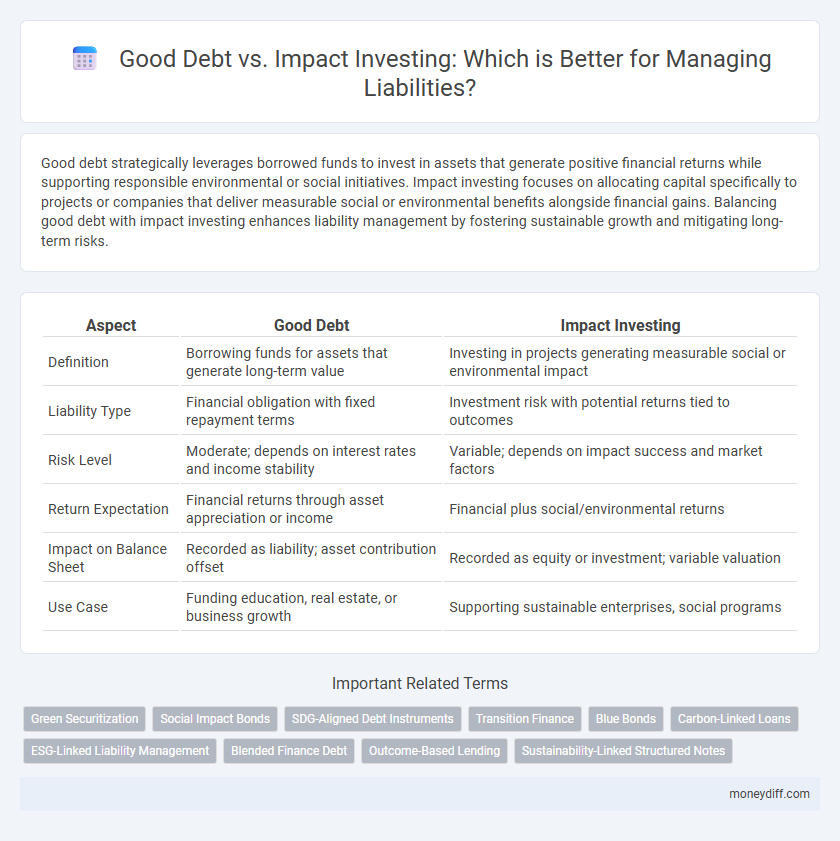

Good debt strategically leverages borrowed funds to invest in assets that generate positive financial returns while supporting responsible environmental or social initiatives. Impact investing focuses on allocating capital specifically to projects or companies that deliver measurable social or environmental benefits alongside financial gains. Balancing good debt with impact investing enhances liability management by fostering sustainable growth and mitigating long-term risks.

Table of Comparison

| Aspect | Good Debt | Impact Investing |

|---|---|---|

| Definition | Borrowing funds for assets that generate long-term value | Investing in projects generating measurable social or environmental impact |

| Liability Type | Financial obligation with fixed repayment terms | Investment risk with potential returns tied to outcomes |

| Risk Level | Moderate; depends on interest rates and income stability | Variable; depends on impact success and market factors |

| Return Expectation | Financial returns through asset appreciation or income | Financial plus social/environmental returns |

| Impact on Balance Sheet | Recorded as liability; asset contribution offset | Recorded as equity or investment; variable valuation |

| Use Case | Funding education, real estate, or business growth | Supporting sustainable enterprises, social programs |

Understanding Good Debt in Modern Money Management

Good debt plays a crucial role in modern money management by leveraging borrowed funds to generate long-term financial benefits and enhance asset value. In the context of liability, good debt typically includes low-interest loans for investments like education, real estate, or business expansion that capitalize on expected future income streams. Understanding the strategic use of good debt helps individuals and businesses optimize their liability structure while supporting sustainable financial growth.

Defining Impact Investing: Beyond Financial Returns

Impact investing prioritizes measurable social and environmental benefits alongside financial returns, differentiating it from good debt, which primarily manages liability through favorable borrowing terms. This approach integrates Environmental, Social, and Governance (ESG) criteria to achieve positive outcomes without compromising financial performance. Investors balance risk and responsibility, positioning impact investing as a strategic tool for long-term sustainable liability management.

Liability Considerations in Good Debt Decisions

Liability considerations in good debt decisions revolve around evaluating the risk and repayment capacity linked to borrowing for investments with positive social or environmental impacts. Good debt involves leveraging financing that generates returns exceeding the cost of debt while maintaining manageable liability levels to avoid financial distress. Impact investing requires careful analysis of liability structure to ensure that debts incurred do not outweigh portfolio resilience or jeopardize long-term fiscal stability.

Impact Investing as a Risk Mitigation Strategy

Impact investing serves as a strategic approach to liability management by aligning financial returns with social and environmental benefits, thereby mitigating risks associated with traditional debt exposure. This method reduces liability risk through diversified investments in sustainable projects that often exhibit lower default rates and enhanced resilience to market fluctuations. Incorporating impact investments into a liability portfolio enhances risk-adjusted returns while promoting long-term financial stability and positive societal impact.

Comparing Long-Term Liabilities: Good Debt vs. Impact Investing

Comparing long-term liabilities reveals that good debt leverages borrowing to finance assets or projects with predictable returns, enhancing cash flow and creditworthiness over time. Impact investing, while potentially generating social and environmental benefits, often involves higher risks and less liquidity, which may complicate liability management. Evaluating these options requires balancing financial cost, risk tolerance, and the strategic alignment of liabilities with organizational goals.

