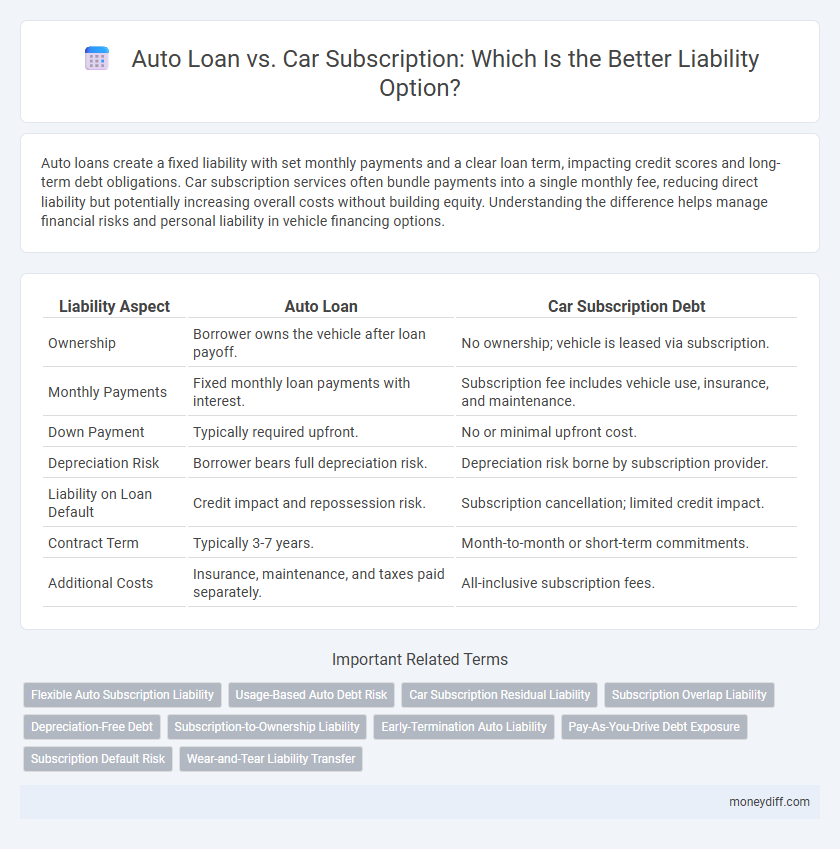

Auto loans create a fixed liability with set monthly payments and a clear loan term, impacting credit scores and long-term debt obligations. Car subscription services often bundle payments into a single monthly fee, reducing direct liability but potentially increasing overall costs without building equity. Understanding the difference helps manage financial risks and personal liability in vehicle financing options.

Table of Comparison

| Liability Aspect | Auto Loan | Car Subscription Debt |

|---|---|---|

| Ownership | Borrower owns the vehicle after loan payoff. | No ownership; vehicle is leased via subscription. |

| Monthly Payments | Fixed monthly loan payments with interest. | Subscription fee includes vehicle use, insurance, and maintenance. |

| Down Payment | Typically required upfront. | No or minimal upfront cost. |

| Depreciation Risk | Borrower bears full depreciation risk. | Depreciation risk borne by subscription provider. |

| Liability on Loan Default | Credit impact and repossession risk. | Subscription cancellation; limited credit impact. |

| Contract Term | Typically 3-7 years. | Month-to-month or short-term commitments. |

| Additional Costs | Insurance, maintenance, and taxes paid separately. | All-inclusive subscription fees. |

Understanding Auto Loan Liability

Auto loan liability represents a fixed financial obligation where the borrower owes the lender the principal amount plus interest over a predetermined term, directly impacting credit scores and debt-to-income ratios. Car subscription services, by contrast, typically entail monthly fees without long-term debt, reducing traditional liability risks but potentially increasing ongoing expenses. Understanding auto loan liability is crucial for assessing financial commitments when choosing between purchasing a vehicle and subscribing to one, as loans contribute to debt-based liabilities while subscriptions are operational expenses.

Car Subscription Debt: A New Liability Paradigm

Car subscription debt introduces a new liability paradigm by blending vehicle access with recurring financial obligations that differ from traditional auto loans. Unlike auto loans, which represent long-term debt tied to ownership and collateralized by the vehicle, car subscriptions generate liabilities through monthly fees without asset ownership, impacting credit and financial statements differently. This evolving model requires consumers and lenders to reconsider risk assessments, liability management, and credit reporting in the context of subscription-based vehicle access.

Comparing Financial Risks: Auto Loans vs Car Subscriptions

Auto loans create a secured liability with fixed monthly payments and interest, often impacting credit scores and long-term financial obligations. Car subscriptions represent a short-term, flexible liability without ownership, typically including maintenance and insurance but may result in higher monthly costs and no asset accumulation. Comparing financial risks involves evaluating loan interest rates, depreciation, subscription fees, and potential impacts on credit and cash flow stability.

Liability Impact on Credit Score: Loan vs Subscription

Auto loan liabilities directly affect credit scores through monthly payment history and debt-to-income ratios, often reflecting positively if managed well. Car subscription debts typically do not appear on credit reports, minimizing impact on credit scores but offering less opportunity to build credit. Understanding these differences is crucial for managing financial liabilities and maintaining a healthy credit profile.

Long-Term Debt Obligations: Which Is Riskier?

Auto loans represent a fixed long-term debt obligation with predictable monthly payments and collateralized by the vehicle, reducing lender risk but posing default risk for borrowers. Car subscription services typically involve short-term, flexible agreements without traditional debt, potentially leading to less financial liability but higher overall costs and limited asset ownership. Auto loans carry greater long-term risk due to debt accumulation and interest, whereas car subscriptions minimize debt exposure but may strain cash flow if frequently extended.

