Liabilities in traditional frameworks involve manual enforcement and complex legal processes that can delay resolution and increase costs. Smart contract-based liabilities automate the execution of agreements through code, ensuring transparent, immediate, and tamper-proof liability management. This innovation reduces risks of disputes by providing clear, predefined rules that trigger actions without intermediary intervention.

Table of Comparison

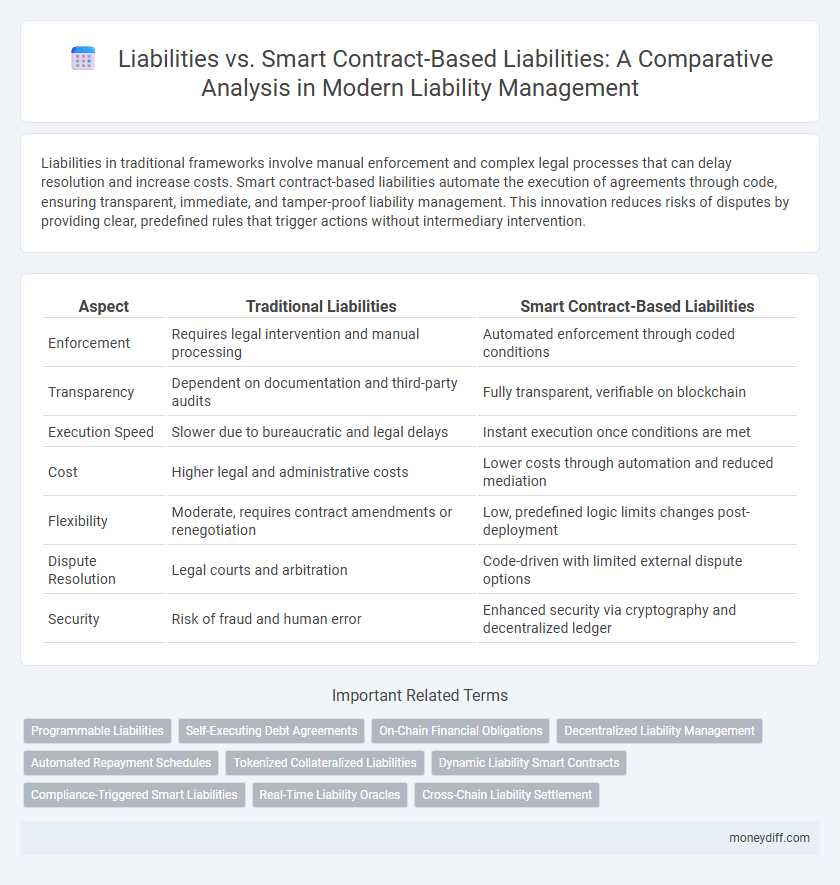

| Aspect | Traditional Liabilities | Smart Contract-Based Liabilities |

|---|---|---|

| Enforcement | Requires legal intervention and manual processing | Automated enforcement through coded conditions |

| Transparency | Dependent on documentation and third-party audits | Fully transparent, verifiable on blockchain |

| Execution Speed | Slower due to bureaucratic and legal delays | Instant execution once conditions are met |

| Cost | Higher legal and administrative costs | Lower costs through automation and reduced mediation |

| Flexibility | Moderate, requires contract amendments or renegotiation | Low, predefined logic limits changes post-deployment |

| Dispute Resolution | Legal courts and arbitration | Code-driven with limited external dispute options |

| Security | Risk of fraud and human error | Enhanced security via cryptography and decentralized ledger |

Understanding Traditional Liabilities in Money Management

Traditional liabilities in money management involve legally binding obligations where one party owes money or services to another, often formalized through contracts or promissory notes. These liabilities include loans, accounts payable, mortgages, and other debts recorded on financial statements, impacting cash flow and creditworthiness. Understanding the nature of these conventional obligations is essential for accurate financial planning, risk assessment, and regulatory compliance.

