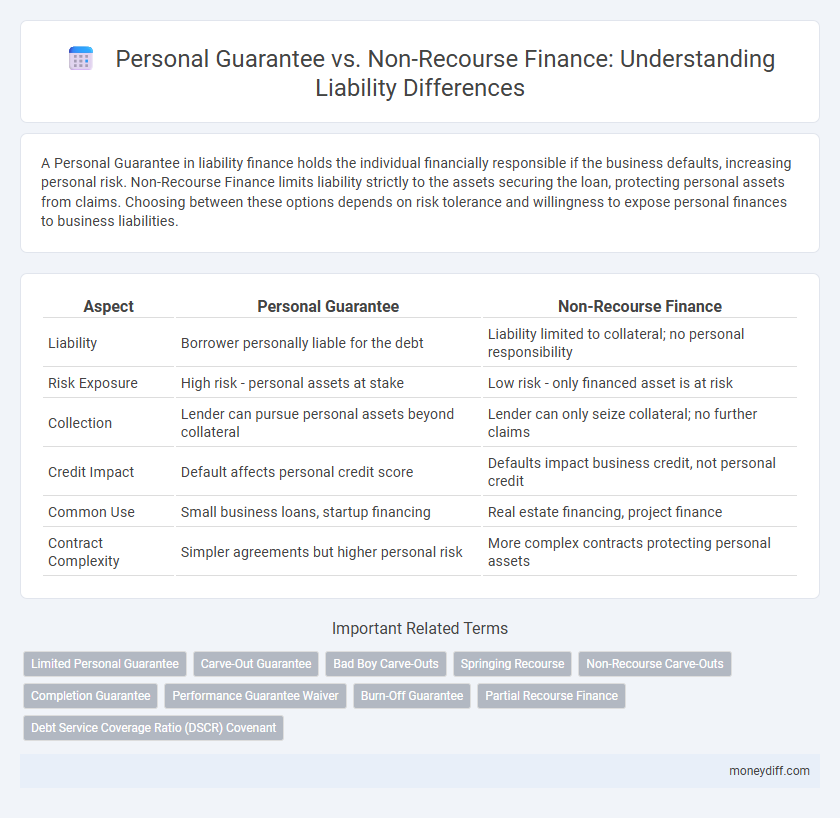

A Personal Guarantee in liability finance holds the individual financially responsible if the business defaults, increasing personal risk. Non-Recourse Finance limits liability strictly to the assets securing the loan, protecting personal assets from claims. Choosing between these options depends on risk tolerance and willingness to expose personal finances to business liabilities.

Table of Comparison

| Aspect | Personal Guarantee | Non-Recourse Finance |

|---|---|---|

| Liability | Borrower personally liable for the debt | Liability limited to collateral; no personal responsibility |

| Risk Exposure | High risk - personal assets at stake | Low risk - only financed asset is at risk |

| Collection | Lender can pursue personal assets beyond collateral | Lender can only seize collateral; no further claims |

| Credit Impact | Default affects personal credit score | Defaults impact business credit, not personal credit |

| Common Use | Small business loans, startup financing | Real estate financing, project finance |

| Contract Complexity | Simpler agreements but higher personal risk | More complex contracts protecting personal assets |

Understanding Personal Guarantees in Liability

Personal guarantees transfer liability directly to the individual, making them personally responsible for the debt if the business defaults, which increases financial risk for the guarantor. Non-recourse finance limits liability to the collateral pledged, protecting the borrower's personal assets by preventing creditors from pursuing them beyond the secured property. Understanding the implications of personal guarantees is crucial in assessing the extent of financial exposure and risk management in liability arrangements.

What Is Non-Recourse Finance?

Non-recourse finance is a loan structure where the borrower is not personally liable beyond the collateral securing the loan, typically the financed asset itself. This means if the borrower defaults, the lender can only seize the asset but cannot pursue the borrower's other personal assets. Non-recourse financing reduces personal liability risk compared to personal guarantees, which require borrowers to be fully responsible for repayment regardless of the asset's value.

Key Differences Between Personal Guarantee and Non-Recourse Finance

Personal guarantee involves an individual's commitment to repay a loan, exposing their personal assets to liability if the business defaults, whereas non-recourse finance limits the lender's claim strictly to the collateralized asset with no personal liability for the borrower. In personal guarantees, borrowers face unlimited liability, increasing financial risk, while non-recourse financing offers protection by capping liability to the secured asset alone. The key difference lies in the risk allocation: personal guarantees extend liability beyond the loan asset, while non-recourse finance confines risk to the collateral without affecting personal wealth.

Legal Implications of Personal Guarantees

Personal guarantees expose individuals to direct legal liability, making them personally responsible for fulfilling loan obligations if the primary borrower defaults. Courts can pursue the guarantor's personal assets, creating significant financial risk beyond the business entity's liabilities. In contrast, non-recourse finance limits lender claims strictly to the collateral, protecting guarantors from personal asset seizures.

Risk Exposure: Personal Assets vs Limited Liability

Personal guarantees expose individuals to unlimited risk by placing their personal assets on the line to cover business debts, increasing financial vulnerability. Non-recourse financing limits liability strictly to the collateralized assets, protecting personal wealth from creditor claims beyond the financed property. This clear distinction in risk exposure makes non-recourse loans a strategic choice for entrepreneurs seeking to safeguard personal assets against business liabilities.

