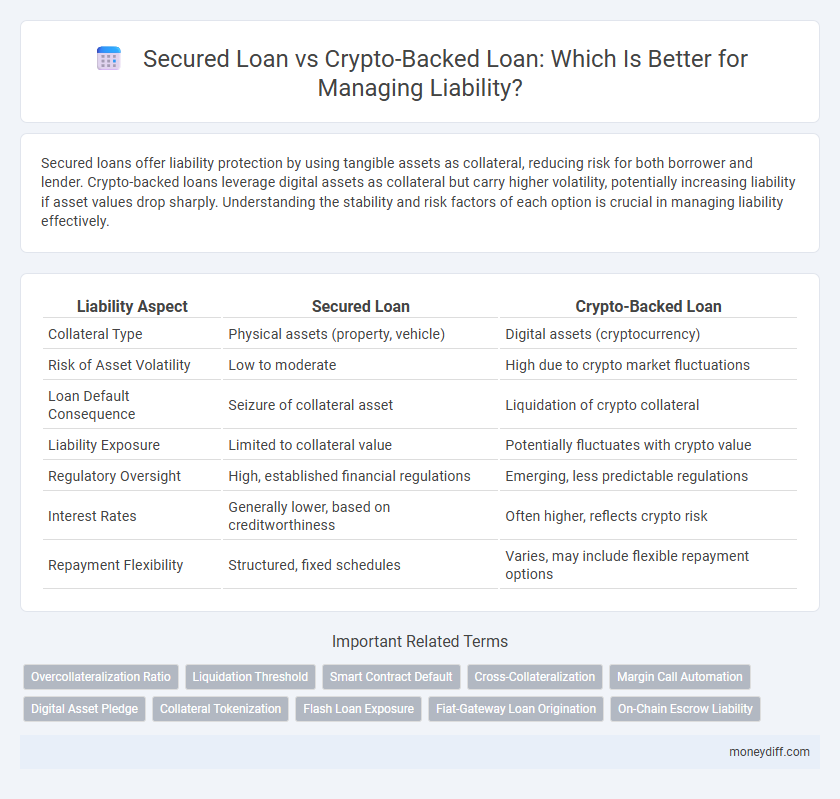

Secured loans offer liability protection by using tangible assets as collateral, reducing risk for both borrower and lender. Crypto-backed loans leverage digital assets as collateral but carry higher volatility, potentially increasing liability if asset values drop sharply. Understanding the stability and risk factors of each option is crucial in managing liability effectively.

Table of Comparison

| Liability Aspect | Secured Loan | Crypto-Backed Loan |

|---|---|---|

| Collateral Type | Physical assets (property, vehicle) | Digital assets (cryptocurrency) |

| Risk of Asset Volatility | Low to moderate | High due to crypto market fluctuations |

| Loan Default Consequence | Seizure of collateral asset | Liquidation of crypto collateral |

| Liability Exposure | Limited to collateral value | Potentially fluctuates with crypto value |

| Regulatory Oversight | High, established financial regulations | Emerging, less predictable regulations |

| Interest Rates | Generally lower, based on creditworthiness | Often higher, reflects crypto risk |

| Repayment Flexibility | Structured, fixed schedules | Varies, may include flexible repayment options |

Understanding Liability in Money Management

Liability management in money management involves recognizing the differences between secured loans and crypto-backed loans, where secured loans use tangible assets like property as collateral, providing predictable risk and stability. Crypto-backed loans rely on volatile digital assets, increasing the risk of collateral value fluctuations and potential margin calls, which can impact debt repayment obligations. Understanding these liability nuances helps borrowers optimize debt strategies and manage financial risk effectively.

Overview of Secured Loans: Traditional Liability Solutions

Secured loans represent a traditional liability solution where borrowers pledge collateral such as real estate or vehicles to secure financing, reducing lender risk and often resulting in lower interest rates. These loans typically have fixed terms and repayment schedules, providing predictable liability management for individuals and businesses. The firm legal framework governing secured loans ensures enforceability, making them a reliable option for managing financial obligations.

