Revolving credit provides a flexible borrowing option with a preset credit limit that borrowers can repeatedly use and repay, making it suitable for managing ongoing liability expenses in pet care. Virtual credit lines offer a digital-first approach with quick access and seamless integration into financial apps, ideal for real-time tracking and controlling liability-related expenditures. Comparing both, revolving credit emphasizes traditional credit management, while virtual credit lines prioritize convenience and technological efficiency for liability handling.

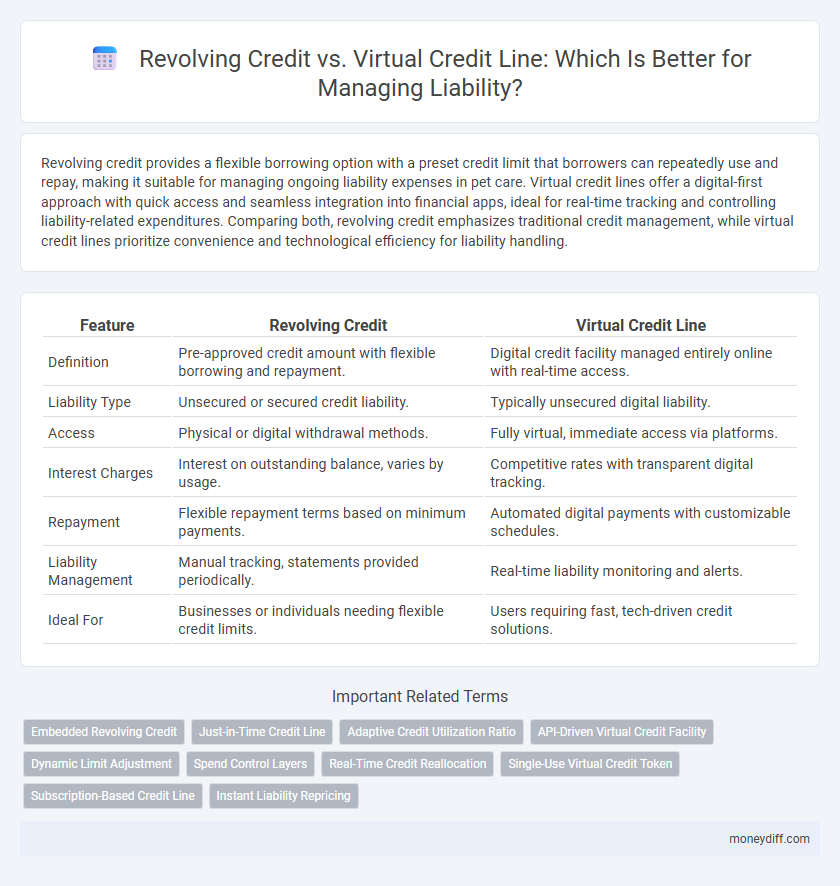

Table of Comparison

| Feature | Revolving Credit | Virtual Credit Line |

|---|---|---|

| Definition | Pre-approved credit amount with flexible borrowing and repayment. | Digital credit facility managed entirely online with real-time access. |

| Liability Type | Unsecured or secured credit liability. | Typically unsecured digital liability. |

| Access | Physical or digital withdrawal methods. | Fully virtual, immediate access via platforms. |

| Interest Charges | Interest on outstanding balance, varies by usage. | Competitive rates with transparent digital tracking. |

| Repayment | Flexible repayment terms based on minimum payments. | Automated digital payments with customizable schedules. |

| Liability Management | Manual tracking, statements provided periodically. | Real-time liability monitoring and alerts. |

| Ideal For | Businesses or individuals needing flexible credit limits. | Users requiring fast, tech-driven credit solutions. |

Understanding Revolving Credit: Key Features and Functions

Revolving credit is a flexible financial liability that allows borrowers to access funds up to a predetermined credit limit, with the ability to repay and reuse the credit repeatedly. Key features include variable interest rates, minimum monthly payments, and ongoing availability of credit until the limit is reached or the account is closed. This liability type supports cash flow management by providing continuous access to capital, distinguishing it from traditional loans and virtual credit lines.

