Conventional debt imposes fixed financial obligations on borrowers, creating predictable liabilities but limited flexibility in repayment. Social Impact Bonds (SIBs) link repayment to social outcomes, transferring some liability risk to investors and incentivizing impact-driven performance. Choosing between conventional debt and SIBs depends on balancing financial certainty against mission-oriented accountability in liability management.

Table of Comparison

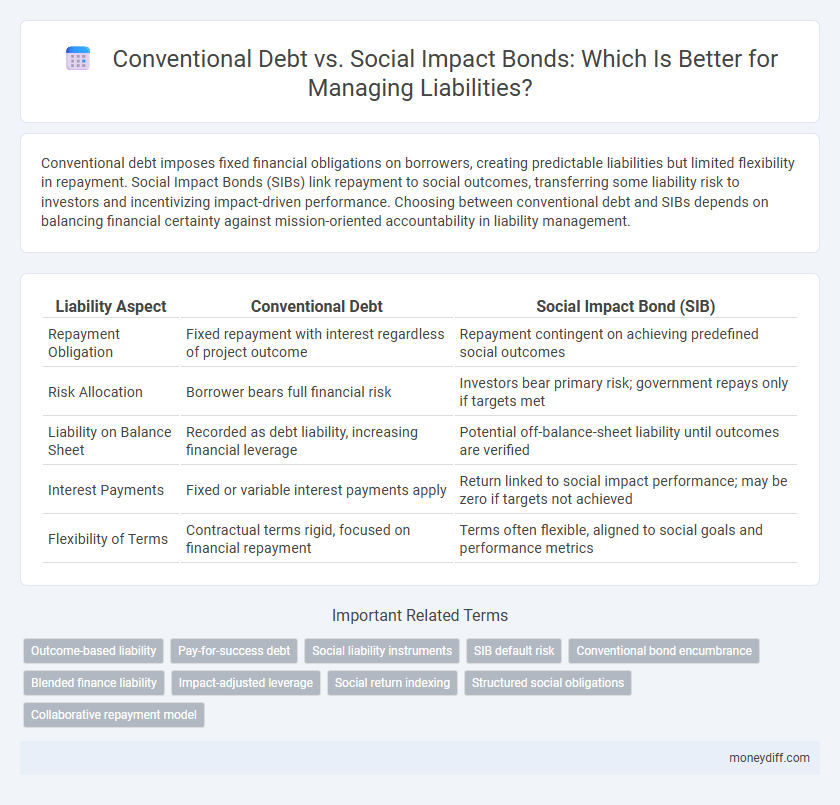

| Liability Aspect | Conventional Debt | Social Impact Bond (SIB) |

|---|---|---|

| Repayment Obligation | Fixed repayment with interest regardless of project outcome | Repayment contingent on achieving predefined social outcomes |

| Risk Allocation | Borrower bears full financial risk | Investors bear primary risk; government repays only if targets met |

| Liability on Balance Sheet | Recorded as debt liability, increasing financial leverage | Potential off-balance-sheet liability until outcomes are verified |

| Interest Payments | Fixed or variable interest payments apply | Return linked to social impact performance; may be zero if targets not achieved |

| Flexibility of Terms | Contractual terms rigid, focused on financial repayment | Terms often flexible, aligned to social goals and performance metrics |

Understanding Conventional Debt in Liability Management

Conventional debt in liability management involves borrowing funds with fixed repayment schedules and predetermined interest rates, representing a clear financial obligation on the balance sheet. This type of liability requires timely servicing to avoid default risks, impacting a company's credit rating and financial stability. Unlike Social Impact Bonds, conventional debt does not link repayments to social outcomes, focusing solely on fiscal accountability and risk management.

An Overview of Social Impact Bonds (SIBs)

Social Impact Bonds (SIBs) represent a results-based financing mechanism where private investors fund social programs and are repaid by the government only if predefined outcomes are achieved, contrasting conventional debt that requires fixed repayments regardless of success. Unlike traditional loans, SIBs transfer performance risk from public entities to investors, aligning financial returns with social impact. This innovative liability structure promotes accountability and efficient resource allocation in addressing complex social challenges.

