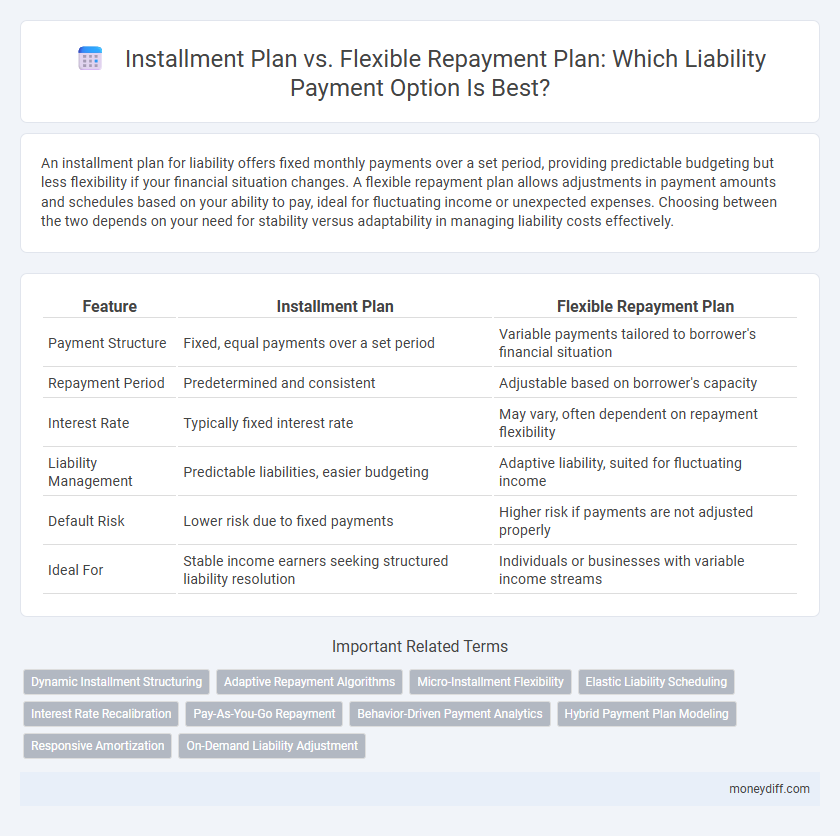

An installment plan for liability offers fixed monthly payments over a set period, providing predictable budgeting but less flexibility if your financial situation changes. A flexible repayment plan allows adjustments in payment amounts and schedules based on your ability to pay, ideal for fluctuating income or unexpected expenses. Choosing between the two depends on your need for stability versus adaptability in managing liability costs effectively.

Table of Comparison

| Feature | Installment Plan | Flexible Repayment Plan |

|---|---|---|

| Payment Structure | Fixed, equal payments over a set period | Variable payments tailored to borrower's financial situation |

| Repayment Period | Predetermined and consistent | Adjustable based on borrower's capacity |

| Interest Rate | Typically fixed interest rate | May vary, often dependent on repayment flexibility |

| Liability Management | Predictable liabilities, easier budgeting | Adaptive liability, suited for fluctuating income |

| Default Risk | Lower risk due to fixed payments | Higher risk if payments are not adjusted properly |

| Ideal For | Stable income earners seeking structured liability resolution | Individuals or businesses with variable income streams |

Understanding Installment Plans for Liability Management

Installment plans for liability management enable borrowers to repay debts through fixed, scheduled payments over a specified period, ensuring consistent cash flow and predictable financial planning. These plans typically involve set principal and interest amounts, reducing the risk of default by providing clear repayment timelines. Understanding the terms and conditions of installment plans is crucial for effective liability control and sustained credit health.

What Are Flexible Repayment Plans?

Flexible repayment plans allow borrowers to adjust payment schedules based on their financial circumstances, offering more adaptability than fixed installment plans. These plans often include variable payment amounts, extended timelines, and options to skip or defer payments without penalties. Flexible repayment options are particularly beneficial for managing liability when income fluctuates or unexpected expenses arise.

Key Differences Between Installment and Flexible Repayment Options

Installment plans require fixed, equal payments over a predetermined period, ensuring predictable liability reduction and easier budgeting for debtors. Flexible repayment plans offer variable payment amounts and schedules, allowing adjustments based on the debtor's financial situation but potentially extending the liability duration. Key differences include payment consistency, impact on interest accumulation, and adaptability to changes in financial circumstances.

Advantages of Using Installment Plans for Debt Repayment

Installment plans offer predictability by dividing debt into fixed, manageable monthly payments, simplifying budgeting and reducing financial stress. These plans typically have structured timelines, enabling borrowers to clear liabilities within a set period while potentially minimizing interest accumulation. Consistent payments under installment plans also help improve credit scores by demonstrating reliable debt management.

Benefits of Flexible Repayment Plans for Liability Control

Flexible Repayment Plans offer superior liability control by allowing borrowers to adjust payment amounts and schedules based on their financial situation, reducing the risk of default and improving cash flow management. These plans often include options to pause or reduce payments temporarily during financial hardship, providing greater financial flexibility compared to rigid Installment Plans. Enhanced adaptability helps maintain creditworthiness and lowers the likelihood of incurring additional fees or penalties associated with missed payments.

