Liabilities represent traditional debt obligations that require repayment with interest, impacting cash flow and financial stability. Tokenized liabilities transform these obligations into digital assets on a blockchain, enabling increased transparency, fractional ownership, and faster settlement processes. This innovation enhances money management by providing more flexible, secure, and efficient ways to track and transfer debt.

Table of Comparison

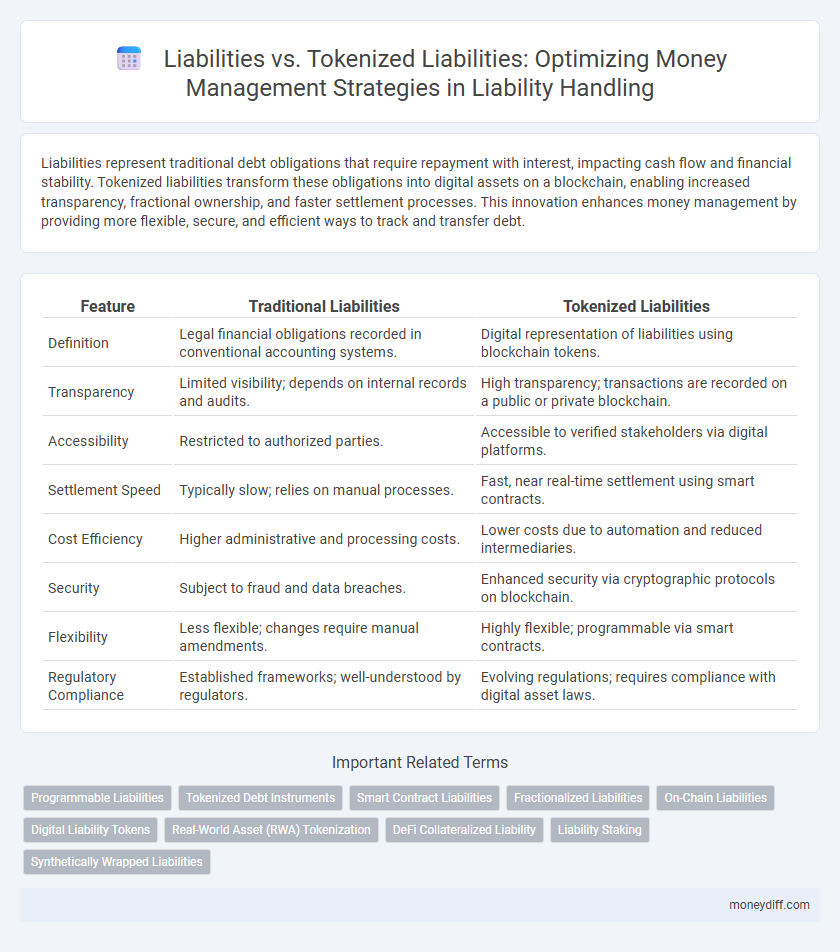

| Feature | Traditional Liabilities | Tokenized Liabilities |

|---|---|---|

| Definition | Legal financial obligations recorded in conventional accounting systems. | Digital representation of liabilities using blockchain tokens. |

| Transparency | Limited visibility; depends on internal records and audits. | High transparency; transactions are recorded on a public or private blockchain. |

| Accessibility | Restricted to authorized parties. | Accessible to verified stakeholders via digital platforms. |

| Settlement Speed | Typically slow; relies on manual processes. | Fast, near real-time settlement using smart contracts. |

| Cost Efficiency | Higher administrative and processing costs. | Lower costs due to automation and reduced intermediaries. |

| Security | Subject to fraud and data breaches. | Enhanced security via cryptographic protocols on blockchain. |

| Flexibility | Less flexible; changes require manual amendments. | Highly flexible; programmable via smart contracts. |

| Regulatory Compliance | Established frameworks; well-understood by regulators. | Evolving regulations; requires compliance with digital asset laws. |

Understanding Traditional Liabilities in Money Management

Traditional liabilities in money management represent financial obligations such as loans, accounts payable, and accrued expenses recorded on a company's balance sheet. These liabilities require scheduled payments and impact cash flow, influencing creditworthiness and financial stability. Accurate tracking and management of traditional liabilities are essential for maintaining liquidity and ensuring timely debt servicing.