The Evolution: Introduction of Smart Contract-Based Liabilities

The evolution from traditional liabilities to smart contract-based liabilities marks a significant shift in legal enforcement and financial accountability, leveraging blockchain technology to automate and secure contractual obligations. Smart contract-based liabilities offer increased transparency, reduced reliance on intermediaries, and real-time execution, minimizing disputes and enhancing efficiency in liability management. This transformation is driving industries toward more reliable and immutable liability frameworks, reshaping risk mitigation and compliance strategies.

Key Differences Between Conventional and Smart Contract Liabilities

Conventional liabilities rely on traditional legal frameworks and manual enforcement, often resulting in longer resolution times and higher costs. Smart contract-based liabilities utilize automated, self-executing code on blockchain platforms to enforce terms instantly and transparently, reducing the risk of disputes and fraud. Key differences include real-time execution, immutable records, and decentralized trust mechanisms inherent to smart contract liabilities compared to centralized oversight in conventional liabilities.

Benefits of Smart Contract-Based Liabilities in Financial Operations

Smart contract-based liabilities offer enhanced transparency and automation in financial operations, reducing the risk of human error and fraud. These programmable liabilities execute terms automatically based on predefined conditions, ensuring timely settlements and improving auditability. The integration of blockchain technology strengthens security and compliance, making financial liabilities more efficient and reliable than traditional methods.

Legal Considerations: Smart Contracts vs Traditional Liabilities

Traditional liabilities rely on established legal frameworks and enforceability through courts, often involving complex claim validation processes and potential delays. Smart contract-based liabilities operate on blockchain protocols with automated execution, reducing intermediaries but raising concerns about jurisdiction, code interpretation, and limited legal precedent. Understanding the balance between enforceability, transparency, and adaptability is crucial for integrating smart contracts within existing liability regulations.

Risk Management: Assessing Liability in Automated Agreements

Liabilities in traditional contracts rely heavily on human interpretation and manual enforcement, which introduces higher risks of ambiguity and delayed recourse in dispute resolution. In contrast, smart contract-based liabilities automate enforcement through pre-defined, coded conditions on blockchain platforms, significantly reducing the risk of non-compliance and enhancing transparency. Risk management in automated agreements requires thorough assessment of code vulnerabilities and the accuracy of contract terms to prevent unintended liabilities and ensure robust legal accountability.

Transparency and Accountability with Smart Contract Liabilities

Smart contract-based liabilities enhance transparency by automating contract execution on a public blockchain, providing immutable records accessible to all parties involved. This technology enforces accountability through predefined conditions that trigger actions or penalties without human intervention, reducing disputes and increasing trust. Traditional liabilities often rely on manual verification and enforcement, which can lead to delays and opacity in the process.

Cost Efficiency: Reducing Administrative Burdens via Automation

Smart contract-based liabilities significantly reduce administrative burdens by automating contractual obligations and enforcement, resulting in lower operational costs compared to traditional liabilities. These blockchain-enabled contracts eliminate the need for intermediaries and manual processing, enhancing cost efficiency and accuracy in liability management. Automated execution and transparent record-keeping streamline liability settlements, minimizing disputes and associated legal expenses.

Challenges and Limitations of Smart Contract-Based Liabilities

Smart contract-based liabilities face significant challenges including code vulnerabilities, limited legal recognition, and inflexibility in handling unforeseen circumstances. The immutability of blockchain transactions complicates error correction and dispute resolution, while the lack of standardized regulations hinders enforceability across jurisdictions. These limitations restrict the widespread adoption of smart contracts for managing complex liability agreements.

Future Trends: The Role of Blockchain in Liability Management

Blockchain technology is revolutionizing liability management by enabling smart contract-based liabilities that offer automated enforcement, enhanced transparency, and immutable record-keeping. Traditional liabilities often suffer from delayed settlements and limited traceability, whereas blockchain provides real-time verification and decentralized auditing, reducing dispute risks. Future trends indicate widespread adoption of smart contracts in liability frameworks, driving efficiency and trust across legal and financial sectors.