Comparing Interest Rates: Installment vs Flexible Repayment

Installment plans typically feature fixed interest rates, providing predictability in monthly payments and overall cost. Flexible repayment plans often carry variable interest rates that can fluctuate based on market conditions, potentially leading to lower initial costs but higher long-term expenses. Borrowers should evaluate the implications of fixed versus variable rates on total interest accrued to determine the most cost-effective liability management strategy.

Which Plan Suits Different Financial Situations?

Installment plans suit individuals with stable incomes seeking predictable monthly payments and fixed terms to manage liability effectively. Flexible repayment plans benefit those with fluctuating cash flow, allowing adjustments in payment amounts and schedules to accommodate varying financial situations. Choosing the right plan depends on income consistency, financial goals, and ability to commit to fixed versus variable payments.

Risks and Pitfalls of Each Repayment Plan

Installment plans often pose risks such as accumulating interest and rigid payment schedules that may lead to default if cash flow is inconsistent. Flexible repayment plans can mitigate strict deadlines but carry the pitfall of higher overall costs due to variable interest rates and potential extended debt duration. Both plans require careful assessment of financial stability and loan terms to avoid exacerbating liability burdens.

Choosing the Best Repayment Plan for Your Liabilities

Choosing the best repayment plan for your liabilities depends on cash flow stability and financial goals. An Installment Plan offers fixed monthly payments that simplify budgeting and reduce the risk of missed payments, ensuring a predictable path to debt elimination. In contrast, a Flexible Repayment Plan allows variable payments adapting to fluctuating income, providing relief during financial strain but requiring disciplined management to avoid prolonged debt.

Expert Tips for Successful Liability Repayment Management

Establishing a clear budget and prioritizing high-interest liabilities enhances repayment efficiency in both installment and flexible repayment plans. Expert tips recommend leveraging automated payments to avoid missed deadlines and reduce penalties, ensuring liability obligations are met consistently. Evaluating the specific terms and adjusting repayment amounts within flexible plans can optimize cash flow without compromising debt clearance timelines.

Related Important Terms

Dynamic Installment Structuring

Dynamic installment structuring in liability management allows borrowers to tailor payment amounts and schedules within an installment plan, enhancing cash flow predictability and reducing default risk compared to fixed repayment terms. Flexible repayment plans further adapt to changing financial circumstances by permitting adjustments in payment frequency or amounts, providing a responsive approach to liability reduction.

Adaptive Repayment Algorithms

Installment plans typically follow fixed schedules for liability repayment, while flexible repayment plans leverage adaptive repayment algorithms that analyze financial behavior and adjust payment amounts dynamically to optimize debt clearance and mitigate default risks. These algorithms enhance liability management by tailoring repayment strategies to individual cash flow patterns and financial capacity, promoting more efficient and responsive debt reduction.

Micro-Installment Flexibility

Installment Plans offer structured, fixed repayment schedules that ensure predictable liability management, while Flexible Repayment Plans provide micro-installment options tailored to fluctuating cash flows and variable income, enhancing affordability and reducing default risk. Micro-installment flexibility allows debtors to adjust payment amounts and frequencies dynamically, optimizing financial planning and minimizing the burden of liabilities.

Elastic Liability Scheduling

Elastic liability scheduling under flexible repayment plans allows borrowers to adjust payment amounts and timelines based on fluctuating income, reducing default risk compared to the fixed structure of installment plans. This adaptability enhances cash flow management by aligning liability obligations with real-time financial capacity, promoting sustainable debt servicing.

Interest Rate Recalibration

Installment plans typically feature fixed interest rates, providing predictable monthly payments but less adaptability to changing financial circumstances. Flexible repayment plans offer periodic interest rate recalibration, allowing adjustments based on market conditions or borrower's financial status, potentially reducing overall interest costs or extending payment timelines.

Pay-As-You-Go Repayment

A Pay-As-You-Go Repayment model under liability management allows borrowers to make payments based on actual usage or income, offering greater flexibility than traditional Installment Plans with fixed monthly amounts. This adaptive method reduces financial strain by aligning repayments with real-time cash flow, enhancing affordability and minimizing default risk.

Behavior-Driven Payment Analytics

Installment Plans provide fixed payments over a set period, enabling predictable liability management, while Flexible Repayment Plans adapt based on Behavior-Driven Payment Analytics that analyze repayment patterns and financial behavior to optimize cash flow and reduce default risk. Leveraging data on transaction frequency, payment timeliness, and spending trends enhances the customization of repayment schedules, improving liability forecast accuracy and customer engagement.

Hybrid Payment Plan Modeling

Hybrid payment plan modeling integrates installment plans and flexible repayment options to optimize liability management by balancing fixed periodic payments with adaptable terms based on borrower capacity and financial fluctuations. This approach enhances cash flow predictability while accommodating variable payment schedules, reducing default risk and improving debt recovery efficiency.

Responsive Amortization

A Flexible Repayment Plan offers responsive amortization by adjusting payment schedules based on the borrower's financial situation, reducing the risk of default and improving liability management. Unlike a fixed Installment Plan, it allows dynamic reallocation of principal and interest, enhancing cash flow stability and optimizing debt servicing efficiency.

On-Demand Liability Adjustment

Installment Plans provide fixed monthly payments that reduce liability predictably over a set period, while Flexible Repayment Plans enable On-Demand Liability Adjustment, allowing borrowers to modify payments based on real-time financial changes. This adaptive approach minimizes default risk by aligning liability repayment with fluctuating income and expense patterns.

Installment Plan vs Flexible Repayment Plan for liability. Infographic

moneydiff.com

moneydiff.com