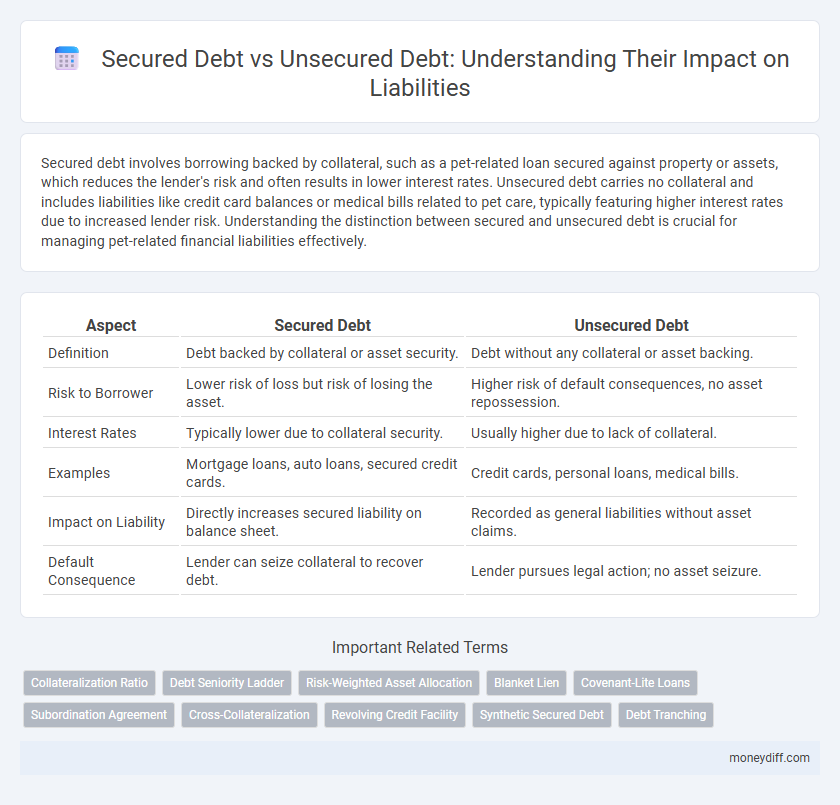

Secured debt involves borrowing backed by collateral, such as a pet-related loan secured against property or assets, which reduces the lender's risk and often results in lower interest rates. Unsecured debt carries no collateral and includes liabilities like credit card balances or medical bills related to pet care, typically featuring higher interest rates due to increased lender risk. Understanding the distinction between secured and unsecured debt is crucial for managing pet-related financial liabilities effectively.

Table of Comparison

| Aspect | Secured Debt | Unsecured Debt |

|---|---|---|

| Definition | Debt backed by collateral or asset security. | Debt without any collateral or asset backing. |

| Risk to Borrower | Lower risk of loss but risk of losing the asset. | Higher risk of default consequences, no asset repossession. |

| Interest Rates | Typically lower due to collateral security. | Usually higher due to lack of collateral. |

| Examples | Mortgage loans, auto loans, secured credit cards. | Credit cards, personal loans, medical bills. |

| Impact on Liability | Directly increases secured liability on balance sheet. | Recorded as general liabilities without asset claims. |

| Default Consequence | Lender can seize collateral to recover debt. | Lender pursues legal action; no asset seizure. |

Understanding Secured and Unsecured Debt

Secured debt involves loans backed by collateral, such as a mortgage or car loan, which reduces the lender's risk and often results in lower interest rates. Unsecured debt, including credit cards and personal loans, has no collateral, making it riskier for lenders and typically carrying higher interest rates. Understanding the distinction between secured and unsecured debt is crucial for managing financial liability and assessing the potential consequences of default.

Key Differences Between Secured and Unsecured Liabilities

Secured debt involves a borrower pledging specific assets as collateral, reducing lender risk and often resulting in lower interest rates, while unsecured debt lacks collateral, leading to higher interest rates due to increased lender risk. In the event of default, secured creditors have priority claims on the collateral, whereas unsecured creditors rely on the borrower's general creditworthiness and may face greater difficulty in recovering funds. Key differences include the presence of collateral, impact on interest rates, and the priority of claims in bankruptcy or default scenarios.

Common Examples of Secured Debt

Common examples of secured debt include mortgages, auto loans, and home equity lines of credit, where the borrower pledges specific assets as collateral to mitigate lender risk. These secured liabilities enable creditors to claim the collateral if the debtor defaults, reducing potential financial losses. Secured debt typically offers lower interest rates compared to unsecured debt due to the reduced risk associated with collateral backing.

Typical Unsecured Debt Types

Typical unsecured debt types include credit card balances, medical bills, personal loans, and utility bills, all of which lack collateral backing, increasing the lender's risk. Unlike secured debt, such as mortgages or auto loans, unsecured debts rely solely on the borrower's creditworthiness and promise to repay. This higher risk often results in elevated interest rates and more aggressive collection efforts during defaults.

Risk Factors for Borrowers: Secured vs Unsecured

Secured debt poses lower risk for borrowers as it is backed by collateral, reducing lenders' likelihood of default but increasing the chance of asset loss. Unsecured debt carries higher interest rates due to greater lender risk and can lead to severe credit damage or legal action if unpaid. Borrowers must assess asset availability and repayment ability to balance risk exposure between secured and unsecured liabilities.

