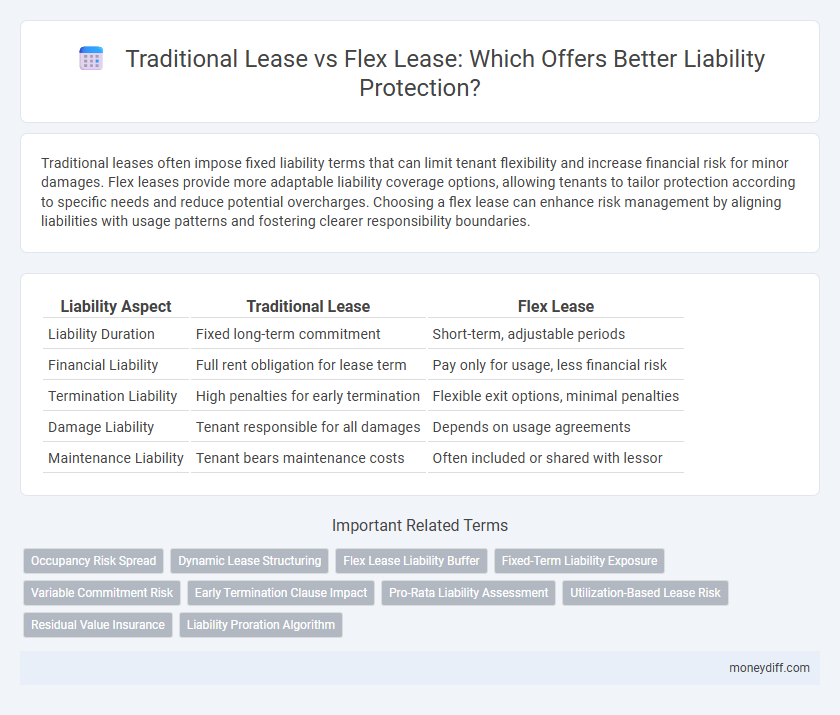

Traditional leases often impose fixed liability terms that can limit tenant flexibility and increase financial risk for minor damages. Flex leases provide more adaptable liability coverage options, allowing tenants to tailor protection according to specific needs and reduce potential overcharges. Choosing a flex lease can enhance risk management by aligning liabilities with usage patterns and fostering clearer responsibility boundaries.

Table of Comparison

| Liability Aspect | Traditional Lease | Flex Lease |

|---|---|---|

| Liability Duration | Fixed long-term commitment | Short-term, adjustable periods |

| Financial Liability | Full rent obligation for lease term | Pay only for usage, less financial risk |

| Termination Liability | High penalties for early termination | Flexible exit options, minimal penalties |

| Damage Liability | Tenant responsible for all damages | Depends on usage agreements |

| Maintenance Liability | Tenant bears maintenance costs | Often included or shared with lessor |

Understanding Liability in Traditional Leases

Traditional leases typically assign full liability for property maintenance and damages to the tenant throughout the lease term, creating fixed financial obligations regardless of usage. Landlords retain minimal responsibility beyond structural integrity, placing the burden of risk and repairs on tenants. This arrangement contrasts with flexible leases, which often distribute liability more dynamically based on actual occupancy or usage.

Flex Lease Liability: What’s Different?

Flex lease liability differs significantly from traditional lease liability by offering variable terms that adjust based on actual usage, reducing fixed financial commitments and associated risks. Unlike traditional leases with predetermined liabilities throughout the contract duration, flex leases allocate liabilities proportionally, providing greater financial flexibility and minimizing penalties for early termination. This adaptive liability structure mitigates long-term obligations and aligns costs more closely with operational needs.

Key Contractual Obligations for Lessees

Traditional leases impose long-term liability commitments on lessees, including fixed rent payments and maintenance responsibilities that persist for the entire lease term. Flex leases limit liability exposure by offering shorter lease durations and customizable terms, reducing financial risk and enabling lessees to adapt obligations based on changing operational needs. Key contractual obligations in traditional leases often include strict penalties for early termination, while flex leases provide lessees with more flexible exit clauses and adjustable rent structures to mitigate potential liabilities.

Risk Allocation: Traditional vs Flex Lease

Traditional leases typically place greater liability risk on tenants, requiring them to cover property damage, maintenance, and compliance costs, while landlords retain responsibility for structural issues. Flex leases distribute liability more evenly by incorporating shared responsibilities, often including built-in clauses that reduce tenant risk exposure through shorter terms and customizable coverage. This risk allocation difference significantly impacts financial and legal obligations, influencing tenant decision-making based on operational flexibility and liability tolerance.

Insurance Requirements and Coverage

Traditional leases often require tenants to carry comprehensive insurance with higher liability coverage limits, protecting landlords from potential claims. Flex leases may have more flexible insurance requirements, sometimes allowing tenants to opt for lower coverage thresholds tailored to short-term or variable occupancy. Landlords under traditional leases typically remain covered under the tenant's policy as an additional insured, whereas flex leases may require specific agreements to ensure adequate protection against liabilities.

Handling Property Damage and Accidents

Traditional leases often place full liability for property damage and accidents on the tenant, requiring renters to secure comprehensive insurance coverage and bear repair costs. Flex leases typically allocate liability more dynamically, with landlords sharing responsibility for certain damages and providing clearer protocols for accident handling. This approach in flex leases can reduce tenant risk exposure and streamline the resolution process for property-related incidents.

