Overdraft fees can quickly accumulate and create significant liability for pet owners when unexpected expenses arise, whereas early wage access offers a more manageable way to cover emergency pet costs without incurring high charges. Overdrafts often result in penalties that worsen financial strain, while early wage access provides timely funds to prevent further debt. Choosing early wage access reduces liability by avoiding costly overdraft fees and ensuring sufficient cash flow for pet-related emergencies.

Table of Comparison

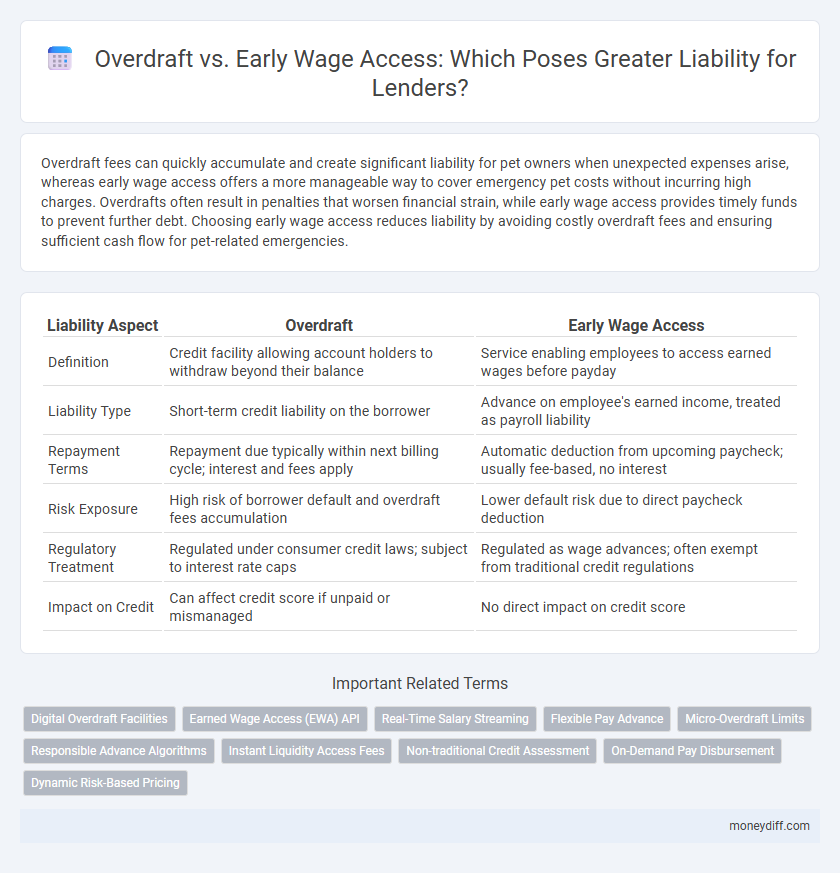

| Liability Aspect | Overdraft | Early Wage Access |

|---|---|---|

| Definition | Credit facility allowing account holders to withdraw beyond their balance | Service enabling employees to access earned wages before payday |

| Liability Type | Short-term credit liability on the borrower | Advance on employee's earned income, treated as payroll liability |

| Repayment Terms | Repayment due typically within next billing cycle; interest and fees apply | Automatic deduction from upcoming paycheck; usually fee-based, no interest |

| Risk Exposure | High risk of borrower default and overdraft fees accumulation | Lower default risk due to direct paycheck deduction |

| Regulatory Treatment | Regulated under consumer credit laws; subject to interest rate caps | Regulated as wage advances; often exempt from traditional credit regulations |

| Impact on Credit | Can affect credit score if unpaid or mismanaged | No direct impact on credit score |

Understanding Overdrafts and Early Wage Access

Overdrafts and Early Wage Access both serve as short-term financial solutions but differ significantly in their liability implications. Overdrafts occur when a bank allows account holders to withdraw more funds than available, creating a liability that must be repaid with potential fees and interest. Early Wage Access enables employees to access earned wages before the payday, reducing the risk of debt accumulation and offering a liability structure tied directly to earned income rather than credit extensions.

Defining Financial Liability in Money Management

Financial liability in money management refers to an individual's obligation to repay borrowed funds or debts, which directly impacts their creditworthiness and financial stability. Overdrafts create immediate liability by allowing spending beyond available balances, often incurring fees and interest that increase debt burden. Early wage access, while providing timely liquidity, establishes a forward-looking liability by deducting future earnings, affecting cash flow and financial planning.

How Overdrafts Impact Personal Liabilities

Overdrafts increase personal liabilities by creating short-term debt that accrues fees and interest, potentially leading to higher overall financial obligations. This form of borrowing can negatively affect credit scores if overdraft limits are frequently exceeded or unpaid. Unlike early wage access, overdrafts usually involve higher costs and tighter repayment terms, intensifying the borrower's liability risk.

Early Wage Access: Liability Considerations

Early Wage Access (EWA) presents liability considerations centered on regulatory compliance and financial risk management, as employers advance wages before payroll processing. Unlike overdrafts, which shift liability largely to financial institutions and consumers, EWA programs may increase employer exposure to cash flow disruptions and require adherence to wage laws and lending regulations. Proper structuring of EWA agreements and transparent communication mitigates legal risks and enhances compliance with labor and consumer protection statutes.

Fee Structures: Overdraft vs Early Wage Access

Overdraft fees typically include fixed per-transaction charges and daily penalties that accrue quickly, increasing the overall liability for account holders. Early Wage Access services often utilize transparent subscription or flat fees without per-use surcharges, reducing unpredictable financial burdens. Understanding these fee structures is crucial for managing personal liability and avoiding excessive costs associated with short-term cash flow solutions.

