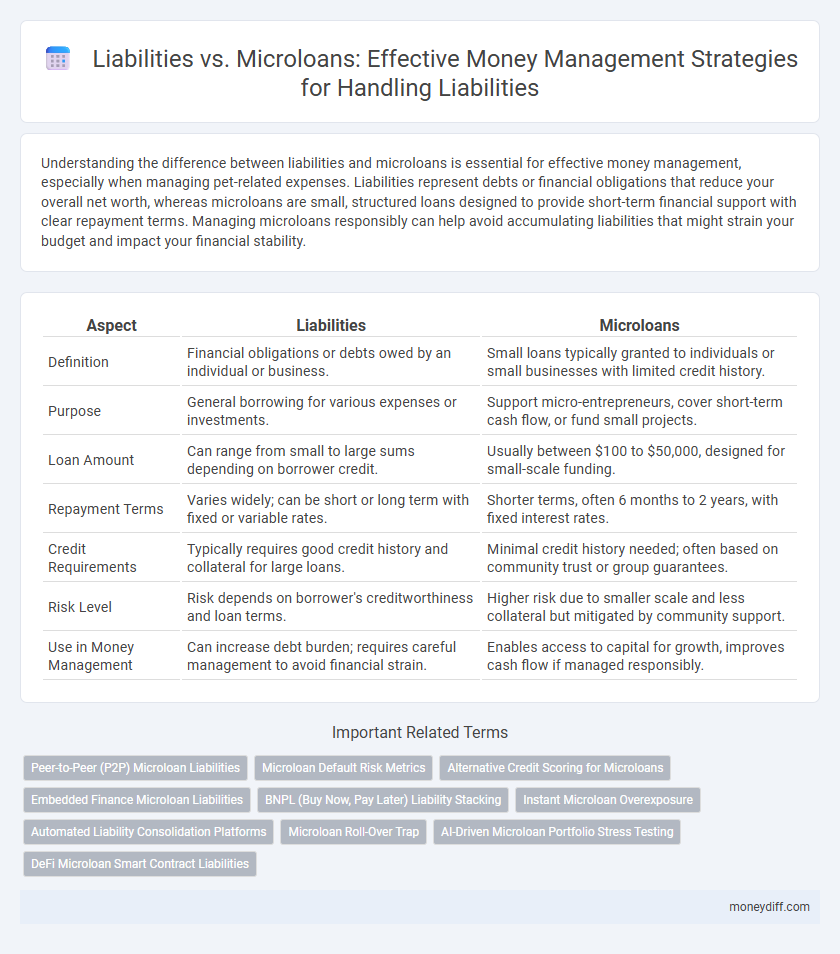

Understanding the difference between liabilities and microloans is essential for effective money management, especially when managing pet-related expenses. Liabilities represent debts or financial obligations that reduce your overall net worth, whereas microloans are small, structured loans designed to provide short-term financial support with clear repayment terms. Managing microloans responsibly can help avoid accumulating liabilities that might strain your budget and impact your financial stability.

Table of Comparison

| Aspect | Liabilities | Microloans |

|---|---|---|

| Definition | Financial obligations or debts owed by an individual or business. | Small loans typically granted to individuals or small businesses with limited credit history. |

| Purpose | General borrowing for various expenses or investments. | Support micro-entrepreneurs, cover short-term cash flow, or fund small projects. |

| Loan Amount | Can range from small to large sums depending on borrower credit. | Usually between $100 to $50,000, designed for small-scale funding. |

| Repayment Terms | Varies widely; can be short or long term with fixed or variable rates. | Shorter terms, often 6 months to 2 years, with fixed interest rates. |

| Credit Requirements | Typically requires good credit history and collateral for large loans. | Minimal credit history needed; often based on community trust or group guarantees. |

| Risk Level | Risk depends on borrower's creditworthiness and loan terms. | Higher risk due to smaller scale and less collateral but mitigated by community support. |

| Use in Money Management | Can increase debt burden; requires careful management to avoid financial strain. | Enables access to capital for growth, improves cash flow if managed responsibly. |

Understanding Liabilities: Key Concepts in Money Management

Liabilities represent financial obligations that require future repayment, impacting an individual's net worth and cash flow. Understanding the nature and terms of liabilities, such as interest rates and repayment schedules, is crucial for effective money management and avoiding debt traps. Comparing liabilities with microloans highlights differences in borrowing costs and accessibility, guiding informed financial decisions.