Financial Health: Balancing Debt and Social Impact

Good debt enhances financial health by leveraging borrowed funds for growth and asset acquisition, positively influencing creditworthiness and long-term stability. Impact investing allocates capital toward socially responsible projects, generating measurable social and environmental benefits without compromising financial returns. Balancing these approaches helps manage liabilities by optimizing both economic outcomes and social impact, promoting sustainable financial health.

Opportunity Cost: Allocating Capital for Good Debt or Impact Investing

Allocating capital to good debt can offer predictable returns and lower risk, reducing liability exposure compared to impact investing, which often involves higher opportunity costs due to uncertain financial outcomes. Choosing impact investing focuses on long-term social and environmental benefits, potentially sacrificing immediate financial gains that could otherwise be used to offset liabilities. Evaluating opportunity cost helps determine whether capital is better utilized in debt reduction strategies or in creating positive impact through sustainable investments.

Measuring Liability Reduction through Impact Investing

Measuring liability reduction through impact investing involves quantifying social and environmental benefits alongside financial returns, using standardized metrics like ESG scores, social return on investment (SROI), and carbon footprint reduction. Impact investing targets companies or projects that actively reduce future liabilities by mitigating risks related to climate change, social inequality, or governance issues, thereby enhancing long-term sustainability and decreasing potential financial losses. Comparing good debt with impact investing reveals that while both strategies improve balance sheets, impact investing uniquely contributes to liability reduction by generating measurable positive externalities that reduce regulatory and reputational risks.

Portfolio Diversification: Integrating Good Debt and Impact Investments

Portfolio diversification enhances liability management by integrating good debt and impact investments, balancing risk and return while supporting social and environmental goals. Good debt instruments provide stable cash flows and predictable repayments, reducing overall portfolio volatility and ensuring reliable liability coverage. Impact investments contribute measurable positive social impact, increasing portfolio resilience and aligning financial strategies with sustainable development objectives.

Decision Factors: Choosing Between Good Debt and Impact Investing

Evaluating liability strategies requires analyzing decision factors such as risk tolerance, expected returns, and long-term financial goals. Good debt, often characterized by lower interest rates and tax advantages, can optimize cash flow and leverage growth opportunities without overwhelming liabilities. Impact investing prioritizes social and environmental returns, balancing financial performance with mission-driven outcomes, which may appeal to investors seeking to align liability management with ethical considerations.

Related Important Terms

Green Securitization

Green securitization transforms environmentally responsible loans into tradable securities, reducing liability risks linked to non-performing assets while promoting sustainable finance. This method contrasts with good debt strategies by directly tying liability management to positive environmental impact and investor demand for green assets.

Social Impact Bonds

Social Impact Bonds represent a strategic approach within liability management by leveraging good debt to fund social programs that generate measurable positive outcomes. This innovative financial instrument aligns investor returns with social impact performance, mitigating traditional liability risks while advancing public welfare.

SDG-Aligned Debt Instruments

SDG-aligned debt instruments enhance liability portfolios by integrating sustainable development goals, promoting responsible borrowing while mitigating long-term risks. Good debt leverages these instruments to finance projects with measurable social and environmental impact, aligning financial returns with positive global outcomes.

Transition Finance

Good debt in transition finance provides structured liability solutions that support companies shifting towards sustainable operations, often offering lower interest rates and longer maturities aligned with environmental goals. Impact investing targets liabilities by channeling capital into projects with measurable social and environmental outcomes, balancing financial returns with positive climate impact in transition finance frameworks.

Blue Bonds

Blue bonds offer a strategic approach to managing liabilities by financing ocean-related projects that promote sustainability while generating reliable returns. Their positive environmental impact aligns with impact investing principles, making them a preferable alternative to traditional good debt by mitigating risks linked to ecological degradation and regulatory changes.

Carbon-Linked Loans

Carbon-linked loans offer a strategic liability management tool by aligning debt terms with borrowers' environmental performance, incentivizing reduced carbon emissions through interest rate adjustments. Compared to good debt, which traditionally targets favorable financial terms or social causes, carbon-linked loans uniquely integrate climate impact metrics, enhancing sustainable finance frameworks while mitigating long-term environmental risks.

ESG-Linked Liability Management

ESG-linked liability management integrates environmental, social, and governance criteria into debt structures, transforming traditional liabilities into good debt by aligning financial obligations with sustainable impact goals. This approach leverages impact investing principles to enhance corporate responsibility while optimizing capital costs and mitigating reputational risks associated with conventional liabilities.

Blended Finance Debt

Blended finance debt strategically combines concessional funding with market-rate capital to mitigate liability risks while maximizing social impact, making it an effective tool for managing good debt in sustainable investment portfolios. This approach alleviates liability pressures by mobilizing private capital alongside philanthropic funds, enhancing financial returns without compromising impact objectives.

Outcome-Based Lending

Outcome-based lending aligns liability management with measurable social impact by linking loan repayment terms to predefined environmental or social outcomes, enhancing the effectiveness of good debt versus traditional impact investing. This approach incentivizes borrowers to achieve specific impact goals while providing lenders with performance-based risk mitigation, driving sustainable finance innovation.

Sustainability-Linked Structured Notes

Sustainability-linked structured notes offer a strategic liability management tool by aligning debt obligations with environmental, social, and governance (ESG) performance targets, thereby enhancing corporate responsibility while potentially reducing financing costs. These instruments incentivize issuers to meet sustainability goals, differentiating good debt from traditional borrowing and supporting impact investing principles that prioritize measurable social and environmental outcomes alongside financial returns.

Good Debt vs Impact Investing for Liability Infographic

moneydiff.com

moneydiff.com