What Are Tokenized Liabilities?

Tokenized liabilities represent financial obligations converted into digital tokens on a blockchain, enabling transparent, efficient tracking and transferability. Unlike traditional liabilities, tokenized liabilities offer enhanced liquidity and programmable automation through smart contracts, reducing operational friction and settlement times. This innovation transforms money management by providing real-time insights and increased accessibility to complex liability structures.

Key Differences: Liabilities vs Tokenized Liabilities

Liabilities represent traditional financial obligations recorded on balance sheets, involving tangible assets and contractual duties, while tokenized liabilities convert these obligations into digital tokens on blockchain platforms, enabling enhanced transparency and liquidity. Tokenized liabilities offer fractional ownership, streamlined transfers, and automated compliance through smart contracts, reducing settlement times and operational risks compared to conventional liabilities. This digitization transforms asset management by providing real-time tracking, increased access to secondary markets, and improved capital efficiency for financial institutions.

Advantages of Tokenized Liabilities for Investors

Tokenized liabilities offer enhanced transparency and liquidity compared to traditional liabilities, allowing investors to trade fractional ownership on blockchain platforms efficiently. These digital assets reduce settlement times and costs through automated smart contracts, increasing accessibility and market responsiveness. Investors benefit from improved risk management and portfolio diversification due to the programmable and verifiable nature of tokenized liabilities.

Risks and Challenges of Tokenized Liabilities

Tokenized liabilities introduce risks such as smart contract vulnerabilities, regulatory uncertainty, and challenges in valuation due to market volatility. The immutable nature of blockchain can complicate dispute resolution and increase exposure to cyber-attacks. Traditional liabilities benefit from established legal frameworks, whereas tokenized liabilities require robust governance to mitigate operational and compliance risks.

Impact on Financial Transparency and Auditing

Tokenized liabilities enhance financial transparency by providing immutable, real-time records of obligations on distributed ledger technology, facilitating accurate auditing and reducing discrepancies found in traditional liability management. The digitization of liabilities allows auditors to verify transactions instantly through cryptographic proofs, improving audit efficiency and reliability. This shift contributes to more transparent financial reporting, mitigating risks of misstatement and improving stakeholder trust in money management practices.

Regulatory Considerations for Tokenized Liabilities

Regulatory considerations for tokenized liabilities focus on compliance with securities laws, anti-money laundering (AML) regulations, and Know Your Customer (KYC) requirements to prevent fraud and ensure transparency. Jurisdictions may classify tokenized liabilities as digital securities, requiring adherence to specific registration and reporting standards under financial regulatory authorities like the SEC or FCA. The evolving regulatory landscape necessitates continuous monitoring and adaptation to maintain legal conformity while leveraging the efficiency of blockchain technology in money management.

Real-World Use Cases of Tokenized Liabilities

Tokenized liabilities enable more transparent and efficient management of debts by leveraging blockchain technology, allowing real-time tracking and automated settlement of financial obligations. In supply chain financing, tokenized liabilities facilitate faster and more secure credit issuance, reducing counterparty risk and enhancing liquidity for businesses. Real estate and loans also benefit from tokenized liabilities, as they streamline asset-backed borrowing processes and enable fractional ownership that improves access to capital markets.

Integration with Existing Money Management Systems

Tokenized liabilities enable seamless integration with existing money management systems by leveraging blockchain technology, enhancing transparency and real-time tracking of debt obligations. Traditional liabilities often rely on manual reconciliation and periodic updates, causing inefficiencies and risks of errors. Utilizing tokenized liabilities facilitates automated processes, interoperability with financial software, and improved liquidity management for businesses.

