Liabilities in traditional finance represent legally binding obligations to repay debts or fulfill financial commitments, often involving complex enforcement mechanisms. Smart contract debts, however, are self-executing agreements encoded on blockchain platforms that automate payments and settlements without intermediaries. Managing money through smart contract debts enhances transparency and reduces the risk of default by embedding trust directly into the code.

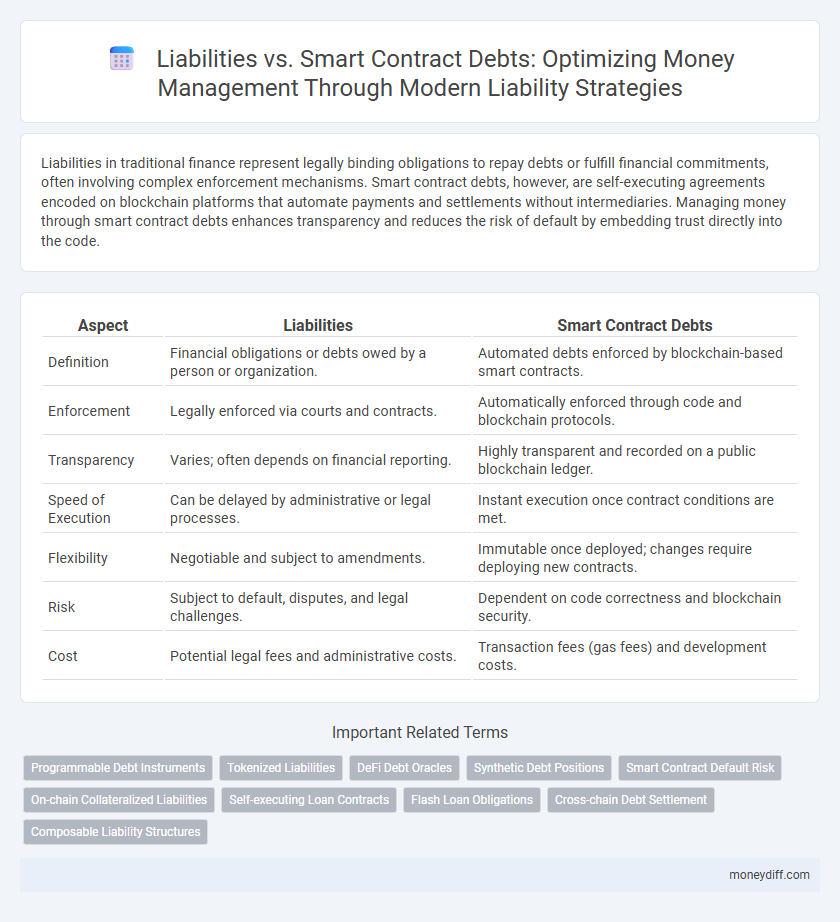

Table of Comparison

| Aspect | Liabilities | Smart Contract Debts |

|---|---|---|

| Definition | Financial obligations or debts owed by a person or organization. | Automated debts enforced by blockchain-based smart contracts. |

| Enforcement | Legally enforced via courts and contracts. | Automatically enforced through code and blockchain protocols. |

| Transparency | Varies; often depends on financial reporting. | Highly transparent and recorded on a public blockchain ledger. |

| Speed of Execution | Can be delayed by administrative or legal processes. | Instant execution once contract conditions are met. |

| Flexibility | Negotiable and subject to amendments. | Immutable once deployed; changes require deploying new contracts. |

| Risk | Subject to default, disputes, and legal challenges. | Dependent on code correctness and blockchain security. |

| Cost | Potential legal fees and administrative costs. | Transaction fees (gas fees) and development costs. |

Understanding Liabilities in Money Management

Liabilities in money management represent legal financial obligations or debts an individual or entity must settle, encompassing loans, accounts payable, and mortgages. Smart contract debts, automated obligations executed via blockchain technology, ensure transparent and enforceable repayment terms without intermediaries. Understanding traditional liabilities alongside smart contract debts enhances financial planning by integrating conventional credit responsibilities with decentralized, programmable debt instruments.

