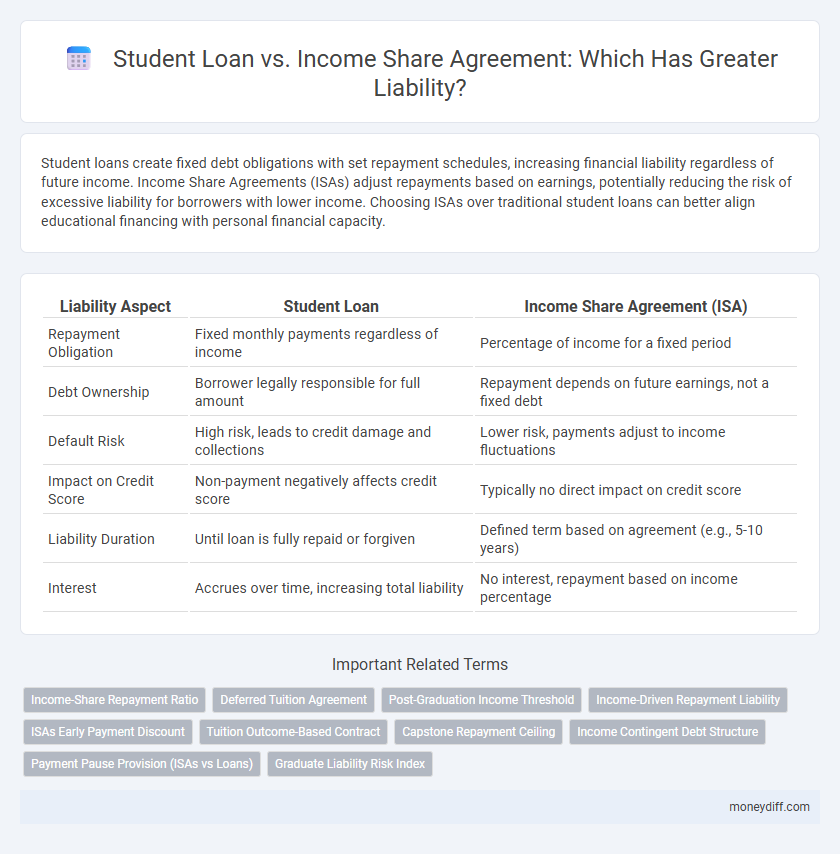

Student loans create fixed debt obligations with set repayment schedules, increasing financial liability regardless of future income. Income Share Agreements (ISAs) adjust repayments based on earnings, potentially reducing the risk of excessive liability for borrowers with lower income. Choosing ISAs over traditional student loans can better align educational financing with personal financial capacity.

Table of Comparison

| Liability Aspect | Student Loan | Income Share Agreement (ISA) |

|---|---|---|

| Repayment Obligation | Fixed monthly payments regardless of income | Percentage of income for a fixed period |

| Debt Ownership | Borrower legally responsible for full amount | Repayment depends on future earnings, not a fixed debt |

| Default Risk | High risk, leads to credit damage and collections | Lower risk, payments adjust to income fluctuations |

| Impact on Credit Score | Non-payment negatively affects credit score | Typically no direct impact on credit score |

| Liability Duration | Until loan is fully repaid or forgiven | Defined term based on agreement (e.g., 5-10 years) |

| Interest | Accrues over time, increasing total liability | No interest, repayment based on income percentage |

Understanding Student Loan Liability

Student loan liability involves a borrower's legal obligation to repay borrowed funds with interest under predefined terms set by the lender. This contrasts with income share agreements (ISAs), where repayment is contingent on the borrower's future income without accruing traditional debt liability. Understanding the fixed repayment schedules and potential default consequences of student loans is crucial for assessing long-term financial responsibility and credit impact.

