Mortgage loans for homeownership typically carry full liability for the borrower, requiring responsibility for the entire debt in case of default. Fractional home ownership loans distribute liability among multiple owners, reducing individual financial risk by sharing both ownership and repayment obligations. Understanding these liability differences helps borrowers choose the best financing option aligned with their risk tolerance and financial situation.

Table of Comparison

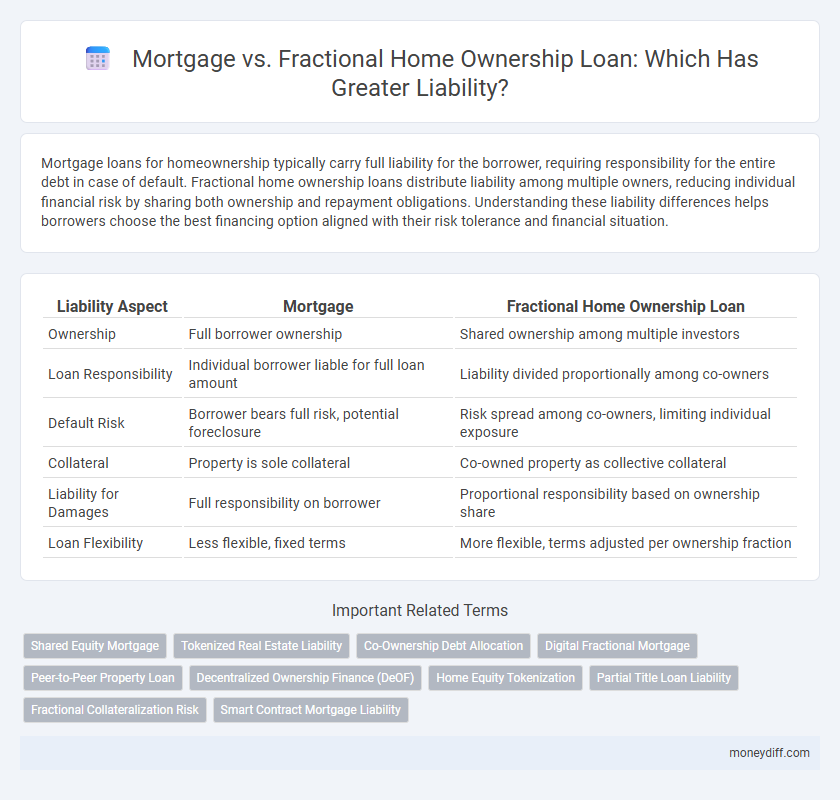

| Liability Aspect | Mortgage | Fractional Home Ownership Loan |

|---|---|---|

| Ownership | Full borrower ownership | Shared ownership among multiple investors |

| Loan Responsibility | Individual borrower liable for full loan amount | Liability divided proportionally among co-owners |

| Default Risk | Borrower bears full risk, potential foreclosure | Risk spread among co-owners, limiting individual exposure |

| Collateral | Property is sole collateral | Co-owned property as collective collateral |

| Liability for Damages | Full responsibility on borrower | Proportional responsibility based on ownership share |

| Loan Flexibility | Less flexible, fixed terms | More flexible, terms adjusted per ownership fraction |

Understanding Mortgage and Fractional Home Ownership Loan Liabilities

Mortgage liabilities involve a borrower's legal responsibility to repay the full loan amount secured by the property, typically with fixed or variable interest over a set term. Fractional Home Ownership Loan liabilities are shared among multiple co-owners, where each party is responsible for their proportionate share of the loan and associated costs, reducing individual financial exposure but requiring collective agreement on repayments. Understanding these liabilities is crucial for assessing risk, as mortgages hold sole accountability for the borrower, while fractional loans distribute liability and financial obligations across multiple stakeholders.

Liability Structure: Mortgage vs Fractional Home Ownership Loan

Mortgage liability is structured as a singular, long-term debt secured by the entire property, where the borrower is fully responsible for repayments and potential foreclosure risks. Fractional Home Ownership Loan liability is divided among multiple owners, limiting individual financial exposure but requiring shared responsibility for maintenance costs and loan repayment. This shared liability model can reduce personal risk but may complicate decision-making and credit obligations.

Personal Financial Exposure in Mortgages and Fractional Ownership

Mortgages expose individuals to full personal financial liability, requiring borrowers to repay the entire loan amount even if property value declines or they default. Fractional home ownership limits individual liability to the invested share, reducing personal financial exposure and risk of total loss. This shared responsibility in fractional ownership mitigates the impact of market fluctuations and potential liabilities compared to traditional mortgages.

Title and Legal Responsibilities in Each Loan Type

Mortgage loans place full title and legal responsibility on the borrower, making them liable for repayment and property obligations until the loan is fully paid off. Fractional home ownership loans divide the title and legal responsibilities among multiple owners, reducing individual liability but requiring collective decision-making and shared accountability. Understanding the distinctions in title rights and legal duties is crucial for assessing financial risk and legal exposure in each loan type.

Default Risk Comparison: Mortgage vs Fractional Loan

Default risk in mortgage loans is typically higher due to the full property lien held by lenders, increasing borrower liability if payments falter. Fractional home ownership loans distribute property stakes among multiple investors, reducing individual default exposure but complicating liability due to shared ownership agreements. Lenders assessing default risk prioritize mortgage holders for clearer recovery options, while fractional loan participants face nuanced liability based on contract terms and partial ownership percentages.