Virtual Credit Line Explained: A Modern Financial Solution

A Virtual Credit Line offers a flexible liability management option by providing instant access to funds without the need for physical credit cards, improving cash flow efficiency for businesses. Unlike traditional revolving credit, virtual credit lines leverage advanced technology to deliver real-time tracking and customizable credit limits, enhancing financial control and risk mitigation. This modern financial solution reduces liability exposure through automated repayment schedules and integrated monitoring tools, ensuring transparent and optimized debt management.

Comparing Liability Structures: Revolving Credit vs Virtual Credit Line

Revolving credit typically involves a fixed credit limit with ongoing access to funds, creating a liability that fluctuates based on usage and repayments, while virtual credit lines offer customizable draw amounts with digital management, often enabling more flexible liability tracking and control. Liability on revolving credit is contingent on outstanding balances accruing interest, whereas virtual credit lines may integrate advanced risk assessment tools to dynamically adjust available credit and associated liabilities. Evaluating liability structures reveals that virtual credit lines can provide enhanced transparency and adaptability in managing credit exposure compared to traditional revolving credit frameworks.

Flexibility and Accessibility: Which Credit Option Wins?

Revolving credit offers higher flexibility with a pre-approved credit limit that borrowers can repeatedly draw from and repay without reapplying, making it ideal for managing fluctuating liabilities. Virtual credit lines provide enhanced accessibility through digital platforms, enabling quick approvals and real-time fund availability, suitable for businesses needing immediate liquidity. While revolving credit excels in ongoing flexibility, virtual credit lines lead in accessibility, making the choice dependent on specific liability management needs.

Interest Rates and Fee Structures: What to Consider

Revolving credit typically features variable interest rates that can fluctuate with market conditions, impacting overall liability costs, while virtual credit lines often offer fixed or more predictable rates, enhancing budgeting accuracy. Fee structures for revolving credit may include annual fees, transaction fees, and penalties for late payments, increasing the total cost of liability management. Virtual credit lines usually present transparent, upfront fees without hidden charges, making them a more straightforward option for businesses seeking to control liability expenses.

Impact on Credit Score and Financial Profile

Revolving credit usage directly influences credit utilization ratio, impacting credit scores by reflecting ongoing debt management, while virtual credit lines offer more flexible borrowing without immediate high utilization spikes. Virtual credit lines often show as contingent liabilities, potentially lowering debt-to-income ratios less than traditional revolving credit, which records active balances. Proper management of either credit type is crucial to maintaining a balanced financial profile and optimizing creditworthiness for future lending opportunities.

Managing Repayments: Strategies for Each Credit Type

Revolving credit requires careful management of minimum monthly payments and interest accrual to avoid escalating liabilities and maintain a healthy credit utilization ratio. Virtual credit lines often allow for more flexible repayment schedules, enabling borrowers to tailor payments according to cash flow and reduce the risk of default. Strategic repayment planning for both credit types focuses on balancing timely payments with available credit limits to optimize liability management and financial stability.

Risk Assessment: Minimizing Liability with Smart Choices

Risk assessment in liability management favors virtual credit lines over revolving credit due to their enhanced control and transparency features. Virtual credit lines enable precise tracking and limit setting, reducing the risk of overextension and potential defaults. Choosing virtual credit lines supports proactive liability minimization by aligning credit availability with real-time financial conditions and risk profiles.

Practical Use Cases: When to Choose Revolving Credit or Virtual Credit Line

Revolving credit is ideal for businesses needing flexible, ongoing access to funds for operational expenses or inventory purchases, with the ability to borrow, repay, and borrow again up to a credit limit. Virtual credit lines suit companies requiring quick, secure, and trackable digital transactions, often integrated with financial management platforms for simplified liability tracking and real-time expense control. Choosing between them depends on the need for physical credit access and payment flexibility versus digital convenience and enhanced financial oversight.

