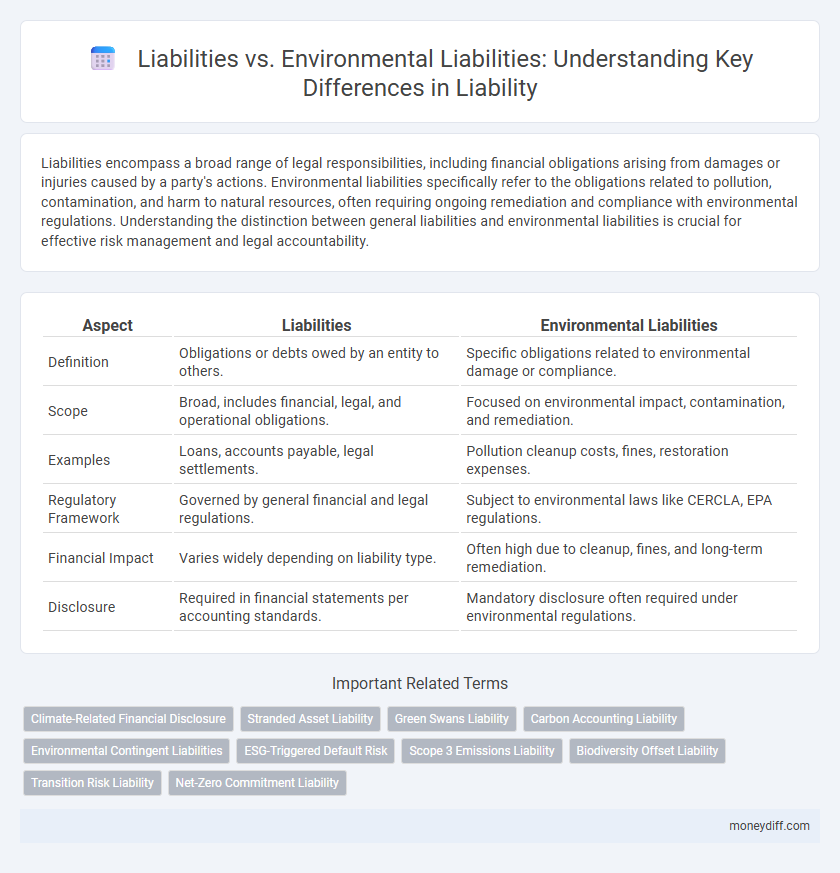

Liabilities encompass a broad range of legal responsibilities, including financial obligations arising from damages or injuries caused by a party's actions. Environmental liabilities specifically refer to the obligations related to pollution, contamination, and harm to natural resources, often requiring ongoing remediation and compliance with environmental regulations. Understanding the distinction between general liabilities and environmental liabilities is crucial for effective risk management and legal accountability.

Table of Comparison

| Aspect | Liabilities | Environmental Liabilities |

|---|---|---|

| Definition | Obligations or debts owed by an entity to others. | Specific obligations related to environmental damage or compliance. |

| Scope | Broad, includes financial, legal, and operational obligations. | Focused on environmental impact, contamination, and remediation. |

| Examples | Loans, accounts payable, legal settlements. | Pollution cleanup costs, fines, restoration expenses. |

| Regulatory Framework | Governed by general financial and legal regulations. | Subject to environmental laws like CERCLA, EPA regulations. |

| Financial Impact | Varies widely depending on liability type. | Often high due to cleanup, fines, and long-term remediation. |

| Disclosure | Required in financial statements per accounting standards. | Mandatory disclosure often required under environmental regulations. |

Understanding General Liabilities in Money Management

General liabilities encompass financial obligations arising from everyday business operations, including debts, loans, and accounts payable, directly influencing cash flow and budgeting decisions in money management. Environmental liabilities specifically pertain to costs associated with pollution cleanup, legal penalties, and compliance with environmental regulations, often representing contingent liabilities requiring careful risk assessment. Effective money management involves distinguishing these liability types to allocate resources appropriately, ensuring both operational stability and preparedness for potential environmental contingencies.

