A Mortgage places full liability on the borrower, requiring them to repay the entire loan amount regardless of property value changes. In contrast, a Shared Equity Agreement distributes liability based on the property's appreciated or depreciated value, minimizing the borrower's financial risk. Choosing between these options depends on whether you prefer fixed repayment obligations or flexible liability tied to property performance.

Table of Comparison

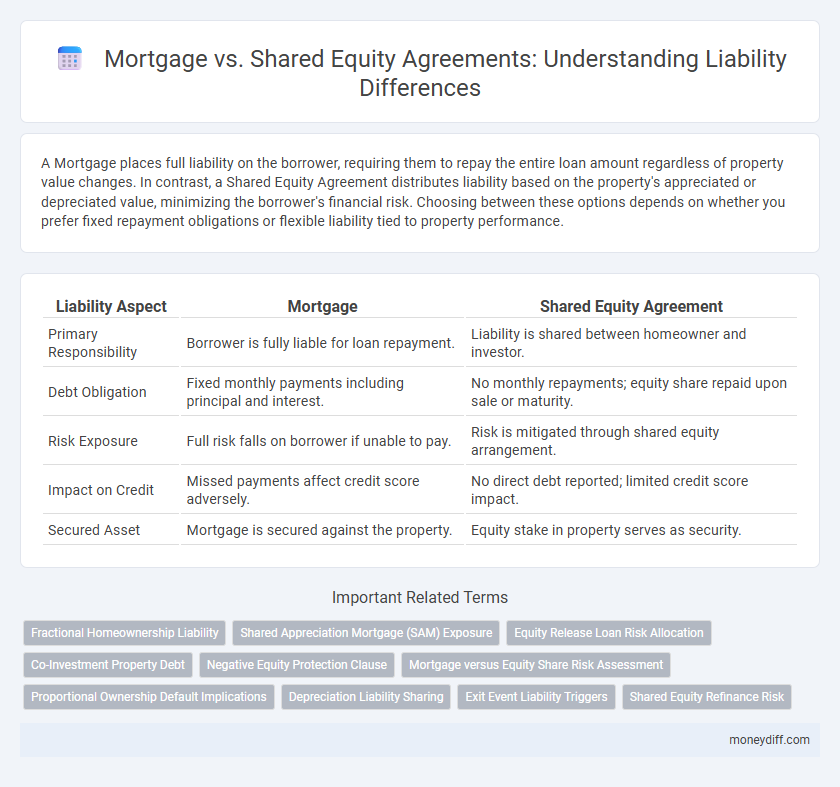

| Liability Aspect | Mortgage | Shared Equity Agreement |

|---|---|---|

| Primary Responsibility | Borrower is fully liable for loan repayment. | Liability is shared between homeowner and investor. |

| Debt Obligation | Fixed monthly payments including principal and interest. | No monthly repayments; equity share repaid upon sale or maturity. |

| Risk Exposure | Full risk falls on borrower if unable to pay. | Risk is mitigated through shared equity arrangement. |

| Impact on Credit | Missed payments affect credit score adversely. | No direct debt reported; limited credit score impact. |

| Secured Asset | Mortgage is secured against the property. | Equity stake in property serves as security. |

Understanding Mortgage Liabilities

Mortgage liabilities represent a borrower's legal obligation to repay the full loan amount secured against the property, including principal, interest, and fees. In contrast, a Shared Equity Agreement involves joint ownership where financial responsibility and liabilities are proportionally shared between parties. Understanding mortgage liabilities helps borrowers assess long-term financial commitments and the risks of foreclosure in case of default.

What Is a Shared Equity Agreement?

A shared equity agreement is a financial arrangement where the homeowner and investor jointly share ownership and proportionate liability based on the property's value. Unlike a traditional mortgage, the liability in a shared equity agreement is tied to the property's equity fluctuations, affecting both parties' financial responsibilities. This structure reduces borrower debt obligations but requires clear terms to manage potential risks associated with property value changes.

Liability Differences: Mortgage vs Shared Equity

Mortgage liability involves a borrower legally responsible for full repayment of the loan amount plus interest, creating a fixed debt obligation secured by property collateral. Shared Equity Agreements distribute financial risk by splitting property ownership and appreciation between the homeowner and investor, reducing personal debt liability but potentially impacting future equity gains. Mortgages typically impose greater personal liability with defined repayment schedules, whereas shared equity arrangements align liability with property value fluctuations and shared financial interests.

Risk Assessment for Homebuyers

Mortgage liability primarily places the borrower at risk for full repayment of the loan amount plus interest, impacting credit score and financial stability in case of default. Shared equity agreements distribute financial risk between the homeowner and investor, reducing borrower exposure to market fluctuations and potential negative equity. Homebuyers should carefully assess risk tolerance, potential property value changes, and financial obligations before choosing between mortgage and shared equity liability structures.

Financial Responsibilities of Each Option

Mortgage liability requires borrowers to repay the full loan amount with interest, making them solely responsible for monthly payments and potential foreclosure risks. In a Shared Equity Agreement, financial responsibility is split between the homeowner and investor, reducing monthly payment burdens but involving shared risks and profits upon property sale. Choosing between these options depends on the borrower's ability to manage debt and willingness to share future equity gains.

Impact on Personal Credit and Debt

Mortgage liability directly affects personal credit, as missed payments or defaults are reported to credit bureaus, potentially lowering credit scores and increasing debt obligations. In contrast, a Shared Equity Agreement may not appear as traditional debt on personal credit reports, reducing immediate impact on credit scores but potentially complicating future borrowing due to shared ownership terms. Understanding these differences is crucial for managing long-term financial liability and credit health.

