Liabilities in traditional finance refer to obligations or debts that an entity owes, often recorded on a centralized ledger. In decentralized finance (DeFi), liabilities are managed through smart contracts on blockchain platforms, eliminating intermediaries while maintaining transparency and security. DeFi liabilities include lending protocols and collateralized loans, where users assume risks and obligations in a trustless environment.

Table of Comparison

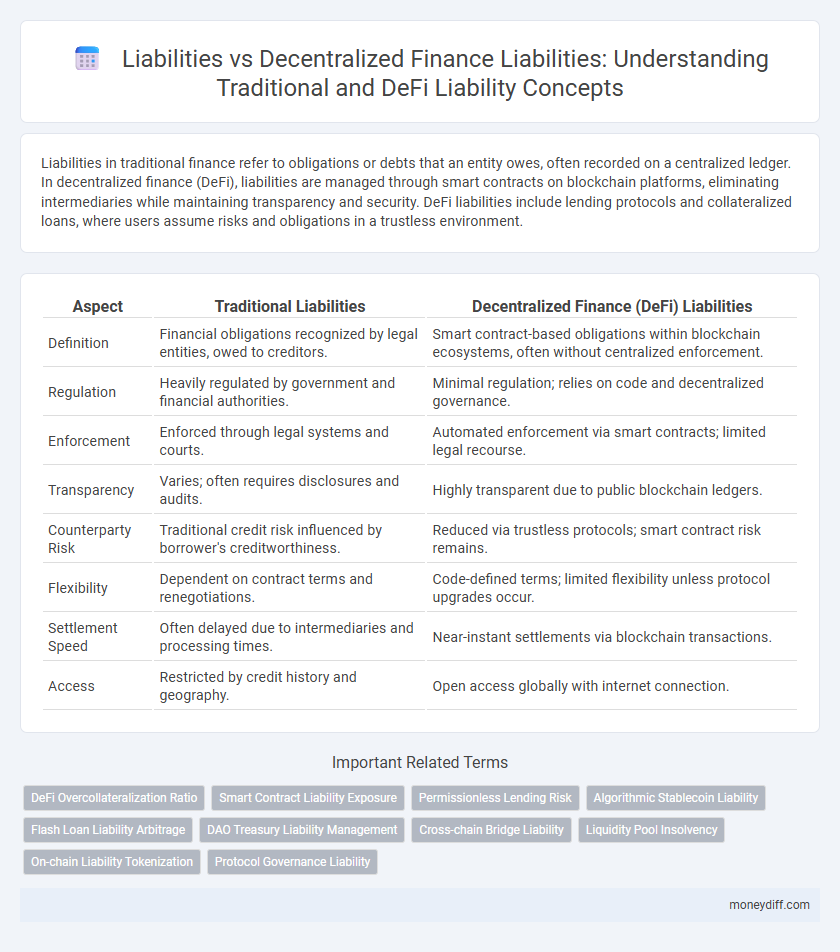

| Aspect | Traditional Liabilities | Decentralized Finance (DeFi) Liabilities |

|---|---|---|

| Definition | Financial obligations recognized by legal entities, owed to creditors. | Smart contract-based obligations within blockchain ecosystems, often without centralized enforcement. |

| Regulation | Heavily regulated by government and financial authorities. | Minimal regulation; relies on code and decentralized governance. |

| Enforcement | Enforced through legal systems and courts. | Automated enforcement via smart contracts; limited legal recourse. |

| Transparency | Varies; often requires disclosures and audits. | Highly transparent due to public blockchain ledgers. |

| Counterparty Risk | Traditional credit risk influenced by borrower's creditworthiness. | Reduced via trustless protocols; smart contract risk remains. |

| Flexibility | Dependent on contract terms and renegotiations. | Code-defined terms; limited flexibility unless protocol upgrades occur. |

| Settlement Speed | Often delayed due to intermediaries and processing times. | Near-instant settlements via blockchain transactions. |

| Access | Restricted by credit history and geography. | Open access globally with internet connection. |

Understanding Traditional Liabilities in Money Management

Traditional liabilities in money management represent financial obligations such as loans, mortgages, and accounts payable that businesses or individuals must repay within a set timeframe. These liabilities are recorded on a balance sheet and impact creditworthiness, liquidity, and long-term financial planning by reflecting the entity's debt responsibilities. Understanding the structure, terms, and repayment schedules of these liabilities is crucial for effective risk management and maintaining financial stability in conventional finance.