What Are Environmental Liabilities?

Environmental liabilities refer to the legal obligations and financial responsibilities a company or individual faces due to environmental damage or contamination caused by their operations. These liabilities include costs related to cleanup, remediation, fines, and damages associated with pollution, hazardous waste, and regulatory non-compliance. Unlike general liabilities, environmental liabilities specifically pertain to environmental laws and impact, requiring specialized assessment and reporting under frameworks such as the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA).

Key Differences: Liabilities vs Environmental Liabilities

Liabilities encompass general financial obligations a company must settle, including debts, loans, and legal responsibilities. Environmental liabilities specifically refer to obligations arising from environmental damage, such as cleanup costs, fines, and remediation efforts mandated by environmental laws. Key differences lie in the source and scope, where environmental liabilities are tied to ecological impact and regulatory compliance, whereas general liabilities cover a broader range of financial responsibilities.

Financial Impacts of Traditional Liabilities

Traditional liabilities, such as loans, accounts payable, and accrued expenses, directly affect a company's financial stability by increasing obligations that must be settled through future cash outflows. These liabilities impact key financial metrics including liquidity ratios and debt-to-equity ratios, influencing credit ratings and borrowing capacity. In contrast, environmental liabilities, though potentially significant, often involve contingent risks and long-term remediation costs that require specialized accounting treatment and disclosure.

Environmental Liabilities: Risks and Realities

Environmental liabilities represent a critical subset of overall liabilities, encompassing obligations arising from contamination, pollution, and regulatory non-compliance related to environmental damage. These liabilities often involve extensive costs for remediation, legal penalties, and long-term monitoring, distinguishing them from general financial or operational liabilities. Understanding the risks and realities of environmental liabilities is essential for accurate risk assessment, regulatory compliance, and sustainable business practices.

Legal Frameworks: Managing Liabilities and Environmental Liabilities

Legal frameworks governing liabilities establish clear responsibilities for financial and legal obligations arising from business operations. Environmental liabilities specifically fall under stringent regulations such as the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) and the Environmental Protection Agency (EPA) enforcement policies, which mandate remediation of contamination and impose penalties for non-compliance. Effective management of both general liabilities and environmental liabilities requires comprehensive risk assessments, ongoing compliance monitoring, and adherence to evolving statutory requirements to mitigate legal and financial exposure.

Reporting Requirements for Liabilities vs Environmental Liabilities

Reporting requirements for general liabilities often involve standardized financial disclosures under accounting standards such as GAAP or IFRS, emphasizing recognition, measurement, and presentation in financial statements. Environmental liabilities require more specialized reporting, including detailed disclosures about potential remediation costs, regulatory compliance status, and contingent liabilities related to environmental damage under frameworks like EPA regulations or IFRS IAS 37. Accurate estimation and transparent reporting of environmental liabilities are critical due to their potential impact on a company's financial health and stakeholder trust.

Best Practices for Identifying Environmental Liabilities

Effective identification of environmental liabilities requires comprehensive site assessments, including historical land use reviews and phase I and II environmental audits to detect potential contamination. Employing robust due diligence processes, such as evaluating regulatory requirements and consulting with environmental experts, ensures accurate risk assessment and compliance. Maintaining detailed documentation and continuous monitoring programs supports early detection and mitigation of environmental liabilities, reducing long-term financial and legal exposure.

Strategies for Minimizing Liabilities and Environmental Liabilities

Effective strategies for minimizing liabilities encompass thorough risk assessments, implementing comprehensive compliance programs, and maintaining clear documentation to reduce legal exposures. Specifically for environmental liabilities, proactive measures such as regular environmental audits, adopting sustainable practices, and securing environmental insurance play critical roles in mitigating potential damages and regulatory penalties. Integrating these approaches ensures robust liability management, safeguarding businesses from both general and environmental financial risks.

