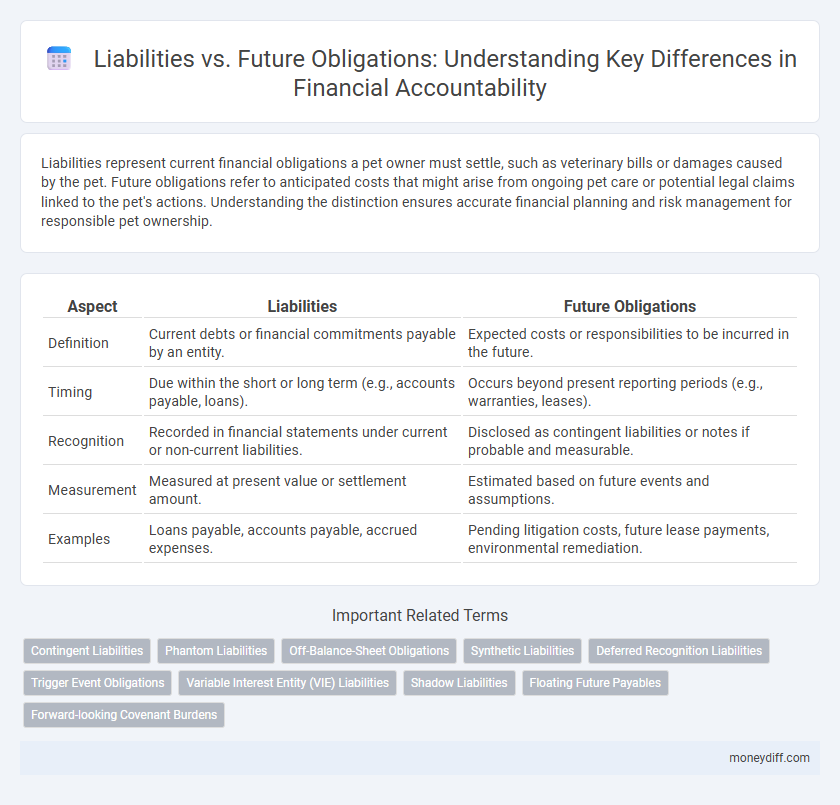

Liabilities represent current financial obligations a pet owner must settle, such as veterinary bills or damages caused by the pet. Future obligations refer to anticipated costs that might arise from ongoing pet care or potential legal claims linked to the pet's actions. Understanding the distinction ensures accurate financial planning and risk management for responsible pet ownership.

Table of Comparison

| Aspect | Liabilities | Future Obligations |

|---|---|---|

| Definition | Current debts or financial commitments payable by an entity. | Expected costs or responsibilities to be incurred in the future. |

| Timing | Due within the short or long term (e.g., accounts payable, loans). | Occurs beyond present reporting periods (e.g., warranties, leases). |

| Recognition | Recorded in financial statements under current or non-current liabilities. | Disclosed as contingent liabilities or notes if probable and measurable. |

| Measurement | Measured at present value or settlement amount. | Estimated based on future events and assumptions. |

| Examples | Loans payable, accounts payable, accrued expenses. | Pending litigation costs, future lease payments, environmental remediation. |

Understanding Liabilities: Definition and Types

Liabilities represent present obligations arising from past transactions that require future economic sacrifices, whereas future obligations may include contingent or potential commitments not yet recognized on the balance sheet. Understanding liabilities involves distinguishing between current liabilities, such as accounts payable and accrued expenses, and long-term liabilities, including bonds payable and lease obligations. Accurate classification helps stakeholders assess an entity's financial health and its ability to meet both immediate and long-term financial responsibilities.

Future Obligations: What They Mean in Money Management

Future obligations represent financial commitments that a business or individual is expected to fulfill beyond current liabilities, typically involving expenses such as loans, leases, or contract payments scheduled for future dates. These obligations impact money management by requiring careful planning to ensure sufficient liquidity and cash flow to meet upcoming payments without jeopardizing financial stability. Properly forecasting and accounting for future obligations allows for better budgeting, risk assessment, and overall financial health maintenance.

Key Differences Between Current Liabilities and Future Obligations

Current liabilities represent financial obligations a company must settle within one year, such as accounts payable, short-term loans, and accrued expenses, directly affecting working capital management. Future obligations, often long-term liabilities, include debts like bonds payable, lease commitments, and pension liabilities, typically extending beyond a year and impacting long-term financial planning. Understanding these distinctions is crucial for accurate balance sheet analysis and assessing a company's liquidity versus solvency positions.

How Liabilities Impact Financial Health

Liabilities represent current legal debts or financial obligations that a company must settle, directly affecting its liquidity and solvency ratios. Future obligations, while not immediate liabilities, indicate potential financial commitments that could influence long-term financial planning and risk assessment. Managing both liabilities and future obligations is crucial for maintaining a balanced capital structure and ensuring sustainable financial health.

Recognizing Hidden Future Obligations

Liabilities represent current obligations recognized on the balance sheet, while future obligations often remain hidden and unrecorded until they become enforceable. Identifying and quantifying hidden future obligations, such as contingent liabilities or unaccrued expenses, is crucial for accurate financial reporting and risk assessment. Comprehensive disclosure of these potential liabilities ensures transparency and helps stakeholders anticipate the financial impact of possible future claims or commitments.

