Liability pet owners face distinct challenges in managing financial risks, where liability protection is crucial compared to interest-free lending circles that focus on shared borrowing without formal risk coverage. Liability insurance provides legal and financial safeguards against damages or injuries caused by pets, ensuring peace of mind and financial security. Interest-free lending circles offer community-based support for short-term cash needs but lack the structured protection necessary for managing pet-related liabilities effectively.

Table of Comparison

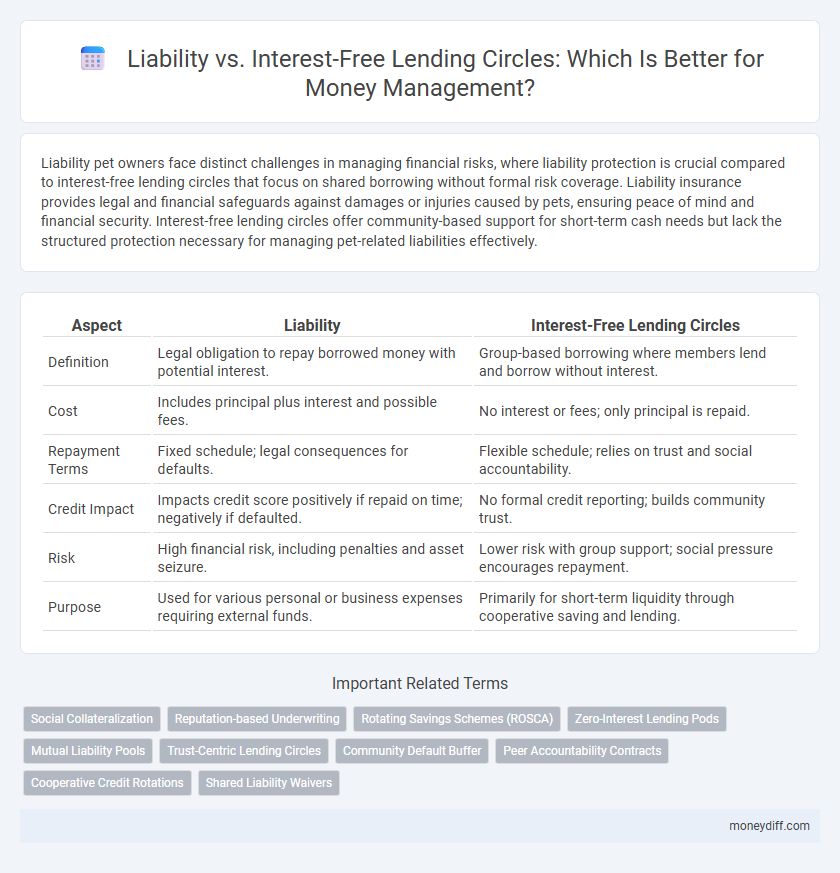

| Aspect | Liability | Interest-Free Lending Circles |

|---|---|---|

| Definition | Legal obligation to repay borrowed money with potential interest. | Group-based borrowing where members lend and borrow without interest. |

| Cost | Includes principal plus interest and possible fees. | No interest or fees; only principal is repaid. |

| Repayment Terms | Fixed schedule; legal consequences for defaults. | Flexible schedule; relies on trust and social accountability. |

| Credit Impact | Impacts credit score positively if repaid on time; negatively if defaulted. | No formal credit reporting; builds community trust. |

| Risk | High financial risk, including penalties and asset seizure. | Lower risk with group support; social pressure encourages repayment. |

| Purpose | Used for various personal or business expenses requiring external funds. | Primarily for short-term liquidity through cooperative saving and lending. |

Understanding Liability in Personal Finance

Liability in personal finance refers to the legal responsibility to repay debts or obligations, which directly impacts creditworthiness and financial stability. Unlike interest-free lending circles that foster community-based borrowing without added costs, liabilities often involve formal agreements with interest and penalties for non-payment. Understanding liabilities helps individuals manage risks, prioritize debt repayment, and maintain healthy financial standing.

What Are Interest-Free Lending Circles?

Interest-free lending circles are community-based financial groups where members contribute fixed amounts regularly to create a pooled fund, which is then lent interest-free to participants in rotation. Unlike traditional liability, these circles emphasize trust and social accountability over formal credit checks or legal obligations. This model helps individuals manage money collaboratively while avoiding debt accumulation and interest payments.

Key Differences Between Liability and Lending Circles

Liability in financial contexts represents a legal responsibility to repay borrowed money or fulfill contractual obligations, often accompanied by interest and formal credit risk. Interest-free lending circles operate as informal, community-based groups where members contribute and borrow funds without accruing interest, emphasizing trust and mutual support over legal enforcement. The key difference lies in liability's formal, enforceable debt obligation with interest versus lending circles' informal, interest-free agreements based on social accountability and shared responsibility.

Impact of Traditional Liabilities on Financial Health

Traditional liabilities such as credit card debt and personal loans can significantly impact financial health by increasing monthly obligations and reducing credit scores. Unlike interest-free lending circles, these liabilities often accumulate interest charges that amplify overall debt burden and limit future borrowing capacity. Managing or avoiding high-interest liabilities is crucial for maintaining financial stability and achieving long-term money management goals.

