Installment debt offers structured payments over time, making it easier to manage liability costs by spreading out financial obligations. Point-of-sale financing provides immediate access to funds but may carry higher interest rates, increasing overall liability expenses. Choosing between installment debt and point-of-sale financing depends on balancing cash flow management with long-term liability impact.

Table of Comparison

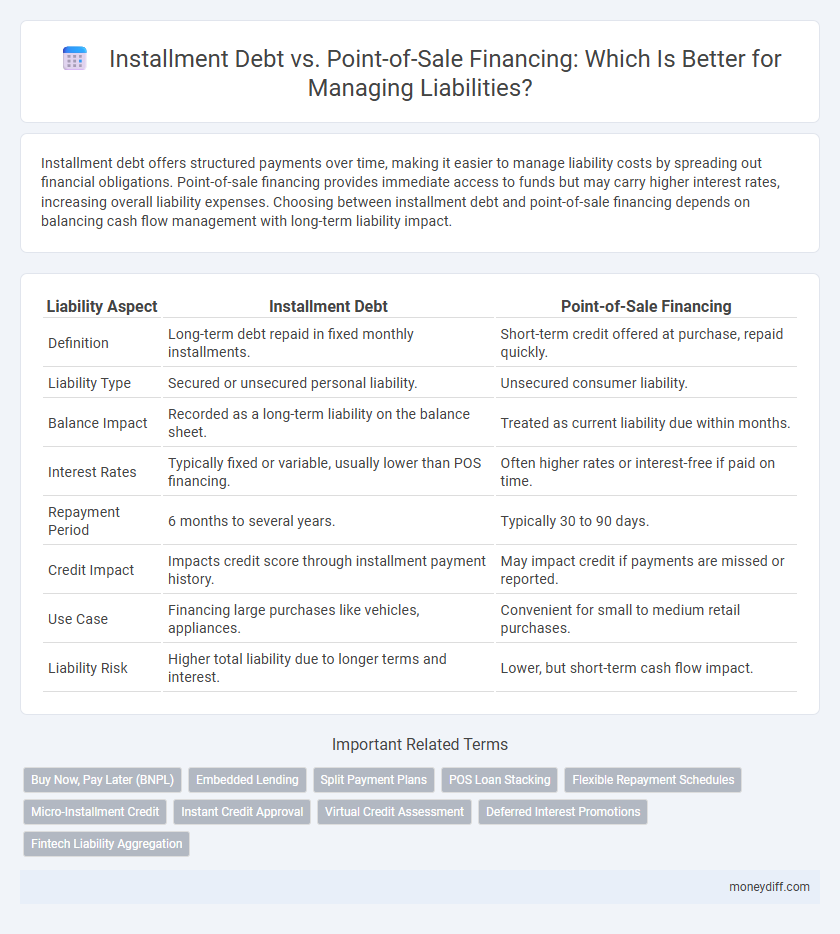

| Liability Aspect | Installment Debt | Point-of-Sale Financing |

|---|---|---|

| Definition | Long-term debt repaid in fixed monthly installments. | Short-term credit offered at purchase, repaid quickly. |

| Liability Type | Secured or unsecured personal liability. | Unsecured consumer liability. |

| Balance Impact | Recorded as a long-term liability on the balance sheet. | Treated as current liability due within months. |

| Interest Rates | Typically fixed or variable, usually lower than POS financing. | Often higher rates or interest-free if paid on time. |

| Repayment Period | 6 months to several years. | Typically 30 to 90 days. |

| Credit Impact | Impacts credit score through installment payment history. | May impact credit if payments are missed or reported. |

| Use Case | Financing large purchases like vehicles, appliances. | Convenient for small to medium retail purchases. |

| Liability Risk | Higher total liability due to longer terms and interest. | Lower, but short-term cash flow impact. |

Understanding Installment Debt in Money Management

Installment debt involves borrowing a fixed amount and repaying it in scheduled payments over time, which helps in managing liabilities by providing predictable monthly obligations. Unlike point-of-sale financing that often includes variable terms and potential higher interest, installment debt offers clearer budgeting paths and can improve credit management. Understanding installment debt is crucial for effective money management, as it allows individuals to plan liabilities and avoid unexpected financial burdens.

What Is Point-of-Sale Financing?

Point-of-sale financing allows consumers to make purchases by spreading payments over time, often through third-party lenders integrated at the checkout. This type of liability differs from installment debt by typically offering short-term repayment plans with promotional interest rates. Businesses benefit from increased sales volume while consumers manage liabilities without tapping into traditional credit lines.

Comparing Installment Debt and POS Financing

Installment debt involves borrowing a fixed amount of money and repaying it over a set period with interest, which typically impacts long-term liability on the balance sheet. Point-of-sale (POS) financing provides immediate credit at the time of purchase, often resulting in short-term liabilities that may carry higher interest rates and fees. Comparing both, installment loans offer predictable repayment schedules useful for managing long-term liabilities, while POS financing increases short-term liability volatility but can improve cash flow flexibility for consumers.

Liability Implications of Installment Loans

Installment loans create a fixed liability on the borrower's balance sheet, requiring regular payments over time and impacting creditworthiness. Unlike point-of-sale financing, which often has shorter terms and may not appear as long-term liabilities, installment debt is recorded as a formal obligation with interest costs affecting financial statements. Understanding these liability implications is crucial for managing debt structure and assessing overall financial risk.

POS Financing: A Liability Perspective

Point-of-Sale (POS) financing increases liability risk due to its short-term, high-interest payment structure, which can lead to higher default rates compared to traditional installment debt. Businesses must carefully assess the potential for increased financial obligations and impaired cash flow when offering POS financing options. Proper risk management strategies and clear disclosure of terms help mitigate liability while maintaining consumer trust.