Future Trends: The Evolution of Liabilities through Tokenization

The evolution of liabilities through tokenization is set to revolutionize money management by enabling real-time tracking, fractional ownership, and enhanced liquidity of debt instruments. Tokenized liabilities leverage blockchain technology to provide transparent, immutable records, reducing counterparty risk and streamlining regulatory compliance. Future trends indicate widespread adoption of tokenized liabilities in corporate finance, enhancing capital efficiency and unlocking new avenues for decentralized borrowing and lending.

Related Important Terms

Programmable Liabilities

Programmable liabilities enable dynamic automation of debt terms, interest calculations, and repayment schedules on blockchain platforms, enhancing transparency and reducing administrative costs compared to traditional liabilities. This innovation in money management allows for real-time tracking, conditional payments, and seamless integration with decentralized finance (DeFi) protocols, optimizing financial operations and risk mitigation.

Tokenized Debt Instruments

Tokenized debt instruments transform traditional liabilities into digital assets on blockchain platforms, enabling enhanced transparency, liquidity, and fractional ownership for more efficient money management. This digital representation streamlines debt issuance, trading, and settlement processes while reducing counterparty risk and operational costs compared to conventional liabilities.

Smart Contract Liabilities

Smart Contract Liabilities revolutionize traditional liabilities by automating obligations and settlements through blockchain technology, ensuring transparency, security, and immutability in money management. Unlike conventional liabilities, tokenized liabilities enable fractional ownership, real-time tracking, and reduced counterparty risk, enhancing efficiency and trust in financial ecosystems.

Fractionalized Liabilities

Fractionalized liabilities enable precise ownership division of financial obligations through tokenization, enhancing transparency and liquidity compared to traditional liabilities. This innovation allows investors to manage risk more effectively by holding smaller, easily transferable portions of debt within blockchain-based ecosystems.

On-Chain Liabilities

On-chain liabilities provide transparent, immutable records of obligations secured by blockchain technology, enhancing trust and reducing disputes compared to traditional liabilities held off-chain. Tokenized liabilities enable fractional ownership and streamlined trading of debt instruments, improving liquidity and accessibility in money management.

Digital Liability Tokens

Digital Liability Tokens represent a transformative approach to traditional liabilities by enabling transparent, programmable, and easily transferable debt instruments on blockchain networks. Unlike conventional liabilities, these tokenized assets improve liquidity, reduce settlement times, and enhance accuracy in money management through automated smart contracts.

Real-World Asset (RWA) Tokenization

Liabilities represent financial obligations that a company must settle, traditionally recorded as debts or payables on balance sheets, while tokenized liabilities leverage blockchain technology to digitize these obligations, enhancing transparency and liquidity. Real-World Asset (RWA) tokenization transforms physical assets into digital tokens, enabling programmable liabilities that facilitate automated repayments, fractional ownership, and streamlined collateral management in money management systems.

DeFi Collateralized Liability

DeFi collateralized liabilities leverage blockchain technology to create transparent, programmable debt instruments secured by digital assets, enhancing liquidity and risk management compared to traditional liabilities. Tokenized liabilities enable fractional ownership and seamless transferability, providing efficient capital allocation and improved trustless enforcement in decentralized finance ecosystems.

Liability Staking

Liabilities in traditional finance represent obligations owed by an entity, whereas tokenized liabilities leverage blockchain technology to create digital tokens representing debt, enhancing transparency and liquidity. Liability staking allows holders to lock tokenized liabilities in decentralized finance (DeFi) protocols, generating yields while securing the underlying debt, optimizing money management by combining liability obligation with income generation.

Synthetically Wrapped Liabilities

Synthetically wrapped liabilities enable more flexible money management by transforming traditional liabilities into blockchain-based tokens that can be traded or collateralized, providing enhanced liquidity and transparency. This tokenization reduces friction in asset transfer and facilitates real-time settlement, distinguishing it from conventional liabilities bound by rigid, off-chain constraints.

Liabilities vs Tokenized Liabilities for money management. Infographic

moneydiff.com

moneydiff.com