What Are Microloans? An Overview

Microloans are small, short-term loans designed to support entrepreneurs and individuals with limited access to traditional financing, often used for starting or expanding a small business. Unlike liabilities that represent financial obligations impacting an individual's or company's overall debt profile, microloans carry specific benefits such as lower interest rates and flexible repayment terms tailored for micro-entrepreneurs. These loans play a crucial role in financial inclusion by enabling capital access for underserved communities while managing debt responsibly to avoid excessive liability accumulation.

Comparing Liabilities and Microloans: Fundamental Differences

Liabilities represent financial obligations or debts owed by an individual or business, often encompassing loans, credit card balances, and other forms of borrowed money that require repayment with interest. Microloans are a specific type of liability, typically small-scale loans designed to support entrepreneurs or low-income borrowers, often featuring lower interest rates and flexible repayment terms. Understanding the fundamental differences between general liabilities and microloans is crucial for effective money management, as microloans offer targeted financial solutions with distinct benefits compared to broader liability categories.

Financial Risks: Liabilities vs Microloans

Financial risks associated with liabilities include potential default, increased debt burden, and impaired creditworthiness, which can escalate long-term financial instability. Microloans, while smaller in amount, carry risks such as higher interest rates and shorter repayment terms, potentially leading to cash flow challenges for borrowers. Effective money management requires assessing the risk profile of both liabilities and microloans to avoid excessive debt and ensure sustainable financial health.

Impact on Cash Flow: Microloans Compared to Traditional Liabilities

Microloans typically offer smaller principal amounts with shorter repayment terms, resulting in more manageable monthly payments that positively influence cash flow compared to traditional liabilities. Traditional liabilities, such as bank loans or credit lines, often involve larger sums and longer terms, which may strain cash flow due to higher fixed payments and interest obligations. Businesses leveraging microloans can maintain greater liquidity and financial flexibility, reducing the risk of cash flow shortages during critical periods.

Credit Scores: The Role of Liabilities and Microloans

Liabilities directly impact credit scores by influencing debt-to-income ratios and payment histories, which lenders use to assess creditworthiness. Microloans, often smaller and easier to obtain, can help build credit when repaid on time, demonstrating responsible money management. Understanding the balance between managing liabilities and leveraging microloans is crucial for maintaining a healthy credit profile and improving financial opportunities.

Long-term Financial Planning: Weighing Liabilities Against Microloans

Long-term financial planning requires careful distinction between liabilities and microloans, as liabilities typically represent ongoing financial obligations that can strain cash flow, while microloans offer targeted, often short-term funding solutions with flexible repayment terms. Effective money management involves assessing the interest rates, repayment schedules, and overall impact on credit health when balancing existing liabilities against potential microloan opportunities. Prioritizing microloans can support entrepreneurial growth without exacerbating long-term debt burdens, but integrating them into a comprehensive financial strategy is crucial for sustainable financial stability.

Managing Debt: Strategies with Liabilities and Microloans

Managing debt effectively requires understanding the differences between liabilities and microloans, where liabilities encompass all financial obligations while microloans are small, targeted loans often designed for specific short-term needs. Prioritizing high-interest liabilities for repayment reduces overall debt burden, whereas strategically using microloans can improve cash flow and support essential expenses without creating long-term financial strain. Employing budgeting techniques alongside careful evaluation of microloan terms ensures balanced debt management and minimizes the risk of escalating liabilities.

Small Business Financing: Microloans vs Traditional Liabilities

Small businesses often weigh microloans against traditional liabilities when managing financing options, as microloans typically offer lower borrowing amounts with flexible repayment terms tailored for startups and small enterprises. Traditional liabilities, such as bank loans or lines of credit, usually involve higher collateral requirements and longer approval processes but provide larger funding sums essential for significant capital investments. Choosing between these financing methods depends on the business's size, creditworthiness, and immediate financial needs, impacting cash flow management and long-term liabilities on the balance sheet.

