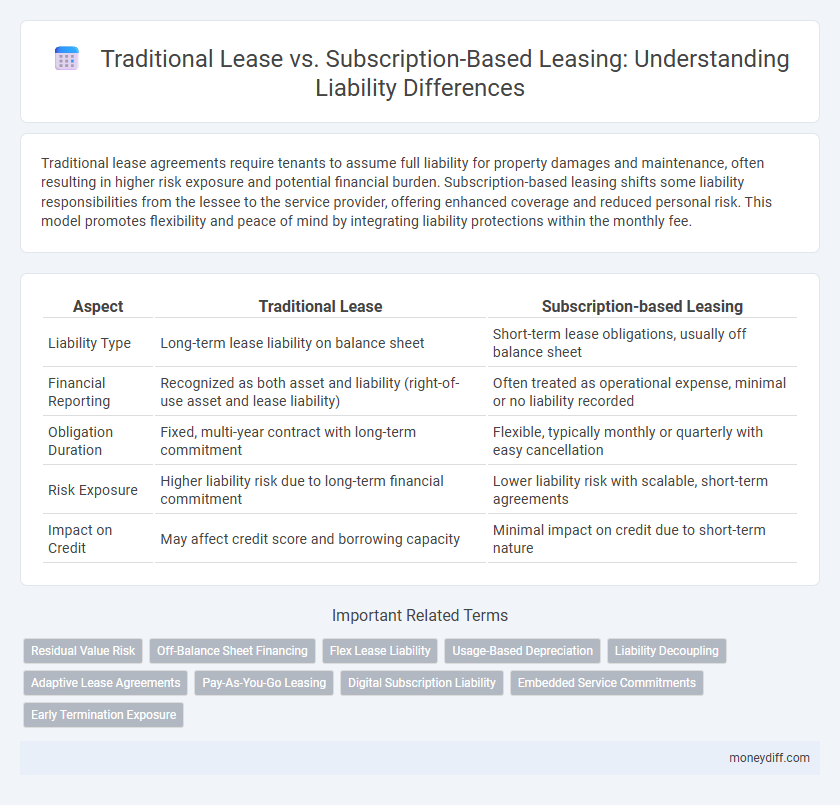

Traditional lease agreements require tenants to assume full liability for property damages and maintenance, often resulting in higher risk exposure and potential financial burden. Subscription-based leasing shifts some liability responsibilities from the lessee to the service provider, offering enhanced coverage and reduced personal risk. This model promotes flexibility and peace of mind by integrating liability protections within the monthly fee.

Table of Comparison

| Aspect | Traditional Lease | Subscription-based Leasing |

|---|---|---|

| Liability Type | Long-term lease liability on balance sheet | Short-term lease obligations, usually off balance sheet |

| Financial Reporting | Recognized as both asset and liability (right-of-use asset and lease liability) | Often treated as operational expense, minimal or no liability recorded |

| Obligation Duration | Fixed, multi-year contract with long-term commitment | Flexible, typically monthly or quarterly with easy cancellation |

| Risk Exposure | Higher liability risk due to long-term financial commitment | Lower liability risk with scalable, short-term agreements |

| Impact on Credit | May affect credit score and borrowing capacity | Minimal impact on credit due to short-term nature |

Understanding Liability in Traditional Leasing

In traditional leasing, liability primarily rests with the lessee, who is responsible for maintenance, repairs, and potential damages to the leased asset. The lease agreement often includes clauses outlining financial obligations related to asset depreciation or early termination penalties. Understanding these liabilities ensures accurate financial reporting and risk management for businesses engaged in long-term lease contracts.

Liability Implications in Subscription-based Leasing

Subscription-based leasing shifts liability by often including maintenance and repairs under the service provider's responsibility, reducing the lessee's direct obligations. This model typically classifies payments as operational expenses rather than capital liabilities, improving balance sheet flexibility. However, it requires careful contract evaluation to avoid hidden liabilities related to usage limits, damage fees, or early termination penalties.

Comparative Risk Exposure: Traditional vs Subscription Leases

Traditional leases pose higher liability risk as tenants are responsible for asset maintenance and damage over the contract term, often resulting in prolonged financial exposure. Subscription-based leasing limits liability exposure by transferring maintenance and repair responsibilities to the provider, reducing tenant risk of unexpected costs. This model offers increased flexibility and lower long-term liability, making it a safer option for businesses seeking predictable financial commitments.

Lessee and Lessor Responsibilities Explained

In traditional leases, lessees assume full responsibility for asset maintenance and liability risks, while lessors hold ownership and long-term financial risks. Subscription-based leasing shifts more liability to lessors by bundling services like maintenance and insurance, reducing lessee obligations. This model enhances risk management for lessees but requires lessors to maintain robust liability coverage and asset management systems.

Insurance Requirements: Traditional Lease vs Subscription Model

Traditional lease agreements typically require lessees to carry comprehensive insurance coverage, including liability, collision, and comprehensive policies, to mitigate financial risk for both parties. Subscription-based leasing models often incorporate insurance within the monthly fee, shifting liability coverage responsibilities to the provider and simplifying the lessee's obligations. This integrated insurance approach in subscription services reduces gaps in liability protection and potentially lowers out-of-pocket costs for subscribers.

Damage and Maintenance Liabilities in Both Leasing Options

Traditional lease agreements generally assign damage and maintenance liabilities to the lessee, requiring them to cover repair costs and upkeep during the lease term, which can lead to unpredictable expenses. Subscription-based leasing typically includes maintenance and covers damages within the monthly fee, reducing financial risk and administrative burdens for the subscriber. This difference significantly impacts liability exposure, with subscription models offering more predictable costs and less responsibility for unanticipated damage repairs.

