Liabilities in traditional finance represent legally binding obligations that require repayment, often accompanied by strict regulatory oversight and centralized control. Decentralized finance (DeFi) obligations, by contrast, operate on blockchain technology, enabling transparent, programmable contracts without intermediaries, but carry risks like smart contract vulnerabilities and regulatory uncertainty. Effective money management in this landscape requires balancing traditional liability frameworks with the innovative, automated mechanisms inherent in DeFi, ensuring both security and operational efficiency.

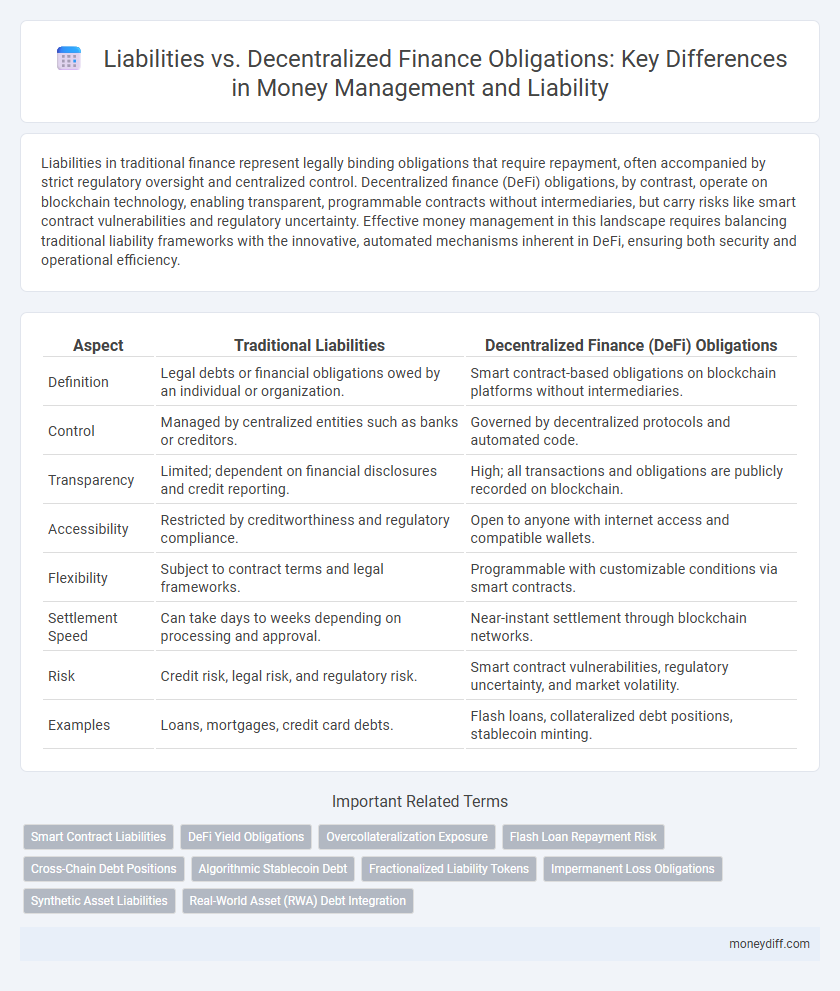

Table of Comparison

| Aspect | Traditional Liabilities | Decentralized Finance (DeFi) Obligations |

|---|---|---|

| Definition | Legal debts or financial obligations owed by an individual or organization. | Smart contract-based obligations on blockchain platforms without intermediaries. |

| Control | Managed by centralized entities such as banks or creditors. | Governed by decentralized protocols and automated code. |

| Transparency | Limited; dependent on financial disclosures and credit reporting. | High; all transactions and obligations are publicly recorded on blockchain. |

| Accessibility | Restricted by creditworthiness and regulatory compliance. | Open to anyone with internet access and compatible wallets. |

| Flexibility | Subject to contract terms and legal frameworks. | Programmable with customizable conditions via smart contracts. |

| Settlement Speed | Can take days to weeks depending on processing and approval. | Near-instant settlement through blockchain networks. |

| Risk | Credit risk, legal risk, and regulatory risk. | Smart contract vulnerabilities, regulatory uncertainty, and market volatility. |

| Examples | Loans, mortgages, credit card debts. | Flash loans, collateralized debt positions, stablecoin minting. |

Understanding Traditional Liabilities in Money Management

Traditional liabilities in money management refer to financial obligations such as loans, mortgages, credit card debts, and accounts payable that a person or organization is legally required to settle. Unlike decentralized finance obligations, which operate on blockchain-based smart contracts facilitating automated, transparent, and trustless transactions, traditional liabilities rely on centralized institutions and regulatory frameworks for enforcement and resolution. Understanding these conventional liabilities involves recognizing their impact on cash flow, creditworthiness, and overall financial stability within established banking and financial systems.