The Future of Liability Management: Emphasizing Environmental Risks

Liability management is increasingly prioritizing environmental liabilities due to growing regulatory pressures and the rising costs of environmental remediation, which can significantly impact corporate financial health. Advanced risk assessment tools and sustainability reporting frameworks enable companies to better identify, quantify, and mitigate environmental risks compared to traditional liabilities. Investing in proactive environmental liability strategies enhances long-term compliance, reduces potential legal exposures, and supports corporate social responsibility goals.

Related Important Terms

Climate-Related Financial Disclosure

Liabilities encompass a company's financial obligations, including debts and pending legal claims, while environmental liabilities specifically refer to costs related to environmental damage, remediation, and compliance with climate regulations. Climate-Related Financial Disclosure mandates transparent reporting of these environmental liabilities to assess risks and impacts linked to climate change on corporate financial health.

Stranded Asset Liability

Liabilities encompass all financial obligations a company owes, while environmental liabilities specifically refer to costs associated with legal or cleanup responsibilities due to environmental damage. Stranded asset liability arises when environmental regulations or market shifts render assets obsolete or financially burdensome, posing significant risks to long-term corporate valuations.

Green Swans Liability

Environmental liabilities, often categorized under Green Swans liability, represent unpredictable and high-impact risks related to ecological damage caused by business operations. Unlike general liabilities, Green Swans liability emphasizes long-term environmental harm with substantial financial and reputational consequences driven by climate change and regulatory uncertainty.

Carbon Accounting Liability

Liabilities encompass financial obligations owed by a company, while environmental liabilities specifically address obligations related to environmental regulations, penalties, or remediation costs. Carbon accounting liability quantifies greenhouse gas emissions responsibilities, translating them into financial terms to ensure compliance with regulatory frameworks and mitigate climate-related risks.

Environmental Contingent Liabilities

Environmental contingent liabilities represent potential obligations arising from environmental regulations, such as remediation costs or penalties related to pollution or hazardous waste management, differing from general liabilities which encompass broader financial obligations. These contingent liabilities require careful assessment and disclosure due to their uncertain timing and amount, significantly impacting a company's financial statements and risk management strategies.

ESG-Triggered Default Risk

Liabilities encompass all financial obligations a company owes, while environmental liabilities specifically arise from legal or regulatory actions related to environmental damage, often increasing ESG-triggered default risk due to potential fines, cleanup costs, and reputational harm. Investors assess these risks by analyzing environmental liabilities separately to gauge their impact on a company's creditworthiness and long-term financial stability.

Scope 3 Emissions Liability

Liabilities encompass all financial obligations a company owes, while environmental liabilities specifically relate to damages caused by environmental harm, including remediation costs and regulatory fines. Scope 3 emissions liability refers to indirect greenhouse gas emissions from a company's value chain, such as suppliers and product use, which increasingly expose businesses to regulatory risks and potential financial responsibilities beyond direct operations.

Biodiversity Offset Liability

Liability encompasses general legal obligations arising from various activities, while environmental liabilities specifically address damages caused to ecosystems, including contamination and habitat destruction. Biodiversity offset liability refers to the legal responsibility of entities to compensate for ecological harm by ensuring equivalent conservation outcomes, often mandated under environmental regulations to maintain or enhance biodiversity balance.

Transition Risk Liability

Transition risk liability arises from the financial obligations companies face during shifts to low-carbon economies, including compliance costs, asset write-downs, and legal claims linked to climate policies. Unlike general liabilities, environmental liabilities specifically account for remediation, cleanup, and damages caused by pollution or environmental harm, making transition risk a subset that bridges regulatory and reputational impacts within environmental liabilities.

Net-Zero Commitment Liability

Liabilities encompass financial obligations a company must settle, whereas environmental liabilities specifically refer to responsibilities related to environmental damage or compliance costs, including remediation and regulatory penalties. Net-zero commitment liability arises from the financial and operational risks companies face when accounting for emissions reduction targets, carbon offset investments, and potential non-compliance with sustainability goals.

Liabilities vs Environmental Liabilities for liability. Infographic

moneydiff.com

moneydiff.com