Medical debt can quickly accumulate when unexpected pet health issues arise, leading to high out-of-pocket expenses and financial stress. Health savings sharing plans offer a proactive alternative by pooling resources within a community to cover veterinary costs, reducing individual financial burden. Choosing health savings sharing for liability can provide more predictable support and prevent the negative impacts of overwhelming medical debt.

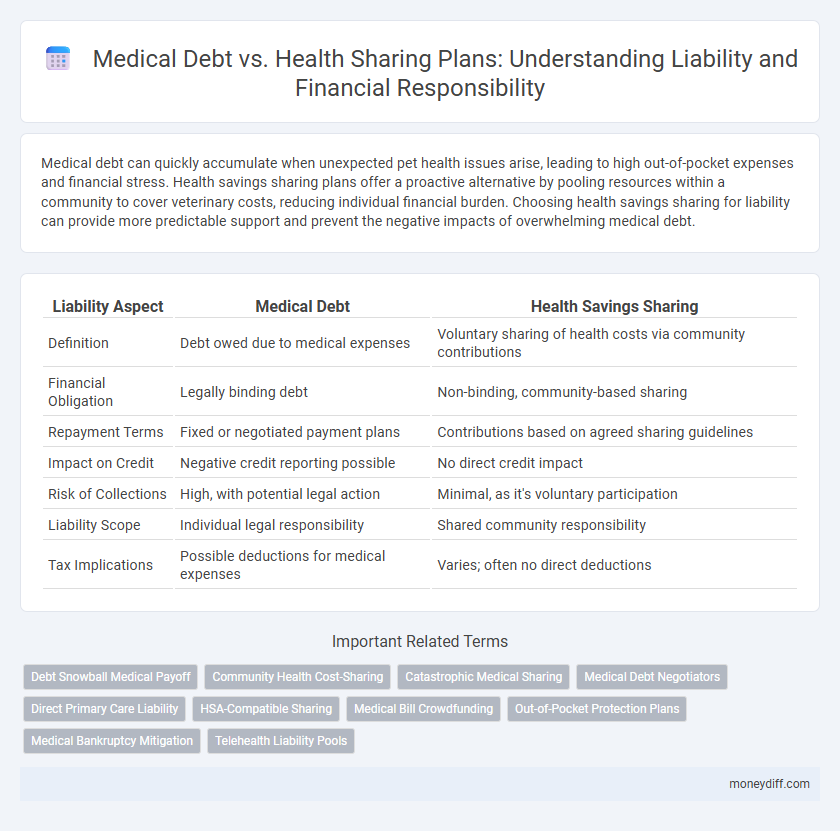

Table of Comparison

| Liability Aspect | Medical Debt | Health Savings Sharing |

|---|---|---|

| Definition | Debt owed due to medical expenses | Voluntary sharing of health costs via community contributions |

| Financial Obligation | Legally binding debt | Non-binding, community-based sharing |

| Repayment Terms | Fixed or negotiated payment plans | Contributions based on agreed sharing guidelines |

| Impact on Credit | Negative credit reporting possible | No direct credit impact |

| Risk of Collections | High, with potential legal action | Minimal, as it's voluntary participation |

| Liability Scope | Individual legal responsibility | Shared community responsibility |

| Tax Implications | Possible deductions for medical expenses | Varies; often no direct deductions |

Understanding Medical Debt: Financial Implications and Risks

Medical debt often leads to significant financial liability due to high-interest rates and accumulation of unpaid balances, negatively impacting credit scores and limiting future borrowing capacity. Health savings sharing plans provide an alternative by pooling funds to cover medical expenses, reducing out-of-pocket costs and mitigating long-term financial risk. Understanding the differences in liability exposure between traditional medical debt and health sharing arrangements is crucial for effective healthcare financial planning.

