrower Liability

Mortgage loans typically impose full personal liability on borrowers, making them responsible for the entire debt amount should default occur. Crowdfunding real estate loans often distribute liability among multiple investors, reducing individual borrower risk through shared repayment obligations. This key difference affects borrower accountability and risk exposure in real estate financing.

Legal Structures Impacting Liability

Mortgage loans typically involve secured debt tied directly to the property, placing primary liability on the borrower with potential foreclosure risk upon default. Crowdfunding real estate loans distribute liability among multiple investors through a limited liability company (LLC) or special purpose vehicle (SPV), which isolates individual investor risk from personal assets. The choice of legal structure in crowdfunding arrangements significantly limits personal liability, contrasting with the more direct borrower responsibility inherent in traditional mortgage agreements.

Default Risks: Mortgage vs Crowdfunding

Default risks in mortgage loans typically involve the borrower's failure to meet scheduled payments, leading to foreclosure and significant financial liability for both lender and borrower. Crowdfunding real estate loans distribute risk among multiple investors, potentially reducing individual liability but introducing collective challenges if the project defaults. The legal and financial frameworks differ vastly, with mortgages offering more traditional protections, whereas crowdfunding loans carry higher unpredictability in default scenarios due to less stringent regulatory oversight.

Personal Guarantees and Liability Exposure

Mortgage loans typically require personal guarantees, directly exposing borrowers to full liability if they default, which can lead to the loss of personal assets. Crowdfunding real estate loans often limit individual liability by spreading risk among multiple investors, reducing personal financial exposure. Understanding the differences in liability exposure and personal guarantee requirements is critical when choosing between mortgage loans and crowdfunding options for real estate financing.

Loan Recourse: Mortgage vs Crowdfunding

Mortgage loans typically offer recourse, meaning the lender can pursue the borrower's other assets beyond the property in case of default, increasing personal liability. Crowdfunding real estate loans often operate as non-recourse or limited recourse loans, restricting lender claims solely to the property collateral and minimizing borrower liability. Understanding the loan recourse structure is crucial for borrowers assessing risk exposure in mortgage versus crowdfunding real estate financing.

Protecting Yourself from Excess Liability

Mortgage loans for real estate typically involve a single lender, allowing for clearer liability terms and easier protection through insurance such as private mortgage insurance (PMI). Crowdfunding real estate loans, involving multiple investors, can complicate liability exposure due to shared risk and less straightforward legal frameworks. To protect yourself from excess liability, thoroughly review loan agreements, consider liability insurance options, and seek professional legal advice to navigate shared investor risks.

Impact on Credit Score and Financial Standing

Mortgage loans typically require thorough credit checks and have a significant impact on credit scores due to large loan amounts and long repayment terms, enhancing financial standing when managed responsibly. Crowdfunding real estate loans may involve less stringent credit assessments and diversify liability among multiple investors, potentially reducing individual credit risk but offering less influence on credit score improvement. Understanding the liability differences helps borrowers optimize credit health and manage financial standing effectively.

Choosing the Right Option for Your Liability Profile

Evaluating mortgage versus crowdfunding real estate loans depends heavily on your liability profile, with traditional mortgages typically offering fixed interest rates and established legal protections that limit personal liability. Crowdfunding loans often involve higher risk and potentially unsecured agreements, exposing investors to greater liability if the project underperforms or defaults. Selecting the right financing option requires assessing your risk tolerance, creditworthiness, and ability to manage potential liability exposure throughout the loan term.

Related Important Terms

Fractional Ownership Liability

Mortgage loans typically assign full liability to the individual borrower, exposing them to complete financial risk in case of default, whereas crowdfunding real estate loans distribute fractional ownership liability among multiple investors, reducing personal financial exposure and providing shared risk management. This fractional liability model often limits each investor's loss to their initial contribution, enhancing portfolio diversification and risk mitigation in real estate investments.

Peer-to-Peer Lending Risk

Mortgage loans typically involve regulated lenders assuming primary liability, providing borrowers with clearer legal protections, whereas crowdfunding real estate loans via peer-to-peer lending platforms expose investors to increased risk due to less stringent oversight and shared liability among multiple lenders. Peer-to-peer lending risk includes potential borrower default, platform insolvency, and limited recourse, making liability management more complex compared to traditional mortgage agreements.

Loan Default Waterfall

Mortgage loan default waterfall prioritizes secured lenders, with foreclosure proceedings targeting the collateral first, minimizing losses and limiting liability exposure predominantly to the borrower. Crowdfunding real estate loan default waterfall distributes recoveries pro-rata among numerous investors, often increasing liability complexity and potential investor losses due to lower collateral claims and shared risk structures.

Tokenized Real Estate Debt

Tokenized real estate debt offers enhanced liquidity and fractional ownership compared to traditional mortgage liabilities, allowing investors to diversify risk and manage exposure more efficiently. Crowdfunding real estate loans on a blockchain enable transparent tracking of liabilities and automated smart contract enforcement, reducing counterparty risk and increasing accountability in loan servicing.

Non-Recourse Crowdfunded Loans

Non-recourse crowdfunded real estate loans limit borrower liability strictly to the collateral property, protecting personal assets from claims beyond the loaned amount unlike traditional mortgage loans where borrowers often hold full personal liability. This characteristic makes non-recourse loans particularly attractive in crowdfunding platforms, as investors benefit from reduced default risks without exposing their personal wealth.

Distributed Lender Exposure

Mortgage loans concentrate liability risk on a single lender, increasing exposure to borrower default, whereas crowdfunding real estate loans distribute liability across multiple investors, mitigating individual risk through diversified lender exposure. This distributed model enhances risk management by spreading potential losses over a broad investor base, reducing the impact on any single entity's financial liability.

First-Lien Position Tokenization

First-lien position tokenization in mortgage loans offers superior liability protection by ensuring that investors hold primary claims on the property in the event of default, minimizing risk exposure compared to crowdfunding real estate loans, which often involve subordinate liens and increased default liability. This structural priority significantly enhances asset security and reduces potential financial loss for token holders in the real estate investment market.

Equity Crowdfunding Repayment Structure

Equity crowdfunding real estate loans typically involve investors receiving returns through profit sharing or dividends, reducing the borrower's liability exposure compared to traditional mortgages that require fixed monthly repayments and full principal repayment. This repayment structure in equity crowdfunding mitigates repayment risk and offers flexible liability terms aligned with the project's performance and cash flow.

Smart Contract Foreclosure Risk

Mortgage agreements typically involve traditional foreclosure processes that place liability on borrowers through court-supervised asset seizure, while crowdfunding real estate loans using smart contracts automatically trigger foreclosure upon default, minimizing lender risk but increasing borrower exposure to immediate, irreversible asset loss due to blockchain-enforced terms. Smart contract foreclosure risk necessitates careful evaluation of liability implications, as the automated nature can accelerate financial penalties without discretionary legal intervention, contrasting the more gradual, negotiable foreclosure protocols in conventional mortgage liabilities.

Crowdlending Collateralization Ratio

Crowdfunding real estate loans typically offer higher collateralization ratios compared to traditional mortgages, which reduces creditor liability by providing a stronger asset-backed security. This enhanced collateralization ratio in crowdlending mitigates default risk and improves protection for investors through diversified loan portfolios.

Mortgage vs Crowdfunding Real Estate Loan for Liability. Infographic

moneydiff.com

moneydiff.com