Repayment Obligations and Borrower Liability

Overdrafts create immediate repayment obligations, often with high interest and fees, increasing borrower liability if not managed promptly. Early Wage Access offers a controlled advance on earned wages, typically with fixed fees and predefined repayment from future paychecks, reducing unpredictable liability. Understanding these differences helps borrowers manage financial responsibility and avoid excessive debt.

Credit Score Implications for Both Options

Overdrafts can negatively impact credit scores if not managed carefully, as frequent or prolonged overdraft usage may lead to overdraft fees and potential account closures reflected in credit reports. Early wage access typically does not directly affect credit scores since it is an advance on earned wages rather than a loan or credit extension reported to credit bureaus. Borrowers should consider that responsible use of early wage access may avoid the credit risks associated with overdraft reliance and protect their credit health.

Legal Liabilities and Consumer Protections

Overdraft services typically carry legal liabilities tied to stringent federal regulations like the Truth in Lending Act, which mandates transparent disclosure of fees and terms to protect consumers from deceptive practices. Early Wage Access programs often fall under emerging regulatory scrutiny to ensure compliance with wage laws and prevent practices that could lead to unauthorized lending liabilities. Consumer protections differ as overdraft fees are heavily regulated to prevent excessive financial burden, whereas early wage access models must navigate evolving legal standards to safeguard consumers from predatory financial risks.

Risk Management: Choosing Between Overdraft and Early Wage Access

Overdraft facilities often carry higher fees and interest rates, increasing the risk of escalating debt and financial strain for account holders. Early Wage Access services mitigate this risk by providing employees with controlled access to earned wages before payday, reducing reliance on costly credit. Effective risk management involves assessing the long-term financial impact, user behavior patterns, and cost structures to select the most sustainable liability solution.

Best Practices to Minimize Liability in Short-Term Cash Solutions

Implementing clear terms and transparent fee structures in overdraft and early wage access programs minimizes liability by reducing consumer misunderstandings. Regular risk assessments and compliance with regulatory guidelines ensure short-term cash solutions do not expose financial institutions to excessive legal risk. Leveraging real-time transaction monitoring and customer education enhances responsible use, further mitigating potential liabilities.

Related Important Terms

Digital Overdraft Facilities

Digital overdraft facilities provide an immediate, short-term liability for banks by extending credit when account balances fall below zero, often incurring fees and interest that reflect risk exposure. Early wage access programs shift liability timing by allowing employees to access earned wages before payday, reducing overdraft occurrences but creating a controlled liability through wage advances managed via fintech platforms.

Earned Wage Access (EWA) API

Earned Wage Access (EWA) APIs reduce employer liability by providing employees access to earned wages before payday, minimizing overdraft risks linked to traditional credit-based solutions. Unlike overdraft fees that increase consumer debt, EWA offers a transparent, fee-free alternative that mitigates financial stress and regulatory compliance concerns.

Real-Time Salary Streaming

Overdraft liability arises when a bank allows account holders to withdraw more than their available balance, often incurring fees and interest charges, while early wage access through real-time salary streaming reduces liability by providing employees instant access to earned wages without overdraft risks. Real-time salary streaming leverages API integrations to minimize financial institution exposure and enhances cash flow management for users, decreasing reliance on costly credit alternatives.

Flexible Pay Advance

Flexible Pay Advance offers a liability solution distinct from traditional overdraft by providing employees early access to earned wages without incurring overdraft fees or interest charges. This approach reduces financial stress and minimizes the risk of accumulating debt, making it a preferred alternative for managing short-term liquidity needs responsibly.

Micro-Overdraft Limits

Micro-overdraft limits typically range from $50 to $200, reducing financial liability by capping potential overdraft fees compared to traditional overdrafts. Early wage access offers a fixed advance on earned wages without generating overdraft fees, minimizing consumer debt risk and institutional liability.

Responsible Advance Algorithms

Overdraft services often result in unpredictable fees and increased consumer liability, whereas early wage access programs leverage responsible advance algorithms to provide transparent, real-time access to earned wages, reducing financial stress and minimizing overdraft occurrences. These algorithms assess user spending patterns and income flows to offer customized advances, mitigating risk for lenders while promoting responsible borrowing behavior.

Instant Liquidity Access Fees

Overdraft fees typically range from $30 to $35 per transaction, resulting in significant liability due to repeated fee charges, whereas early wage access programs often charge a flat or low fixed fee, providing instant liquidity with reduced cost-related liability. Financial institutions face higher risk exposure from overdraft liabilities compared to the predictable, transparent fees associated with early wage access solutions.

Non-traditional Credit Assessment

Overdraft and Early Wage Access differ significantly in their approach to liability management, with traditional overdraft relying on credit history and conventional risk assessments, while Early Wage Access often uses non-traditional credit assessments such as income flow and spending behavior to determine user eligibility. Non-traditional credit assessments reduce reliance on credit scores, minimizing default risk and offering a more inclusive financial solution for users with limited or poor credit histories.

On-Demand Pay Disbursement

Overdraft fees typically generate high liability risk due to unpredictable consumer spending patterns, while Early Wage Access (On-Demand Pay Disbursement) offers controlled, pre-approved funds that reduce financial liability exposure for employers. Implementing Early Wage Access programs minimizes overdraft occurrences by providing employees immediate access to earned wages before payday, thereby lowering overdraft-related fees and associated bank liabilities.

Dynamic Risk-Based Pricing

Dynamic risk-based pricing in overdraft services adjusts fees and limits based on individual spending behavior and credit risk, increasing liability exposure during high-risk periods. Early wage access uses predictive analytics to offer advances based on anticipated income, reducing default risk and enabling more precise liability management.

Overdraft vs Early Wage Access for liability. Infographic

moneydiff.com

moneydiff.com