Choosing between a payday loan and a salary advance app affects liability management significantly; payday loans often carry high interest rates and fees, increasing financial risk. Salary advance apps provide a more controlled repayment structure tied directly to your paycheck, reducing the likelihood of accumulating unmanageable debt. Opting for a salary advance app can help minimize liability by promoting responsible borrowing and timely repayments.

Table of Comparison

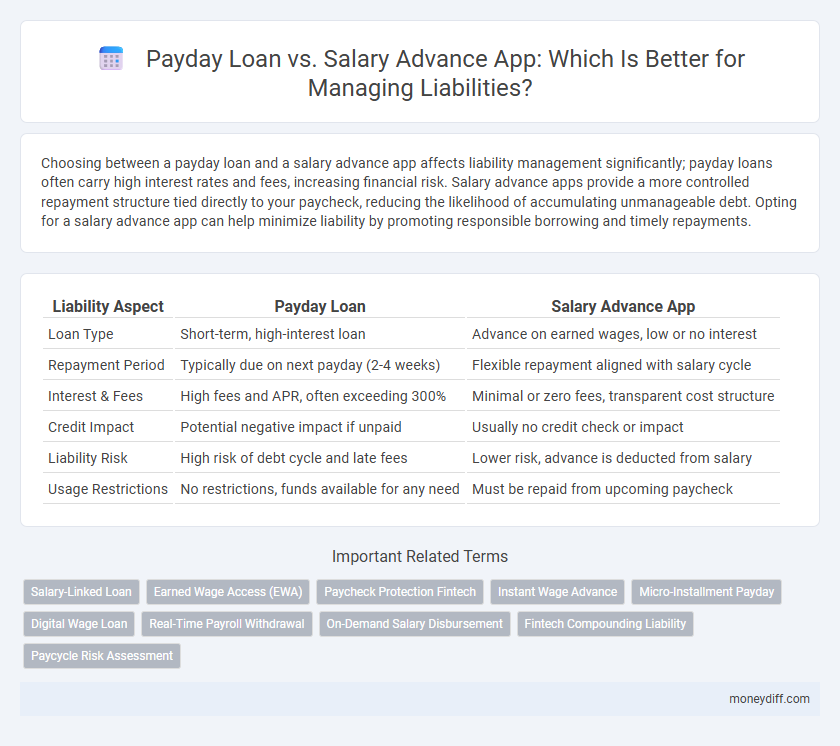

| Liability Aspect | Payday Loan | Salary Advance App |

|---|---|---|

| Loan Type | Short-term, high-interest loan | Advance on earned wages, low or no interest |

| Repayment Period | Typically due on next payday (2-4 weeks) | Flexible repayment aligned with salary cycle |

| Interest & Fees | High fees and APR, often exceeding 300% | Minimal or zero fees, transparent cost structure |

| Credit Impact | Potential negative impact if unpaid | Usually no credit check or impact |

| Liability Risk | High risk of debt cycle and late fees | Lower risk, advance is deducted from salary |

| Usage Restrictions | No restrictions, funds available for any need | Must be repaid from upcoming paycheck |

Understanding Payday Loans: Liability Risks

Payday loans carry significant liability risks due to their high interest rates and short repayment terms, often leading to a cycle of debt for borrowers. Salary advance apps typically present lower liability concerns by offering controlled, manageable advances directly linked to earned wages, reducing the chance of default. Understanding the financial obligations and potential penalties associated with payday loans is crucial for managing overall personal financial liability effectively.

Salary Advance Apps: Safer Alternative or Hidden Liabilities?

Salary advance apps often present lower interest rates and transparent fee structures compared to payday loans, potentially reducing immediate financial liability for users. However, they may encourage repeated borrowing due to easy access and automatic repayment features, which can accumulate hidden liabilities over time. Careful analysis of app terms and individual financial behavior is crucial to avoid long-term debt burdens while leveraging salary advances safely.

Comparing Interest Rates: Payday Loan vs. Salary Advance App

Payday loans often carry exorbitant interest rates, sometimes exceeding 400% APR, which significantly increases borrower liability over a short term. In contrast, salary advance apps tend to offer lower and more transparent fees, frequently capped at a small percentage of the borrowed amount or a flat fee, reducing overall financial burden. Comparing these options, salary advance apps present a more manageable liability risk by limiting costs and repayment pressure relative to payday loans.

Legal Implications and Consumer Protection

Payday loans often involve high interest rates and aggressive collection practices, exposing borrowers to significant legal liabilities and regulatory scrutiny. Salary advance apps typically operate under employer agreements, offering regulated repayment terms that reduce legal risks and enhance consumer protection. Understanding these distinctions helps consumers and regulators mitigate liability through clearer compliance and fair lending practices.

Financial Impact on Borrowers: Short-Term vs. Long-Term Liability

Payday loans create significant short-term liability with high-interest rates and fees that rapidly increase borrowers' debt, often leading to a cycle of recurring borrowing. Salary advance apps typically offer lower-cost, short-term borrowing with deductions aligned to payroll, reducing long-term debt risk and improving financial predictability. The financial impact on borrowers varies significantly, with payday loans exacerbating long-term liability due to compounding costs, while salary advance apps mitigate it through transparent, manageable repayment structures.