Defining Smart Contract Debts

Smart contract debts represent automated financial obligations encoded within blockchain protocols, triggering repayment based on predefined conditions without human intervention. Unlike traditional liabilities, these debts are transparent, programmable, and enforceable through code, reducing counterparty risk and enhancing transactional efficiency. Understanding smart contract debts is crucial for modern money management, as they shift liability frameworks from manual accounting entries to algorithm-driven liabilities on distributed ledgers.

Traditional Liabilities vs Blockchain Liabilities

Traditional liabilities consist of debts and obligations recorded on centralized ledgers managed by financial institutions, often involving delayed settlement and limited transparency. Blockchain liabilities, embodied as smart contract debts, operate on decentralized ledgers with automated, enforceable terms that enable instant settlement and immutable record-keeping. This shift enhances liquidity management by reducing counterparty risk and increasing transparency in money management systems.

Risk Assessment: Liabilities and Smart Contract Debts

Risk assessment of liabilities involves evaluating legal obligations and financial responsibilities that affect creditworthiness and cash flow stability. In contrast, smart contract debts require analyzing programmable obligations tied to blockchain protocols, emphasizing automated enforcement and potential vulnerabilities to code errors or hacks. Effective money management demands comparing traditional liability risks with technological risks inherent to smart contracts, ensuring optimized financial security and compliance.

Transparency and Accountability in Smart Contracts

Smart contract debts enhance transparency by automatically recording all transactions on a public ledger, reducing the risk of undisclosed liabilities in traditional money management. The immutable nature of blockchain ensures accountability, as every obligation and payment is traceable and verifiable by all parties involved. This real-time visibility into financial commitments helps prevent fraud and promotes trust in decentralized financial ecosystems.

Cost Efficiency: Conventional Debts vs Smart Contracts

Conventional debts often involve high administrative costs, interest fees, and slow processing times, which reduce overall cost efficiency in money management. Smart contract debts automate repayment schedules and enforce terms via blockchain, minimizing intermediaries and lowering transaction costs. This automation leads to faster settlements and greater transparency, enhancing cost efficiency compared to traditional liabilities.

Legal and Regulatory Implications

Liabilities in traditional finance represent legally enforceable obligations, subject to established regulatory frameworks ensuring debtor accountability and creditor protection. Smart contract debts operate on blockchain protocols, raising unique legal challenges due to code-based enforcement, jurisdictional ambiguity, and the lack of uniform regulatory oversight. Regulatory bodies are increasingly scrutinizing smart contracts to address compliance issues, fraud prevention, and dispute resolution mechanisms within decentralized finance ecosystems.

Security Concerns in Smart Contract Debts

Smart contract debts present unique security concerns compared to traditional liabilities, as vulnerabilities in the code can lead to unauthorized access or fund loss. Unlike conventional liabilities governed by legal frameworks, smart contract debts rely on automated execution, which can be exploited through bugs or hacking attacks. Rigorous auditing and robust code design are essential to mitigate risks inherent in decentralized finance platforms managing these debts.

Impact on Personal and Business Financial Planning

Liabilities represent traditional obligations requiring repayment, often linked to loans or accounts payable, which impact cash flow and creditworthiness in personal and business financial planning. Smart contract debts automate repayments based on predefined terms coded on blockchain, increasing transparency and reducing default risks but requiring technological literacy and reliable blockchain access. Incorporating both liabilities and smart contract debts into financial strategies demands balancing conventional credit management with emerging decentralized finance mechanisms to optimize cash management and risk mitigation.