Asset Ownership and Liability Management

Auto loans create a liability through a secured debt tied to the ownership of the vehicle, impacting credit scores and requiring monthly payments until full repayment. Car subscriptions eliminate long-term liability by bundling vehicle use, insurance, and maintenance under a monthly fee without asset ownership, reducing exposure to depreciation risks. Effective liability management depends on whether asset ownership is prioritized, as auto loans build equity while subscriptions offer flexibility without debt accumulation.

Early Termination and Liability Consequences

Auto loan early termination often results in remaining loan balance liability, where the borrower must pay off the outstanding amount or face credit risk. Car subscription services typically charge early termination fees but limit liability to those fees, avoiding long-term debt obligations. Understanding these differences is crucial for managing financial exposure and avoiding unexpected debt burdens.

Monthly Payments: Predictable vs Flexible Liabilities

Auto loan monthly payments are predictable liabilities with fixed amounts due each month over a set term, providing budget stability for borrowers. Car subscription services offer flexible liabilities with variable monthly fees that often include insurance, maintenance, and the option to switch vehicles, allowing for adaptable budget management. Understanding the contrast between fixed auto loan payments and flexible subscription fees is essential when evaluating total liability impact on personal finances.

Liability Protection: Insurance and Legal Considerations

Auto loan agreements typically require comprehensive insurance coverage, protecting borrowers from financial liability in collisions or theft, while car subscription services often include insurance as part of the package, shifting liability risks to the provider. Liability protection under auto loans depends on borrowers maintaining adequate personal insurance policies consistent with lender requirements to avoid legal and financial repercussions. Understanding contract-specific liability clauses and insurance obligations within each financing option is crucial for managing potential legal risks effectively.

Choosing the Right Option for Sustainable Liability

Choosing the right option between auto loan and car subscription debt influences long-term financial liability management by balancing fixed monthly payments against flexible usage costs. Auto loans typically build equity with predictable liabilities, while car subscriptions offer short-term flexibility but may result in higher cumulative expenses and uncertain debt duration. Evaluating credit impact, total cost of ownership, and personal financial goals ensures sustainable liability aligned with budget and lifestyle preferences.

Related Important Terms

Flexible Auto Subscription Liability

Flexible auto subscription liability offers a lower financial risk compared to traditional auto loan debt by limiting customer obligations to monthly fees without long-term loan commitments. This model reduces exposure to depreciation costs and unexpected repair liabilities, enhancing overall flexibility and cash flow management.

Usage-Based Auto Debt Risk

Auto loan liability often involves fixed monthly payments based on principal and interest, whereas car subscription debt aligns with usage-based fees that fluctuate according to mileage and wear, increasing financial unpredictability. Usage-based auto debt risk heightens exposure to unexpected expenses, impacting overall liability management and credit stability.

Car Subscription Residual Liability

Car subscription residual liability typically involves a predetermined fee due at the end of the subscription term, representing the vehicle's estimated depreciation and market value risk, which contrasts with auto loan debt that centers on fixed monthly payments covering principal and interest. Managing car subscription residual liability is crucial for consumers to avoid unexpected financial burdens, as this form of liability can significantly impact overall vehicle cost compared to traditional auto loan obligations.

Subscription Overlap Liability

Auto loan debt typically involves a fixed liability secured by the vehicle title, whereas car subscription services create overlapping liabilities due to ongoing monthly fees without ownership transfer. Subscription overlap liability arises when subscribers maintain multiple active subscriptions or combine auto loans with subscriptions, increasing financial obligations and risk exposure.

Depreciation-Free Debt

Auto loan debt accrues liability with vehicle depreciation, resulting in a long-term financial burden as loan balances often exceed market value over time. Car subscription debt offers depreciation-free liability by including usage and maintenance costs in fixed fees, eliminating exposure to resale value fluctuations.

Subscription-to-Ownership Liability

Subscription-to-ownership liability in car subscriptions typically results in lower long-term obligations compared to traditional auto loans, as subscribers avoid large upfront costs and depreciation risks. Auto loan liability increases with principal and interest payments, often leading to higher total debt and asset ownership responsibilities.

Early-Termination Auto Liability

Early-termination auto liability for auto loans often results in higher financial penalties due to outstanding principal and accrued interest, while car subscription debt may involve prorated fees and fewer residual obligations. Understanding these distinct liabilities is critical for managing financial risks associated with early contract termination in vehicle financing.

Pay-As-You-Drive Debt Exposure

Pay-as-you-drive debt exposure in auto loans typically involves fixed monthly payments and interest accrual, increasing overall liability depending on loan terms and mileage commitments. Car subscriptions often reduce liability risk by including maintenance and insurance in a single fee, limiting unexpected costs and providing more predictable monthly expenses.

Subscription Default Risk

Car subscription debt carries a higher liability risk compared to traditional auto loans due to the recurring monthly fees and stricter default terms that can lead to immediate service termination and additional penalties. Subscription default risk arises from fluctuating payment abilities, increasing the likelihood of negative credit impacts and potential legal actions from providers.

Wear-and-Tear Liability Transfer

Auto loan agreements place full wear-and-tear liability on the borrower, requiring them to cover repair costs and depreciation from usage. Car subscription services transfer wear-and-tear liability to the provider, reducing unexpected expenses and simplifying financial management for subscribers.

Auto Loan vs Car Subscription Debt for Liability. Infographic

moneydiff.com

moneydiff.com