Related Important Terms

Programmable Liabilities

Programmable liabilities in smart contracts automate enforcement and execution of obligations through code, reducing human error and enhancing transparency compared to traditional liabilities managed via legal agreements. These blockchain-based liabilities enable real-time monitoring, automatic penalty assessment, and seamless transfer of responsibilities, revolutionizing liability management with self-executing, tamper-proof contracts.

Self-Executing Debt Agreements

Self-executing debt agreements leverage smart contracts to automate liability enforcement, ensuring real-time compliance and reducing human error in debt settlements. Traditional liabilities rely on manual processes and legal intervention, whereas smart contract-based liabilities provide transparent, immutable records that accelerate dispute resolution and enhance trust among parties.

On-Chain Financial Obligations

On-chain financial obligations embedded in smart contracts enhance transparency and automating liability execution, reducing disputes and enforcement costs compared to traditional liabilities that rely on off-chain agreements and manual enforcement. Blockchain's immutable ledger ensures real-time verification and traceability of liabilities, fostering trust and efficiency in financial responsibility management.

Decentralized Liability Management

Liabilities in traditional finance involve centralized entities managing obligations and risk exposure, often resulting in limited transparency and delayed settlement. Smart contract-based liabilities leverage blockchain technology for decentralized liability management, ensuring automated execution, real-time transparency, and immutable records that reduce counterparty risk and increase efficiency.

Automated Repayment Schedules

Traditional liabilities typically involve manual tracking and enforcement of repayment schedules, leading to potential delays and errors. Smart contract-based liabilities automate repayment schedules through self-executing code on blockchain platforms, ensuring precise, timely payments and enhanced transparency.

Tokenized Collateralized Liabilities

Tokenized collateralized liabilities leverage blockchain technology to transform traditional financial obligations into secure, transparent smart contract-based liabilities, reducing counterparty risk through automated enforcement and real-time tracking. Unlike conventional liabilities, these digital assets enable fractional ownership, enhanced liquidity, and instant settlement, enhancing efficiency in collateral management and mitigating default risks.

Dynamic Liability Smart Contracts

Dynamic Liability Smart Contracts enable automated, real-time adjustments of obligations and risk allocations based on predefined conditions, reducing human errors and enhancing transparency in liability management. Unlike traditional liabilities, these smart contracts leverage blockchain technology to enforce agreements instantly and securely, facilitating dynamic compliance and dispute resolution.

Compliance-Triggered Smart Liabilities

Compliance-triggered smart liabilities automate enforcement of contractual obligations through blockchain-based smart contracts, reducing human error and increasing transparency compared to traditional liabilities. These smart liabilities ensure real-time compliance verification and self-execution of penalty clauses, streamlining dispute resolution and enhancing legal certainty in automated environments.

Real-Time Liability Oracles

Liabilities in traditional frameworks often lack real-time updates, causing delays in risk assessment and claim processing; smart contract-based liabilities utilize real-time liability oracles to automate verification and enforce obligations instantly, enhancing transparency and reducing disputes. Real-time liability oracles integrate external data feeds directly into blockchain ecosystems, enabling dynamic adjustment of liabilities based on live information such as market conditions, claim events, or regulatory changes, which optimizes accuracy and efficiency in liability management.

Cross-Chain Liability Settlement

Cross-chain liability settlement leverages blockchain interoperability to securely automate and verify liability obligations across multiple decentralized platforms, reducing traditional legal ambiguities and enforcement delays. Smart contract-based liabilities enforce precise terms without intermediaries, ensuring transparent, real-time execution and settlement compared to conventional liabilities that often rely on manual processes and cross-jurisdictional enforcement challenges.

Liabilities vs Smart Contract-Based Liabilities for liability. Infographic

moneydiff.com

moneydiff.com