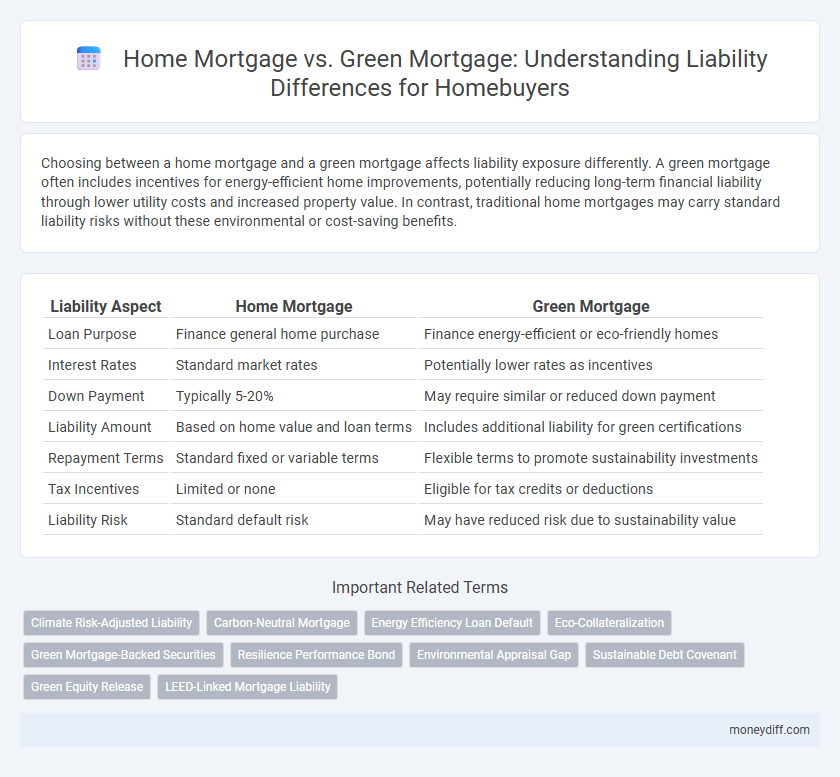

Choosing between a home mortgage and a green mortgage affects liability exposure differently. A green mortgage often includes incentives for energy-efficient home improvements, potentially reducing long-term financial liability through lower utility costs and increased property value. In contrast, traditional home mortgages may carry standard liability risks without these environmental or cost-saving benefits.

Table of Comparison

| Liability Aspect | Home Mortgage | Green Mortgage |

|---|---|---|

| Loan Purpose | Finance general home purchase | Finance energy-efficient or eco-friendly homes |

| Interest Rates | Standard market rates | Potentially lower rates as incentives |

| Down Payment | Typically 5-20% | May require similar or reduced down payment |

| Liability Amount | Based on home value and loan terms | Includes additional liability for green certifications |

| Repayment Terms | Standard fixed or variable terms | Flexible terms to promote sustainability investments |

| Tax Incentives | Limited or none | Eligible for tax credits or deductions |

| Liability Risk | Standard default risk | May have reduced risk due to sustainability value |

Understanding Home Mortgage Liability

Home mortgage liability refers to the financial obligation a borrower assumes when securing a loan to purchase a property, typically involving fixed monthly payments and interest over the loan term. Green mortgage liability carries similar obligations but incorporates additional terms linked to energy-efficient improvements or sustainable property features, potentially affecting loan conditions and repayment aspects. Understanding the nuances of home mortgage liability ensures borrowers accurately assess risks and benefits, especially when considering specialized loans like green mortgages.

What is a Green Mortgage?

A green mortgage is a specialized home loan designed to finance energy-efficient or environmentally friendly property improvements, reducing overall liability by lowering utility costs and increasing property value. Unlike traditional home mortgages, green mortgages often feature lower interest rates or incentives to encourage sustainable upgrades that mitigate financial risk related to energy consumption. These loans help homeowners manage long-term liabilities by promoting eco-friendly practices that decrease maintenance and operational expenses.

Comparing Liability: Traditional vs Green Mortgages

Traditional home mortgages typically involve standard liability terms based on the borrower's creditworthiness and property value, with less emphasis on environmental factors. Green mortgages, however, incorporate liability considerations linked to energy efficiency improvements and sustainable property upgrades, potentially reducing financial risk through lower utility costs and government incentives. Comparing liability, green mortgages may offer benefits such as lower default rates and risk mitigation tied to the property's enhanced sustainability features.

Environmental Impact and Financial Risk

Home mortgages typically carry standard financial liabilities without incentives for environmental considerations, while green mortgages often include terms that reduce financial risk through lower interest rates or government-backed subsidies tied to energy-efficient property improvements. Environmental impact plays a crucial role in green mortgages by promoting sustainable building practices that can decrease long-term liabilities related to energy costs and regulatory compliance. Lenders offering green mortgages mitigate liability risks by encouraging borrowers to invest in environmentally friendly properties, which can maintain or increase asset value in a market increasingly focused on sustainability.

Interest Rates and Liability Implications

Home mortgages typically feature fixed or variable interest rates that directly influence the borrower's long-term financial liability, often resulting in higher overall interest costs compared to green mortgages. Green mortgages offer lower interest rates or incentives tied to energy-efficient property improvements, reducing the total liability burden by decreasing monthly payments and enhancing property value. Choosing a green mortgage can mitigate liability risks through government-backed subsidies and decreased utility expenses, promoting sustainable financial planning.