Liability in Case of Market Downturn

Mortgage holders face full liability for the outstanding loan amount even during a market downturn, which may result in negative equity if property values decline. In fractional home ownership loans, liability is shared among co-owners, reducing individual financial exposure during depreciating market conditions. This shared liability structure can mitigate risks, but also requires coordinated decision-making among all fractional owners.

Recourse vs Non-Recourse: Implications for Borrowers

Mortgage loans typically involve recourse liability, meaning borrowers are personally responsible for the full loan amount if they default, potentially risking additional assets beyond the property. Fractional home ownership loans often operate under non-recourse terms, limiting borrower liability solely to the property itself, which reduces personal financial risk. Understanding the distinction between recourse and non-recourse liability is critical for borrowers to evaluate potential financial exposure and protect personal assets.

Debt-to-Income Impact: Mortgage vs Fractional Ownership

Mortgage loans typically result in a higher debt-to-income (DTI) ratio due to full loan amounts and monthly principal and interest payments, increasing overall liability. Fractional home ownership loans allocate debt among multiple owners, reducing individual DTI impact but potentially complicating liability through shared financial responsibility. Understanding the DTI implications of each can help borrowers manage credit risk and qualify for future financing.

Exit Strategies and Associated Liabilities

Mortgage loans typically involve a full ownership transfer with clear exit strategies such as property sale or refinancing, exposing borrowers to liabilities including repayment obligations and potential foreclosure risks. Fractional home ownership loans divide property rights among multiple stakeholders, complicating exit options due to shared ownership agreements and creating joint liability concerns if one party defaults or seeks to exit early. Understanding the legal framework and contractual exit clauses is essential for managing liabilities and ensuring smooth asset liquidation in both mortgage and fractional ownership scenarios.

Long-term Liability Outlook for Homebuyers

Mortgage loans typically constitute a long-term liability due to fixed repayment schedules and interest accrual over 15 to 30 years, impacting homebuyers' financial stability and creditworthiness. Fractional home ownership loans distribute liability among multiple investors, potentially reducing individual debt burden but complicating personal asset control and resale options. Homebuyers should evaluate the long-term implications on equity growth, liability exposure, and risk management associated with each financing model before committing.

Related Important Terms

Shared Equity Mortgage

Shared Equity Mortgages reduce individual liability by distributing loan repayment responsibilities proportionally among co-owners, limiting personal financial risk compared to traditional mortgages. Loan default impacts each co-owner's credit score and liability share, necessitating clear agreements to manage shared financial obligations in fractional home ownership.

Tokenized Real Estate Liability

Tokenized real estate liability in fractional home ownership loans is distributed proportionally among investors, reducing individual risk compared to a traditional mortgage where a single borrower holds full liability. This decentralized liability structure enhances transparency and potentially limits financial exposure through blockchain-enforced smart contracts.

Co-Ownership Debt Allocation

Co-ownership debt allocation in mortgage agreements typically assigns full liability to the individual borrower, whereas fractional home ownership loans distribute liability proportionally among co-owners based on their ownership share. This distinction impacts responsibility for repayments, potential defaults, and credit implications, making fractional loans potentially less risky for individual co-owners compared to traditional mortgages.

Digital Fractional Mortgage

Digital Fractional Mortgage reduces borrower liability by dividing home ownership and loan responsibility among multiple investors, contrasting with traditional mortgages where a single borrower is solely liable. This shared liability model minimizes individual financial risk and enhances credit flexibility in the real estate financing landscape.

Peer-to-Peer Property Loan

Peer-to-peer property loans typically reduce liability risks compared to traditional mortgages by distributing debt among multiple investors in fractional home ownership loans, offering borrowers flexible repayment terms and lower default exposure. Mortgage liabilities remain consolidated with a single lender, increasing financial risk under default conditions, whereas fractional ownership structures mitigate individual borrower liability through shared debt responsibilities.

Decentralized Ownership Finance (DeOF)

Mortgage loans typically place full liability on the borrower for the entire loan amount, whereas Fractional Home Ownership Loans distribute liability among multiple investors, reducing individual risk exposure. Decentralized Ownership Finance (DeOF) leverages blockchain technology to transparently manage and automate liability allocation in fractional home ownership, enhancing security and accountability.

Home Equity Tokenization

Mortgage loans typically involve a secured liability where the borrower is solely responsible for repayment, while fractional home ownership loans leverage home equity tokenization to distribute liability among multiple investors through digital tokens representing shared property rights. Home equity tokenization enhances liquidity and risk diversification by converting property ownership into tradable assets, thereby reducing individual borrower liability and simplifying access to capital.

Partial Title Loan Liability

Partial title loan liability in fractional home ownership involves shared responsibility among co-owners, reducing individual exposure compared to a full mortgage loan where a single borrower holds complete liability. This shared liability structure can mitigate personal financial risk but requires clear agreements to manage repayment obligations and default consequences effectively.

Fractional Collateralization Risk

Fractional home ownership loans increase liability exposure due to fractional collateralization risk, where default by one co-owner can jeopardize the entire mortgage's security. Unlike traditional mortgages secured by full collateral, fractional models create complex liability structures that complicate risk assessment and recovery for lenders.

Smart Contract Mortgage Liability

Smart contract mortgage liability automates and enforces loan agreements with transparent, tamper-proof blockchain records, reducing risks of default and disputes compared to traditional fractional home ownership loans, which often involve complex co-owner liabilities and less secure contractual frameworks. This decentralized approach streamlines liability management by ensuring automatic payments and real-time auditability, enhancing trust and minimizing legal exposure for all parties involved.

Mortgage vs Fractional Home Ownership Loan for liability. Infographic

moneydiff.com

moneydiff.com