Legal Implications of Lease Violations

Traditional leases often impose strict liability on tenants for lease violations, potentially resulting in significant legal penalties, including eviction and damages claims. Flex leases provide more adaptable terms, potentially limiting tenant liability but requiring careful scrutiny of clauses to avoid unexpected obligations or reduced protections. Understanding the distinct legal implications in these lease types is crucial for managing risk and ensuring compliance.

Subletting and Third-Party Liability

Traditional leases often restrict subletting, limiting tenant flexibility and placing full liability on the original leaseholder for any damages or breaches caused by subtenants. Flex leases typically allow easier subletting arrangements, shifting some third-party liability risks from the primary tenant to the subtenant or landlord through clearly defined contractual terms. Understanding these distinctions is crucial for managing financial responsibility and minimizing potential legal exposure in lease agreements.

Termination Clauses and Liability Exposure

Traditional leases typically involve long-term commitments with stringent termination clauses, resulting in higher liability exposure for tenants due to ongoing rent obligations even after vacating the premises. Flex leases offer shorter terms and more flexible termination options, reducing liability exposure by allowing tenants to exit agreements with minimal penalties. Landlords benefit from flex leases by attracting tenants seeking lower risk, while tenants enjoy greater control over their financial liability.

Financial Consequences of Breach in Both Lease Types

Traditional leases typically impose substantial financial penalties for breach, including full rent liability for the lease term and potential legal fees, leading to significant long-term financial exposure. Flex leases offer more limited financial consequences, often capping liability to a shorter notice period or monthly rent payments, thus reducing overall risk. Understanding the specific breach clauses in each lease type is essential for accurately assessing potential financial obligations.

Related Important Terms

Occupancy Risk Spread

Traditional leases concentrate occupancy risk on a single tenant, increasing the landlord's exposure to vacancy and default liabilities. Flex leases distribute occupancy risk across multiple short-term tenants, reducing overall liability by minimizing prolonged vacancy and financial uncertainty.

Dynamic Lease Structuring

Dynamic lease structuring in traditional leases often results in fixed, long-term liabilities with limited flexibility to adjust payments based on usage or market changes, increasing financial risk. In contrast, flex leases offer scalable liability exposure by aligning lease obligations with actual occupancy or business performance, enabling more agile financial management and risk mitigation.

Flex Lease Liability Buffer

Flex Lease agreements include a Liability Buffer that offers tenants enhanced protection by capping their financial exposure to unforeseen damages or obligations, unlike Traditional Leases where liabilities are typically unlimited and directly tied to the tenant's full responsibility. This Liability Buffer in Flex Leases mitigates risk by providing a predefined maximum liability amount, making it a more attractive option for businesses seeking controlled and predictable lease-related liabilities.

Fixed-Term Liability Exposure

Traditional leases impose fixed-term liability exposure with tenant obligations consistently tied to the entire lease duration, creating predictable but potentially long-term financial commitment risks. Flex leases reduce fixed-term liability exposure by offering shorter, adjustable terms, minimizing long-tail obligations and providing greater flexibility to mitigate ongoing financial liability.

Variable Commitment Risk

Traditional leases often involve fixed long-term financial obligations, increasing the risk of variable commitment liability due to rigid payment structures. Flex leases mitigate this risk by offering adaptable terms and variable payment options, reducing the burden of unfixed liabilities tied to fluctuating usage or needs.

Early Termination Clause Impact

Traditional leases impose significant liability on tenants for early termination, often requiring full rent payments for the remaining lease term. Flex leases minimize early termination liability by offering more flexible exit options and reduced penalties, aligning with dynamic business needs and mitigating financial risk.

Pro-Rata Liability Assessment

Traditional leases often allocate liability based on a fixed lease term with clearly defined responsibilities, resulting in straightforward pro-rata liability assessments determined by the lease duration. Flex leases introduce variable lease periods and dynamic use terms, requiring more complex pro-rata liability calculations that adjust proportionally to the fluctuating occupancy and service usage.

Utilization-Based Lease Risk

Traditional leases pose higher liability risks due to fixed payment obligations regardless of asset utilization, leading to potential overpayment during low usage periods. Flex leases mitigate utilization-based lease risk by aligning payments with actual usage, enhancing financial flexibility and reducing exposure to underutilized assets.

Residual Value Insurance

Traditional leases typically require lessees to manage residual value risk directly, increasing potential liability exposure if asset depreciation exceeds projections. Flex leases often incorporate residual value insurance, transferring this risk to the insurer and reducing lessee liability while providing greater financial predictability.

Liability Proration Algorithm

Traditional leases typically assign liability based on fixed contract terms, often leading to straightforward but less flexible liability distribution, whereas flex leases utilize dynamic liability proration algorithms that allocate responsibility proportionally based on actual usage or occupancy periods, ensuring more precise and equitable liability management. The liability proration algorithm in flex leases calculates liability by evaluating time-weighted or usage-weighted factors, minimizing disputes and aligning financial obligations with real occupancy patterns.

Traditional Lease vs Flex Lease for liability. Infographic

moneydiff.com

moneydiff.com