Key Differences Between Conventional Debt and Social Impact Bonds

Conventional debt involves a fixed repayment schedule with interest, creating a predictable financial liability for the borrower. Social impact bonds (SIBs) transfer financial risk to investors who are repaid only if predefined social outcomes are met, linking liability to performance rather than a fixed obligation. Unlike conventional debt, SIBs align financial incentives with social objectives, reducing direct fiscal responsibility for governments or organizations until success is demonstrated.

Financial Structure: Conventional Debt vs Social Impact Bonds

Conventional debt involves fixed interest payments and principal repayment obligations creating direct financial liabilities on a balance sheet, with predictable cash flow requirements. Social Impact Bonds (SIBs) structure financial risk by linking returns to the achievement of predefined social outcomes, transferring some performance risk to private investors rather than creating traditional liabilities. The SIB financial model often results in contingent liabilities contingent on outcome success, contrasting with the guaranteed repayment structure of conventional debt instruments.

Risk Allocation in Liability Management

Conventional debt assigns financial liability solely to the borrower, exposing them to fixed repayment risks regardless of project outcomes. Social Impact Bonds (SIBs) distribute liability between investors and service providers, transferring repayment risk to investors based on achievement of predefined social outcomes. This risk allocation in SIBs aligns incentives and mitigates borrower exposure, promoting more effective liability management through performance-based accountability.

Measuring Success: Financial Returns vs Social Outcomes

Conventional debt prioritizes financial returns by measuring success through fixed interest payments and principal repayment schedules, emphasizing quantifiable monetary performance. Social Impact Bonds (SIBs) assess success based on achieving predefined social outcomes, linking investor returns directly to the effectiveness of social interventions rather than traditional financial metrics. This outcome-driven model shifts liability evaluation from conventional debt's financial obligations to performance-based social impact metrics, aligning investor risk with societal benefits.

Cost Implications: Interest Rates and Pay-for-Success Models

Conventional debt typically involves fixed or variable interest rates, resulting in predictable but sometimes higher cost liabilities, especially when market rates rise. Social Impact Bonds (SIBs) employ pay-for-success models where repayment, including returns, depends on achieving predefined social outcomes, potentially reducing financial risk and aligning costs with performance. The cost implication of SIBs is often lower upfront expenditure and incentivized outcomes, contrasting with the guaranteed interest payments of conventional debt.

Regulatory Considerations for Debt Instruments

Regulatory considerations for conventional debt focus on compliance with securities laws, disclosure requirements, and creditor protection regulations that ensure transparency and creditor priority in case of default. Social impact bonds (SIBs) face additional scrutiny related to social outcome measurement, alignment with public sector goals, and regulatory frameworks governing public-private partnerships and performance-based contracting. Both instruments must navigate jurisdiction-specific rules, but SIBs require more robust impact reporting and stakeholder engagement to satisfy regulatory oversight tied to social objectives.

Suitability for Organizations: When to Choose Conventional Debt or SIBs

Conventional debt suits organizations with predictable cash flows and a strong ability to meet fixed repayment schedules, making it ideal for established entities seeking straightforward liability management. Social Impact Bonds (SIBs) are preferable for organizations aiming to fund social programs with uncertain outcomes, as repayment depends on achieving specific social performance targets, thus shifting financial risk from the organization to investors. Choosing between conventional debt and SIBs hinges on organizational capacity for risk management, cash flow stability, and the strategic priority of social impact versus financial certainty.

Future Trends: The Evolving Role of SIBs in Liability Management

Social Impact Bonds (SIBs) are increasingly integrated into liability management strategies, offering performance-based financing that aligns social outcomes with financial returns. Unlike conventional debt, SIBs reduce default risk by tying repayment to measurable social impact metrics, making them attractive for public sector liabilities. Future trends indicate growing adoption of SIBs as governments and investors seek sustainable, outcome-driven alternatives to traditional borrowing.

