Liabilities represent traditional financial obligations where a party owes a specific amount to another, often recorded in accounting books. Tokenized debt transforms these obligations into digital assets on a blockchain, allowing for increased transparency, fractional ownership, and easier transferability. This shift reduces administrative burdens and enhances liquidity compared to conventional liabilities.

Table of Comparison

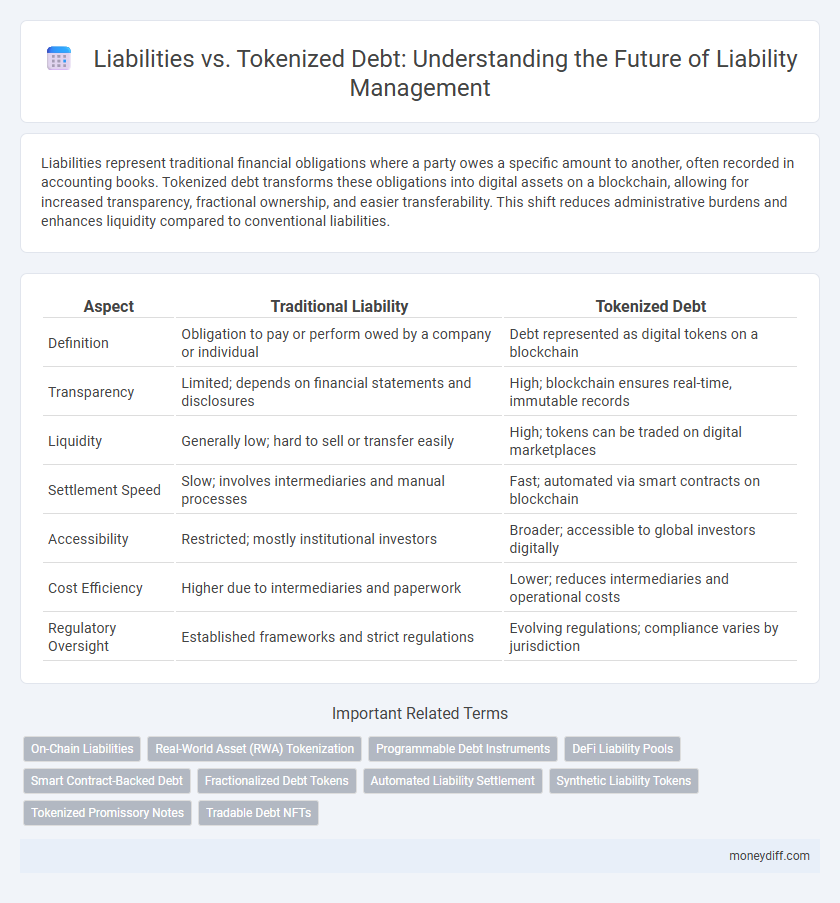

| Aspect | Traditional Liability | Tokenized Debt |

|---|---|---|

| Definition | Obligation to pay or perform owed by a company or individual | Debt represented as digital tokens on a blockchain |

| Transparency | Limited; depends on financial statements and disclosures | High; blockchain ensures real-time, immutable records |

| Liquidity | Generally low; hard to sell or transfer easily | High; tokens can be traded on digital marketplaces |

| Settlement Speed | Slow; involves intermediaries and manual processes | Fast; automated via smart contracts on blockchain |

| Accessibility | Restricted; mostly institutional investors | Broader; accessible to global investors digitally |

| Cost Efficiency | Higher due to intermediaries and paperwork | Lower; reduces intermediaries and operational costs |

| Regulatory Oversight | Established frameworks and strict regulations | Evolving regulations; compliance varies by jurisdiction |

Understanding Traditional Liabilities in Money Management

Traditional liabilities in money management represent obligations a company must settle, such as loans, accounts payable, and accrued expenses, typically recorded on the balance sheet to reflect financial obligations. These liabilities impact cash flow forecasting and risk assessment, requiring careful monitoring to maintain solvency and creditworthiness. Tokenized debt, by contrast, digitizes these liabilities on a blockchain, increasing transparency and enabling fractional ownership, but understanding traditional liabilities remains crucial for accurate financial planning and regulatory compliance.

