Debt and Buy Now Pay Later (BNPL) options both impact liability but differ significantly in management and risk. Debt typically accrues interest and contributes to long-term financial obligations, increasing liability on the balance sheet. BNPL offers short-term repayment flexibility without immediate interest, yet it can lead to overlooked liabilities and potential credit risks if payments are missed.

Table of Comparison

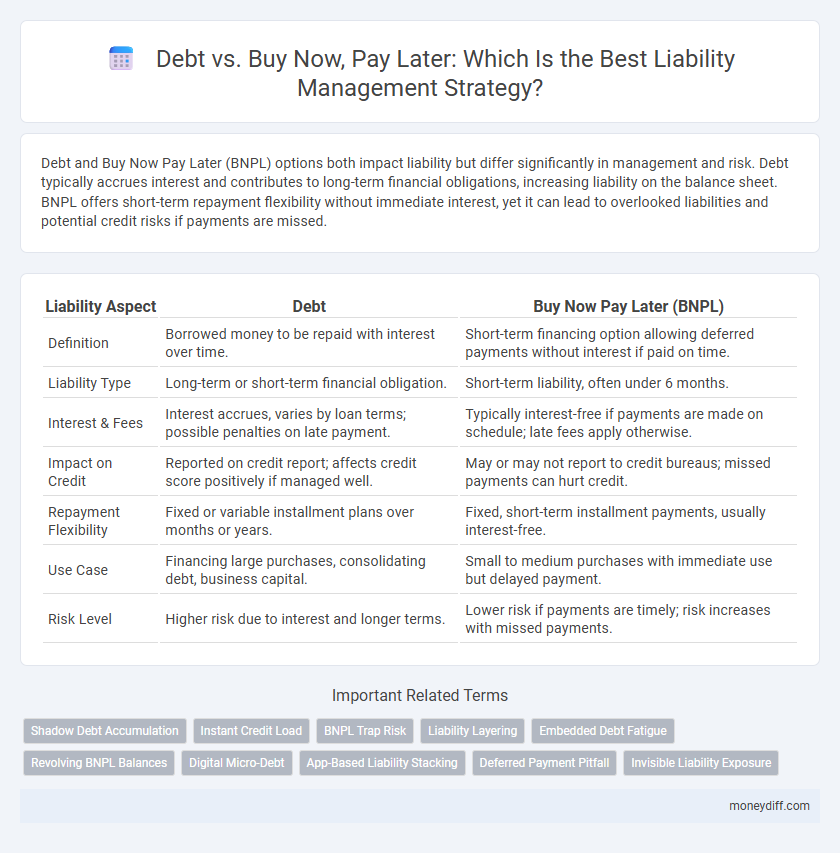

| Liability Aspect | Debt | Buy Now Pay Later (BNPL) |

|---|---|---|

| Definition | Borrowed money to be repaid with interest over time. | Short-term financing option allowing deferred payments without interest if paid on time. |

| Liability Type | Long-term or short-term financial obligation. | Short-term liability, often under 6 months. |

| Interest & Fees | Interest accrues, varies by loan terms; possible penalties on late payment. | Typically interest-free if payments are made on schedule; late fees apply otherwise. |

| Impact on Credit | Reported on credit report; affects credit score positively if managed well. | May or may not report to credit bureaus; missed payments can hurt credit. |

| Repayment Flexibility | Fixed or variable installment plans over months or years. | Fixed, short-term installment payments, usually interest-free. |

| Use Case | Financing large purchases, consolidating debt, business capital. | Small to medium purchases with immediate use but delayed payment. |

| Risk Level | Higher risk due to interest and longer terms. | Lower risk if payments are timely; risk increases with missed payments. |

Understanding Debt and Buy Now Pay Later: Key Differences

Debt involves borrowing a fixed amount of money with agreed-upon interest and repayment terms, creating a clear liability on your balance sheet. Buy Now Pay Later (BNPL) allows consumers to make purchases immediately and pay in installments without traditional interest rates, although missed payments can lead to fees and impact credit scores. Understanding these distinctions helps manage financial liabilities by evaluating long-term obligations versus short-term payment flexibility.

