Liabilities in pet ownership encompass financial responsibilities such as veterinary bills, food, and emergency care costs that must be carefully managed to ensure ongoing pet welfare. Sustainable finance obligations prioritize ethical investment and responsible money management practices that align financial goals with environmental and social considerations. Balancing liabilities with sustainable finance strategies ensures pet owners can meet immediate expenses while supporting long-term financial health and ethical accountability.

Table of Comparison

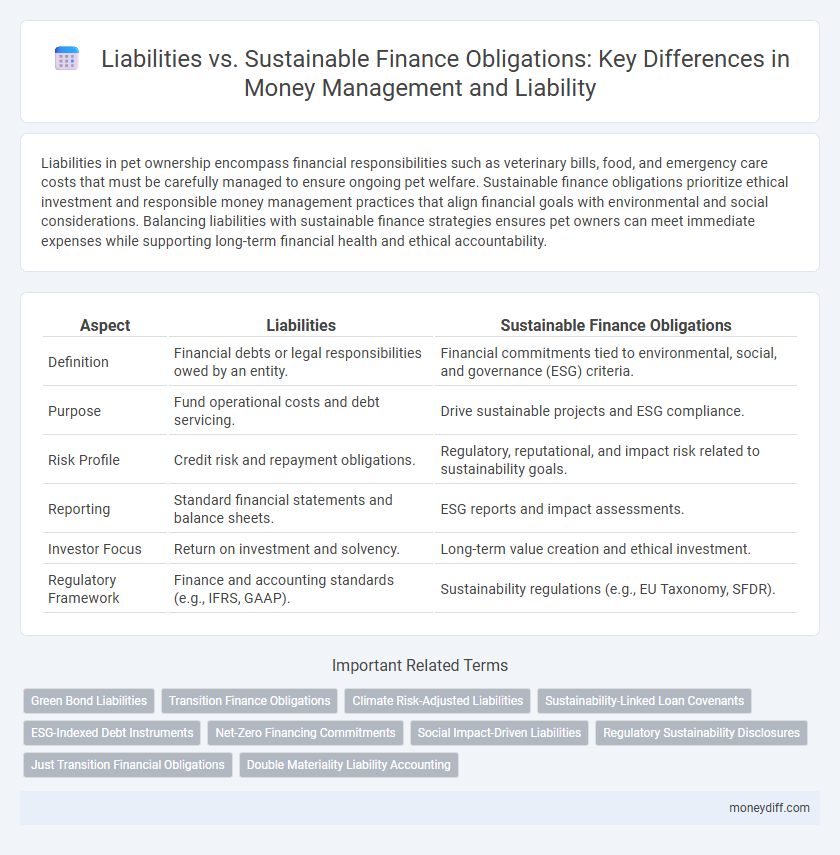

| Aspect | Liabilities | Sustainable Finance Obligations |

|---|---|---|

| Definition | Financial debts or legal responsibilities owed by an entity. | Financial commitments tied to environmental, social, and governance (ESG) criteria. |

| Purpose | Fund operational costs and debt servicing. | Drive sustainable projects and ESG compliance. |

| Risk Profile | Credit risk and repayment obligations. | Regulatory, reputational, and impact risk related to sustainability goals. |

| Reporting | Standard financial statements and balance sheets. | ESG reports and impact assessments. |

| Investor Focus | Return on investment and solvency. | Long-term value creation and ethical investment. |

| Regulatory Framework | Finance and accounting standards (e.g., IFRS, GAAP). | Sustainability regulations (e.g., EU Taxonomy, SFDR). |

Understanding Liabilities in Money Management

Liabilities in money management represent the financial obligations or debts a business or individual must repay, impacting cash flow and financial stability. Sustainable finance obligations emphasize investments that consider environmental, social, and governance (ESG) criteria, aligning financial goals with long-term sustainability. Understanding the distinction between traditional liabilities and sustainable finance obligations is crucial for optimizing risk management and ensuring responsible capital allocation.