Crypto-Backed Loans: A Modern Approach to Liability

Crypto-backed loans offer a distinctive approach to liability by using digital assets as collateral, reducing traditional credit risk and enabling quick access to liquidity without selling holdings. These loans leverage blockchain technology for transparent, secure transactions, minimizing counterparty risk and facilitating automated smart contract enforcement. By turning volatile cryptocurrencies into manageable debt instruments, crypto-backed loans present a flexible solution for balancing asset management with liability obligations in the evolving financial landscape.

Collateral Requirements: Property vs. Cryptocurrency

Secured loans require tangible property as collateral, such as real estate or vehicles, providing lenders with a physical asset to claim in case of default. Crypto-backed loans leverage digital assets like Bitcoin or Ethereum as collateral, introducing volatility risk due to fluctuating cryptocurrency values. The choice between property and cryptocurrency collateral affects liability exposure, as property typically offers stable value while crypto collateral may require over-collateralization to mitigate insolvency risk.

Interest Rates and Repayment Terms Comparison

Secured loans typically offer lower interest rates ranging from 4% to 10%, with fixed repayment terms spanning 1 to 7 years, enhancing predictability for liability management. In contrast, crypto-backed loans feature variable interest rates between 6% and 12%, often with flexible repayment schedules but higher volatility due to cryptocurrency market fluctuations. Understanding these differences is essential for effective liability planning, balancing cost stability against potential repayment flexibility.

Risk Factors: Evaluating Default and Security

Secured loans carry the risk of asset forfeiture upon default, typically involving tangible collateral such as real estate or vehicles, providing lenders with a clearer claim in case of repayment failure. Crypto-backed loans pose higher volatility risk due to fluctuating digital asset values, potentially requiring borrowers to provide additional collateral or face liquidation during market downturns. Evaluating default risk involves understanding the stability of the collateral, lender's recourse options, and the borrower's ability to meet margin calls in the case of crypto-backed liabilities.

Legal Protections in Secured vs. Crypto-Backed Loans

Legal protections in secured loans typically include collateral repossession rights and clear regulatory oversight, reducing lender and borrower liability risk. In contrast, crypto-backed loans often face uncertain legal frameworks and fluctuating asset values, increasing the potential for disputes and unclear liability responsibilities. Traditional secured loans offer more robust contractual safeguards, while crypto-backed liabilities remain susceptible to evolving jurisdictional interpretations.

Accessibility and Process: Qualification Criteria

Secured loans typically require a strong credit score and proof of stable income, making qualification more stringent and less accessible for individuals with limited credit history. Crypto-backed loans offer easier access by accepting digital assets as collateral, bypassing traditional credit checks and allowing borrowers with volatile or limited financial backgrounds to qualify. The streamlined process of crypto-backed loans often results in faster approvals and fewer documentation requirements compared to conventional secured loans.

Impact on Credit Score and Financial Reporting

Secured loans typically have a positive impact on credit scores by demonstrating responsible debt management and timely payments, which are reported to credit bureaus and reflected in financial statements. Crypto-backed loans may not always be reported to traditional credit agencies, potentially limiting their influence on credit scores despite affecting overall liability on financial records. The choice between these loans impacts financial transparency and creditworthiness, with secured loans offering clearer benefits for credit score improvement and standardized financial reporting.

Choosing the Right Loan for Liability Management

Secured loans provide predictable repayment terms and lower interest rates, reducing liability risk for borrowers with stable income sources and valuable collateral like real estate or vehicles. Crypto-backed loans offer flexible access to digital asset value without liquidating holdings, yet they carry higher volatility and liquidation risks impacting liability management. Evaluating asset stability, risk tolerance, and liability goals ensures the optimal loan choice for effective financial responsibility and debt control.