How Debt Impacts Your Financial Liability

Debt increases financial liability by creating fixed repayment obligations that affect cash flow and creditworthiness. Buy Now Pay Later (BNPL) schemes offer short-term liquidity but can accumulate fees and penalties, potentially escalating total liability if payments are missed. Managing debt effectively minimizes risk of default and protects long-term financial stability.

Buy Now Pay Later: Liability Risks and Rewards

Buy Now Pay Later (BNPL) services create liability risks by potentially increasing consumer debt without thorough credit evaluations, leading to higher default rates and financial strain. However, BNPL also offers rewards such as improved cash flow management and increased purchasing power for consumers, which can stimulate economic activity. Businesses adopting BNPL face the challenge of balancing these risks against the potential for higher sales and customer loyalty.

Comparing Interest Rates: Debt vs Buy Now Pay Later

Debt typically involves higher interest rates compared to Buy Now Pay Later (BNPL) services, which often offer interest-free periods or lower fees if payments are made on time. Traditional debt, such as credit cards or personal loans, accrues interest daily, increasing the overall liability burden significantly over time. BNPL solutions can minimize interest costs but may impose penalties or elevated rates if payment deadlines are missed, influencing the total cost of liability management.

The Psychological Effects of Debt vs Buy Now Pay Later

Debt often triggers anxiety and stress due to long-term financial obligations and interest accrual, impacting mental well-being and decision-making. Buy Now Pay Later (BNPL) schemes, while perceived as convenient, can create a false sense of immediate affordability, potentially leading to overspending and future financial strain. Understanding these psychological dynamics is crucial for managing liabilities and fostering healthier financial habits.

Credit Score Implications: Debt Versus Buy Now Pay Later

Debt typically impacts credit scores by increasing credit utilization and adding to outstanding balances, which may lower scores if not managed responsibly. Buy Now Pay Later (BNPL) services often do not report to credit bureaus immediately, reducing short-term credit score effects but potentially harming scores if payments are missed or accounts default. Understanding the credit reporting practices of BNPL providers is crucial for managing liabilities and maintaining a healthy credit profile.

Managing Multiple Liabilities: Debt and Buy Now Pay Later

Managing multiple liabilities requires careful prioritization of Debt and Buy Now Pay Later (BNPL) obligations to minimize financial strain. Debt typically involves interest accrual and longer repayment terms, increasing total liability over time, while BNPL services often feature interest-free periods but can lead to short-term cash flow challenges if multiple purchases are deferred simultaneously. Effective liability management involves budgeting for scheduled debt repayments and tracking BNPL payment deadlines to avoid penalties and mitigate the risk of accumulating excessive liabilities.

Legal Protections and Consumer Rights: Debt vs BNPL

Debt carries established legal protections and clear consumer rights, including regulated interest rates, mandatory disclosures, and dispute resolution mechanisms under laws such as the Fair Credit Reporting Act and Truth in Lending Act. Buy Now Pay Later (BNPL) services often operate in a regulatory gray area, providing fewer explicit legal safeguards, with consumers sometimes lacking protections related to interest rates and credit reporting. Understanding the differences in legal frameworks is essential for evaluating liability exposure and ensuring informed financial decisions between traditional debt and BNPL options.

Strategies to Minimize Liability with Debt and Buy Now Pay Later

Effective strategies to minimize liability with debt include maintaining a low debt-to-income ratio, prioritizing high-interest debt repayment, and consolidating loans to secure better interest rates. For Buy Now Pay Later (BNPL) services, consumers should limit purchase amounts, monitor payment schedules closely, and choose plans with no or low fees to avoid late charges. Both approaches benefit from budgeting discipline and regular credit report reviews to manage outstanding obligations and protect credit scores.

