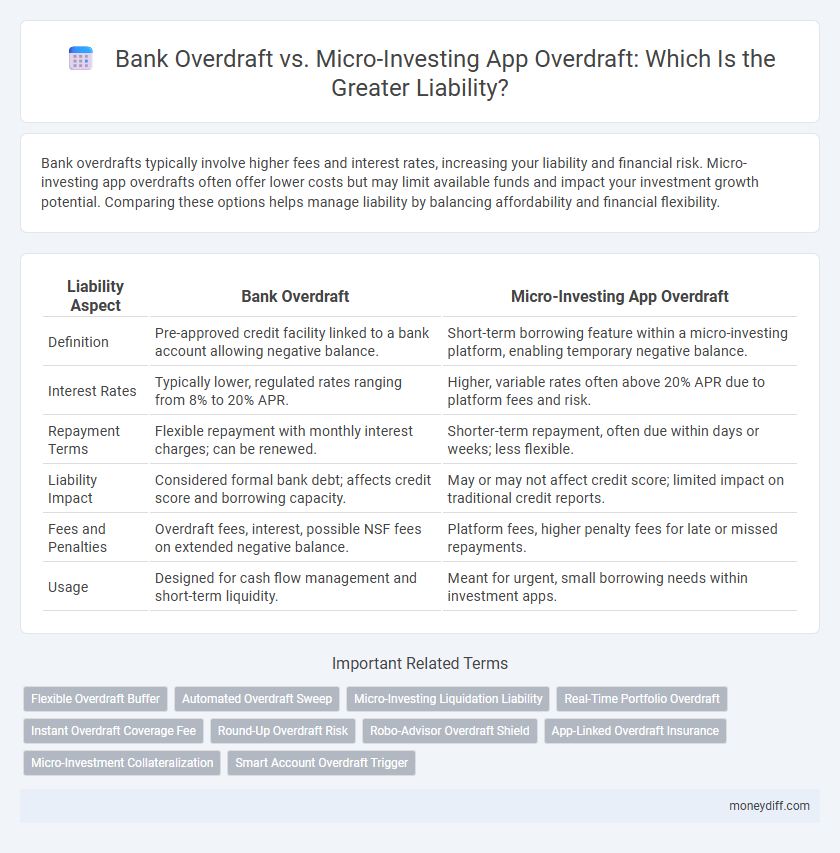

Bank overdrafts typically involve higher fees and interest rates, increasing your liability and financial risk. Micro-investing app overdrafts often offer lower costs but may limit available funds and impact your investment growth potential. Comparing these options helps manage liability by balancing affordability and financial flexibility.

Table of Comparison

| Liability Aspect | Bank Overdraft | Micro-Investing App Overdraft |

|---|---|---|

| Definition | Pre-approved credit facility linked to a bank account allowing negative balance. | Short-term borrowing feature within a micro-investing platform, enabling temporary negative balance. |

| Interest Rates | Typically lower, regulated rates ranging from 8% to 20% APR. | Higher, variable rates often above 20% APR due to platform fees and risk. |

| Repayment Terms | Flexible repayment with monthly interest charges; can be renewed. | Shorter-term repayment, often due within days or weeks; less flexible. |

| Liability Impact | Considered formal bank debt; affects credit score and borrowing capacity. | May or may not affect credit score; limited impact on traditional credit reports. |

| Fees and Penalties | Overdraft fees, interest, possible NSF fees on extended negative balance. | Platform fees, higher penalty fees for late or missed repayments. |

| Usage | Designed for cash flow management and short-term liquidity. | Meant for urgent, small borrowing needs within investment apps. |

Understanding Overdraft: Bank vs Micro-Investing Apps

Bank overdrafts represent a traditional liability where banks permit account holders to withdraw more than their available balance, usually incurring interest and fees. Micro-investing app overdrafts function differently, often involving short-term, lower-limit credit extensions linked to investment accounts, with varied fee structures and regulatory oversight. Comparing these overdrafts reveals distinct liability implications, interest calculations, and risk profiles linked to the nature of financial institutions and user agreements.