Repayment Terms: How Liabilities Accumulate

Payday loans typically have short repayment periods, often due on the borrower's next paycheck, leading to high-interest fees that quickly accumulate if unpaid on time. Salary advance apps usually offer more flexible repayment terms, deducting smaller amounts directly from subsequent paychecks, which can reduce the risk of escalating debt liabilities. Understanding these repayment structures is crucial for managing liabilities effectively and avoiding spiraling financial obligations.

Credit Score Effects: Payday Loan vs. Salary Advance App

Payday loans often lead to a significant negative impact on credit scores due to high-interest rates and frequent missed payments reported to credit bureaus. Salary advance apps usually offer more favorable terms with minimal or no credit checks, helping users avoid credit score damage. Choosing a salary advance app can reduce the risk of long-term credit liabilities compared to payday loan debt cycles.

Transparency in Fees and Charges

Payday loans often involve high-interest rates and hidden fees that escalate borrower liability rapidly, making transparency in fees and charges critical for informed decision-making. Salary advance apps typically offer clearer, upfront disclosures of costs, reducing unexpected financial burdens and enhancing user trust. Transparent fee structures help borrowers accurately assess liabilities, preventing costly debt cycles associated with payday loans.

Avoiding Debt Traps: Risk Mitigation Strategies

Payday loans often carry high interest rates and fees that can quickly escalate liabilities, whereas salary advance apps typically offer lower-cost, employer-supported repayments that reduce the risk of accumulating unmanageable debt. Implementing strict borrowing limits, transparent fee disclosures, and automatic repayment deductions are key mitigation strategies to avoid debt traps in both lending types. Employers and app providers should prioritize financial education and sustained monitoring to ensure borrowers maintain healthy liability levels.

Choosing the Right Solution for Your Liability Management

Payday loans typically carry higher interest rates and fees, increasing overall liability and potential financial strain. Salary advance apps offer a more manageable option with lower costs and direct deductions from future paychecks, reducing the risk of accumulating debt. Selecting the right solution requires evaluating interest rates, repayment terms, and personal financial stability to effectively manage your liabilities.

Related Important Terms

Salary-Linked Loan

Salary-linked loans reduce liability risks by directly debiting repayments from the borrower's paycheck, ensuring timely payments and minimizing default rates compared to traditional payday loans. Utilizing salary advance apps integrates real-time salary verification, enhancing borrower credit assessment and lowering financial institutions' liability exposure.

Earned Wage Access (EWA)

Payday loans typically carry high-interest rates and fees, increasing financial liability for borrowers, whereas Salary Advance Apps offering Earned Wage Access (EWA) provide employees with immediate access to earned wages without incurring debt or additional charges. Utilizing EWA through Salary Advance Apps reduces liability risk by promoting responsible borrowing and improving cash flow management.

Paycheck Protection Fintech

Payday loans often carry high-interest rates and fees, resulting in significant borrower liability, whereas salary advance apps, particularly those integrated with paycheck protection fintech solutions, offer more transparent terms and lower-cost access to earned wages, reducing financial risk. These fintech platforms utilize real-time payroll data to limit overborrowing and ensure compliance with paycheck protection regulations, ultimately minimizing user liability.

Instant Wage Advance

Instant wage advance through salary advance apps reduces liability risk by enabling employees to access earned wages before payday without incurring high-interest debt typical of payday loans. Unlike payday loans that create short-term liabilities with steep repayment terms, salary advance apps offer transparent, low-cost solutions that mitigate financial stress and potential default.

Micro-Installment Payday

Micro-installment payday loans distribute repayment into smaller, manageable amounts, reducing short-term financial liability compared to traditional payday loans that demand a lump-sum payment. Salary advance apps often provide direct employer-backed advances with lower interest rates, minimizing borrower liability and enhancing financial predictability.

Digital Wage Loan

Digital wage loan platforms streamline access to funds by offering salary advances with transparent fees and flexible repayment terms, reducing the liability risks commonly associated with traditional payday loans that often impose high-interest rates and strict penalties. Employers and employees benefit from improved financial management and lowered default rates through integrated salary advance apps that align repayments with payroll cycles.

Real-Time Payroll Withdrawal

Payday loans incur high-interest liabilities increasing borrower debt, while salary advance apps offer real-time payroll withdrawal reducing financial risk and immediate liabilities. Real-time payroll withdrawal ensures transparent fund access, minimizing unexpected fees and short-term debt accumulation.

On-Demand Salary Disbursement

On-demand salary disbursement through salary advance apps reduces liability risks by providing employees access to earned wages before payday, minimizing expensive payday loan dependencies that carry high-interest rates and increased default risks. This shift enhances financial well-being with transparent repayment terms and lowers employer liability related to wage disputes and employee financial stress.

Fintech Compounding Liability

Payday loans often carry higher interest rates and fees, significantly increasing fintech compounding liability due to borrower default risks and regulatory scrutiny. Salary advance apps, leveraging employer partnerships, reduce liability by offering controlled, lower-cost advances that improve repayment rates and mitigate financial exposure.

Paycycle Risk Assessment

Paycycle risk assessment reveals payday loans carry higher default rates and interest liabilities compared to salary advance apps that typically integrate employer payroll data for real-time repayment tracking, reducing borrower insolvency risks. Salary advance apps offer lower financial liability exposure due to transparent salary deductions and regulatory compliance, improving overall risk management for lenders and borrowers.

Payday Loan vs Salary Advance App for Liability. Infographic

moneydiff.com

moneydiff.com