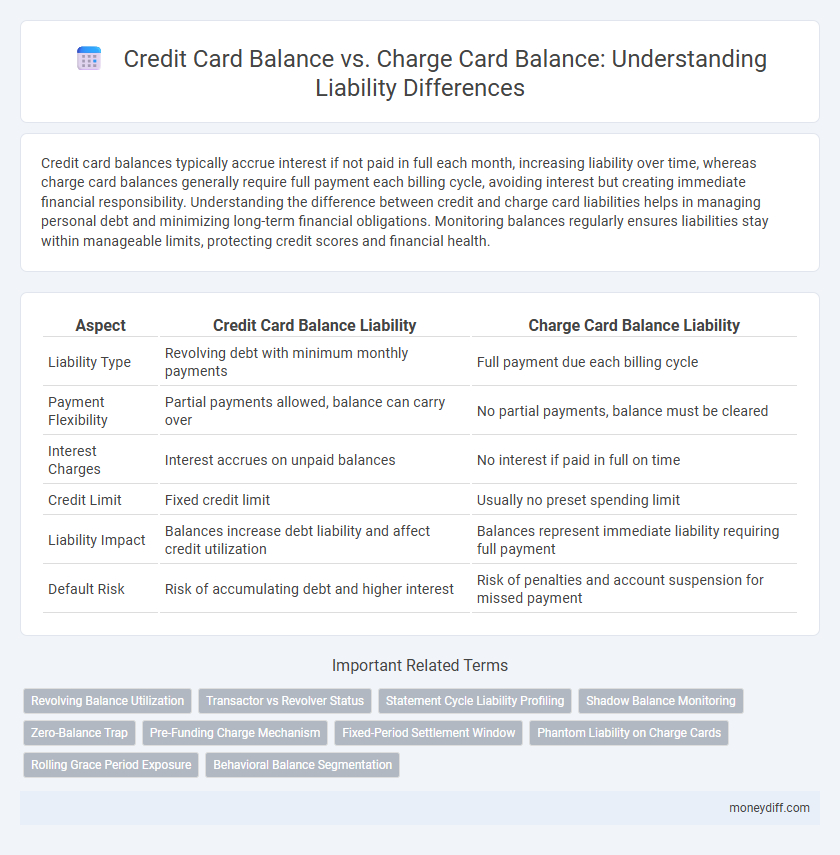

Credit card balances typically accrue interest if not paid in full each month, increasing liability over time, whereas charge card balances generally require full payment each billing cycle, avoiding interest but creating immediate financial responsibility. Understanding the difference between credit and charge card liabilities helps in managing personal debt and minimizing long-term financial obligations. Monitoring balances regularly ensures liabilities stay within manageable limits, protecting credit scores and financial health.

Table of Comparison

| Aspect | Credit Card Balance Liability | Charge Card Balance Liability |

|---|---|---|

| Liability Type | Revolving debt with minimum monthly payments | Full payment due each billing cycle |

| Payment Flexibility | Partial payments allowed, balance can carry over | No partial payments, balance must be cleared |

| Interest Charges | Interest accrues on unpaid balances | No interest if paid in full on time |

| Credit Limit | Fixed credit limit | Usually no preset spending limit |

| Liability Impact | Balances increase debt liability and affect credit utilization | Balances represent immediate liability requiring full payment |

| Default Risk | Risk of accumulating debt and higher interest | Risk of penalties and account suspension for missed payment |

Understanding Liability: Credit Card vs Charge Card Balances

Credit card balances create ongoing liability as they reflect borrowed funds to be repaid over time with interest, while charge card balances require full payment each billing cycle, eliminating revolving debt but still representing a current obligation. Managing credit card liabilities involves careful tracking of minimum payments to avoid penalties and interest accumulation, contrasting with charge cards that enforce immediate settlement, reducing long-term debt risk. Understanding these differences is crucial for accurate liability assessment and effective financial planning.

Key Differences in Liability: Credit vs Charge Cards

Credit card balances carry revolving liabilities with minimum payment requirements and accrue interest on unpaid amounts, increasing overall debt risk. Charge card balances must be paid in full each billing cycle, eliminating revolving debt but imposing strict full-payment liability. The key difference lies in the liability structure: credit cards allow partial payments with interest, whereas charge cards require full settlement, impacting borrower's financial obligations and credit risk management.

How Credit Card Balances Impact Your Financial Risk

Credit card balances directly increase your financial liability by accumulating interest charges when unpaid, which can escalate your overall debt burden and risk of default. Larger credit card balances negatively impact your credit utilization ratio, lowering your credit score and limiting access to future credit. Charge card balances, typically requiring full monthly payment, minimize long-term liability but demand disciplined cash flow management to avoid penalties and fees.

Charge Card Balances: Unique Liability Considerations

Charge card balances differ from credit card liabilities as they typically require full payment each billing cycle, preventing revolving debt and minimizing interest accumulation. The unique liability consideration lies in the immediate payment obligation, which impacts cash flow management and increases short-term financial liability. Unlike credit cards that carry a balance over time, charge card balances demand precise budgeting to avoid penalties and maintain credit standing.

Payment Flexibility and Liability: Credit vs Charge Cards

Credit card balances offer greater payment flexibility by allowing users to carry a revolving balance with minimum monthly payments, creating ongoing liability until fully paid. Charge card balances require full payment each billing cycle, eliminating long-term liability but increasing immediate financial responsibility. The fundamental difference in liability between credit and charge cards hinges on payment options: credit cards extend liability over time, while charge cards enforce complete settlement promptly.

