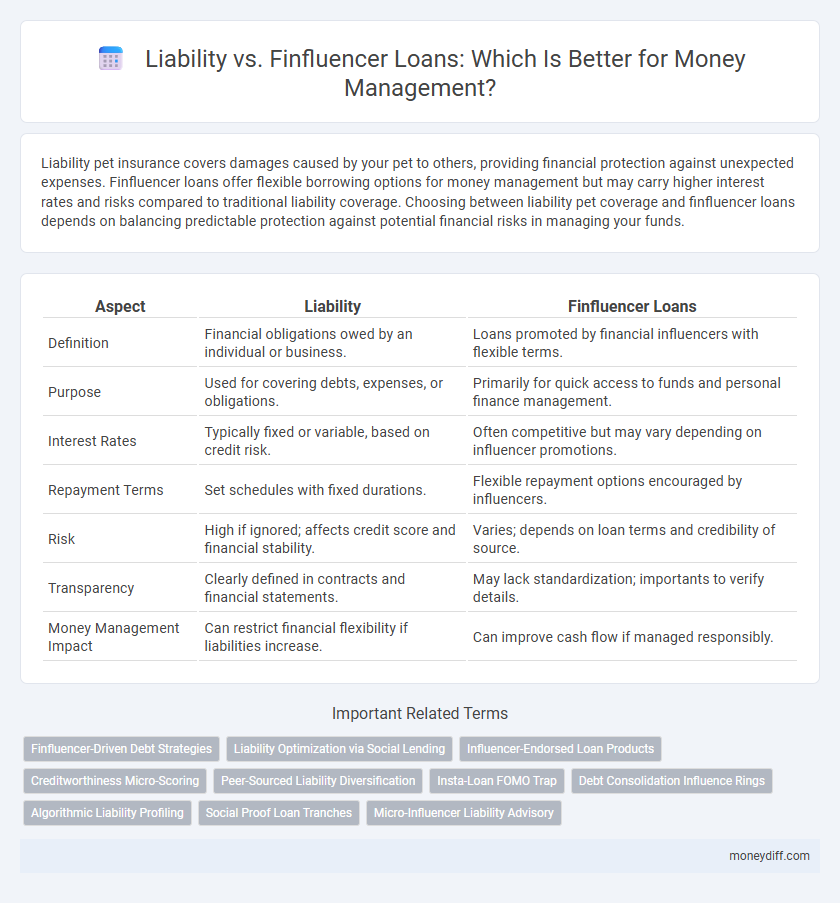

Liability pet insurance covers damages caused by your pet to others, providing financial protection against unexpected expenses. Finfluencer loans offer flexible borrowing options for money management but may carry higher interest rates and risks compared to traditional liability coverage. Choosing between liability pet coverage and finfluencer loans depends on balancing predictable protection against potential financial risks in managing your funds.

Table of Comparison

| Aspect | Liability | Finfluencer Loans |

|---|---|---|

| Definition | Financial obligations owed by an individual or business. | Loans promoted by financial influencers with flexible terms. |

| Purpose | Used for covering debts, expenses, or obligations. | Primarily for quick access to funds and personal finance management. |

| Interest Rates | Typically fixed or variable, based on credit risk. | Often competitive but may vary depending on influencer promotions. |

| Repayment Terms | Set schedules with fixed durations. | Flexible repayment options encouraged by influencers. |

| Risk | High if ignored; affects credit score and financial stability. | Varies; depends on loan terms and credibility of source. |

| Transparency | Clearly defined in contracts and financial statements. | May lack standardization; importants to verify details. |

| Money Management Impact | Can restrict financial flexibility if liabilities increase. | Can improve cash flow if managed responsibly. |

Understanding Liability in Money Management

Liability in money management refers to financial obligations or debts that an individual or entity is responsible for, impacting overall net worth and credit health. Unlike finfluencer loans, which may offer quick borrowing options but often come with higher interest rates and less regulatory oversight, traditional liabilities require structured repayment and affect long-term financial stability. Proper understanding and management of liabilities are crucial for maintaining healthy cash flow and avoiding potential financial pitfalls.

Who Are Finfluencers and What Are Finfluencer Loans?

Finfluencers are social media personalities who provide financial advice, often influencing followers' money management decisions through platforms like Instagram and TikTok. Finfluencer loans refer to lending products that these influencers promote, frequently targeting young audiences with quick approval and flexible repayment terms. These loans can increase liability for borrowers who may not fully understand the associated risks or the implications of accruing high-interest debt.

Key Differences: Liability vs Finfluencer Loans

Liability refers to an individual's or organization's legal financial obligations, recorded on balance sheets as debts or duties payable. Finfluencer loans, promoted by financial influencers on social media platforms, often involve unconventional lending terms and may lack regulatory oversight compared to traditional liabilities. The key differences lie in the formal recognition and regulation of liabilities versus the informal, often promotional nature of finfluencer loans, influencing risk assessment and money management strategies.

Risks Associated with Personal Liability

Personal liability in money management exposes individuals to the risk of having to repay loans out of their own assets if the borrower defaults, unlike many Finfluencer loans that often use non-recourse terms limiting personal responsibility. Misunderstanding the extent of liability can lead to significant financial loss and credit damage, especially when personal guarantees are involved. Assessing the risk profile of each loan type is crucial to avoid unexpected personal financial obligations.

The Appeal of Finfluencer Loans Explained

Finfluencer loans attract borrowers by offering quick access to funds through social media platforms, bypassing traditional banking channels and complex credit assessments. These loans often come with flexible repayment options tailored to the digital audience, enhancing convenience and perceived control over finances. However, the lack of regulatory oversight can increase liability risks, making borrowers vulnerable to unclear terms and potential financial mismanagement.