What Are Decentralized Finance (DeFi) Liabilities?

Decentralized Finance (DeFi) liabilities refer to obligations or debts that arise within blockchain-based financial platforms without centralized intermediaries. These liabilities include smart contract debts, liquidity provider obligations, and tokenized loan commitments recorded on the blockchain. Unlike traditional liabilities, DeFi liabilities are transparent, programmable, and automatically enforced through decentralized protocols.

Key Differences Between Traditional and DeFi Liabilities

Traditional liabilities represent legally binding financial obligations recorded on centralized ledgers, often involving intermediaries like banks or lenders, whereas decentralized finance (DeFi) liabilities operate on blockchain networks with smart contracts enforcing terms autonomously. DeFi liabilities are inherently more transparent, programmable, and accessible 24/7 without reliance on third-party institutions, enabling peer-to-peer lending and borrowing with lower barriers. The key difference lies in trust mechanisms: traditional liabilities depend on centralized authority enforcement, while DeFi liabilities utilize cryptographic proof and decentralized consensus to manage obligations.

Risk Assessment: Traditional Liabilities vs DeFi Liabilities

Risk assessment for traditional liabilities typically involves evaluating creditworthiness, collateral value, and regulatory compliance, ensuring predictable obligations under established legal frameworks. In contrast, DeFi liabilities introduce complexities such as smart contract vulnerabilities, volatility in collateral assets, and decentralized governance that can amplify systemic risk. The dynamic nature of DeFi protocols demands continuous monitoring of on-chain activities and liquidity conditions to accurately assess exposure and mitigate financial losses.

Collateralization: How Liability is Managed in DeFi

In decentralized finance (DeFi), liabilities are often managed through collateralization, where users lock digital assets to secure loans or other financial obligations. This system reduces lender risk by ensuring liabilities are backed by tangible value, often exceeding the loan amount to account for market volatility. Unlike traditional liabilities, DeFi collateralization relies on smart contracts to automate enforcement and liquidation processes, enhancing transparency and efficiency.

Transparency in DeFi vs Conventional Liability Tracking

Transparency in decentralized finance (DeFi) significantly surpasses conventional liability tracking by leveraging blockchain's immutable ledger, enabling real-time auditing and verification of liabilities. Traditional systems often rely on centralized intermediaries and periodic reporting, creating delays and potential opacity in liability records. DeFi's transparent ecosystem reduces information asymmetry, enhancing trust and accountability in managing financial obligations.

Legal Implications: Compliance Issues in Traditional and DeFi Liabilities

Traditional liabilities require strict adherence to established regulatory frameworks such as the Sarbanes-Oxley Act and GAAP standards, ensuring clear accountability and legal recourse for non-compliance. In contrast, decentralized finance (DeFi) liabilities pose complex legal challenges due to the absence of centralized control, creating ambiguity in jurisdiction, enforcement, and consumer protection under existing laws. Compliance issues in DeFi demand innovative regulatory approaches and smart contract auditing to mitigate risks and align with anti-money laundering (AML) and know-your-customer (KYC) requirements.

Liquidity Risks: Comparing DeFi Liabilities to Traditional Counterparts

Liquidity risks in decentralized finance (DeFi) liabilities differ significantly from traditional liabilities due to the lack of centralized intermediaries and reliance on smart contracts. DeFi platforms face higher volatility and potential sudden liquidity shortages since asset values and collateral can rapidly fluctuate in open markets without lender-of-last-resort mechanisms. Traditional liabilities benefit from regulated financial institutions that manage liquidity through reserve requirements and central bank support, mitigating risks more effectively compared to the inherently dynamic and less predictable environment of DeFi liabilities.

Impact of Smart Contracts on DeFi Liability Management

Smart contracts in decentralized finance (DeFi) automate liability agreements, reducing human error and increasing transparency in liability management. These self-executing contracts enforce terms without intermediaries, which minimizes counterparty risk and enhances trust across DeFi platforms. Real-time execution and programmable conditions allow for more precise liability tracking and faster dispute resolution compared to traditional liability frameworks.