What Is Health Savings Sharing? A Modern Approach to Healthcare Costs

Health Savings Sharing (HSS) is an innovative financial approach where members contribute to a communal fund designed to offset medical expenses, reducing individual liability for medical debt. Unlike traditional insurance, HSS fosters a community-driven model that emphasizes preemptive saving and shared responsibility, offering a transparent alternative to high healthcare costs. This model minimizes out-of-pocket liabilities by pooling resources, enabling timely access to medical care without accumulating significant medical debt.

Liability Comparison: Medical Debt vs Health Savings Sharing

Medical debt often results in high-interest liabilities that can accumulate rapidly, negatively impacting credit scores and financial stability. Health Savings Sharing accounts, by contrast, function as cooperative liability-sharing pools where participants contribute funds to cover eligible medical expenses without incurring traditional debt. Comparing liabilities, medical debt presents a direct financial obligation with potential legal consequences, while health savings sharing spreads liability across members, reducing individual financial risk and promoting collaborative expense management.

How Medical Debt Impacts Credit and Financial Stability

Medical debt significantly impacts credit scores by increasing debt-to-income ratios and triggering late payment reports, which lowers creditworthiness. Persistent medical debt can lead to collection accounts, causing long-term damage to financial stability and restricting access to loans or credit lines. Health Savings Sharing (HSS) offers a proactive approach to managing medical expenses, reducing reliance on credit and mitigating adverse effects on financial health.

Legal Responsibilities in Medical Debt Repayment

Legal responsibilities in medical debt repayment vary significantly from health savings sharing arrangements, as medical debt often entails binding contracts with healthcare providers or lenders, creating enforceable obligations for patients. Unlike health savings sharing, which typically operates on voluntary contributions without formal liability, medical debt can lead to legal actions including wage garnishment or asset liens if repayments are not fulfilled. Understanding the legal framework surrounding medical debt is crucial for managing liability, as failing to meet these obligations may result in significant financial and credit consequences.

Member Obligations and Liability in Health Savings Sharing Programs

In Health Savings Sharing Programs (HSSPs), member obligations typically involve contributing agreed-upon amounts to a collective fund used to cover eligible medical expenses, which reduces individual liability by distributing financial responsibility. Unlike traditional medical debt, where individuals are directly liable for unpaid medical bills, HSSPs offer a structured approach that limits personal liability through shared risk and mutual support within the program. Members must understand that failure to meet contribution commitments may lead to exclusions from coverage and potential liability for uncovered expenses outside the shared pool.

Protections Against Catastrophic Medical Liability: Debt vs Sharing

Medical debt often leads to overwhelming financial liability due to high interest rates and limited repayment options, increasing personal risk during catastrophic health events. Health savings sharing plans provide a community-based protection mechanism by pooling funds to cover extraordinary medical expenses, reducing individual financial burden without incurring traditional debt. These sharing arrangements emphasize shared responsibility and preventive cost management, which significantly mitigate the personal liability typically associated with catastrophic medical bills.

Cost Predictability: Medical Debt Versus Sharing Models

Medical debt often results in unpredictable financial liability due to unexpected medical expenses and high interest rates, increasing overall cost uncertainty for patients. Health savings sharing models, by contrast, provide greater cost predictability as members contribute fixed monthly amounts pooled to cover eligible medical expenses, minimizing sudden financial burdens. This collective approach reduces individual liability by spreading risk and fostering transparency in healthcare spending.

Navigating Medical Billing Disputes: Debt Collection vs Sharing Coordination

Navigating medical billing disputes requires clear understanding of liability differences between medical debt and health savings sharing agreements. Medical debt often involves third-party debt collectors legally pursuing outstanding balances, whereas health savings sharing coordinators facilitate direct communication between members and providers to resolve payment responsibilities. Prioritizing transparent documentation and proactive dispute resolution reduces financial liability and enhances patient-provider trust.

