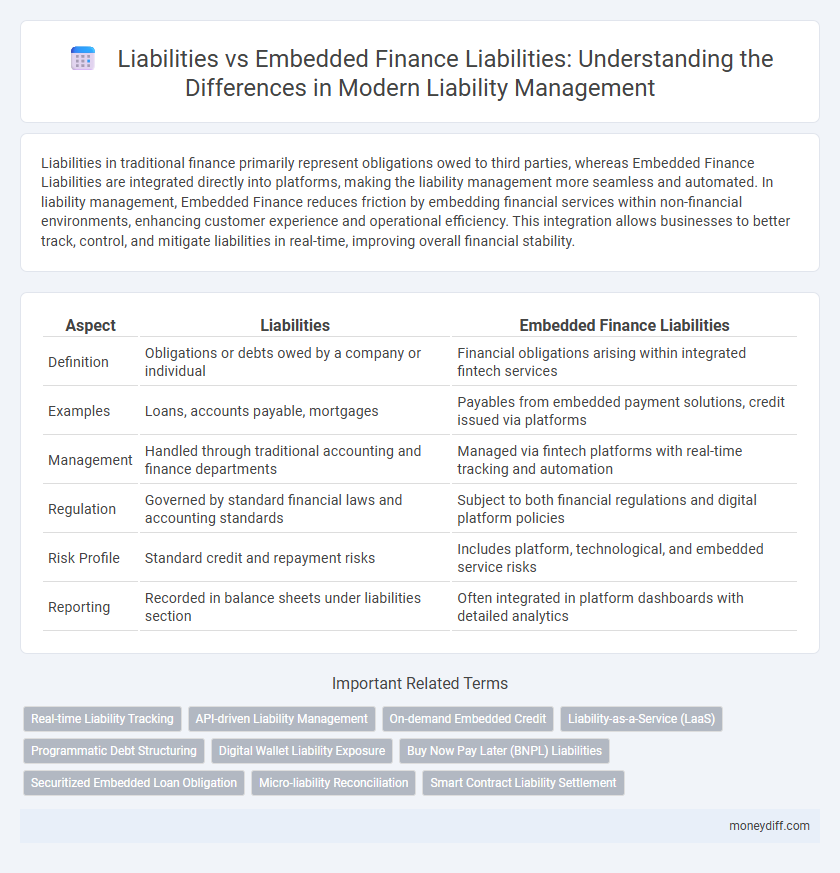

Liabilities in traditional finance primarily represent obligations owed to third parties, whereas Embedded Finance Liabilities are integrated directly into platforms, making the liability management more seamless and automated. In liability management, Embedded Finance reduces friction by embedding financial services within non-financial environments, enhancing customer experience and operational efficiency. This integration allows businesses to better track, control, and mitigate liabilities in real-time, improving overall financial stability.

Table of Comparison

| Aspect | Liabilities | Embedded Finance Liabilities |

|---|---|---|

| Definition | Obligations or debts owed by a company or individual | Financial obligations arising within integrated fintech services |

| Examples | Loans, accounts payable, mortgages | Payables from embedded payment solutions, credit issued via platforms |

| Management | Handled through traditional accounting and finance departments | Managed via fintech platforms with real-time tracking and automation |

| Regulation | Governed by standard financial laws and accounting standards | Subject to both financial regulations and digital platform policies |

| Risk Profile | Standard credit and repayment risks | Includes platform, technological, and embedded service risks |

| Reporting | Recorded in balance sheets under liabilities section | Often integrated in platform dashboards with detailed analytics |

Understanding Liabilities in Money Management

Liabilities in money management refer to the financial obligations a person or business must settle, such as loans, credit card debts, or mortgages. Embedded finance liabilities arise when non-financial companies integrate financial services into their offerings, creating new forms of debt or payment responsibilities linked to these embedded solutions. Understanding the distinction helps in accurately assessing overall financial health and managing risks associated with both traditional and embedded finance commitments.