The Future of Liability: Facing Challenges and Opportunities in DeFi

Decentralized Finance (DeFi) redefines traditional liabilities by leveraging blockchain technology to create transparent, programmable obligations that reduce counterparty risk. The future of liability in DeFi faces challenges including regulatory uncertainty, smart contract vulnerabilities, and asset volatility, which require innovative risk management solutions. Opportunities arise from automated compliance protocols and decentralized insurance models that enhance liability coverage and financial resilience in decentralized ecosystems.

Related Important Terms

DeFi Overcollateralization Ratio

Liabilities in traditional finance represent owed obligations, whereas Decentralized Finance (DeFi) liabilities emphasize protocol-level accountability, with the DeFi overcollateralization ratio serving as a critical metric to ensure loan security and minimize default risk. Maintaining a high overcollateralization ratio is essential in DeFi platforms to protect lenders by requiring borrowers to lock assets exceeding the loan value, thereby sustaining system solvency and reducing systemic risk.

Smart Contract Liability Exposure

Smart contract liability exposure in decentralized finance (DeFi) arises from code vulnerabilities, exploit risks, and governance failures that can lead to significant financial losses. Unlike traditional liabilities, DeFi liabilities necessitate rigorous audit protocols and continuous risk assessment to mitigate unintended contract behaviors and protect stakeholders.

Permissionless Lending Risk

Liabilities in traditional finance often involve regulated entities with defined credit risk frameworks, whereas decentralized finance (DeFi) liabilities arise from permissionless lending protocols that expose users to smart contract vulnerabilities, liquidity risks, and volatile collateral valuations. Permissionless lending in DeFi increases counterparty risk due to the absence of centralized intermediaries and reliance on algorithmic interest rates, resulting in unpredictable debt obligations and potential insolvency during market stress.

Algorithmic Stablecoin Liability

Algorithmic stablecoin liabilities arise from the protocol's obligation to maintain price stability through algorithm-driven token supply adjustments, contrasting traditional liabilities that stem from fixed financial obligations or centralized control. DeFi liabilities, particularly in algorithmic stablecoins, are decentralized and automated, relying on market incentives and smart contracts to manage collateralization and redemption risks without direct counterparty guarantees.

Flash Loan Liability Arbitrage

Flash loan liability arbitrage exploits vulnerabilities in decentralized finance liabilities by rapidly borrowing and repaying large sums without collateral, creating temporary liability imbalances across protocols. This technique leverages instantaneous liquidity to manipulate price discrepancies and smart contract conditions, minimizing traditional liability exposure while maximizing arbitrage opportunities.

DAO Treasury Liability Management

DAO treasury liability management in decentralized finance involves accurately tracking and categorizing on-chain obligations such as outstanding loans, smart contract debts, and governance token obligations to ensure transparent financial reporting. Unlike traditional liabilities, DeFi liabilities require real-time monitoring of blockchain events and automated risk assessment algorithms to maintain solvency and safeguard stakeholder interests in the DAO ecosystem.

Cross-chain Bridge Liability

Cross-chain bridge liability in decentralized finance (DeFi) arises from the risks of asset mismanagement, smart contract vulnerabilities, and potential exploits during inter-blockchain transactions. Unlike traditional liabilities, DeFi cross-chain bridges must address custody risks and ensure secure asset transfers to prevent loss or theft inherent in multi-chain interoperability.

Liquidity Pool Insolvency

Liquidity pool insolvency in decentralized finance (DeFi) occurs when the value of pooled assets falls below the liabilities owed to liquidity providers, leading to potential losses and withdrawal restrictions. Traditional liabilities differ as they typically involve legally enforceable obligations with clearer risk assessments, whereas DeFi liabilities depend on smart contract performance and market volatility.

On-chain Liability Tokenization

On-chain liability tokenization in decentralized finance (DeFi) enables the representation of liabilities as digital tokens on blockchain networks, enhancing transparency, liquidity, and efficiency compared to traditional liabilities recorded off-chain. This innovation allows users to trade, collateralize, and manage liabilities in a decentralized manner, providing real-time tracking and reducing counterparty risks associated with conventional financial systems.

Protocol Governance Liability

Protocol governance liability in decentralized finance (DeFi) arises from the risks associated with decision-making mechanisms embedded within smart contracts, where governance token holders influence protocol upgrades and asset management. Unlike traditional liabilities, DeFi governance liabilities are decentralized, creating challenges in attributing responsibility and enforcing accountability for protocol failures or financial losses.

Liabilities vs Decentralized Finance Liabilities for liability. Infographic

moneydiff.com

moneydiff.com