Interest Accrual and Liability Risks in Credit vs Charge Cards

Credit card balances accrue interest daily on outstanding amounts, increasing liability risk if not paid in full each billing cycle, whereas charge card balances typically require full payment monthly with no interest but may involve significant penalties for late payment. The revolving nature of credit cards can lead to compounding interest, escalating debt and financial liability over time. Charge cards, while less prone to ongoing interest, pose risks related to high immediate payment demands and potential credit limit restrictions impacting cash flow management.

Credit Utilization and Its Effect on Liability

Credit card balance directly impacts credit utilization ratio, a key factor influencing overall liability and credit score; higher utilization increases perceived risk, raising liability costs. Charge card balances, typically requiring full payment monthly, do not contribute to credit utilization, thereby minimizing their effect on liability. Maintaining a low credit card balance is essential for optimizing credit utilization and managing liability effectively.

Late Payments: Liability Implications for Each Card Type

Late payments on credit card balances accrue interest and may incur penalty fees, increasing the cardholder's overall liability and impacting credit scores. Charge card balances generally require full payment each billing cycle, so late payments can result in immediate liability through hefty fees and potential suspension of spending privileges. The key liability difference lies in credit cards allowing revolving balances with interest, whereas charge cards demand prompt settlement, elevating the risk and financial consequence of late payments.

Managing Liability: Strategies for Credit and Charge Card Balances

Managing liability for credit card balances requires monitoring interest rates and payment schedules to avoid accumulating high debt and impacting credit scores. Charge card balances often demand full monthly payments, minimizing interest but necessitating careful cash flow management to prevent financial strain. Employing timely payments and balance tracking tools helps optimize liability control and maintain fiscal health.

Choosing the Right Card for Lower Liability Exposure

Credit card balances often carry revolving debt with interest, increasing financial liability, while charge card balances require full payment each billing cycle, reducing ongoing liability risk. Choosing a charge card minimizes prolonged financial exposure by mandating complete settlement, making it ideal for managing liability. Understanding the differences in payment terms between credit and charge cards is essential for optimizing debt liability and maintaining control over financial obligations.

Related Important Terms

Revolving Balance Utilization

Credit card balance liability involves revolving balance utilization where the outstanding amount is carried over monthly, accruing interest based on the revolving credit limit. Charge card balance liability typically requires full payment each billing cycle, resulting in no revolving balance or associated interest charges.

Transactor vs Revolver Status

Credit card balance liability differs significantly between transactors, who pay off their full balance monthly avoiding interest charges, and revolvers, who carry a balance and incur interest, increasing financial risk. Charge card users typically have no preset spending limit but must pay the full balance each month, minimizing liability exposure compared to credit card revolvers.

Statement Cycle Liability Profiling

Credit card balance liability reflects the outstanding amount owed within a specific statement cycle, typically accruing interest if not paid in full by the due date, while charge card balance liability requires full payment each cycle, minimizing carryover debt risk. Statement cycle liability profiling identifies differences in repayment behavior and financial obligations by analyzing balance trends, payment patterns, and credit utilization for accurate risk assessment.

Shadow Balance Monitoring

Credit card balance liability arises from revolving credit with interest applied to carried balances, whereas charge card balance liability requires full payment each cycle, eliminating rolling debt concerns. Shadow balance monitoring tracks unposted or pending transactions to provide accurate liability exposure before statement issuance.

Zero-Balance Trap

Credit card balances often carry interest and compound liability if not paid in full each billing cycle, whereas charge card balances typically require full payment monthly to avoid penalties, reducing the risk of accumulating debt. The zero-balance trap occurs when cardholders believe maintaining a zero balance on a credit card minimizes liability, yet repeated partial payments can still accrue interest, increasing overall financial responsibility.

Pre-Funding Charge Mechanism

Credit card balances represent revolving liabilities with payments made post-purchase, whereas charge card balances require full payment in a pre-funding charge mechanism, reflecting immediate liability settlement. This pre-funding process minimizes outstanding debt risk and ensures that charge card transactions are fully funded before completion.

Fixed-Period Settlement Window

Credit card balances typically involve revolving credit with a flexible repayment schedule, while charge card balances require full payment within a fixed-period settlement window, often 30 days, minimizing liability exposure risk. The fixed settlement window of charge cards enforces stricter financial discipline, reducing outstanding liabilities and potential interest accumulation compared to credit cards.

Phantom Liability on Charge Cards

Credit card balances represent actual debt owed, whereas charge card balances often involve phantom liability because users must pay the full amount each cycle, yet expenses may not immediately appear on statements, creating a misleading sense of available credit. This phantom liability can obscure true financial obligations, increasing risk for both cardholders and creditors by masking outstanding spend not yet billed.

Rolling Grace Period Exposure

Credit card balances accrue liability through interest charges if not paid within the rolling grace period, increasing consumer financial risk and lender exposure. In contrast, charge card balances typically require full payment each cycle, minimizing rolling grace period exposure and reducing borrower liability.

Behavioral Balance Segmentation

Credit card balance segmentation highlights revolving debt behavior, showing users who carry monthly balances and incur interest charges, increasing their financial liability; charge card balance segmentation reflects users who pay in full monthly, minimizing carryover debt but potentially indicating higher spending commitments. Understanding behavioral balance patterns allows lenders to assess liability risks accurately and tailor credit risk management strategies accordingly.

Credit Card Balance vs Charge Card Balance for liability. Infographic

moneydiff.com

moneydiff.com