Embedded Finance Liabilities: A New Paradigm

Embedded finance liabilities represent a transformative approach where financial services are integrated directly into non-financial platforms, creating new obligations that differ from traditional liabilities. These liabilities often involve real-time transaction processing, regulatory compliance complexities, and shared risk between platform providers and financial institutions. This paradigm shifts liability management towards more dynamic, technology-driven frameworks requiring advanced monitoring and adaptive risk controls.

Traditional Liabilities vs Embedded Finance: Key Differences

Traditional liabilities typically include long-term debt, accounts payable, and accrued expenses recorded on a company's balance sheet. Embedded finance liabilities arise from integrated financial services within non-financial platforms, involving customer deposits, payment obligations, and financing products seamlessly embedded in user experiences. Key differences lie in liability recognition, risk management, and regulatory frameworks due to varying sources and transactional nature of embedded finance versus conventional financial liabilities.

The Evolution of Liability: From Banks to Embedded Finance

Liabilities have traditionally been confined to banks, acting as obligations like customer deposits and loans on financial statements. The evolution to embedded finance liabilities integrates financial services into non-financial platforms, where obligations arise from new sources such as buy-now-pay-later schemes and embedded payment systems. This shift diversifies liability profiles, requiring enhanced risk management and regulatory frameworks tailored to the unique interface between technology and finance.

Assessing Risk: Conventional vs Embedded Liabilities

Conventional liabilities involve traditional financial obligations like loans, accounts payable, and accrued expenses, which are clearly defined and regulated. Embedded finance liabilities integrate financial services directly into non-financial platforms, creating complex, dynamic risk profiles due to real-time transaction flows and user behavior data. Assessing risk in embedded finance requires advanced analytics and continuous monitoring to manage liquidity, credit, and operational risks that differ significantly from conventional liability frameworks.

Regulatory Implications for Embedded Finance Liabilities

Embedded finance liabilities present unique regulatory implications compared to traditional liabilities, requiring compliance with both financial service regulations and platform-specific obligations. Regulatory authorities emphasize transparent risk management, customer protection, and anti-money laundering measures within embedded finance ecosystems. Failure to address these regulatory requirements can lead to significant legal penalties and undermine consumer trust in embedded financial products.

Impact on Businesses: Managing Liabilities in Embedded Finance

Liabilities in traditional finance primarily involve straightforward obligations such as loans and accounts payable, while embedded finance liabilities integrate financial services within non-financial platforms, increasing complexity in risk management. Businesses leveraging embedded finance face heightened regulatory scrutiny and operational challenges due to real-time transaction processing and layered customer data compliance. Effective management of these liabilities demands advanced technology, robust compliance frameworks, and strategic risk mitigation to maintain financial stability and customer trust.

Liability Reporting: Transparency in Embedded Finance Solutions

Liability reporting in embedded finance solutions demands enhanced transparency to accurately capture contingent and off-balance-sheet liabilities that traditional financial statements may overlook. Embedded finance integrates third-party financial services within non-financial platforms, complicating liability recognition and requiring real-time, granular reporting to manage risks effectively. Advanced analytics and automated disclosure tools are essential for maintaining compliance and providing stakeholders with a clear view of embedded finance liabilities versus conventional liabilities.

Strategies for Reducing Liability in Embedded Finance

Strategies for reducing liability in embedded finance focus on implementing robust compliance frameworks and leveraging automated risk management tools to monitor transactional activities. Financial institutions prioritize clear contractual agreements that delineate responsibilities between partners, minimizing exposure and potential disputes. Utilizing advanced data encryption and continuous auditing also mitigates the risk of fraud and regulatory breaches, safeguarding both the embedded finance provider and end users.