Related Important Terms

Overcollateralization Ratio

Secured loans typically require an overcollateralization ratio of 100% or slightly more to mitigate lender risk, whereas crypto-backed loans often demand significantly higher ratios, commonly ranging from 150% to 200%, due to cryptocurrency price volatility and liquidity concerns. This higher overcollateralization ratio in crypto-backed loans increases borrower liability and potential for liquidation if asset values decline sharply.

Liquidation Threshold

A secured loan typically has a fixed liquidation threshold tied to the collateral's market value, minimizing the risk of immediate liability upon default. In contrast, crypto-backed loans often feature dynamic liquidation thresholds due to the volatility of digital assets, increasing the potential liability when collateral value fluctuates rapidly.

Smart Contract Default

Smart contract default risk in crypto-backed loans can trigger automatic liquidation of collateral, increasing liability exposure compared to traditional secured loans where default resolution typically involves negotiated legal processes. The transparency and automation of smart contracts reduce counterparty risk but also amplify the potential for rapid asset loss without human intervention in secured loan defaults.

Cross-Collateralization

Cross-collateralization in secured loans typically involves using multiple assets as collateral, increasing the lender's security and potentially reducing liability risk for borrowers. In crypto-backed loans, cross-collateralization can amplify liability exposure due to the high volatility of digital assets, potentially triggering margin calls or liquidation events that escalate borrower obligations.

Margin Call Automation

Secured loans typically involve collateral such as real estate or vehicles, where margin call automation is managed through traditional financial institutions ensuring timely notifications and risk mitigation. In contrast, crypto-backed loans rely on smart contracts for automated margin calls, triggering collateral liquidation instantly based on cryptocurrency price volatility, which increases exposure to rapid market fluctuations and potential liability for borrowers.

Digital Asset Pledge

Secured loans require tangible collateral like real estate or vehicles, while crypto-backed loans use digital asset pledges such as Bitcoin or Ethereum to secure debt, offering quicker access to liquidity but with volatility risks. The liability in crypto-backed loans depends heavily on the market value fluctuations of the digital assets pledged, potentially leading to margin calls or liquidation.

Collateral Tokenization

Collateral tokenization in secured loans involves pledging tangible or intangible assets like property or stocks, providing lenders with a clear legal claim and reducing liability risks through traditional asset valuation methods. In contrast, crypto-backed loans use digital tokens as collateral, introducing volatility and regulatory uncertainty that can complicate liability management and increase the potential for rapid collateral value fluctuations.

Flash Loan Exposure

Flash loan exposure in crypto-backed loans significantly increases liability risk due to the potential for instantaneous, uncollateralized borrowing that can be exploited for arbitrage or market manipulation, unlike secured loans which are backed by tangible assets and offer more stable liability management. This heightened vulnerability in crypto-backed loans requires advanced risk mitigation strategies to prevent sudden, large-scale liabilities from flash loan attacks.

Fiat-Gateway Loan Origination

Fiat-gateway loan origination in secured loans typically involves traditional collateral such as real estate or vehicles, minimizing counterparty risk and providing clear regulatory oversight, which enhances borrower liability protection. In contrast, crypto-backed loans expose borrowers to the volatility of digital assets, increasing the risk of liquidation under market fluctuations and potentially amplifying liability due to less established legal frameworks.

On-Chain Escrow Liability

On-chain escrow liabilities in securitized loans involve a trusted third party holding collateral, reducing default risk and ensuring transparent asset transfer through blockchain verification; crypto-backed loans leverage smart contracts to automate collateral liquidation, minimizing liability exposure and enhancing security. The decentralized nature of crypto-backed loans mitigates counterparty risk but introduces smart contract vulnerability, while secured loans rely on legal frameworks for liability enforcement.

Secured Loan vs Crypto-Backed Loan for liability. Infographic

moneydiff.com

moneydiff.com