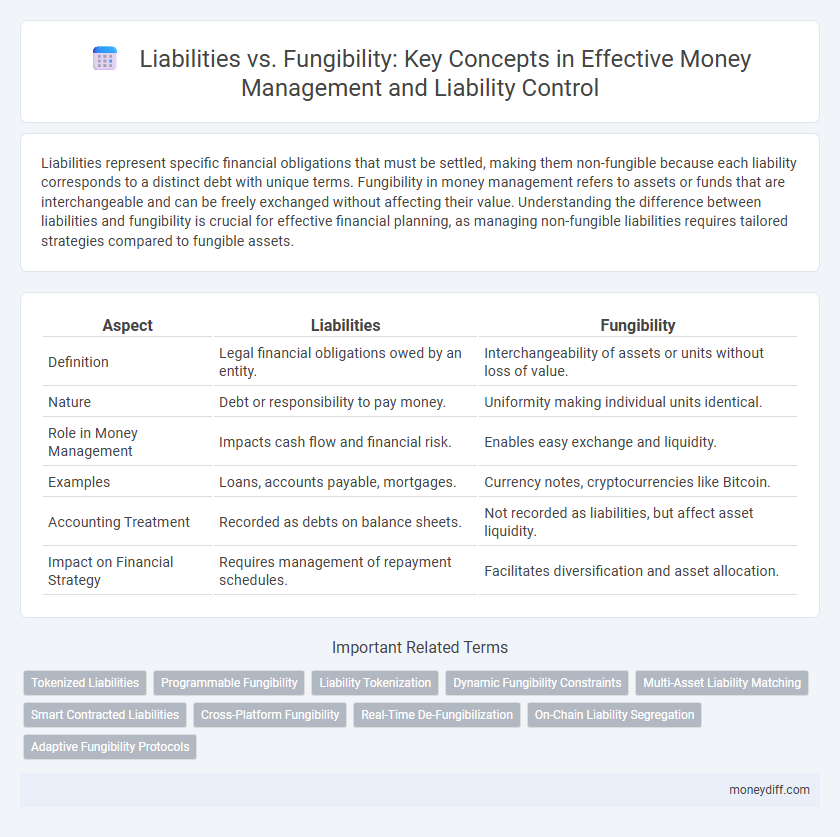

Liabilities represent specific financial obligations that must be settled, making them non-fungible because each liability corresponds to a distinct debt with unique terms. Fungibility in money management refers to assets or funds that are interchangeable and can be freely exchanged without affecting their value. Understanding the difference between liabilities and fungibility is crucial for effective financial planning, as managing non-fungible liabilities requires tailored strategies compared to fungible assets.

Table of Comparison

| Aspect | Liabilities | Fungibility |

|---|---|---|

| Definition | Legal financial obligations owed by an entity. | Interchangeability of assets or units without loss of value. |

| Nature | Debt or responsibility to pay money. | Uniformity making individual units identical. |

| Role in Money Management | Impacts cash flow and financial risk. | Enables easy exchange and liquidity. |

| Examples | Loans, accounts payable, mortgages. | Currency notes, cryptocurrencies like Bitcoin. |

| Accounting Treatment | Recorded as debts on balance sheets. | Not recorded as liabilities, but affect asset liquidity. |

| Impact on Financial Strategy | Requires management of repayment schedules. | Facilitates diversification and asset allocation. |

Understanding Liabilities in Money Management

Liabilities in money management represent financial obligations or debts that reduce net worth and impact cash flow stability. Understanding liabilities involves recognizing fixed and variable obligations, such as loans, mortgages, and credit card debt, which must be strategically managed to maintain financial health. Unlike fungible assets that can be easily exchanged or substituted, liabilities require precise tracking and repayment planning to avoid liquidity issues and ensure sustainable money management.

The Concept of Fungibility: What It Means for Your Finances

Fungibility refers to the property of an asset whereby individual units are interchangeable and indistinguishable, allowing for seamless substitution in money management. Unlike liabilities, which represent specific obligations or debts tied to a distinct entity, fungible assets such as cash or cryptocurrencies enable flexible financial transactions and easier portfolio liquidity. Understanding fungibility is crucial for efficient financial planning, ensuring that assets can be readily exchanged or used to meet obligations without loss of value.

Liabilities vs. Fungibility: Key Differences Explained

Liabilities represent financial obligations that a person or entity owes, impacting cash flow and creditworthiness, while fungibility refers to the interchangeable nature of assets like money or cryptocurrencies that maintain consistent value across units. In money management, liabilities require careful tracking and repayment strategies to avoid insolvency, whereas fungible assets provide liquidity and ease of exchange, facilitating smoother transactions. Understanding these differences aids in balancing debt obligations against asset liquidity, optimizing financial stability and operational efficiency.

How Fungibility Impacts Debt Repayment Strategies

Fungibility ensures that each unit of money or debt is interchangeable, allowing borrowers to prioritize repayment based on interest rates or due dates rather than specific liabilities. This characteristic simplifies debt management by enabling flexible allocation of funds toward any outstanding obligation without concern for the origin of each debt unit. Understanding fungibility aids in optimizing repayment strategies to minimize costs and improve financial stability.

Managing Personal Liabilities with Fungible Assets

Managing personal liabilities effectively requires leveraging fungible assets, as their interchangeable nature facilitates liquidity and debt repayment flexibility. Fungible assets like cash, stocks, or commodities enable individuals to convert holdings quickly to address diverse liabilities without loss of value. Prioritizing fungible asset accumulation enhances one's ability to balance debt obligations and maintain financial stability.

