Liability management through traditional methods often involves higher risks and less flexibility compared to microloan platforms, which offer tailored financial solutions and quicker access to funds. Microloan platforms provide enhanced transparency and user-friendly interfaces, allowing better tracking and control of liabilities. By leveraging these platforms, individuals can effectively manage their financial obligations with improved accountability and reduced burden.

Table of Comparison

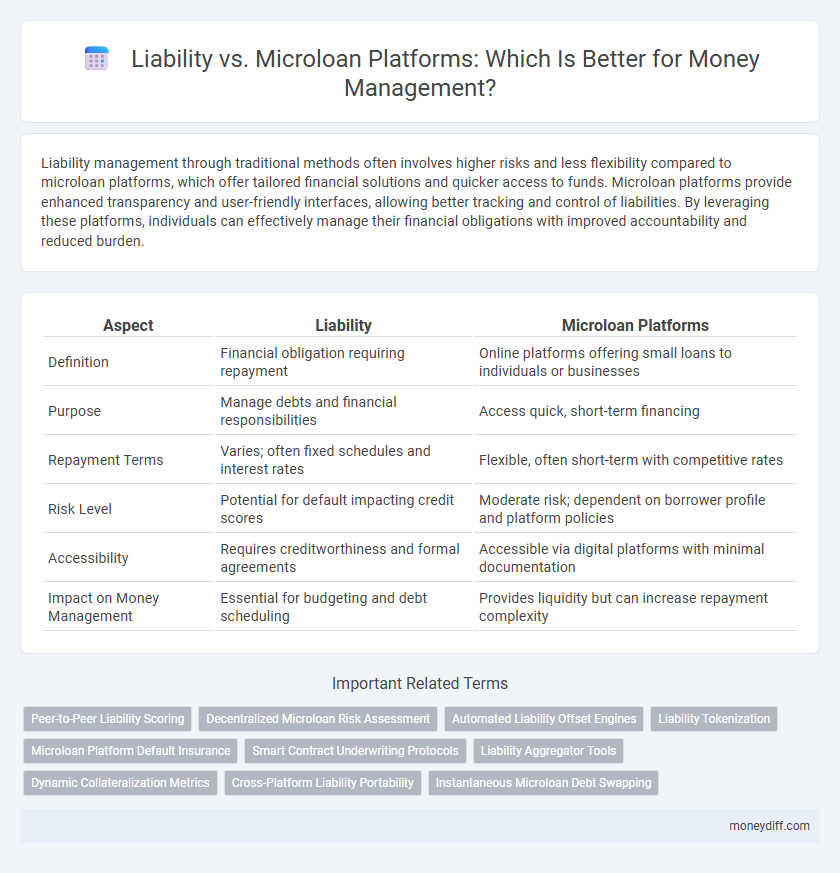

| Aspect | Liability | Microloan Platforms |

|---|---|---|

| Definition | Financial obligation requiring repayment | Online platforms offering small loans to individuals or businesses |

| Purpose | Manage debts and financial responsibilities | Access quick, short-term financing |

| Repayment Terms | Varies; often fixed schedules and interest rates | Flexible, often short-term with competitive rates |

| Risk Level | Potential for default impacting credit scores | Moderate risk; dependent on borrower profile and platform policies |

| Accessibility | Requires creditworthiness and formal agreements | Accessible via digital platforms with minimal documentation |

| Impact on Money Management | Essential for budgeting and debt scheduling | Provides liquidity but can increase repayment complexity |

Understanding Liability: A Core Principle in Money Management

Understanding liability is essential for effective money management, as it represents financial obligations that must be settled, impacting overall asset allocation. Microloan platforms often function as short-term liabilities for borrowers, requiring careful consideration of repayment terms to avoid financial strain. Properly managing liabilities, including microloans, ensures accurate tracking of debts and promotes healthier financial decisions within personal or business finances.

Microloan Platforms: An Overview and Their Role in Finance

Microloan platforms provide accessible, short-term financing solutions with flexible repayment options, making them vital for individuals and small businesses lacking traditional credit. These digital platforms utilize advanced algorithms and data analytics to assess borrower risk, streamlining approval processes and enhancing financial inclusion. By facilitating microloans, they play a crucial role in bridging funding gaps while managing liability by distributing risk across a diverse pool of lenders and borrowers.

Key Differences Between Liability and Microloan Platforms

Liability represents a company's financial obligations or debts, often requiring long-term repayment plans and impacting credit ratings. Microloan platforms provide small, short-term loans with quicker approval processes and higher interest rates, designed for immediate capital access rather than long-term debt management. Key differences include repayment terms, risk exposure, and regulatory frameworks, with liabilities typically subject to stricter accounting standards compared to the more flexible, peer-to-peer nature of microloan services.

How Liabilities Impact Personal and Business Finances

Liabilities directly affect cash flow management by requiring consistent debt repayments that reduce available capital for personal or business expenses. The burden of liabilities can limit borrowing capacity on microloan platforms, impacting credit scores and financial flexibility. Understanding the interplay between liability obligations and microloan utilization is critical for optimizing financial health and sustaining long-term growth.

Microloan Platforms: Potential Risks and Advantages

Microloan platforms offer accessible funding options with streamlined application processes and faster approval times compared to traditional liabilities, but they can carry higher interest rates and less regulatory oversight, increasing default risk. These platforms provide flexibility for borrowers who lack credit history, enabling financial inclusion; however, the potential for financial strain rises if repayment terms are misunderstood or neglected. Understanding the balance between immediate cash flow benefits and long-term liabilities is crucial for effective money management on microloan platforms.