Loan Qualification and Credit Requirements

Home mortgage loan qualification typically involves evaluating credit scores above 620, stable income verification, and a debt-to-income ratio under 43%, ensuring manageable liability risk for lenders. In contrast, green mortgages often require similar credit criteria but may also mandate proof of energy-efficient property improvements or certifications, which can affect loan approval and terms. Borrowers with strong credit profiles may benefit from lower interest rates and reduced liabilities on green mortgages due to incentives promoting sustainable housing.

Long-term Cost Analysis: Green vs Standard Mortgages

Green mortgages often offer lower interest rates and tax incentives that reduce long-term liabilities compared to standard home mortgages, which typically lack eco-friendly benefits. Over a 30-year period, the energy savings and government rebates associated with green mortgages can offset higher initial costs and decrease overall financial exposure. Standard mortgages may result in higher total costs due to missed opportunities for efficiency upgrades and potential future regulations on energy consumption.

Government Incentives and Liability Reduction

Green mortgages often come with government incentives such as tax credits or reduced interest rates, directly lowering borrower liability by decreasing overall loan costs. These incentives encourage energy-efficient home improvements, which can reduce future expenses and liabilities related to utility bills and potential regulatory penalties. Compared to traditional home mortgages, green mortgages provide a financial advantage by lessening liability through both government-backed benefits and long-term cost savings.

Resale Value and Future Financial Liability

Home mortgages typically carry standard liability risks tied to property market fluctuations, impacting resale value and potential financial obligations. Green mortgages often offer lower interest rates and incentives, reducing long-term financial liability while enhancing resale value through energy-efficient property appeal. Choosing a green mortgage can mitigate future financial risks by boosting home demand and lowering ownership costs.

Choosing the Right Mortgage for Your Liability Profile

Selecting the appropriate mortgage aligns closely with your liability profile, where a home mortgage typically offers fixed liability obligations, providing predictable monthly payments and stable interest rates. Green mortgages often include lower interest rates or incentives tied to energy-efficient properties, which can reduce long-term liabilities through cost savings on utilities and potential tax benefits. Evaluating factors such as your risk tolerance, financial stability, and environmental goals ensures your mortgage choice effectively manages your liability exposure.

Related Important Terms

Climate Risk-Adjusted Liability

Climate risk-adjusted liability incorporates environmental factors into the assessment of home mortgage risks, reflecting potential financial impacts from climate change-related events such as flooding or wildfires. Green mortgages, designed for energy-efficient homes, typically lower liability exposure by incentivizing sustainable property improvements that reduce climate-related damage and enhance long-term asset resilience.

Carbon-Neutral Mortgage

Carbon-neutral mortgages reduce liability by financing energy-efficient home improvements that lower carbon emissions and potential future carbon taxes, unlike traditional home mortgages that do not account for environmental impact. Lenders offer green mortgages with preferential rates or incentives, minimizing financial risk linked to climate regulations and supporting sustainable property values.

Energy Efficiency Loan Default

Home mortgages typically carry higher default risks due to traditional lending criteria, whereas green mortgages offer reduced liability exposure by incentivizing energy efficiency improvements that lower borrower default rates. Energy efficiency loans under green mortgages enhance property value and reduce utility expenses, thereby mitigating financial risk and decreasing the likelihood of loan default.

Eco-Collateralization

Green mortgages leverage eco-collateralization by using energy-efficient home upgrades as part of the collateral, potentially reducing liability risk through enhanced property value tied to sustainability features. In contrast, traditional home mortgages rely solely on market value without accounting for the environmental impact or energy savings, limiting liability protection linked to modern green improvements.

Green Mortgage-Backed Securities

Green mortgage-backed securities (Green MBS) represent a growing segment in the liability landscape by bundling environmentally sustainable home mortgages, which can attract investors seeking ESG-compliant assets with potential regulatory incentives. These securities offer potentially lower risk profiles and financial benefits linked to the energy efficiency and sustainability features of the underlying properties, distinguishing them from traditional home mortgage-backed liabilities.

Resilience Performance Bond

Home mortgages typically involve standard liability risks managed through traditional insurance and escrow accounts, whereas green mortgages incorporate resilience performance bonds that specifically address environmental risks and long-term sustainability liabilities. These bonds enhance borrower accountability by ensuring funds are available for mitigating damages from climate-related events, thereby reducing lender exposure to liability from property degradation or non-compliance with green regulations.

Environmental Appraisal Gap

Home mortgage liabilities generally do not account for environmental factors, whereas green mortgages incorporate the Environmental Appraisal Gap by adjusting property valuations based on energy efficiency and sustainability metrics. Addressing this gap reduces financial risk exposure for lenders and homeowners by promoting investments in environmentally friendly properties with potentially higher long-term value.

Sustainable Debt Covenant

Green mortgages incorporate sustainable debt covenants that incentivize borrowers to maintain energy-efficient property standards, reducing long-term environmental liability compared to traditional home mortgages. These covenants often include clauses for regular energy performance monitoring and penalties for non-compliance, aligning financial liability with sustainability goals.

Green Equity Release

Green equity release options reduce long-term liability by leveraging the increased property value resulting from energy-efficient home improvements, unlike traditional home mortgages that do not account for environmental upgrades. This approach lowers financial risk and potential debt burdens by integrating sustainable asset appreciation into the mortgage framework.

LEED-Linked Mortgage Liability

LEED-linked mortgage liability ties the borrower's repayment terms to achieving specific environmental standards, potentially affecting default risk and financial obligations differently than traditional home mortgage liability. Green mortgages can lower liability by incentivizing sustainable upgrades, reducing energy costs, and aligning with regulatory benefits, while traditional home mortgages lack these environmentally linked risk mitigations.

Home Mortgage vs Green Mortgage for Liability Infographic

moneydiff.com

moneydiff.com