Liability Prioritization: Fungibility as a Decision Tool

Liability prioritization leverages fungibility to streamline money management by enabling interchangeable allocation of funds across debts. Fungibility allows liabilities to be treated as equivalent units, simplifying decisions on which debts to pay first based on interest rates, due dates, or tax implications. This approach ensures optimal cash flow management and reduces overall financial risk by addressing high-priority liabilities efficiently.

Financial Planning: Integrating Liabilities and Fungibility

Effective financial planning requires balancing liabilities with the fungibility of assets to ensure liquidity and solvency. Liabilities represent obligations that must be managed alongside fungible assets, which can be easily exchanged or allocated to meet financial demands. Integrating these concepts improves cash flow planning, risk assessment, and long-term wealth management.

Risk Management: The Role of Fungible Money in Debt Handling

Fungible money plays a crucial role in risk management by allowing liabilities to be settled interchangeably without altering the value or terms of debt. Its inherent interchangeability minimizes exposure to fluctuations and inefficiencies in debt handling, promoting smoother financial operations. This characteristic enhances the flexibility and predictability of managing liabilities, aiding in effective risk mitigation strategies.

Balancing Growth and Stability: Fungibility vs. Liability Focus

Liabilities in money management represent obligations that must be met, influencing overall financial stability and risk exposure, while fungibility ensures that assets or money can be easily exchanged or substituted without losing value, promoting liquidity and operational flexibility. Balancing liabilities with fungibility involves managing debt levels and financial commitments to prevent instability, while maintaining enough liquid and interchangeable assets to support growth opportunities and meet short-term needs. This approach optimizes capital allocation, minimizing financial strain and enhancing the ability to navigate market fluctuations effectively.

Practical Tips for Optimizing Liabilities Using Fungibility

Maximizing liabilities through fungibility involves treating debt as interchangeable instruments to enhance financial flexibility and risk management. Prioritize restructuring high-interest liabilities into more fungible, lower-cost options to improve liquidity and investment capacity. Employ regular reviews of liability portfolios to identify opportunities for consolidation, reducing costs, and leveraging fungible assets for strategic financial planning.

Related Important Terms

Tokenized Liabilities

Tokenized liabilities enhance money management by enabling precise tracking, fractional ownership, and seamless transferability, overcoming traditional liabilities' lack of fungibility. This shift allows financial institutions to optimize liquidity and risk distribution while maintaining compliance with regulatory frameworks.

Programmable Fungibility

Programmable fungibility enhances money management by enabling liabilities to be selectively distinguishable despite their nominal interchangeability, allowing smart contracts to enforce specific rules on funds based on origin, purpose, or compliance status. This capability transforms traditional fungible liabilities into dynamic, programmable units that optimize tracking, accountability, and regulatory adherence within decentralized financial systems.

Liability Tokenization

Liability tokenization transforms traditional financial liabilities into digital tokens, enhancing fungibility by enabling seamless transfer, division, and trading of debt obligations. This innovation improves liquidity and transparency in money management by allowing liabilities to be standardized and integrated within decentralized financial ecosystems.

Dynamic Fungibility Constraints

Dynamic fungibility constraints affect how liabilities are managed by restricting the interchangeability of funds based on their origin, conditions, or timing. This limitation necessitates precise tracking and categorization of financial obligations to ensure compliance and optimize liquidity in money management strategies.

Multi-Asset Liability Matching

Multi-Asset Liability Matching enhances money management by aligning diverse asset classes with specific liabilities, optimizing risk-adjusted returns while maintaining liquidity and minimizing funding gaps. Unlike fungibility, where assets are interchangeable, liability-driven strategies require precise matching to ensure cash flow timing and amount, critical for effective liability management.

Smart Contracted Liabilities

Smart Contracted Liabilities introduce programmable obligations that enhance transparency and automate enforcement, contrasting traditional liabilities that lack fungibility and are prone to manual errors. Fungibility in money management ensures interchangeable value units, while smart contracts embed liabilities into digital assets, enabling seamless, trustless transactions and precise risk allocation.

Cross-Platform Fungibility

Cross-platform fungibility in money management enhances liquidity by allowing liabilities to be settled seamlessly across different financial systems, reducing friction and improving efficiency. Ensuring liabilities are interoperable across diverse platforms minimizes risk and increases flexibility in asset allocation and debt management.

Real-Time De-Fungibilization

Real-time de-fungibilization transforms liabilities into unique, traceable units, enhancing transparency and accountability in money management by preventing the interchangeable treatment of financial obligations. This approach mitigates risks associated with fungibility, such as anonymity and misuse, enabling precise tracking and differentiation of liabilities across accounts.

On-Chain Liability Segregation

On-chain liability segregation enhances money management by distinctly categorizing liabilities to ensure precise tracking and accountability within blockchain ecosystems. This approach contrasts fungibility, where interchangeable assets blur individual liabilities, by enabling transparent and immutable records tied to specific obligations.

Adaptive Fungibility Protocols

Adaptive Fungibility Protocols enhance money management by allowing liabilities to be dynamically reclassified and exchanged, increasing flexibility and risk mitigation in financial systems. This approach improves liquidity efficiency by enabling tailored fungibility adjustments, ensuring liabilities can adapt seamlessly to varying transaction contexts and regulatory constraints.

Liabilities vs Fungibility for money management. Infographic

moneydiff.com

moneydiff.com