Pros and Cons of Personal Guarantee Financing

Personal Guarantee financing increases borrower liability by making personal assets vulnerable if business obligations are unmet, enhancing lender confidence but posing significant financial risk. It can improve loan accessibility and potentially secure lower interest rates due to the added security for lenders. However, the risk of personal bankruptcy and the potential loss of personal property often outweigh these benefits for many entrepreneurs.

Advantages and Disadvantages of Non-Recourse Finance

Non-recourse finance limits borrower liability to the collateral securing the loan, protecting personal assets from being targeted in case of default. This financing option reduces personal financial risk but typically involves higher interest rates and stricter lending criteria due to elevated lender risk. Borrowers benefit from liability containment, whereas lenders demand robust collateral and may offer less flexible terms compared to personal guarantees.

Impact on Credit and Financial Reputation

Personal guarantees directly impact credit scores and personal financial reputation since the guarantor becomes personally liable for the debt, risking credit damage if repayment defaults. Non-recourse finance limits liability to the collateral, preventing personal credit deterioration and preserving individual financial reputation even if the debt remains unpaid. This distinction affects lenders' risk assessment and borrowers' willingness to secure financing based on their credit protection priorities.

Choosing Between Personal Guarantee and Non-Recourse Finance

Choosing between personal guarantee and non-recourse finance hinges on risk tolerance and asset protection priorities. Personal guarantees expose individuals to unlimited liability, making personal assets vulnerable if the business defaults, while non-recourse finance limits lenders' claims to the collateral, shielding personal assets from liability. Evaluating creditworthiness, business stability, and the potential impact on personal finances is essential in selecting the appropriate liability structure.

Best Practices for Managing Liability Exposure

Personal guarantees increase liability exposure by making individuals directly responsible for debts, thus requiring careful assessment of personal asset risk before signing. Non-recourse financing limits liability exposure to the collateral alone, protecting personal assets and should be prioritized in agreements to minimize personal financial risk. Best practices for managing liability exposure include thorough contract review, seeking non-recourse terms when possible, and maintaining clear documentation of all guarantees and obligations.

Related Important Terms

Limited Personal Guarantee

Limited personal guarantee restricts the guarantor's liability to a specified amount or conditions, providing a safeguard against unlimited financial exposure. This contrasts with non-recourse finance, where the lender's recovery is limited solely to the collateral, ensuring the borrower's personal assets remain protected beyond the secured asset.

Carve-Out Guarantee

A Carve-Out Guarantee in personal guarantee liability imposes borrower responsibility for specific exceptions like fraud or misappropriation, distinguishing it from non-recourse finance where lenders typically cannot claim beyond collateral. This targeted liability enhances lender protection while limiting borrower exposure strictly to defined carve-out events.

Bad Boy Carve-Outs

Bad Boy Carve-Outs in Personal Guarantees hold individuals liable for fraud, gross negligence, or willful misconduct, increasing personal risk beyond standard liability protections. Non-Recourse Finance limits borrower liability to the collateral, but Bad Boy Carve-Outs override this protection, exposing guarantors to full financial responsibility under specific wrongful acts.

Springing Recourse

Springing recourse provisions activate personal liability only upon specific triggering events, distinguishing personal guarantees from non-recourse financing where liability is limited to collateral. This mechanism protects borrowers by converting non-recourse loans into recourse obligations if loan covenants are breached or default occurs.

Non-Recourse Carve-Outs

Non-recourse finance limits borrower liability to the collateral, but non-recourse carve-outs create exceptions allowing lenders to pursue personal assets for specific wrongful acts such as fraud, misrepresentation, or intentional damage. Understanding these carve-outs is crucial, as they effectively impose personal guarantees despite the nominal non-recourse structure, increasing borrower risk exposure.

Completion Guarantee

Completion Guarantee requires the guarantor to be personally liable for project completion, ensuring lenders recover costs if the borrower defaults, unlike Non-Recourse Finance where liability is limited to the project's assets without personal obligation. This guarantee shifts risk to the guarantor, providing stronger assurance of debt repayment and project fulfillment.

Performance Guarantee Waiver

A Performance Guarantee Waiver eliminates personal liability by removing the requirement for a personal guarantee, shifting risk entirely to the lender under non-recourse finance arrangements. This waiver protects guarantors from financial loss, ensuring that only the collateralized assets are at stake in the event of default.

Burn-Off Guarantee

Burn-off guarantees in personal guarantee agreements limit the guarantor's liability by reducing the guarantee amount proportionally as the borrower repays the loan, thereby mitigating long-term financial risk. Non-recourse finance, by contrast, absolves the borrower of personal liability entirely, restricting lender claims to the collateral rather than the borrower's personal assets.

Partial Recourse Finance

Partial recourse finance limits borrower liability to a specific portion of the loan, blending aspects of personal guarantees and non-recourse financing while mitigating risk exposure. This structure allows lenders to seek repayment from collateral and partially from the borrower's personal assets, balancing risk and creditworthiness.

Debt Service Coverage Ratio (DSCR) Covenant

Personal guarantees increase borrower liability by holding individuals personally responsible for loan repayment, impacting credit risk assessments and often requiring higher Debt Service Coverage Ratio (DSCR) covenants to mitigate lender risk. Non-recourse finance limits liability to the collateral, allowing for potentially lower DSCR requirements as lenders rely primarily on asset performance rather than personal creditworthiness.

Personal Guarantee vs Non-Recourse Finance for liability. Infographic

moneydiff.com

moneydiff.com