Repayment Terms and Liability

In mortgage agreements, liability typically rests fully on the borrower, who is responsible for repaying the entire loan amount with fixed repayment terms. Shared equity agreements shift some financial risk by having repayment tied to property value appreciation, reducing direct liability but potentially increasing overall payment if the property performs well. Borrowers in shared equity arrangements share liability with the equity partner, often resulting in more flexible, value-based repayment conditions compared to traditional mortgage obligations.

Legal Implications and Protections

A mortgage imposes a fixed legal liability on the borrower, who is personally responsible for repaying the entire loan amount plus interest, securing the debt with the property itself. In contrast, a shared equity agreement involves joint ownership, where liability is typically limited to the agreed investment share, reducing personal risk but potentially complicating legal responsibilities upon sale or default. Legal protections vary: mortgage borrowers have clear statutory foreclosure processes, while shared equity participants must rely on contractual terms that govern equity division, buyout options, and dispute resolution.

Long-Term Financial Consequences

A mortgage typically involves personal liability where the borrower is responsible for full repayment, potentially impacting credit and financial stability over decades. Shared equity agreements limit personal liability by dividing ownership and risk between the homeowner and investor, which can reduce long-term financial burden. Understanding the differences in liability exposure is crucial for assessing the long-term financial consequences of each option.

Choosing the Right Agreement for Your Liability Profile

Selecting the appropriate agreement between a mortgage and a shared equity agreement depends on your liability tolerance and financial situation. Mortgages impose fixed repayment obligations with full liability, while shared equity agreements distribute risk by linking repayment to property value changes, reducing personal liability exposure. Assessing your income stability and risk appetite helps determine which agreement aligns best with your liability profile.

Related Important Terms

Fractional Homeownership Liability

Mortgage liability binds the borrower to full repayment of the loan amount, placing sole financial responsibility on the homeowner for defaults or property devaluation. Shared Equity Agreements mitigate fractional homeownership liability by dividing risk between the homeowner and investor, where repayment obligations align with the property's value fluctuations rather than fixed loan amounts.

Shared Appreciation Mortgage (SAM) Exposure

Shared Appreciation Mortgage (SAM) exposure shifts liability by allowing lenders to claim a percentage of the property's future appreciation instead of relying solely on fixed repayments, creating variable financial obligations tied to market performance. Unlike traditional mortgages, shared equity agreements distribute risk between borrower and lender, potentially reducing immediate liability but increasing exposure to property value fluctuations.

Equity Release Loan Risk Allocation

In a Mortgage, the borrower holds full liability for the loan repayment, with risk concentrated solely on the property's value and their ability to repay, whereas a Shared Equity Agreement distributes liability between the homeowner and the investor based on changes in property equity, reducing the homeowner's repayment burden but introducing potential equity dilution risk. Equity release in a Shared Equity Agreement shifts risk allocation, as investors share the property's future market value fluctuations, balancing financial responsibility and limiting homeowner debt exposure compared to traditional mortgage liabilities.

Co-Investment Property Debt

Mortgage agreements impose full liability on the borrower for the entire property debt, requiring sole responsibility for repayments. Shared Equity Agreements distribute liability proportionally among co-investors, reducing individual debt exposure based on ownership share in the co-investment property.

Negative Equity Protection Clause

A Mortgage typically places full liability for negative equity on the borrower, exposing them to potential financial loss if property values decline, whereas a Shared Equity Agreement often includes a Negative Equity Protection Clause that limits the investor's and homeowner's exposure by sharing losses proportionally. This clause ensures that neither party bears disproportionate risk, enhancing financial security in fluctuating real estate markets.

Mortgage versus Equity Share Risk Assessment

Mortgage liability involves fixed repayment obligations with the risk concentrated on borrower default and property foreclosure, while shared equity agreements distribute financial risk by linking liability to property value fluctuations, reducing the burden of fixed repayments but exposing parties to market volatility. Assessing risk in mortgages centers on creditworthiness and income stability, whereas equity share agreements require thorough evaluation of market trends and long-term asset appreciation potential.

Proportional Ownership Default Implications

In a mortgage, liability is typically proportional to the loan amount, meaning each party is responsible for their share of the debt based on ownership percentage. Shared equity agreements allocate liability according to the percentage of equity each party holds, impacting default consequences and financial obligations accordingly.

Depreciation Liability Sharing

Mortgage agreements typically hold the borrower solely liable for depreciation-related losses, requiring full repayment regardless of property value decline. Shared equity agreements distribute depreciation liability proportionally between the investor and homeowner, aligning financial risk with ownership shares.

Exit Event Liability Triggers

In a mortgage, liability is triggered upon default or foreclosure, holding the borrower fully responsible for repayment, including any deficiency balance after property sale. Shared Equity Agreements activate liability primarily at exit events like property sale or refinancing, where repayment is based on the property's appreciated value, aligning both parties' financial interests and risk exposure.

Shared Equity Refinance Risk

Shared Equity Refinance Risk increases liability exposure as refinancing can alter ownership percentages and debt obligations, potentially leading to disputes among co-owners. Unlike traditional mortgages, shared equity agreements require careful management of refinancing terms to avoid unexpected financial liabilities or legal complications.

Mortgage vs Shared Equity Agreement for Liability. Infographic

moneydiff.com

moneydiff.com