Early Termination: Financial and Legal Liabilities

Early termination in traditional leases often results in significant financial penalties and protracted legal disputes due to fixed contract terms and high cancellation fees. Subscription-based leasing minimizes these liabilities by offering flexible exit options with reduced financial burdens and streamlined termination processes. Tenants benefit from lower risk exposure and enhanced liability management in subscription models compared to conventional lease agreements.

Dispute Resolution and Liability Allocation

Traditional leases clearly define liability allocation and dispute resolution terms in written contracts, establishing specific tenant responsibilities for damages and legal recourse. Subscription-based leasing often includes more flexible, technology-driven agreements that may complicate liability distribution due to shared usage models and digital terms of service. Understanding these differences is crucial for managing risk exposure and ensuring effective resolution in disputes involving property damage or contract breaches.

Rollover and Renewal Liabilities Compared

Traditional leases typically involve rollover liabilities where lessees automatically extend agreements, potentially increasing long-term financial obligations recorded as liabilities on the balance sheet. Subscription-based leasing often features predefined renewal terms with fixed fees, leading to more predictable and sometimes lower renewal liabilities impacting liability recognition. Companies must evaluate rollover and renewal liability implications to accurately assess lease obligations and ensure compliance with accounting standards like IFRS 16 or ASC 842.

Choosing the Right Leasing Option for Optimal Liability Management

Traditional leases often result in long-term liability commitments recorded as finance or operating lease liabilities on the balance sheet, impacting debt-to-equity ratios. Subscription-based leasing models typically offer greater flexibility with off-balance-sheet treatment, reducing reported liabilities and improving financial metrics. Choosing the right leasing option requires evaluating the impact on liability recognition, cash flow stability, and compliance with accounting standards like IFRS 16 or ASC 842 for optimal liability management.

Related Important Terms

Residual Value Risk

Traditional leases transfer residual value risk to the lessee, who may face substantial liability if the asset's market value declines below the estimated residual value. Subscription-based leasing shifts residual value risk to the lessor, minimizing lessee liability by offering flexible terms and avoiding long-term asset depreciation exposure.

Off-Balance Sheet Financing

Traditional leases typically appear on the balance sheet as liabilities, increasing the lessee's debt ratio and affecting credit metrics, whereas subscription-based leasing often qualifies as off-balance sheet financing, enabling companies to access assets without significantly impacting their financial leverage. Off-balance sheet treatment in subscription leasing improves liquidity and financial flexibility by keeping lease obligations and associated risks off the reported balance sheet.

Flex Lease Liability

Flex Lease liability reduces financial risk by offering variable lease terms that align with usage patterns, contrasting with traditional lease liability, which often requires fixed, long-term commitments leading to higher off-balance-sheet risk. Subscription-based leasing under Flex Lease models enhances liability transparency and flexibility, improving balance sheet management and regulatory compliance.

Usage-Based Depreciation

Traditional leases typically allocate liability based on fixed depreciation schedules that do not account for actual usage, potentially leading to inaccurate expense recognition and residual value risk. Subscription-based leasing incorporates usage-based depreciation models that align liability with real-time asset consumption, enhancing financial accuracy and reducing unexpected costs.

Liability Decoupling

Traditional leases often embed liability within long-term contractual obligations, causing lessees to carry residual risks tied to asset depreciation or maintenance. Subscription-based leasing decouples liability by offering flexible, short-term agreements where asset risk and maintenance responsibilities are frequently transferred to the lessor, reducing lessee exposure.

Adaptive Lease Agreements

Adaptive lease agreements in subscription-based leasing models offer enhanced flexibility by dynamically adjusting liability terms based on usage and contract modifications, reducing fixed long-term obligations compared to traditional leases. This approach minimizes residual value risk and supports more accurate financial reporting under current liability standards such as IFRS 16 and ASC 842.

Pay-As-You-Go Leasing

Pay-as-you-go leasing significantly reduces long-term liability exposure by aligning payments with actual usage, unlike traditional leases that require fixed monthly obligations regardless of wear or utilization. This model enhances financial flexibility and minimizes off-balance-sheet liabilities, making it an effective risk management tool for businesses seeking adaptive asset control.

Digital Subscription Liability

Digital subscription liability often entails ongoing obligations that differ from the fixed-term commitments typical of traditional leases, requiring companies to recognize and manage continuous service-based liabilities on their balance sheets. Subscription-based leasing models introduce recurring revenue recognition challenges that necessitate more dynamic liability tracking compared to the straightforward, time-bound lease liabilities found in traditional leasing agreements.

Embedded Service Commitments

Traditional lease agreements often present clear-cut liabilities primarily related to lease payments and asset maintenance, whereas subscription-based leasing embeds additional service commitments that can increase liability complexity due to bundled operational and maintenance responsibilities. Embedded service commitments in subscription-based leases shift liability toward service providers, requiring comprehensive risk assessment related to service delivery and performance guarantees.

Early Termination Exposure

Traditional leases often impose significant early termination penalties and require the full remaining lease payments to be recognized as liabilities, increasing financial risk exposure. Subscription-based leasing typically offers flexible cancellation terms with limited or no early termination fees, mitigating potential liability and improving balance sheet management.

Traditional Lease vs Subscription-based Leasing for Liability Infographic

moneydiff.com

moneydiff.com