When managing liability through bank overdraft or flexible credit line, understanding cost and flexibility is crucial. A bank overdraft offers immediate short-term borrowing with potential high fees if not managed carefully, while a flexible credit line provides a preset borrowing limit with lower interest rates and more control over repayment. Choosing between these options depends on liability amount, cash flow stability, and the urgency of funds access.

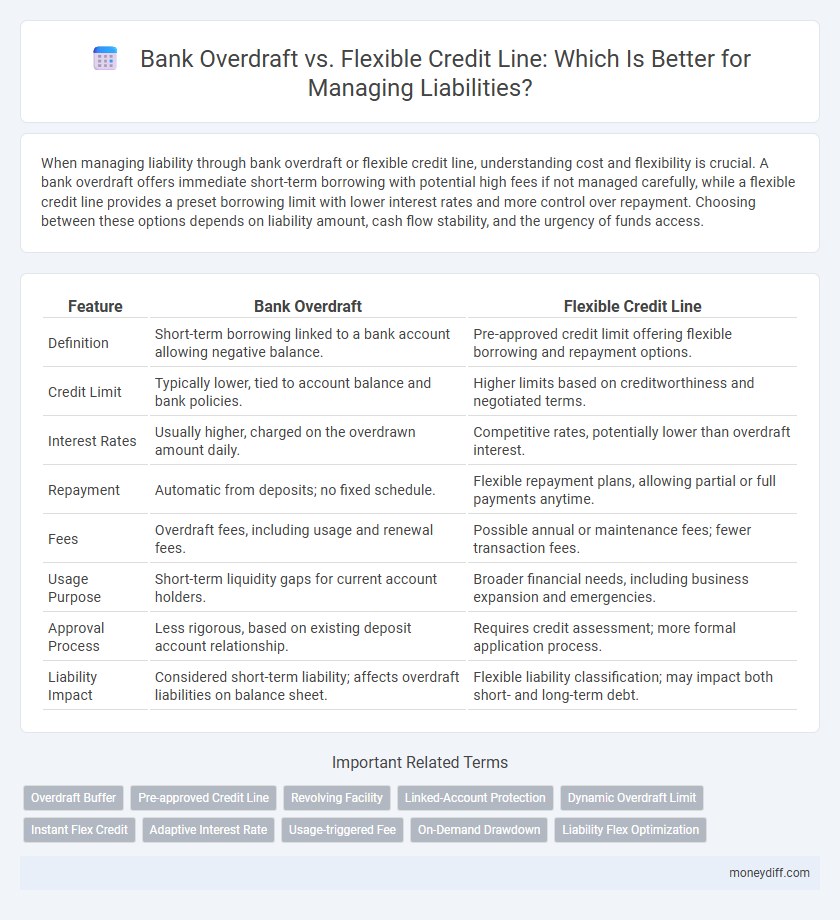

Table of Comparison

| Feature | Bank Overdraft | Flexible Credit Line |

|---|---|---|

| Definition | Short-term borrowing linked to a bank account allowing negative balance. | Pre-approved credit limit offering flexible borrowing and repayment options. |

| Credit Limit | Typically lower, tied to account balance and bank policies. | Higher limits based on creditworthiness and negotiated terms. |

| Interest Rates | Usually higher, charged on the overdrawn amount daily. | Competitive rates, potentially lower than overdraft interest. |

| Repayment | Automatic from deposits; no fixed schedule. | Flexible repayment plans, allowing partial or full payments anytime. |

| Fees | Overdraft fees, including usage and renewal fees. | Possible annual or maintenance fees; fewer transaction fees. |

| Usage Purpose | Short-term liquidity gaps for current account holders. | Broader financial needs, including business expansion and emergencies. |

| Approval Process | Less rigorous, based on existing deposit account relationship. | Requires credit assessment; more formal application process. |

| Liability Impact | Considered short-term liability; affects overdraft liabilities on balance sheet. | Flexible liability classification; may impact both short- and long-term debt. |

Understanding Bank Overdrafts: Definition and Mechanics

Bank overdrafts occur when withdrawals from a bank account exceed the available balance, creating a negative balance that the bank allows temporarily. This liability involves negotiated limits and interest rates, where the bank covers short-term cash flow shortages but charges fees and interest on the overdrawn amount. Understanding the mechanics of bank overdrafts is crucial for managing short-term liabilities and avoiding excessive financial costs compared to structured credit facilities like flexible credit lines.