Benefits of Joining Interest-Free Lending Circles

Joining interest-free lending circles reduces financial liability by eliminating interest costs, making repayments more manageable and predictable. These circles foster community trust and accountability, encouraging disciplined borrowing and lending without the risk of debt accumulation. Participants benefit from access to emergency funds and financial support without incurring additional charges, improving overall financial stability.

Risk Factors: Liability vs Lending Circles

Liability in financial contexts involves legal responsibility for debt repayment, exposing individuals to potential financial loss and credit damage if unable to fulfill obligations. Interest-free lending circles reduce liability risk by pooling resources among trusted members, sharing repayment responsibilities collectively and minimizing individual exposure. However, lending circles carry social and relational risks, as default or late payments may harm trust and solidarity within the group.

Social and Community Aspects of Lending Circles

Liability in money management within interest-free lending circles emphasizes mutual trust and collective responsibility among members. These circles foster strong social bonds by holding participants accountable to one another rather than formal financial institutions. This shared accountability enhances community cohesion and encourages consistent repayment through social reinforcement rather than legal obligation.

Credit Building: Liability Loans vs Lending Circles

Liability loans directly impact credit scores by reporting payment history, enabling borrowers to build or improve credit profiles through consistent repayments. Interest-free lending circles do not typically report to credit bureaus, limiting their effectiveness for credit building despite fostering community trust and financial discipline. Consequently, liability loans remain a more effective tool for individuals seeking to establish or enhance credit standing in formal financial systems.

Financial Flexibility: Which Model Works Best?

Liability and interest-free lending circles offer distinct approaches to financial flexibility, with liability emphasizing individual responsibility for repayments, potentially impacting credit scores and access to future credit. Interest-free lending circles foster a collaborative environment where members share risks and benefits, promoting consistent saving and borrowing without additional financial burdens. Choosing the best model depends on prioritizing either personal liability accountability or collective, interest-free financial support within a community.

Choosing the Right Money Management Strategy

Choosing the right money management strategy depends on understanding the liabilities involved versus the benefits of interest-free lending circles. Traditional liabilities often include accruing debts with interest, which can increase financial burden over time. Interest-free lending circles eliminate the cost of interest, promoting shared responsibility and fostering trust without adding long-term liabilities.

Related Important Terms

Social Collateralization

Liability in money management emphasizes legal responsibility and risk, while interest-free lending circles leverage social collateralization, where trust and community enforcement replace formal credit checks. Social collateralization reduces default risk by creating mutual accountability among participants, promoting financial discipline without the burden of interest or institutional liability.

Reputation-based Underwriting

Reputation-based underwriting in Liability frameworks leverages social trust and repayment histories to assess creditworthiness without traditional collateral, contrasting interest-free lending circles that rely primarily on peer accountability and collective guarantees. This method reduces default risk by integrating community reputation metrics into liability management, enhancing financial inclusion and responsible borrowing.

Rotating Savings Schemes (ROSCA)

Rotating Savings and Credit Associations (ROSCAs) provide members with interest-free loans through pooled contributions, reducing formal financial liabilities by relying on mutual trust and social enforcement rather than legal contracts. Unlike traditional liabilities, ROSCAs avoid interest charges and credit risk, fostering community-based money management that emphasizes shared responsibility and timely repayments.

Zero-Interest Lending Pods

Zero-interest lending pods foster community-based money management by eliminating financial liabilities typically associated with traditional loans, ensuring members borrow without accruing interest or collateral obligations. These cooperative lending circles promote financial inclusion and reduce debt risk, contrasting sharply with conventional liability-driven credit models that impose repayment burdens and interest charges.

Mutual Liability Pools

Mutual Liability Pools in liability structures distribute financial responsibility evenly among members, reducing individual risk compared to traditional interest-free lending circles where borrowers are solely accountable for repayments. This pooling mechanism enhances collective creditworthiness, facilitating more reliable money management and lowering default rates within the group.

Trust-Centric Lending Circles

Trust-centric lending circles minimize liability risks by distributing repayment responsibilities equitably among participants, fostering a collective accountability framework. These interest-free lending circles leverage social trust to enhance financial inclusion and reduce default rates compared to traditional liability-based lending models.

Community Default Buffer

Liability in money management often involves personal risk and potential financial loss, whereas interest-free lending circles create a community default buffer by pooling resources to reduce individual liability and share repayment responsibility. This collective approach enhances trust and accountability, minimizing default risk through mutual support rather than formal debt enforcement.

Peer Accountability Contracts

Liability in money management through Interest-free Lending Circles hinges on Peer Accountability Contracts, which enforce mutual financial responsibility without incurring debt or interest. These contracts create a legally and socially binding framework, reducing default risks by leveraging collective trust and shared obligations among participants.

Cooperative Credit Rotations

Cooperative Credit Rotations provide a liability-free alternative to traditional lending, enabling members to access funds without interest or formal debt obligations, thereby fostering trust and collective financial responsibility. Unlike liability-based loans, these rotations minimize risk by relying on mutual accountability and scheduled contributions within a closed group, enhancing sustainable money management.

Shared Liability Waivers

Shared liability waivers in interest-free lending circles mitigate individual financial risk by distributing repayment responsibility among members, fostering trust and collective accountability. Unlike traditional liability structures, these waivers encourage cooperative money management while minimizing personal credit exposure.

Liability vs Interest-free Lending Circles for money management. Infographic

moneydiff.com

moneydiff.com