Impact on Credit Score: Secured vs Unsecured Debt

Secured debt, backed by collateral, generally has a less negative impact on credit scores due to lower risk for lenders and timely payments improve credit profiles. Unsecured debt, lacking collateral, poses higher risk, so missed payments or high balances can significantly damage credit scores. Maintaining low utilization rates and consistent payments on both types is crucial for preserving strong creditworthiness.

Legal Implications of Defaulting

Secured debt involves collateral that lenders can claim in the event of default, leading to quicker asset seizure and potential foreclosure under legal statutes. Unsecured debt lacks collateral, resulting in creditors pursuing legal judgments, wage garnishments, or asset liens to recover owed amounts. Understanding these legal implications is crucial for managing liability risks and negotiating repayment terms effectively.

Cost and Interest Rate Comparison

Secured debt typically offers lower interest rates due to collateral reducing lender risk, resulting in a lower overall cost of borrowing compared to unsecured debt. Unsecured debt carries higher interest rates reflecting increased risk for lenders, leading to greater liability costs over the loan term. Borrowers with secured debt benefit from more favorable repayment terms and reduced financial liability.

How to Prioritize Debt Repayment

Secured debt, backed by collateral such as a mortgage or car loan, should be prioritized in repayment to avoid asset loss and protect credit standing. Unsecured debt, including credit card balances and medical bills, typically carries higher interest rates, making it essential to manage payments strategically to minimize financial strain. Prioritizing secured debt reduces legal risks and preserves valuable property, while addressing high-interest unsecured debt helps limit escalating charges and overall liability.

Strategies for Managing Secured and Unsecured Liabilities

Effective strategies for managing secured and unsecured liabilities include prioritizing repayment of unsecured debts to avoid high-interest penalties and preserve credit scores. Secured liabilities should be monitored closely by regularly assessing collateral value and refinancing options to reduce interest rates and leverage assets efficiently. Implementing a structured payment plan and maintaining clear communication with creditors can mitigate default risks and improve overall financial stability.

Related Important Terms

Collateralization Ratio

Secured debt involves a collateralization ratio that measures the value of assets pledged against the loan, reducing creditor risk by ensuring asset-backed repayment options. Unsecured debt lacks collateral, resulting in higher liability risk as lenders rely solely on the borrower's creditworthiness without specific asset backing.

Debt Seniority Ladder

Secured debt holds priority in the debt seniority ladder, as it is backed by collateral, reducing the lender's risk and increasing recovery likelihood in default. Unsecured debt ranks lower, lacking collateral claims, which exposes lenders to higher risk and potentially lower repayment in bankruptcy proceedings.

Risk-Weighted Asset Allocation

Secured debt carries lower risk-weighted asset allocations due to collateral backing, reducing potential losses for lenders and improving bank capital adequacy ratios. Unsecured debt entails higher risk-weighted asset charges as lack of collateral increases credit risk, necessitating greater capital reserves to cover potential defaults.

Blanket Lien

Blanket liens grant lenders a security interest over all assets of a borrower, categorizing the related debt as secured liability, which enhances creditor protection in case of default. Unsecured debt lacks collateral backing, posing higher risk for creditors and typically resulting in higher interest rates to compensate for this increased liability exposure.

Covenant-Lite Loans

Covenant-lite loans, a subset of secured debt, impose fewer restrictions and financial maintenance covenants, increasing risk for lenders compared to traditional secured loans with stringent covenants. Unsecured debt lacks collateral entirely, exposing creditors to higher potential losses in default scenarios, whereas covenant-lite loan agreements often prioritize lender recovery through collateral without demanding aggressive borrower compliance.

Subordination Agreement

A Subordination Agreement legally prioritizes secured debt over unsecured debt, ensuring that secured creditors have first claim on assets in the event of default or bankruptcy. This agreement minimizes liability exposure for secured creditors while increasing risk for unsecured creditors, who receive repayment only after secured debts are fully satisfied.

Cross-Collateralization

Cross-collateralization ties multiple loans or debts to a single collateral asset, increasing the risk in secured debt by allowing creditors to claim the asset for various obligations if defaults occur. Unsecured debt lacks this feature, relying solely on the borrower's creditworthiness without specific asset backing, which limits creditor claims to legal judgments rather than direct collateral seizure.

Revolving Credit Facility

Secured debt in a revolving credit facility involves collateral that reduces lender risk and often results in lower interest rates, while unsecured debt lacks specific collateral, increasing liability risk and typically commanding higher costs. Understanding the distinction is crucial for managing liability exposure and optimizing capital structure in corporate finance.

Synthetic Secured Debt

Synthetic secured debt leverages financial derivatives or collateralized instruments to replicate the risk and return profile of traditional secured debt without transferring physical assets, enhancing creditor protection in liability management. This mechanism reduces unsecured exposure by legally prioritizing claims and improving recoverability in the event of borrower default.

Debt Tranching

Secured debt involves loans backed by collateral, reducing lender risk and often resulting in lower interest rates, whereas unsecured debt lacks asset backing, increasing lender exposure and typically carrying higher interest costs. Debt tranching separates liabilities into layers based on risk and security, allowing secured debt tranches to have priority claims over unsecured tranches in the event of default.

Secured Debt vs Unsecured Debt for liability. Infographic

moneydiff.com

moneydiff.com