Strategies for Managing and Prioritizing Liabilities

Effective management of liabilities involves distinguishing between current obligations and future liabilities to allocate resources efficiently and mitigate financial risk. Prioritizing high-interest debts and legally binding commitments ensures timely compliance and reduces potential penalties, while developing a comprehensive cash flow forecast supports strategic planning for anticipated future obligations. Implementing robust monitoring systems and regularly reassessing liability priorities helps maintain financial stability and enhances decision-making accuracy.

Planning for Future Obligations: Tools and Techniques

Planning for future obligations requires accurate forecasting methods, such as scenario analysis and probabilistic modeling, to estimate potential liabilities effectively. Utilizing accounting standards like IFRS and GAAP ensures proper recognition and measurement of these obligations, aiding in transparent financial reporting. Employing risk management tools, including contingency reserves and hedging strategies, safeguards against unforeseen liabilities and strengthens overall financial stability.

The Role of Liabilities in Personal vs. Business Finance

Liabilities represent current financial obligations that must be settled, while future obligations refer to potential debts that may arise based on contractual or regulatory conditions. In personal finance, liabilities often include mortgages, credit card debts, and personal loans, directly impacting credit scores and net worth. Business finance categorizes liabilities as current or long-term, influencing cash flow management, investment capacity, and overall financial health in strategic decision-making.

Liability Reduction: Steps to Minimize Future Risk

Effective liability reduction centers on identifying and managing current liabilities to prevent the escalation of future obligations. Implementing rigorous financial controls, conducting regular risk assessments, and maintaining compliance with legal standards significantly minimize exposure to unforeseen liabilities. Strategic planning and proactive debt management serve as key steps to safeguard against potential financial risks and enhance organizational stability.

Monitoring and Forecasting Future Obligations for Stability

Monitoring and forecasting future obligations is crucial for maintaining financial stability by accurately predicting upcoming liabilities and ensuring sufficient resource allocation. Utilizing advanced analytics and real-time data tracking enables organizations to identify potential risks and adjust strategies proactively. This approach enhances the ability to meet obligations on time, reducing the risk of default and improving overall financial health.

Related Important Terms

Contingent Liabilities

Contingent liabilities represent potential obligations that depend on the outcome of uncertain future events, distinguishing them from future obligations which are legally binding and quantifiable commitments. Accounting standards like IFRS and GAAP require contingent liabilities to be disclosed in financial statements when the loss is probable and can be reasonably estimated, highlighting their significance in risk assessment and financial transparency.

Phantom Liabilities

Phantom liabilities represent contingent obligations not yet recognized on the balance sheet but with potential future financial impact, contrasting with future obligations that are explicitly anticipated and accounted for. Understanding phantom liabilities is crucial for accurate risk assessment and financial planning within corporate accounting frameworks.

Off-Balance-Sheet Obligations

Off-balance-sheet obligations represent liabilities not recorded on the balance sheet, such as operating leases, contingent liabilities, and certain guarantees, which can significantly impact a company's future financial commitments and risk profile. These future obligations require careful disclosure and analysis to assess their potential effect on cash flow, solvency, and overall financial health beyond reported liabilities.

Synthetic Liabilities

Synthetic liabilities represent contingent obligations arising from derivative contracts or structured financial products, differing from traditional liabilities that reflect present, recorded debts. Unlike future obligations, which denote anticipated outflows based on contractual agreements, synthetic liabilities incorporate market risk and valuation adjustments, affecting balance sheet assessment and risk management strategies.

Deferred Recognition Liabilities

Deferred recognition liabilities represent obligations recognized on the balance sheet before the associated expense or revenue is realized, distinguishing them from future obligations that are anticipated but not yet recorded. These liabilities ensure accurate matching of revenues and expenses by deferring recognition until the relevant economic events occur, enhancing the precision of financial reporting.

Trigger Event Obligations

Trigger event obligations arise when specific conditions or contractual terms activate a liability, distinguishing them from future obligations that depend on anticipated events without a definitive trigger. Precise recognition of trigger event obligations is crucial for accurate financial reporting and risk assessment under liability management frameworks.

Variable Interest Entity (VIE) Liabilities

Liabilities represent present financial obligations recognized on the balance sheet, while future obligations pertain to potential commitments contingent on specific events, often not recorded until realized. Variable Interest Entity (VIE) liabilities involve entities where the primary beneficiary consolidates the VIE's assets and liabilities based on economic risks and rewards, requiring careful evaluation of control and exposure to variable interests under ASC 810.

Shadow Liabilities

Shadow liabilities represent potential future obligations not yet recognized on the balance sheet but may arise from contingent events, legal claims, or unresolved disputes. These hidden exposures can significantly impact a company's financial health and risk assessment, emphasizing the need for thorough due diligence and proactive monitoring beyond recorded liabilities.

Floating Future Payables

Floating future payables represent liabilities that vary in amount and timing, often linked to variable interest rates or contingent events, distinguishing them from fixed future obligations with predetermined values. Accurate accounting for floating future payables is critical to managing liquidity risk and ensuring precise financial statement representation under liabilities.

Forward-looking Covenant Burdens

Forward-looking covenant burdens represent future obligations embedded in liability agreements that require ongoing compliance with specific financial or operational conditions, impacting a company's risk profile and creditworthiness. These covenant burdens differ from traditional liabilities by imposing conditional constraints contingent on future performance, which can trigger additional liabilities or restrict financial flexibility if violated.

Liabilities vs Future Obligations for liability. Infographic

moneydiff.com

moneydiff.com