Related Important Terms

Outcome-based liability

Conventional debt imposes fixed repayment obligations regardless of project success, creating a rigid liability structure, whereas Social Impact Bonds (SIBs) align liability with outcome-based performance, transferring risk to investors who are repaid only if predefined social outcomes are achieved. This outcome-driven liability model incentivizes effective service delivery and reduces financial risk for public entities by linking repayment to measurable social impact.

Pay-for-success debt

Conventional debt imposes fixed repayment obligations regardless of outcomes, increasing financial risk for issuers, whereas Social Impact Bonds (SIBs) use a pay-for-success model where investors are repaid only if targeted social outcomes are achieved, aligning liability with performance. This contingent liability structure reduces upfront fiscal burden and incentivizes efficient resource allocation within public sector programs targeting measurable social impact.

Social liability instruments

Social Impact Bonds (SIBs) represent innovative social liability instruments that shift financial risk from governments to private investors, aligning repayment with measurable social outcomes such as reduced recidivism or improved public health. Unlike conventional debt, which requires fixed repayment regardless of impact, SIBs incentivize efficiency and accountability by tying liabilities to the success of social programs, thereby optimizing public sector resource allocation and fostering sustainable community investments.

SIB default risk

Conventional debt carries fixed repayment obligations regardless of project outcomes, increasing default risk in volatile markets, whereas Social Impact Bonds (SIBs) transfer repayment risk to investors contingent on achieving predefined social outcomes, thereby reducing direct liability for issuers but exposing investors to performance risk. The default risk in SIBs is tied to the success metrics of social programs, making their liability contingent and often less predictable compared to traditional debt instruments.

Conventional bond encumbrance

Conventional debt creates a fixed financial liability requiring regular interest payments and principal repayment, which can encumber future cash flows and increase the risk of insolvency. Social Impact Bonds, by contrast, shift repayment obligations to performance-based outcomes, reducing immediate financial encumbrance and aligning liabilities with social impact metrics.

Blended finance liability

Conventional debt typically imposes fixed financial liabilities on borrowers, while Social Impact Bonds (SIBs) introduce performance-based liabilities that align investor returns with social outcomes, creating a risk-sharing mechanism in blended finance structures. Blended finance liability management leverages SIBs to reduce public sector risk exposure by combining concessional capital with private investment, optimizing capital efficiency and accountability in financing social programs.

Impact-adjusted leverage

Conventional debt imposes fixed repayment obligations that limit impact-adjusted leverage by prioritizing financial returns over social outcomes, whereas Social Impact Bonds allocate risk and returns based on measurable social impact, enhancing liability management through outcome-based performance metrics. Impact-adjusted leverage in Social Impact Bonds aligns creditor incentives with social objectives, enabling flexible liability structures that can attract investment while addressing social challenges more effectively.

Social return indexing

Social Impact Bonds reduce liability risk by linking repayments to social return indexing, ensuring payments reflect measured community outcomes and improving accountability. Conventional debt imposes fixed financial obligations regardless of social performance, increasing fiscal liability without incentivizing impact-driven results.

Structured social obligations

Structured social obligations like Social Impact Bonds (SIBs) differ from conventional debt by linking repayment to the achievement of specific social outcomes, reducing financial risk for issuers while attracting impact-focused investors. Conventional debt entails fixed repayments regardless of results, increasing liability exposure, whereas SIBs align financial returns with measurable social impact, optimizing capital deployment for sustainable development goals.

Collaborative repayment model

Conventional debt involves fixed repayments with interest, creating direct financial liabilities for borrowers, whereas Social Impact Bonds employ a collaborative repayment model that ties investor returns to the achievement of social outcomes, reducing upfront risk for service providers. This outcome-based structure shifts financial liability from the public sector to private investors, aligning incentives for effective project delivery and shared accountability.

Conventional Debt vs Social Impact Bond for liability. Infographic

moneydiff.com

moneydiff.com