Future Trends: The Evolving Landscape of Liability Management

Revolving credit and virtual credit lines are transforming liability management by offering flexible borrowing options tailored to dynamic cash flow needs and real-time financial monitoring. Future trends indicate increased integration of AI-powered risk assessment and blockchain technology to enhance transparency, reduce fraud, and optimize liability portfolios. Companies leveraging these advancements can expect improved liquidity management and more efficient debt structuring in an evolving regulatory environment.

Related Important Terms

Embedded Revolving Credit

Embedded revolving credit integrates a flexible borrowing option directly within a business's financial framework, enhancing liquidity management by providing continuous access to funds up to a preset limit without reapplication, thereby optimizing liability handling and cash flow stability. Unlike traditional virtual credit lines that function as standalone digital tools, embedded revolving credit offers seamless, real-time credit utilization aligned with operational needs, reducing the risk of overdrafts and improving financial agility.

Just-in-Time Credit Line

Revolving credit and virtual credit lines both offer flexible access to funds, but virtual credit lines provide just-in-time credit by enabling borrowers to draw only the exact amount needed when required, minimizing unused credit liabilities. This just-in-time approach reduces interest expenses and improves liability management by aligning credit availability closely with cash flow demands.

Adaptive Credit Utilization Ratio

Revolving credit typically exhibits a variable Adaptive Credit Utilization Ratio that fluctuates with ongoing borrowing and repayments, influencing overall liability management and creditworthiness. Virtual credit lines offer smoother control over the Adaptive Credit Utilization Ratio by enabling pre-approved access to funds without impacting reported liabilities until actual utilization occurs.

API-Driven Virtual Credit Facility

API-driven virtual credit facilities offer dynamic, real-time liability management, enabling precise control over revolving credit limits and reducing exposure to default risk. Unlike traditional revolving credit, virtual credit lines facilitate seamless integration with financial platforms, enhancing transparency and automating liability monitoring through advanced analytics.

Dynamic Limit Adjustment

Revolving credit offers a fixed credit limit with periodic repayments, creating predictable liability but limited flexibility in dynamic limit adjustment. Virtual credit lines adapt credit limits in real-time based on borrower behavior and risk assessment, enhancing liability management through scalable and responsive credit availability.

Spend Control Layers

Revolving credit offers limited spend control layers, typically allowing set credit limits and periodic reporting, while virtual credit lines incorporate dynamic spend controls, including real-time expense tracking, user-specific limits, and automated alerts to mitigate liability risks. Enhanced spend control features in virtual credit lines improve liability management by providing granular oversight and reducing unauthorized or excessive expenditures.

Real-Time Credit Reallocation

Revolving credit enables real-time credit reallocation by allowing borrowers to access and repay funds repeatedly within a preset limit, ensuring flexibility in managing liability obligations. Virtual credit lines enhance this process through digital platforms, providing instantaneous credit adjustments and seamless liability management without physical credit card constraints.

Single-Use Virtual Credit Token

Single-use virtual credit tokens in virtual credit lines enhance liability management by limiting exposure to specific transactions, reducing the risk of unauthorized charges compared to revolving credit accounts that maintain ongoing credit availability. This targeted control minimizes potential fraud and helps maintain tighter oversight on liabilities within defined credit limits.

Subscription-Based Credit Line

Subscription-based credit lines offer flexible liability management compared to traditional revolving credit by allowing businesses to borrow and repay within a set limit tied to their subscription agreement. This model minimizes outstanding debt fluctuations and enhances predictability in financial obligations, reducing risk exposure associated with revolving credit liabilities.

Instant Liability Repricing

Revolving credit facilities often feature fixed or periodically adjusted interest rates, limiting the ability to instantly reprice liabilities in response to market changes, whereas virtual credit lines utilize dynamic pricing models that enable immediate liability repricing based on real-time risk assessments and market conditions. This instant liability repricing capability of virtual credit lines enhances financial agility and optimizes cost management by aligning credit costs closely with current credit risk and market rates.

Revolving Credit vs Virtual Credit Line for Liability Infographic

moneydiff.com

moneydiff.com