Choosing Wisely: When to Use Debt or Buy Now Pay Later

Choosing wisely between debt and Buy Now Pay Later (BNPL) options significantly impacts financial liability management. Debt typically involves structured repayment schedules with interest, making it suitable for long-term needs or larger purchases that require careful budgeting. BNPL offers short-term, interest-free installments ideal for smaller, immediate expenses, but can increase liability risk if not managed properly due to potential late fees and accumulating balances.

Related Important Terms

Shadow Debt Accumulation

Buy Now Pay Later (BNPL) services often contribute to shadow debt accumulation by enabling consumers to incur financial obligations that are less visible on traditional credit reports, increasing overall liability without clear tracking. This hidden liability can lead to escalating debt burdens as missed payments or rolling balances compound outside the scope of conventional debt management systems.

Instant Credit Load

Debt represents a legal obligation requiring repayment of borrowed funds, often accruing interest over time, whereas Buy Now Pay Later (BNPL) services provide Instant Credit Load enabling consumers to defer payments without immediate financial burden. BNPL liabilities typically appear as short-term, interest-free obligations but can increase total debt if repayment deadlines are missed or extended.

BNPL Trap Risk

Buy Now Pay Later (BNPL) services often create hidden liability risks as consumers accumulate debt without fully understanding interest rates or late fees, leading to escalating financial burdens. Unlike traditional debt with clear payment schedules, BNPL can encourage overspending and missed payments, significantly increasing the risk of default and long-term credit damage.

Liability Layering

Debt increases long-term liability layers on the balance sheet, impacting creditworthiness and financial leverage ratios. Buy Now Pay Later (BNPL) often appears as short-term liability, potentially obscuring true debt levels and complicating liability layering analysis for risk assessment.

Embedded Debt Fatigue

Buy Now Pay Later (BNPL) services often contribute to embedded debt fatigue by increasing consumers' short-term liabilities without clear long-term repayment plans, unlike traditional debt that typically involves structured schedules and interest rates. This hidden accumulation of liabilities can strain credit profiles and escalate financial risk for both consumers and lenders.

Revolving BNPL Balances

Revolving Buy Now Pay Later (BNPL) balances significantly increase consumer liability by accumulating interest and fees similar to traditional revolving debt, often leading to higher outstanding balances over time. Unlike standard debt, revolving BNPL products lack stringent credit checks, which can result in consumers underestimating their financial obligations and escalating total liabilities.

Digital Micro-Debt

Digital micro-debt, often associated with Buy Now Pay Later (BNPL) services, represents a growing liability category distinct from traditional debt due to its short-term, high-frequency nature and typically lower principal amounts. Unlike conventional debt, BNPL liabilities impact consumer credit profiles differently and require tailored risk management strategies to address potential default risks in digital commerce environments.

App-Based Liability Stacking

App-based liability stacking in Buy Now Pay Later (BNPL) services intensifies debt exposure by accumulating multiple short-term payment obligations across various platforms, increasing overall financial risk. Unlike traditional debt instruments, BNPL liabilities often lack comprehensive credit checks, leading to underestimated cumulative debt burdens on consumers' balance sheets.

Deferred Payment Pitfall

Debt increases liability by creating long-term financial obligations with interest accrual, while Buy Now Pay Later schemes often mask true costs through deferred payments that can lead to unexpected fees and credit damage, posing significant deferred payment pitfalls. Consumers must carefully evaluate the terms to avoid escalating liabilities and potential default risks associated with unseen repayment burdens.

Invisible Liability Exposure

Buy Now Pay Later (BNPL) services create significant invisible liability exposure by accumulating off-balance-sheet debt that is not immediately reflected in financial statements. This hidden obligation risks underestimating true debt levels and complicates credit risk assessment compared to traditional, transparent debt instruments.

Debt vs Buy Now Pay Later for liability. Infographic

moneydiff.com

moneydiff.com