What is a Flexible Credit Line? Key Features Explained

A flexible credit line is a revolving liability that allows borrowers to access funds up to a predetermined limit, offering greater control over cash flow compared to a fixed loan. Key features include adjustable borrowing amounts, interest charged only on the utilized credit, and the ability to repay and reuse funds multiple times within the agreed period. Unlike bank overdrafts, flexible credit lines often provide longer repayment terms and higher credit limits, making them ideal for managing variable short-term liabilities.

Comparing Liability: Overdraft vs Flexible Credit Line

A bank overdraft represents a liability arising when withdrawals exceed the account balance, typically featuring higher interest rates and short-term repayment expectations. A flexible credit line, as a revolving liability, provides pre-approved credit with lower interest rates and adjustable limits, offering more control over borrowing and repayment schedules. Comparing these liabilities reveals that flexible credit lines optimize cash flow management through predictable costs, whereas overdrafts present unpredictable charges and increased risk of overdraft fees.

Interest Rates and Fee Structures: A Side-by-Side Analysis

Bank overdrafts typically feature higher interest rates and unpredictable overdraft fees, which can significantly increase the cost of borrowing. Flexible credit lines often offer lower interest rates with transparent fee structures, including fixed maintenance fees and interest charged only on the drawn amount. Comparing the two, flexible credit lines provide more cost-effective and predictable liability management, making them preferable for ongoing credit needs.

Ease of Access: Overdrafts vs Flexible Credit Lines

Bank overdrafts offer immediate access to funds by allowing account holders to withdraw beyond their balance up to a pre-approved limit, facilitating swift liquidity for short-term expenses. Flexible credit lines provide adaptable borrowing options with pre-approved limits and the ability to draw and repay funds multiple times, enhancing cash flow management. Both options serve as vital liabilities with differences in accessibility, where overdrafts prioritize instant availability, while flexible credit lines emphasize ongoing financial flexibility.

Impact on Credit Score and Financial Health

Bank overdrafts and flexible credit lines both affect credit scores, but flexible credit lines typically have a more positive impact due to structured repayment terms and higher credit limits. Overdrafts can lead to frequent negative balances, increasing the risk of fees and lowering credit utilization ratios, which may harm credit scores. Utilizing a flexible credit line responsibly supports better financial health by offering controlled access to funds and promoting consistent on-time payments, enhancing overall creditworthiness.

Repayment Terms and Flexibility

Bank overdrafts typically require immediate repayment upon demand, limiting flexibility and often resulting in fluctuating interest costs based on the outstanding balance. Flexible credit lines offer structured repayment schedules with customizable terms, allowing borrowers to manage cash flow more efficiently and avoid sudden repayment pressures. The adaptability of flexible credit lines in terms of drawdowns and repayments enhances liability management compared to the rigid nature of bank overdrafts.

Short-Term vs Long-Term Liability Management

Bank overdrafts serve as short-term liabilities, providing immediate, flexible access to funds for managing cash flow fluctuations without long-term commitment. Flexible credit lines offer more strategic, longer-term liability management by granting borrowers extended borrowing capacity with tailored repayment terms, supporting ongoing financial planning. Businesses optimize liability portfolios by balancing the transient nature of overdrafts with the sustainable structure of flexible credit lines for comprehensive cash flow and debt management.

Risks and Potential Pitfalls for Account Holders

Bank overdrafts expose account holders to high interest rates and frequent penalty fees that can quickly escalate liabilities, posing a significant risk to financial stability. Flexible credit lines, while offering more control, may tempt users to overborrow due to lower initial costs, leading to long-term debt accumulation and potential credit score damage. Both options require diligent management to avoid unexpected repayment demands and liquidity challenges that can jeopardize overall financial health.