Interest Rates: Installment Debt vs POS Financing

Installment debt typically features lower and fixed interest rates compared to point-of-sale (POS) financing, which often carries higher, variable rates that can increase liability costs. POS financing may offer initial promotional rates but can significantly escalate the total payable interest if not cleared quickly, increasing financial risk. Understanding these interest rate differences is crucial for managing overall debt liability and minimizing long-term financial exposure.

Impact on Credit Score and Financial Liability

Installment debt typically involves fixed monthly payments over a set period, contributing positively to credit score by demonstrating consistent repayment behavior and managing financial liability predictably. Point-of-sale financing often results in shorter-term debt with variable payment amounts, which can impact credit score less predictably and may increase financial liability if payments are missed or interest rates are higher. Evaluating the structured repayment and long-term effect on credit utilization is essential for managing overall liability when choosing between these financing options.

Managing Monthly Payments: Which Option Is Safer?

Managing monthly payments under installment debt typically offers a structured repayment schedule with fixed monthly amounts, reducing the risk of missed payments and consequent liability. Point-of-sale financing often involves variable payment terms that may lead to fluctuating monthly obligations and potential liability increases if payments are delayed. Choosing installment debt provides greater predictability and safer management of liabilities due to consistent monthly commitments.

Long-Term Liability Considerations

Installment debt typically appears as a long-term liability on the balance sheet, often involving fixed repayment schedules and interest rates that impact a company's debt ratio and creditworthiness. Point-of-sale financing may not always be recorded as long-term liability if it's structured as short-term borrowing or off-balance-sheet arrangements, influencing liquidity assessments differently. Understanding the classification and terms of these financing options is critical for accurate long-term liability management and financial planning.

Choosing the Best Financing Option for Financial Health

Installment debt offers structured repayment plans that help maintain predictable monthly expenses and improve long-term credit scores by demonstrating consistent payment behavior. Point-of-sale financing provides immediate purchasing power with potentially higher interest rates and shorter repayment terms, which can increase the risk of accumulating liability. Carefully assessing interest rates, repayment flexibility, and personal cash flow ensures choosing the best financing option to protect overall financial health.

Related Important Terms

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services typically function as point-of-sale financing, creating a short-term liability that requires consumers to repay installments over a defined period without interest, unlike traditional installment debt which often involves longer terms and interest charges. BNPL liabilities are recorded as current liabilities on balance sheets, impacting consumer credit usage differently compared to conventional installment loans due to their immediate-point-of-sale nature and streamlined approval process.

Embedded Lending

Installment debt offers structured repayment plans with fixed terms, reducing borrower liability risk compared to point-of-sale financing, which often involves higher interest rates and revolving credit that can increase outstanding liabilities. Embedded lending within point-of-sale systems streamlines approval but may amplify consumer liability if repayment terms are unclear or burdensome.

Split Payment Plans

Installment debt offers structured repayment over time with fixed monthly payments, providing predictable financial liability management. Point-of-sale financing often includes split payment plans that divide the total cost into multiple segments, enhancing cash flow flexibility but potentially increasing overall liability due to interest or fees.

POS Loan Stacking

Point-of-sale (POS) financing often increases liability risk due to loan stacking, where multiple concurrent loans accumulate on a single purchase, leading to higher default probability and complexity in debt management. Installment debt consolidates payments into fixed schedules, reducing exposure to overlapping obligations and improving liability predictability.

Flexible Repayment Schedules

Installment debt offers structured, flexible repayment schedules with fixed monthly payments over a set period, helping manage liability by spreading out costs. Point-of-sale financing typically provides shorter-term repayment options but can include variable interest rates that may increase overall liability if payments are missed.

Micro-Installment Credit

Micro-installment credit minimizes liability risk by spreading repayment over short, manageable periods, enhancing borrower affordability and reducing default rates. Compared to point-of-sale financing, micro-installment credit offers greater flexibility and clearer liability tracking for both lenders and consumers.

Instant Credit Approval

Installment debt often involves a slower credit approval process requiring detailed credit checks, while point-of-sale financing typically offers instant credit approval, enabling immediate purchase and minimizing liability risk for both consumers and retailers. Instant credit approval in point-of-sale financing reduces delays and enhances liability management by providing transparent payment terms upfront.

Virtual Credit Assessment

Installment debt typically involves a structured repayment plan with fixed monthly payments and interest rates determined through a virtual credit assessment that evaluates consumer creditworthiness using real-time data analytics. Point-of-sale financing leverages instant virtual credit checks to approve purchases quickly, often with higher interest rates and shorter terms, impacting consumer liability through immediate credit utilization and varying risk profiles.

Deferred Interest Promotions

Deferred interest promotions in installment debt allow borrowers to avoid immediate interest charges if the balance is paid within the promotional period, reducing short-term liability exposure. In contrast, point-of-sale financing often imposes deferred interest only when payments are missed, potentially increasing long-term liability if the promotional terms are not strictly followed.

Fintech Liability Aggregation

Fintech liability aggregation platforms consolidate installment debt and point-of-sale (POS) financing liabilities to provide a comprehensive view of consumer financial obligations, enabling more accurate risk assessments and personalized credit solutions. By integrating data from multiple sources, these platforms enhance transparency, streamline debt management, and reduce the likelihood of default across diverse liability types.

Installment Debt vs Point-of-Sale Financing for Liability. Infographic

moneydiff.com

moneydiff.com