Defining Income Share Agreement (ISA) Obligations

Income Share Agreement (ISA) obligations involve a contractual commitment to pay a fixed percentage of future income for a specified period, differing from traditional student loans that require fixed repayments regardless of income. Unlike student loans that create direct debt liabilities appearing on balance sheets, ISAs are contingent liabilities based on income performance, affecting financial risk assessment and accounting treatment. Understanding ISA obligations is crucial for accurate liability reporting, as payment amounts fluctuate with income, impacting both personal financial planning and institutional risk management.

Key Differences in Liability: Student Loans vs ISAs

Student loans create fixed liabilities requiring borrowers to repay a set amount with interest, regardless of future income, resulting in a long-term financial obligation. Income Share Agreements (ISAs) impose contingent liabilities where repayment varies based on the borrower's income, aligning payments with actual earnings and potentially reducing financial strain. Unlike student loans, ISAs do not accumulate interest or penalties for unemployment, offering a flexible alternative that adjusts to job market fluctuations.

Repayment Structures and Financial Responsibility

Student loans require borrowers to repay a fixed principal amount plus interest, creating a clear liability on their credit and finances. Income Share Agreements (ISAs) shift financial responsibility by linking repayment to a percentage of future income, reducing risk during low-earning periods. The student's liability under ISAs fluctuates with earnings, while student loans impose consistent repayment obligations regardless of income changes.

Legal Consequences of Default: Loans vs ISAs

Defaulting on a student loan triggers legal consequences including wage garnishment, damaged credit scores, and potential lawsuits that increase financial liability. Income Share Agreements (ISAs) typically avoid traditional debt collection actions since repayment depends on income, reducing the risk of legal penalties and default-related lawsuits. However, failure to meet ISA terms may lead to contract enforcement through specific legal avenues, which vary by jurisdiction but generally impose less severe financial liability than defaulted loans.

Impact on Credit Score and Financial Health

Student loans typically impact credit scores by establishing a debt repayment history and affecting credit utilization ratios, with missed payments potentially causing significant score drops. Income Share Agreements (ISAs) do not appear as traditional debt on credit reports, which may protect credit scores from negative reporting but also limit credit-building opportunities. Evaluating liability under each option reveals that student loans increase debt-to-income ratios and long-term financial obligations, while ISAs incur contingent liabilities tied to future earnings, influencing financial health differently.

Flexibility and Deferment: Comparing Liability Options

Student loans typically impose fixed repayment schedules and accumulating interest, increasing borrower liability over time, whereas Income Share Agreements (ISAs) offer repayment flexibility tied to actual income levels, reducing financial strain during periods of low earnings. Deferment options in student loans may pause payments but often lead to interest capitalization, which expands overall debt liability, while ISAs inherently adjust payments without increasing total amounts owed. This dynamic makes ISAs a potentially less burdensome liability choice for students facing unpredictable career trajectories and income fluctuations.

Consumer Protection and Regulatory Oversight

Student loans create direct debt liabilities with fixed repayment terms, subject to comprehensive consumer protection laws such as the Truth in Lending Act and regulations from the Consumer Financial Protection Bureau (CFPB). Income Share Agreements (ISAs) shift liability based on a percentage of future income, raising unique regulatory challenges due to variable payment amounts and potential lack of standardized disclosures. Regulatory oversight for ISAs is evolving, emphasizing transparency and equitable treatment to protect consumers from unpredictable financial burdens and ensure compliance with state and federal financial regulations.

Long-term Liability Implications for Borrowers

Student loans create long-term liability by requiring fixed monthly payments that accrue interest over decades, potentially impacting borrowers' credit scores and financial stability. Income Share Agreements (ISAs) adjust repayment based on income, offering flexible liability but uncertain total repayment amounts tied to future earnings. Borrowers should evaluate long-term financial obligations, as student loans can lead to sustained debt burdens, while ISAs might mitigate risk but introduce variability in liability exposure.