Future Trends: Liability Management in an Embedded Finance Era

Liabilities in traditional finance typically involve fixed obligations such as loans and payables, whereas embedded finance liabilities integrate these obligations within digital platforms, creating seamless financial experiences. Future trends in liability management emphasize real-time tracking, automated compliance, and AI-driven risk assessment to enhance accuracy and efficiency in managing embedded finance liabilities. Increasing adoption of blockchain technology will further transform liability transparency and security, enabling smarter contract execution and reducing counterparty risk.

Related Important Terms

Real-time Liability Tracking

Real-time liability tracking enables businesses to monitor both traditional liabilities and embedded finance liabilities with precision, ensuring up-to-date financial accuracy and risk assessment. Advanced analytics platforms integrate data from embedded finance solutions to provide instantaneous insights into evolving obligations and cash flow impacts.

API-driven Liability Management

API-driven liability management enables seamless integration of traditional liabilities with embedded finance liabilities, enhancing real-time tracking and automation of financial obligations. This approach optimizes liquidity management and risk assessment by unifying diverse liability sources within programmable finance ecosystems.

On-demand Embedded Credit

On-demand embedded credit liabilities represent a subset of traditional liabilities, characterized by their integration within digital platforms to provide instant credit access without separate loan agreements. These liabilities are recognized on the balance sheet as contingent obligations tied directly to consumer spending within partner ecosystems, distinguishing them from conventional liabilities that typically involve fixed repayment schedules and external credit underwriting.

Liability-as-a-Service (LaaS)

Liability-as-a-Service (LaaS) offers scalable, technology-driven management of financial liabilities by integrating embedded finance solutions directly into business operations, enhancing real-time tracking and risk mitigation. Unlike traditional liabilities, embedded finance liabilities streamline compliance and automate payment obligations through APIs, reducing operational costs and improving transparency for enterprises.

Programmatic Debt Structuring

Programmatic debt structuring enhances traditional liabilities by embedding financial services directly into digital platforms, creating seamless and automated liability management solutions. Unlike conventional liabilities, embedded finance liabilities offer dynamic risk allocation and real-time monitoring, optimizing capital efficiency and improving compliance within complex financial ecosystems.

Digital Wallet Liability Exposure

Digital wallet liability exposure significantly differs from traditional liabilities by encompassing real-time transaction risks and regulatory compliance challenges unique to embedded finance systems. These liabilities are dynamic, often involving third-party service providers and complex payment networks, increasing potential financial and operational risks compared to conventional liabilities.

Buy Now Pay Later (BNPL) Liabilities

Buy Now Pay Later (BNPL) liabilities represent deferred payment obligations embedded within consumer financing, distinguishing them from traditional liabilities by integrating payment solutions directly into purchasing processes. These embedded finance liabilities increase short-term liabilities on balance sheets through accrued customer payment commitments, impacting liquidity management and risk assessment differently than standard accounts payable or loans.

Securitized Embedded Loan Obligation

Securitized Embedded Loan Obligations represent a specific category of embedded finance liabilities, where financial obligations are packaged and sold to investors as asset-backed securities, enhancing liquidity and risk transfer compared to traditional liabilities. These obligations differ from conventional liabilities by embedding the loan servicing within digital platforms, enabling streamlined management and tailored risk profiles aligned with the securitized asset pools.

Micro-liability Reconciliation

Micro-liability reconciliation differs significantly from traditional liabilities by emphasizing granular transaction-level tracking within embedded finance ecosystems, enabling precise alignment of micro-balances with real-time financial activities. This approach enhances accuracy in liability management by integrating automated reconciliation tools that reduce discrepancies and streamline reporting processes.

Smart Contract Liability Settlement

Smart Contract Liability Settlement automates the resolution of liabilities within embedded finance ecosystems, reducing the risk of disputes by enforcing contract terms transparently and efficiently. Unlike traditional liabilities that rely on manual reconciliation, embedded finance liabilities managed through smart contracts enhance accuracy, speed, and trust in financial obligations processing.

Liabilities vs Embedded Finance Liabilities for liability. Infographic

moneydiff.com

moneydiff.com