Future Trends in Liability and Debt Management

Future trends in liability and debt management are increasingly influenced by the integration of smart contracts, which automate debt obligations and enable transparent tracking of liabilities on blockchain platforms. Traditional liabilities involve manual reconciliation and legal frameworks, whereas smart contract debts minimize human error and enforce terms automatically, enhancing efficiency and reducing default risks. Financial institutions are exploring hybrid models that combine conventional liability management with decentralized finance (DeFi) innovations to optimize risk assessment and capital allocation.

Related Important Terms

Programmable Debt Instruments

Liabilities in traditional finance represent owed obligations recorded on balance sheets, whereas smart contract debts are programmable debt instruments encoded on blockchain platforms, enabling automatic execution, monitoring, and enforcement of loan terms. Programmable debt instruments improve money management by providing transparency, reducing counterparty risk, and enabling automated interest calculations and repayments without intermediaries.

Tokenized Liabilities

Tokenized liabilities enhance money management by converting traditional debts into blockchain-based digital assets, enabling transparent tracking and automated settlement through smart contracts. Unlike conventional liabilities, tokenized debts reduce counterparty risk and increase liquidity by facilitating fractional ownership and real-time transferability.

DeFi Debt Oracles

Liabilities in traditional finance represent legal obligations for repayment, while smart contract debts in DeFi utilize decentralized protocols to automate and enforce borrowing conditions without intermediaries. DeFi debt oracles play a critical role by providing reliable real-time data on asset prices and borrower creditworthiness, ensuring accurate collateralization and minimizing the risk of defaults in decentralized lending platforms.

Synthetic Debt Positions

Synthetic debt positions in smart contracts enable programmable liabilities that automatically adjust based on market conditions, reducing traditional creditor risks and enhancing transparency in money management. Unlike conventional liabilities, these digital obligations are enforceable through blockchain protocols, ensuring immutable record-keeping and real-time tracking of debt positions.

Smart Contract Default Risk

Smart contract debts introduce unique liability risks due to their automated, code-based execution without intermediary oversight, increasing exposure to default risks from bugs or exploits. Unlike traditional liabilities, smart contract defaults can result in irrevocable asset losses, complicating recovery efforts and necessitating robust code audits and risk assessment frameworks.

On-chain Collateralized Liabilities

On-chain collateralized liabilities leverage blockchain technology to secure debts with digital assets, enhancing transparency and reducing default risk in decentralized finance. These liabilities contrast with traditional smart contract debts by enabling real-time collateral valuation and automated liquidation processes, optimizing money management and risk assessment on-chain.

Self-executing Loan Contracts

Self-executing loan contracts, a type of smart contract debt, automate repayment terms and reduce the risk of default by executing obligations without human intervention, distinguishing them from traditional liabilities that rely on manual enforcement. These contracts enhance money management clarity by providing transparent, immutable records of obligations and repayments, minimizing disputes and improving financial accountability.

Flash Loan Obligations

Flash loan obligations represent immediate, often high-risk liabilities within smart contract debts, requiring rapid repayment within a single transaction block to avoid liquidation or penalties. Unlike traditional liabilities, these obligations leverage decentralized finance protocols, increasing complexity and necessitating advanced risk management strategies to maintain financial stability.

Cross-chain Debt Settlement

Cross-chain debt settlement leverages blockchain interoperability to manage liabilities beyond traditional smart contract debts, enabling seamless repayment and restructuring across multiple decentralized finance (DeFi) platforms. This approach mitigates risks associated with isolated smart contract obligations by synchronizing liabilities on various chains, ensuring efficient cross-network debt reconciliation and enhanced liquidity management.

Composable Liability Structures

Composable liability structures enable the integration of traditional liabilities with smart contract debts, creating flexible and programmable debt frameworks that improve money management efficiency. These structures facilitate dynamic risk allocation and automated compliance, enhancing transparency and reducing counterparty risk in decentralized finance ecosystems.

Liabilities vs Smart Contract Debts for money management. Infographic

moneydiff.com

moneydiff.com