What Is Tokenized Debt?

Tokenized debt represents liability in the form of digital tokens that are recorded on a blockchain, allowing for increased transparency, liquidity, and fractional ownership compared to traditional debt instruments. Unlike conventional liabilities, tokenized debt can be easily traded on secondary markets and incorporates smart contracts to automate interest payments and compliance. This innovation enhances efficiency in managing liabilities while reducing administrative costs and counterparty risks.

Key Differences: Liabilities vs Tokenized Debt

Liabilities represent traditional financial obligations recorded on a company's balance sheet, typically involving contractual repayments and interest terms governed by legal agreements. Tokenized debt converts these obligations into digital tokens on a blockchain, enabling fractional ownership, increased liquidity, and transparent tracking through smart contracts. The key differences lie in accessibility, transparency, and transferability, as tokenized debt facilitates easier secondary market trading compared to conventional liabilities.

How Tokenization Transforms Debt Management

Tokenization transforms debt management by converting traditional liabilities into digital tokens, enhancing liquidity and transparency in financial operations. This shift allows for fractional ownership, real-time tracking, and automated compliance, reducing administrative costs and risks associated with conventional debt handling. Tokenized debt facilitates more efficient market access and enables dynamic structuring of liabilities to meet diverse investor needs.

Risk Assessment: Traditional Liabilities vs Tokenized Debt

Traditional liabilities involve recorded debts subject to regulatory frameworks and credit risk evaluations, often resulting in limited transparency and slower settlement times. Tokenized debt leverages blockchain technology to enhance transparency, enable real-time tracking, and reduce counterparty risk through smart contracts and automated enforcement mechanisms. Risk assessment improves with tokenized debt by providing immutable transaction records and faster liquidation options, mitigating default risks compared to conventional liability models.

Transparency and Accessibility in Liabilities

Tokenized debt enhances transparency compared to traditional liabilities by leveraging blockchain technology, enabling real-time tracking and immutable records of debt obligations. This increased visibility reduces information asymmetry for investors and stakeholders, fostering trust and efficient risk assessment. Accessibility improves as tokenized debt allows fractional ownership and easier transferability, broadening market participation beyond conventional financial institutions.

Smart Contracts and Tokenized Debt Efficiency

Smart contracts streamline liability management by automating debt agreements and payments, reducing errors and increasing transparency. Tokenized debt leverages blockchain technology to fractionalize liabilities, enhancing liquidity and enabling real-time tracking of obligations. This integration improves efficiency by minimizing intermediaries and accelerating settlement processes in liability management.

Regulatory Implications for Tokenized Liabilities

Tokenized liabilities introduce complex regulatory implications compared to traditional liabilities, requiring compliance with securities laws, anti-money laundering (AML) regulations, and Know Your Customer (KYC) protocols. Smart contracts governing tokenized debt must ensure transparency, investor protection, and adherence to jurisdiction-specific financial regulations. Regulatory bodies increasingly emphasize clear frameworks to mitigate risks such as fraud, market manipulation, and legal uncertainty in tokenized liability issuance and trading.

Adoption Barriers: From Traditional to Tokenized Debt

Adoption barriers for tokenized debt in liabilities include regulatory uncertainties, limited market infrastructure, and a lack of widespread trust compared to traditional liabilities. Tokenized debt offers enhanced transparency and liquidity but faces challenges in integrating with established financial systems and legal frameworks. Overcoming these hurdles requires coordinated efforts between regulators, technology providers, and institutional investors to drive mainstream acceptance.