What Are Decentralized Finance (DeFi) Obligations?

Decentralized Finance (DeFi) obligations are smart contract-based financial commitments executed on blockchain networks, enabling peer-to-peer transactions without traditional intermediaries. These obligations include lending, borrowing, and derivative contracts governed by code rather than centralized entities, ensuring transparency and automation. Unlike traditional liabilities recorded on balance sheets, DeFi obligations are programmable and often collateralized through digital assets, reducing counterparty risk but introducing smart contract vulnerabilities.

Key Differences: Liabilities vs DeFi Obligations

Liabilities represent legally binding financial debts or obligations recorded on a company's balance sheet, reflecting traditional centralized accountability frameworks. In contrast, decentralized finance (DeFi) obligations are governed by smart contracts on blockchain networks, enabling automated, transparent, and trustless money management without intermediaries. Key differences include the reliance on centralized institutions for liabilities versus code-enforced agreements for DeFi obligations, impacting risk exposure, enforcement mechanisms, and liquidity dynamics.

Risk Assessment in Traditional vs DeFi Liabilities

Risk assessment in traditional liabilities involves centralized credit evaluations, regulatory compliance, and predictable repayment structures, which provide a framework for mitigating default risk. In contrast, DeFi obligations rely on smart contracts, collateralization protocols, and real-time market data, introducing increased volatility and liquidity risk due to decentralized governance and lack of centralized oversight. Understanding these fundamental differences is critical for effective money management and informed decision-making in both financial paradigms.

Managing Debt: Conventional Methods vs DeFi Solutions

Managing debt through conventional liabilities involves structured repayment schedules, interest rates set by financial institutions, and regulatory oversight ensuring borrower accountability. Decentralized Finance (DeFi) solutions introduce programmable smart contracts that automate loan issuance, collateral management, and interest accrual without intermediaries, increasing transparency and flexibility. While traditional debt management relies on centralized control and credit history, DeFi offers peer-to-peer lending platforms with decentralized credit scoring and reduced barriers to entry.

Legal Implications: Traditional Liabilities vs DeFi Agreements

Traditional liabilities in money management involve legally binding obligations enforceable by established regulatory frameworks and courts, ensuring creditor protection through standardized contracts and insolvency laws. DeFi obligations operate on blockchain-based smart contracts with automated execution but face legal uncertainties due to varying jurisdictional recognition and lack of comprehensive regulatory oversight. This contrast raises significant challenges in dispute resolution, enforceability, and risk assessment between conventional financial liabilities and decentralized finance agreements.

Transparency and Accountability in DeFi vs Traditional Finance

Decentralized Finance (DeFi) obligations offer enhanced transparency through blockchain's immutable ledger, enabling real-time auditing and reducing information asymmetry compared to traditional finance liabilities, which often suffer from opaque reporting and delayed disclosures. Smart contracts autonomously enforce accountability in DeFi, minimizing counterparty risk and enhancing trust without relying on intermediaries, whereas traditional financial liabilities depend heavily on centralized institutions subject to human error and regulatory complexities. This technology-driven accountability framework in DeFi fosters greater financial inclusion and user control over liabilities, contrasting the centralized control and limited transparency characteristic of conventional financial systems.

Cost Structures: Comparing Fees and Interest Rates

Liabilities in traditional finance typically involve fixed interest rates and predictable fee structures, enabling clearer cost projections for money management. Decentralized finance obligations often feature variable fees influenced by network demand and smart contract conditions, leading to potentially fluctuating cost exposure. Comparing these cost structures highlights that traditional liabilities may offer stability, while DeFi obligations provide flexibility but with higher volatility in fees and interest rates.

Security Concerns: Safeguarding Assets in Both Systems

Liabilities in traditional finance represent clear, regulated obligations with established legal protections, while decentralized finance (DeFi) obligations operate on blockchain protocols with varying smart contract risks and limited regulatory oversight. Security concerns in centralized systems rely on institutional safeguards such as insurance and compliance frameworks, whereas DeFi requires vigilant smart contract audits and private key management to prevent hacks and loss of assets. Effective money management in both contexts demands understanding the distinct vulnerabilities and implementing robust asset protection strategies tailored to their operational models.