Choosing Wisely: Minimizing Liability in Healthcare Financial Planning

Medical debt often leads to significant liability risks for patients and providers, emphasizing the importance of proactive financial planning through Health Savings Accounts (HSAs) to mitigate these burdens. HSAs offer tax-advantaged savings specifically designed for medical expenses, reducing out-of-pocket costs and limiting potential liabilities associated with unexpected healthcare bills. Choosing wisely between managing medical debt and utilizing HSAs enhances financial stability and lowers the risk of long-term healthcare-related liabilities.

Related Important Terms

Debt Snowball Medical Payoff

Medical Debt often accumulates rapidly due to high-interest rates and unexpected expenses, making the Debt Snowball method effective by prioritizing smaller balances first to accelerate payoff and reduce overall liability. Health Savings Sharing plans, while helpful for managing ongoing medical expenses, may not address existing medical debt as efficiently as the Debt Snowball strategy, which systematically eliminates liabilities to improve financial stability.

Community Health Cost-Sharing

Medical debt can create significant personal liability, often leading to financial instability and credit damage, whereas health savings sharing in community health cost-sharing programs distributes medical expenses among members, effectively reducing individual financial burdens. These cooperative models promote transparency and collective responsibility, minimizing the risk of overwhelming debt by leveraging pooled resources to cover healthcare costs.

Catastrophic Medical Sharing

Catastrophic Medical Sharing plans offer a specialized approach to managing liability by covering high-cost medical expenses that exceed typical Medical Debt, reducing personal financial risk in emergencies. These plans promote shared financial responsibility among members, enabling effective mitigation of catastrophic health-related liabilities compared to conventional Health Savings Accounts, which primarily address routine medical costs.

Medical Debt Negotiators

Medical debt negotiators specialize in reducing or eliminating outstanding medical liabilities, leveraging negotiation strategies to lower balances and protect credit scores. Compared to health savings sharing plans, which distribute costs among participants, negotiators directly address existing debts, providing tailored settlements that minimize financial liability for individuals burdened by medical expenses.

Direct Primary Care Liability

Direct Primary Care (DPC) reduces medical debt liability by providing transparent, fixed monthly fees that cover most primary care services, minimizing unexpected out-of-pocket expenses. Health Savings Sharing arrangements offer a supplementary approach to managing liability by pooling funds for medical costs, but DPC directly mitigates financial risk through predictable care access.

HSA-Compatible Sharing

HSA-compatible health savings sharing plans provide a flexible, tax-advantaged way to manage medical debt, allowing individuals to contribute pre-tax funds toward eligible medical expenses while minimizing out-of-pocket liability. These plans integrate seamlessly with Health Savings Accounts, enhancing financial preparedness and reducing overall medical debt risk by leveraging shared contributions within a trusted community framework.

Medical Bill Crowdfunding

Medical debt often leads to significant financial liability for individuals, prompting many to turn to medical bill crowdfunding as an alternative solution for managing these expenses. Health savings sharing minimizes personal liability by pooling resources among community members, reducing reliance on debt and promoting collective support.

Out-of-Pocket Protection Plans

Out-of-pocket protection plans reduce medical debt by capping patient expenses through health savings sharing accounts, allowing members to pool resources for eligible medical costs while minimizing personal financial liability. These plans offer a structured alternative to traditional insurance by providing predictable liability limits and fostering community-funded support for unexpected healthcare expenses.

Medical Bankruptcy Mitigation

Medical debt significantly contributes to personal liability and is a leading cause of medical bankruptcy; Health Savings Sharing (HSS) plans mitigate this risk by pooling community funds to cover medical expenses, reducing individual financial burden. By leveraging HSS, individuals can avoid high-interest medical loans and minimize liability exposure, enhancing financial stability during healthcare emergencies.

Telehealth Liability Pools

Medical debt can significantly increase an individual's financial liability, whereas Health Savings Sharing plans reduce out-of-pocket expenses by pooling resources to cover telehealth services. Telehealth liability pools mitigate risks by distributing responsibility among participants, enhancing access to affordable virtual care while minimizing personal financial burden.

Medical Debt vs Health Savings Sharing for Liability Infographic

moneydiff.com

moneydiff.com