Liability Fundamentals in Overdraft Scenarios

Bank overdrafts represent a liability where the account holder borrows funds beyond their balance, typically incurring interest and fees that increase financial obligation. Micro-investing app overdrafts function similarly but often involve smaller amounts and may include specific terms tied to investment activities, affecting liability tracking and management. Understanding the fundamental liabilities in both scenarios requires assessing the overdraft terms, interest rates, and repayment obligations to accurately gauge the financial risk and responsibility.

Bank Overdraft: How Liability is Determined

Bank overdraft liability is determined by the amount the account holder withdraws beyond their available balance, creating a negative balance owed to the bank. The overdraft limit set by the bank defines the maximum liability exposure, and any interest or fees accrued increase the total amount owed. Unlike micro-investing app overdrafts, bank overdrafts are direct liabilities owed to financial institutions with clearly defined terms and potential impact on credit ratings.

Micro-Investing App Overdraft: Unique Liability Risks

Micro-investing app overdrafts pose unique liability risks due to their integration with investment platforms, potentially exposing users to amplified financial losses beyond typical banking overdrafts. These apps often allow seamless access to funds intended for investment, increasing the risk of unintentional market exposure and regulatory scrutiny. Unlike traditional bank overdrafts, liability in micro-investing app overdrafts may involve complex legal implications related to investment securities and user agreements.

Financial Impact: Overdraft Fees and Penalties

Bank overdrafts typically impose higher fees and penalty rates, significantly increasing financial liability due to daily compounded interest and fixed transaction charges. Micro-investing app overdrafts often feature lower fees or flexible repayment terms, reducing immediate financial burden but potentially impacting investment growth. Understanding these cost structures is essential for managing liabilities and minimizing long-term financial consequences.

Consumer Protections: Banks vs Micro-Investing Apps

Bank overdrafts typically offer stronger consumer protections, including federal regulations like the Truth in Lending Act and the Electronic Fund Transfer Act, which limit liability for unauthorized transactions and require clear disclosure of fees. Micro-investing app overdrafts, often governed by less stringent rules, may lack these robust safeguards, increasing consumer risk and potential financial liability. Understanding the regulatory differences is crucial for consumers managing overdraft liabilities across these financial platforms.

Legal Implications of Overdraft Liability

Bank overdraft liability arises from formal agreements where the bank extends credit, making the user legally responsible for repayment including fees and interest, often enforceable through contract law. In contrast, micro-investing app overdrafts may involve less formalized terms, potentially leading to varied legal interpretations regarding liability and user obligations, thus requiring careful review of app-specific user agreements. Understanding these differences is crucial for assessing financial risk and potential legal consequences associated with overdraft liabilities across different financial platforms.

Accountability: User Responsibility in Both Platforms

Bank overdraft liability arises when users withdraw more funds than available, leading to immediate repayment obligations and potential fees, emphasizing strict user accountability. Micro-investing app overdraft liability typically involves small, short-term negative balances tied to investment trades, with users responsible for covering these deficits promptly to avoid platform restrictions. Both platforms enforce accountability through clear terms requiring users to monitor balances and manage overdraft limits to prevent escalating debts.

How Overdraft Limits Affect Liability Exposure

Overdraft limits directly influence liability exposure by defining the maximum amount a user can owe beyond their account balance; higher limits increase potential financial risk for both banks and micro-investing platforms. Bank overdrafts typically feature stricter credit assessments and set limits to mitigate default risk, while micro-investing app overdrafts may offer lower limits but carry higher relative fees, impacting user liability. Understanding these limits helps quantify potential overdraft liability and informs risk management strategies for financial institutions and app developers.

Strategies to Minimize Overdraft Liability

To minimize overdraft liability in both bank and micro-investing app overdrafts, prioritize monitoring account balances through real-time alerts and automatic transfers to cover potential shortfalls. Implement budgeting tools or set spending limits within apps to prevent spending beyond available funds, reducing the risk of fees. Regularly reviewing transaction history enables early detection of unauthorized charges or errors, further safeguarding against unexpected liabilities.