Financial Responsibility: Assessing Your Options

Evaluating liability in the context of Finfluencer loans requires careful analysis of repayment terms and interest rates compared to traditional financial obligations. Understanding the risk exposure and potential impact on credit scores is crucial for responsible money management. Thoroughly assessing fees, lender credibility, and personal financial capacity helps ensure informed decisions that minimize long-term liabilities.

Impact on Credit Score: Liability vs Finfluencer Loans

Liability from traditional loans often results in timely scheduled payments that positively impact credit scores through consistent credit history building. Finfluencer loans, while innovative, may lack stringent reporting to credit bureaus, potentially limiting their effectiveness in improving credit ratings. Understanding the credit reporting practices of each loan type is crucial for effective money management and optimal credit score enhancement.

Common Misconceptions about Finfluencer Loans

Finfluencer loans are often misunderstood as easy financial solutions without risks, but they carry significant liability due to high interest rates and lack of regulatory oversight. Borrowers frequently underestimate the impact of hidden fees and aggressive repayment terms that can lead to mounting debt. Proper money management requires recognizing these liabilities and seeking transparent, regulated loan options for safer financial outcomes.

Legal and Ethical Considerations in Money Management

Liability in money management requires careful legal scrutiny, especially when comparing traditional liabilities with Finfluencer loans, which may lack regulatory oversight and pose increased risk of misinformation. Ethical considerations demand transparency and accountability, as Finfluencer loans often operate in a grey area, potentially exposing consumers to misleading claims and unjust financial burdens. Ensuring compliance with financial regulations and promoting informed decision-making are essential to mitigate liability risks in this rapidly evolving sector.

Making Smart Choices: Which Option Is Right for You?

When evaluating liability between traditional loans and Finfluencer loans, understanding interest rates, repayment terms, and risk exposure is crucial for making smart money management choices. Traditional loans often provide regulated interest rates and clearer liability boundaries, while Finfluencer loans may offer quicker access but carry higher risks and potential hidden fees. Assessing your financial stability and long-term repayment ability helps determine which loan type aligns best with responsible liability management.

Related Important Terms

Finfluencer-Driven Debt Strategies

Finfluencer-driven debt strategies often encourage leveraging loans in a way that prioritizes short-term gains but increases overall liability risk due to high-interest rates and lack of regulatory oversight. Understanding the nuances of these loans is crucial for effective money management, as misusing finfluencer advice can escalate debt burdens and financial instability.

Liability Optimization via Social Lending

Liability optimization through social lending enables borrowers to reduce interest costs and improve cash flow by leveraging peer-to-peer platforms instead of traditional Finfluencer loans, which often carry higher rates and less transparent terms. Social lending structures promote personalized credit assessment and flexible repayment options, enhancing overall financial management and decreasing the burden of excessive liabilities.

Influencer-Endorsed Loan Products

Influencer-endorsed loan products often carry higher liability risks due to aggressive marketing tactics and a lack of thorough financial vetting, increasing the likelihood of borrower default and regulatory scrutiny. Unlike traditional liability management in finance, these finfluencer loans can expose both consumers and endorsers to significant financial and legal consequences.

Creditworthiness Micro-Scoring

Creditworthiness micro-scoring leverages advanced algorithms to assess individual risk profiles more accurately than traditional liability evaluations, enhancing the precision of Finfluencer loan approvals. This granular approach enables lenders to tailor financial products based on nuanced credit data, reducing default rates and optimizing money management strategies.

Peer-Sourced Liability Diversification

Peer-sourced liability diversification in money management offers a strategic advantage over traditional Finfluencer loans by distributing financial risk across multiple participants rather than concentrating it in a single entity. This approach enhances credit stability and reduces default rates by leveraging community-based accountability and diversified borrower profiles.

Insta-Loan FOMO Trap

Liability in money management often increases when individuals fall into the Insta-Loan FOMO trap promoted by finfluencers, leading to impulsive borrowing with high-interest rates and unclear repayment terms. These quick loans create hidden debts that exacerbate financial strain, contrasting with responsible liability management practices emphasizing sustainable credit use and informed decision-making.

Debt Consolidation Influence Rings

Liability in money management emphasizes responsible debt consolidation, where Finfluencer loans often promote consolidating multiple debts into a single payment to reduce financial burden. Careful evaluation of Finfluencer advice is crucial, as misleading influence rings can lead to increased liabilities through high-interest loans or hidden fees.

Algorithmic Liability Profiling

Algorithmic liability profiling enhances risk assessment by analyzing borrower behavior patterns and financial history, offering more precise evaluations than traditional liability methods. Finfluencer loans leverage this profiling to tailor loan terms and improve money management strategies, reducing default rates and optimizing credit allocation.

Social Proof Loan Tranches

Liability in financial management involves obligations or debts that a borrower must repay, whereas Finfluencer loans leverage social proof loan tranches, where multiple smaller loans from social networks aggregate to form a larger, collectively endorsed liability. Social proof loan tranches enhance trust and reduce default risk by distributing risk across a community, contrasting with traditional individual liabilities.

Micro-Influencer Liability Advisory

Micro-influencer liability advisory emphasizes the importance of understanding legal obligations tied to endorsing Finfluencer loans, ensuring responsible money management and mitigating risks of misinformation claims. Effective liability strategies protect micro-influencers from potential financial and reputational damage stemming from improper loan recommendations.

Liability vs Finfluencer Loans for money management. Infographic

moneydiff.com

moneydiff.com