Choosing Wisely: When to Use Microloans Over Liabilities

Choosing microloans over traditional liabilities can optimize cash flow management by offering smaller, short-term funding with typically lower interest rates and faster approval processes. Microloans are ideal for bridging temporary financial gaps or funding small projects without the long-term commitment and higher risk associated with larger liabilities like bank loans or credit lines. Assessing repayment capacity and urgency ensures microloans are used wisely, avoiding excessive debt accumulation and maintaining financial stability.

Related Important Terms

Peer-to-Peer (P2P) Microloan Liabilities

Peer-to-peer (P2P) microloan liabilities represent a unique financial obligation where borrowers incur debt directly from individual lenders, differing from traditional liabilities by enabling flexible repayment terms and potentially lower interest rates. Managing P2P microloan liabilities requires careful assessment of cash flow and credit risk to avoid default, distinguishing them from conventional liabilities that often involve institutional creditors and standardized conditions.

Microloan Default Risk Metrics

Microloan default risk metrics provide crucial data for assessing liabilities by measuring the probability and impact of borrower non-repayment within short-term lending frameworks. Analyzing default rates, borrower credit scores, and loan-to-value ratios enhances financial institutions' ability to manage liabilities effectively and mitigate risks associated with microloan portfolios.

Alternative Credit Scoring for Microloans

Liabilities represent financial obligations that must be repaid, whereas microloans leverage alternative credit scoring models such as behavioral data, social media activity, and transaction histories to assess borrower creditworthiness beyond traditional credit scores. This innovative approach in microloans enhances risk management and expands financial inclusion by providing access to credit for individuals lacking formal credit records.

Embedded Finance Microloan Liabilities

Embedded finance microloan liabilities represent a unique financial obligation arising from integrating lending services directly within non-financial platforms, enabling seamless access to credit while increasing complexity in liability management. These liabilities often carry higher risks due to instant credit issuance and require sophisticated tracking systems to manage repayment schedules and default probabilities effectively.

BNPL (Buy Now, Pay Later) Liability Stacking

Liabilities from BNPL (Buy Now, Pay Later) services contribute to liability stacking by accumulating short-term debts that compound financial risk, unlike microloans which often offer structured repayment plans and credit-building benefits. Managing BNPL liabilities requires careful tracking of deferred payments to prevent overdraft fees and credit score damage, emphasizing disciplined budgeting over impulsive purchases.

Instant Microloan Overexposure

Instant microloan overexposure increases liabilities by accumulating high-interest debt rapidly, leading to cash flow challenges and potential default risks. Effective money management requires balancing microloan usage with liability monitoring to prevent financial strain and maintain credit health.

Automated Liability Consolidation Platforms

Automated liability consolidation platforms streamline debt management by integrating multiple liabilities into a single microloan, often reducing interest rates and simplifying repayment schedules. These platforms use advanced algorithms to analyze spending patterns and optimize debt consolidation, enhancing financial stability and minimizing the risk of accumulating high-interest liabilities.

Microloan Roll-Over Trap

Microloan roll-over traps create a cycle of debt by requiring borrowers to continuously renew loans with high fees and interest, significantly increasing total repayment amounts and exacerbating financial liabilities. Unlike traditional liabilities, these recurring microloan obligations can spiral rapidly, undermining effective money management and long-term financial stability.

AI-Driven Microloan Portfolio Stress Testing

AI-driven microloan portfolio stress testing enhances risk assessment by simulating various economic scenarios to identify potential liabilities and mitigate default risks. Integrating machine learning algorithms with financial data enables more accurate prediction of borrower behavior, optimizing money management strategies for microloan portfolios.

DeFi Microloan Smart Contract Liabilities

DeFi microloan smart contract liabilities represent on-chain obligations encoded to ensure automated repayment and risk mitigation without traditional intermediaries. These liabilities reduce counterparty risk and increase transparency by enforcing loan terms through decentralized protocols and cryptographic guarantees.

Liabilities vs Microloans for money management. Infographic

moneydiff.com

moneydiff.com