Related Important Terms

Flexible Overdraft Buffer

Bank overdrafts offer a flexible overdraft buffer with customizable credit limits linked to your main account, providing immediate access to funds with interest charged only on the overdrawn amount. Micro-investing app overdrafts typically feature smaller, preset buffers integrated into your investment account, allowing limited overdraft usage primarily aimed at maintaining investment continuity rather than extensive borrowing.

Automated Overdraft Sweep

Automated overdraft sweep systems in bank overdrafts typically transfer funds instantly from linked accounts to cover shortfalls, minimizing late fees and liability exposure. In contrast, micro-investing app overdrafts often rely on automated transfers from investment holdings, which may introduce liquidity risk and variable settlement times, affecting the immediacy of liability coverage.

Micro-Investing Liquidation Liability

Micro-investing app overdraft liability arises when users withdraw funds beyond their available balance, triggering automatic liquidation of investment holdings to cover the negative balance, which can incur fees and impact portfolio value. Unlike traditional bank overdrafts, micro-investing liquidations directly affect investment assets, creating a distinct risk profile and financial obligation for users.

Real-Time Portfolio Overdraft

Bank overdrafts typically involve pre-approved credit limits linked to checking accounts, whereas micro-investing app overdrafts operate through real-time portfolio overdrafts, allowing users to borrow against the current value of their investment holdings. Real-time portfolio overdraft features enable immediate liquidity by tapping into fluctuating asset values, introducing unique liability management challenges due to market volatility and instant settlement requirements.

Instant Overdraft Coverage Fee

Bank overdraft fees typically include instant overdraft coverage fees that can range from $10 to $35 per transaction, reflecting the higher risk and immediate fund availability costs for the bank. In contrast, micro-investing app overdrafts often feature lower or waived instant overdraft coverage fees, leveraging smaller transaction amounts and integrated financial management tools to minimize user liability.

Round-Up Overdraft Risk

Bank overdrafts typically involve higher interest rates and immediate liability for exceeding account balances, whereas micro-investing app overdrafts through round-up features carry smaller, incremental liabilities but pose cumulative overdraft risk due to frequent small transactions. The round-up overdraft risk in micro-investing apps may lead to unexpected fees and increased liability exposure if users are not closely monitoring account balances.

Robo-Advisor Overdraft Shield

Bank overdrafts typically incur higher fees and interest rates compared to micro-investing app overdrafts, which often use a Robo-Advisor Overdraft Shield to minimize liability risks by automatically managing short-term borrowing and repayments. The Robo-Advisor Overdraft Shield leverages algorithm-driven financial management to reduce overdraft exposure, enhancing user control over liabilities while offering a cost-effective alternative to traditional bank overdrafts.

App-Linked Overdraft Insurance

Bank overdrafts typically incur higher interest rates and fees, creating substantial short-term financial liability, whereas micro-investing app overdrafts often include app-linked overdraft insurance that mitigates risk by capping user liability and providing protection against overdraft fees. This insurance feature reduces financial exposure for users of micro-investing apps, contrasting with the traditional bank overdraft model where liability is largely borne by the account holder.

Micro-Investment Collateralization

Micro-investing app overdrafts leverage user portfolio collateralization, reducing traditional credit risk compared to bank overdrafts that rely primarily on credit history and account balance. This collateralized overdraft enhances liability management by allowing immediate liquidity against investment assets, minimizing unsecured debt exposure for both the user and the platform.

Smart Account Overdraft Trigger

Bank overdraft liability arises when account holders withdraw more than their available balance, incurring fees and interest, while micro-investing app overdraft liability typically involves automatic funding from linked accounts or credit lines to cover shortfalls, minimizing direct fees. Smart Account Overdraft Trigger technology optimizes liability management by instantly detecting insufficient funds and activating tailored overdraft solutions to reduce costs and improve cash flow efficiency.

Bank Overdraft vs Micro-Investing App Overdraft for liability. Infographic

moneydiff.com

moneydiff.com