Future Trends: The Evolution of Liabilities with Tokenization

Tokenized debt is transforming traditional liabilities by enabling fractional ownership, enhancing liquidity, and improving transparency through blockchain technology. This evolution allows companies to access global investors while reducing settlement times and operational costs. Future trends indicate a shift toward decentralized finance (DeFi) platforms, where tokenized liabilities integrate seamlessly with smart contracts to automate repayments and enhance regulatory compliance.

Related Important Terms

On-Chain Liabilities

On-chain liabilities represent recorded financial obligations on a blockchain, offering transparency, immutability, and real-time tracking compared to traditional liabilities stored in centralized ledgers. Tokenized debt transforms these liabilities into digital tokens, enabling fractional ownership, easier transferability, and automated enforcement through smart contracts.

Real-World Asset (RWA) Tokenization

Liabilities on balance sheets represent traditional debt obligations whereas tokenized debt transforms these liabilities into digital tokens, enabling fractional ownership and improved liquidity within Real-World Asset (RWA) tokenization frameworks. Tokenized debt enhances transparency, automates compliance, and facilitates efficient secondary market trading of liabilities linked to physical assets.

Programmable Debt Instruments

Programmable debt instruments enable dynamic management of liabilities through smart contracts, automating repayment schedules, interest calculations, and enforcement of covenants, enhancing transparency and efficiency compared to traditional liabilities. Tokenized debt converts obligations into digital tokens, facilitating fractional ownership, improved liquidity, and real-time tracking while reducing administrative overhead and counterparty risk.

DeFi Liability Pools

DeFi liability pools transform traditional liabilities into tokenized debt, enabling fractional ownership and enhanced liquidity for borrowers and lenders. Unlike conventional liabilities, tokenized debt in decentralized finance offers transparency, programmable terms, and automated liquidation mechanisms through smart contracts.

Smart Contract-Backed Debt

Smart contract-backed debt automates liability management by encoding terms directly into blockchain protocols, reducing reliance on traditional liability instruments and enhancing transparency. These tokenized liabilities enable real-time tracking and programmable repayment conditions, transforming conventional debt into dynamic, self-executing contracts that minimize default risk and improve creditor confidence.

Fractionalized Debt Tokens

Fractionalized debt tokens enable the division of traditional liabilities into smaller, tradable units, enhancing liquidity and accessibility for investors. This tokenization of debt streamlines liability management by leveraging blockchain technology to increase transparency and reduce settlement times compared to conventional liabilities.

Automated Liability Settlement

Automated liability settlement leverages blockchain technology to streamline the reconciliation process between traditional liabilities and tokenized debt, enabling real-time tracking, reduced settlement times, and enhanced transparency. Tokenized debt offers programmable, tradeable financial instruments that automate payment schedules and compliance, minimizing risks associated with manual liability management and improving overall financial efficiency.

Synthetic Liability Tokens

Synthetic Liability Tokens represent a programmable, blockchain-based alternative to traditional liabilities, enabling real-time, transparent tracking and settlement of debt obligations. Unlike conventional liabilities recorded in financial statements, these tokens facilitate fractional ownership, automated interest payments, and smart contract enforcement, significantly enhancing liquidity and reducing counterparty risk.

Tokenized Promissory Notes

Tokenized promissory notes enhance traditional liabilities by enabling secure, transparent, and easily transferable digital debt instruments on blockchain networks. These tokenized debts reduce administrative costs, streamline compliance, and provide real-time access to ownership history, improving liquidity compared to conventional liability structures.

Tradable Debt NFTs

Liabilities traditionally represent financial obligations recorded on a company's balance sheet, whereas tokenized debt transforms these obligations into tradable NFTs, enabling increased liquidity and fractional ownership. Tradable Debt NFTs offer enhanced transparency and accessibility in secondary markets, revolutionizing how liabilities are managed and transferred.

Liabilities vs Tokenized Debt for liability. Infographic

moneydiff.com

moneydiff.com