Choosing the Right Path: Risk Assessment and Decision Factors

Student loans create fixed liability, requiring consistent repayments with accruing interest regardless of income fluctuations, increasing financial risk for borrowers. Income Share Agreements (ISAs) adjust repayment amounts based on future earnings, potentially reducing liability burden during low-income periods but introducing variable repayment uncertainty. Assessing risk tolerance, income stability, and career projections is crucial for choosing between predictable student loan liabilities and income-contingent ISA obligations.

Related Important Terms

Income-Share Repayment Ratio

Income Share Agreements (ISAs) tie repayment amounts directly to a fixed percentage of the borrower's future income, reducing the risk of excessive debt liability compared to traditional student loans with fixed monthly payments. This income-share repayment ratio adjusts dynamically with earnings, aligning repayment burdens with actual income levels and mitigating the financial strain often associated with standard loan liabilities.

Deferred Tuition Agreement

Student loans create fixed debt liabilities with accruing interest, impacting long-term credit and financial stability, whereas Income Share Agreements (ISAs) function as deferred tuition agreements where repayment adjusts based on income, minimizing fixed debt obligations. Deferred Tuition Agreements under ISAs shift financial risk away from students by linking repayment to future earnings, thereby reducing immediate liability on the borrower's balance sheet.

Post-Graduation Income Threshold

Student loans create a fixed post-graduation liability requiring regular repayments regardless of income, often leading to financial strain if earnings are low. Income Share Agreements (ISAs) adjust repayment amounts based on post-graduation income thresholds, reducing liability risk by aligning payments with actual earnings and improving financial flexibility.

Income-Driven Repayment Liability

Income-driven repayment plans adjust student loan liability based on the borrower's income and family size, reducing financial burden by capping monthly payments and potentially forgiving remaining balances after 20-25 years. Income Share Agreements shift liability from fixed loan repayments to income percentage obligations, aligning repayment amounts directly with post-graduation earnings but may result in higher total payments if income rises significantly.

ISAs Early Payment Discount

Income Share Agreements (ISAs) reduce liability risk for students by offering an Early Payment Discount that lowers the total repayment amount when paid ahead of schedule. Unlike traditional student loans, ISAs adjust payments based on income, minimizing debt burden and providing financial flexibility without accumulating interest-based liability.

Tuition Outcome-Based Contract

Student loans create fixed liabilities with accruing interest regardless of post-graduation income, whereas Income Share Agreements (ISAs) link tuition repayment to a percentage of future earnings, aligning financial obligation with employment success. Tuition outcome-based contracts under ISAs reduce default risk by adjusting payments to actual income, offering a more flexible and outcome-driven approach to managing educational debt.

Capstone Repayment Ceiling

Student loans impose a fixed liability with a defined repayment ceiling based on the principal plus interest, potentially leading to long-term debt burdens. Income Share Agreements limit liability through a capstone repayment ceiling tied to a percentage of future income, offering a flexible, risk-shared repayment structure that adjusts with borrower earnings.

Income Contingent Debt Structure

Income contingent debt structures, such as Income Share Agreements (ISAs), allocate repayment based on a fixed percentage of the borrower's income, reducing default risk by aligning payments with actual earnings. Unlike traditional student loans, ISAs shift liability away from fixed debt obligations to a flexible model that adjusts to income variability, offering a more manageable financial commitment for borrowers.

Payment Pause Provision (ISAs vs Loans)

Student loans often include a payment pause provision, allowing borrowers to temporarily suspend payments during economic hardship, while Income Share Agreements (ISAs) typically do not offer such explicit payment pause options but instead adjust payments based on income fluctuations. This fundamental difference affects borrower liability, as ISAs shift the financial risk according to income, whereas loans maintain fixed obligations despite payment pauses.

Graduate Liability Risk Index

The Graduate Liability Risk Index highlights that student loans create fixed debt obligations with accumulating interest, increasing long-term financial risk for graduates facing uncertain income trajectories. Income Share Agreements transfer liability by linking repayment to actual earnings, reducing default risk and aligning graduate financial obligations with career success.

Student Loan vs Income Share Agreement for Liability. Infographic

moneydiff.com

moneydiff.com