Choosing the Right Option: Factors to Consider

When choosing between a bank overdraft and a flexible credit line for liability management, consider interest rates, repayment terms, and credit limits, as these directly impact cost and cash flow flexibility. Bank overdrafts typically offer short-term, automatic access to funds with higher interest rates, while flexible credit lines provide larger credit amounts with customizable repayment schedules and potentially lower rates. Assessing your business's cash flow variability, credit needs, and long-term financial goals ensures selecting the most cost-effective and manageable liability solution.

Related Important Terms

Overdraft Buffer

Bank overdraft liability often includes an overdraft buffer that provides a predefined limit for short-term negative balances, offering immediate liquidity without formal loan approval. In contrast, a flexible credit line allows borrowers to draw funds up to an agreed credit limit with structured repayment terms, typically lacking the spontaneous overdraft buffer feature.

Pre-approved Credit Line

A pre-approved flexible credit line offers a higher borrowing limit with lower interest rates compared to a typical bank overdraft, providing businesses greater control over their liabilities and cash flow management. While bank overdrafts are often subject to daily limits and variable fees, a pre-approved flexible credit line ensures predictable financing, reducing the risk of unexpected liability surges.

Revolving Facility

A bank overdraft is a short-term revolving liability allowing account holders to withdraw beyond their account balance, typically with variable interest rates and flexible repayment terms. In contrast, a flexible credit line offers a larger, more structured revolving facility with agreed credit limits and often lower interest, suitable for managing ongoing cash flow fluctuations and long-term financing needs.

Linked-Account Protection

Bank overdrafts provide linked-account protection by automatically covering transactions that exceed the account balance, preventing declined payments and overdraft fees. Flexible credit lines offer higher limits with customizable repayment terms, enhancing liability management through linked-account access without immediate fund withdrawal.

Dynamic Overdraft Limit

A Dynamic Overdraft Limit in a bank overdraft offers customizable borrowing capacity based on account activity, enhancing liquidity management compared to a fixed flexible credit line. This allows businesses to efficiently adjust liabilities in real time, optimizing cash flow while minimizing interest costs associated with unused credit.

Instant Flex Credit

Bank overdrafts typically incur higher interest rates and limited credit amounts, making them less cost-effective compared to Flexible Credit Lines like Instant Flex Credit, which offer instant access to larger funds with lower interest and customizable repayment options. Instant Flex Credit enhances liability management by providing businesses with a seamless, revolving credit facility designed to optimize cash flow and reduce financial risk.

Adaptive Interest Rate

A Bank Overdraft typically features a variable interest rate that adapts based on the bank's base rate, often resulting in higher costs during economic fluctuations, whereas a Flexible Credit Line offers a more adaptive interest rate structure tied to market benchmarks, allowing borrowers to benefit from lower rates when market conditions improve. This adaptive interest rate mechanism in Flexible Credit Lines provides greater cost efficiency and financial flexibility compared to the generally fixed or less responsive rates of Bank Overdrafts.

Usage-triggered Fee

Bank overdrafts typically incur usage-triggered fees calculated based on the amount and duration of the overdraft, leading to potentially higher costs during frequent or prolonged overdraft usage; flexible credit lines apply interest only on the borrowed portion without fixed fees, offering more cost-effective management of short-term liabilities. Choosing between these options impacts liability management strategies due to differences in fee structures and usage-based cost implications.

On-Demand Drawdown

Bank overdrafts provide short-term liquidity with automatic on-demand drawdown up to a set limit, offering immediate access to funds without prior approval. Flexible credit lines also offer on-demand drawdown but typically feature higher credit limits and customizable repayment terms, making them suitable for managing larger or more fluctuating liabilities.

Liability Flex Optimization

Bank overdrafts typically incur higher interest rates and may include fees that increase overall liability costs, while flexible credit lines offer adjustable credit limits and potentially lower interest rates, enhancing liability flex optimization by aligning borrowing capacity with cash flow needs. Efficient management of a flexible credit line reduces the risk of excessive debt accumulation and optimizes financial liabilities through tailored repayment schedules and minimized interest expenses.

Bank Overdraft vs Flexible Credit Line for Liability. Infographic

moneydiff.com

moneydiff.com