Future Trends: Evolution of Liabilities in a DeFi World

Future trends in liability management within decentralized finance (DeFi) indicate a shift towards programmable, blockchain-based obligations that enhance transparency and reduce counterparty risk. Smart contracts enable automated enforcement of liabilities, transforming traditional debt instruments into more efficient, auditable assets. Integration of oracles and cross-chain protocols will further evolve liabilities, allowing dynamic adjustment of obligations based on real-time market data, thereby optimizing money management strategies in a DeFi ecosystem.

Related Important Terms

Smart Contract Liabilities

Smart contract liabilities in decentralized finance differ from traditional liabilities by automating obligations through code, reducing reliance on intermediaries and enhancing transparency. These programmable liabilities ensure precise execution of financial agreements, but expose users to risks such as coding errors, security vulnerabilities, and irrevocable contract enforcement.

DeFi Yield Obligations

DeFi yield obligations represent smart contract-based liabilities that promise returns on deposited assets, differing from traditional liabilities by operating without centralized intermediaries. These obligations require precise risk assessment due to their dependence on protocol mechanisms, market volatility, and potential smart contract vulnerabilities.

Overcollateralization Exposure

Overcollateralization in decentralized finance (DeFi) creates exposure by requiring borrowers to secure loans with assets exceeding the loan value, mitigating default risk but increasing capital inefficiency compared to traditional liabilities management. This excess collateral provides a buffer protecting lenders but can lead to liquidity strain for borrowers, contrasting with conventional finance where liabilities are managed through credit evaluations and risk assessments without mandatory asset overhang.

Flash Loan Repayment Risk

Liabilities in traditional finance typically involve fixed obligations with clear repayment terms, whereas decentralized finance (DeFi) obligations, such as flash loans, present unique risks due to their instantaneous and atomic nature that can lead to sudden default events. The inherent risk in flash loan repayment lies in the necessity for executing complex transactions within a single block, making successful repayment contingent on precise timing and market conditions, thereby increasing potential financial exposure.

Cross-Chain Debt Positions

Cross-chain debt positions in decentralized finance (DeFi) represent liabilities that span multiple blockchain networks, requiring accurate tracking and management to prevent default risks and ensure liquidity across platforms. Unlike traditional liabilities confined to single financial institutions, these obligations depend on interoperable smart contracts and oracles for real-time valuation and collateralization across decentralized ecosystems.

Algorithmic Stablecoin Debt

Algorithmic stablecoin debt represents a unique liability within decentralized finance (DeFi), characterized by automated protocols that manage supply to maintain a stable value without centralized backing. Unlike traditional liabilities, these obligations rely on market incentives and smart contract algorithms, which can introduce volatility and systemic risk in money management strategies.

Fractionalized Liability Tokens

Fractionalized Liability Tokens enable precise allocation and trading of financial obligations within decentralized finance, enhancing transparency and risk distribution compared to traditional liabilities. These tokens represent specific portions of debt, allowing participants to manage, transfer, or hedge their obligations more efficiently on blockchain platforms.

Impermanent Loss Obligations

Impermanent Loss Obligations in Decentralized Finance pose unique liability risks due to the volatile nature of liquidity pools, creating potential gaps in asset value compared to traditional liabilities with fixed repayment terms. Unlike conventional liabilities, these obligations fluctuate based on market conditions, requiring advanced risk management strategies to mitigate impermanent loss exposure effectively.

Synthetic Asset Liabilities

Synthetic asset liabilities in decentralized finance (DeFi) represent obligations backed by tokenized derivatives that replicate the value of real-world assets, requiring precise on-chain collateral management to mitigate liquidation risks. Unlike traditional liabilities, these synthetic obligations rely on algorithmic protocols and smart contracts, emphasizing transparency and automated risk adjustments in money management strategies.

Real-World Asset (RWA) Debt Integration

Liabilities in traditional finance represent fixed obligations on a balance sheet, while decentralized finance (DeFi) obligations related to Real-World Asset (RWA) debt integration enable on-chain collateralization and programmable debt settlements. Integrating RWAs into DeFi platforms enhances liquidity, risk distribution, and transparency, transforming static liabilities into dynamic, blockchain-verifiable financial instruments.

Liabilities vs Decentralized Finance Obligations for money management. Infographic

moneydiff.com

moneydiff.com