Managing Liabilities vs. Leveraging Microloans

Effectively managing liabilities requires careful tracking of existing debts to ensure timely repayments and minimize interest costs, preserving overall financial stability. Leveraging microloan platforms offers an accessible way to obtain small, short-term funds that can be strategically used to cover cash flow gaps or invest in income-generating opportunities. Balancing liability management with microloan utilization enhances money management by optimizing liquidity while controlling risk exposure.

Microloan Platforms and Credit Implications: What to Know

Microloan platforms offer quick access to small loans but often come with higher interest rates and strict repayment terms that can impact your credit score. Using these platforms responsibly requires understanding the potential for increased liability if payments are missed, as defaults may lead to negative credit reporting. Careful management of microloan borrowing can mitigate credit risk while leveraging the convenience of instant financing.

Strategies for Balancing Liabilities with Microloan Solutions

Effective strategies for balancing liabilities with microloan solutions involve prioritizing timely repayment schedules to mitigate interest accumulation and maintain a healthy credit profile. Leveraging microloan platforms' flexible terms enables precise matching of loan amounts to immediate cash flow needs, reducing overborrowing risks. Integrating real-time financial tracking tools enhances liability management by providing clear visibility into outstanding debts and upcoming obligations.

Liability Reduction Techniques Compared to Microloan Approaches

Liability reduction techniques emphasize minimizing outstanding debts through structured repayment plans, enhancing cash flow stability and lowering financial risk compared to microloan platforms that often incur higher interest rates and short repayment periods. Implementing debt consolidation and negotiation strategies enables individuals and businesses to reduce overall liability burdens more effectively than relying on microloans, which may compound financial stress. These approaches prioritize sustainable money management by controlling liabilities directly, in contrast to microloan models that can increase exposure to fluctuating obligations.

Choosing Between Traditional Liabilities and Microloan Platforms for Smart Money Management

Traditional liabilities such as credit card debt and bank loans often come with higher interest rates and rigid repayment schedules, impacting cash flow and credit scores. Microloan platforms offer flexible borrowing options with lower entry barriers and faster approval processes, making them appealing for short-term financial needs. Comparing interest rates, repayment terms, and overall impact on credit health is essential for smart money management when choosing between these financial tools.

Related Important Terms

Peer-to-Peer Liability Scoring

Peer-to-peer liability scoring enhances risk assessment accuracy by utilizing transaction data and behavioral insights from microloan platforms, enabling lenders to evaluate borrower credibility beyond traditional credit scores. This approach reduces default rates and improves money management by aligning loan terms with individualized liability profiles derived from decentralized financial interactions.

Decentralized Microloan Risk Assessment

Decentralized microloan risk assessment leverages blockchain technology and smart contracts to enhance transparency and reduce default risk by automating credit evaluations without centralized intermediaries. This approach contrasts traditional liability management on microloan platforms by distributing risk exposure and enabling real-time credit scoring through decentralized data oracles.

Automated Liability Offset Engines

Automated Liability Offset Engines streamline money management by integrating real-time debt tracking with microloan platforms, reducing outstanding liabilities through precise, algorithm-driven offsets. These engines optimize cash flow by dynamically applying repayments across multiple liabilities, enhancing financial efficiency compared to traditional manual management methods.

Liability Tokenization

Liability tokenization in microloan platforms enhances money management by converting liabilities into tradable digital assets, improving transparency and liquidity for borrowers and lenders. This innovative approach enables precise tracking of debt obligations, reduces default risks, and streamlines repayment processes within decentralized finance ecosystems.

Microloan Platform Default Insurance

Microloan platform default insurance mitigates financial risks by covering loan defaults, enhancing borrower trust and platform stability. This insurance reduces the liability exposure for microloan providers, ensuring more secure capital management and improved portfolio performance.

Smart Contract Underwriting Protocols

Smart contract underwriting protocols enhance liability management by automating risk assessment and ensuring transparent, immutable contract execution on microloan platforms. These protocols reduce human error and fraud while enabling real-time adjustments to loan terms based on borrower behavior and credit data.

Liability Aggregator Tools

Liability aggregator tools consolidate financial obligations from multiple sources, providing a comprehensive overview of debts for effective money management compared to microloan platforms that primarily offer small-scale lending options. These tools enhance liability tracking accuracy, enabling better risk assessment and repayment planning essential for maintaining financial stability.

Dynamic Collateralization Metrics

Dynamic collateralization metrics provide real-time adjustments to collateral requirements, reducing liability risks for microloan platforms by ensuring adequate asset coverage amid fluctuating market values. This adaptive mechanism enhances financial stability and borrower accountability compared to traditional static liability management approaches.

Cross-Platform Liability Portability

Cross-platform liability portability enables seamless transfer and consolidation of financial obligations across various microloan platforms, enhancing user control and reducing default risks. This interoperability supports real-time tracking and management of liabilities, optimizing debt repayment strategies and improving overall financial stability.

Instantaneous Microloan Debt Swapping

Liability in instantaneous microloan debt swapping allows borrowers to transfer debt obligations between microloan platforms efficiently, reducing default risk and improving cash flow management. This process enhances money management by optimizing debt allocation and minimizing the financial burden through timely liability adjustments across interconnected microloan services.

Liability vs Microloan Platforms for money management. Infographic

moneydiff.com

moneydiff.com