Defining Sustainable Finance Obligations

Sustainable Finance Obligations refer to financial commitments that prioritize environmental, social, and governance (ESG) criteria, integrating sustainability goals into traditional liability structures. These obligations demand careful management to balance risk, compliance, and long-term impact, distinguishing them from conventional liabilities focused solely on financial returns. Effective money management of Sustainable Finance Obligations involves aligning capital deployment with sustainable development objectives while ensuring regulatory adherence and financial stability.

Key Differences: Liabilities vs Sustainable Finance Obligations

Liabilities represent traditional financial obligations that a company must settle, often involving debt or payables, while sustainable finance obligations specifically target funding activities aligned with environmental, social, and governance (ESG) criteria. Unlike general liabilities, sustainable finance obligations integrate impact measurement and reporting, linking financial returns with positive societal outcomes. These obligations often come with stricter compliance requirements and incentives to promote long-term sustainability goals within money management strategies.

Impact of Liabilities on Financial Health

Liabilities directly influence a company's financial health by determining its debt burden and liquidity risk, affecting its ability to finance sustainable initiatives. Sustainable finance obligations often require integrating environmental, social, and governance (ESG) criteria, which can modify traditional liability structures by prioritizing long-term risk management. Managing liabilities with a focus on sustainability enhances creditworthiness and aligns financial strategy with responsible investment principles, supporting durable economic growth.

The Role of Sustainable Finance in Risk Mitigation

Sustainable finance plays a critical role in risk mitigation by aligning liabilities with environmental, social, and governance (ESG) criteria to reduce exposure to long-term financial and reputational risks. Integrating sustainable finance obligations into money management helps identify and manage risks associated with climate change, regulatory shifts, and social responsibility, enhancing portfolio resilience. This approach promotes transparency and accountability, ensuring liabilities reflect sustainability goals while supporting positive environmental and social outcomes.

Measuring Long-term Effects: Liabilities vs Sustainability Goals

Measuring long-term effects involves comparing traditional liabilities with sustainable finance obligations, which integrate environmental, social, and governance (ESG) criteria into financial frameworks. Sustainable finance obligations prioritize risk management aligned with climate goals, promoting resilience and reducing potential future costs related to environmental impact. This approach enhances financial sustainability by balancing immediate liabilities with long-term societal and ecological benefits.

Regulatory Framework: Liability Compliance vs Sustainable Finance Standards

Liability compliance in money management primarily adheres to established regulatory frameworks such as the Basel III Accord and IFRS standards, ensuring accurate risk assessment and capital adequacy. Sustainable finance obligations integrate specific standards like the EU Taxonomy Regulation and the Task Force on Climate-related Financial Disclosures (TCFD), emphasizing environmental, social, and governance (ESG) criteria alongside financial prudence. Regulatory frameworks for liabilities focus on financial transparency and solvency, whereas sustainable finance standards impose additional mandates for sustainability reporting and impact measurement to align investments with global climate goals.

Integrating Sustainability in Liability Management Strategies

Integrating sustainability in liability management strategies enhances risk assessment by factoring in environmental, social, and governance (ESG) criteria alongside traditional financial metrics. Sustainable finance obligations, such as green bonds and ESG-linked loans, align capital structure decisions with long-term value creation and regulatory compliance. This approach drives resilience in liability portfolios, reducing exposure to stranded assets and fostering responsible investment practices.

Case Studies: Managing Traditional Liabilities and Sustainable Obligations

Case studies reveal distinct strategies in managing traditional liabilities versus sustainable finance obligations, highlighting differences in risk assessment, reporting frameworks, and stakeholder expectations. Traditional liabilities focus on regulatory compliance and financial solvency, whereas sustainable finance obligations integrate environmental, social, and governance (ESG) criteria into liability management. Effective money management necessitates balancing short-term financial commitments with long-term sustainability goals to achieve comprehensive fiscal responsibility.

Best Practices for Balancing Liabilities and Sustainable Finance Commitments

Effective money management requires aligning liabilities with sustainable finance obligations to ensure long-term financial health and environmental responsibility. Best practices include incorporating ESG criteria into risk assessments, regularly monitoring cash flows to meet both debt repayments and green investment targets, and maintaining transparent reporting to stakeholders. Balancing traditional liabilities with sustainable commitments enhances creditworthiness while supporting corporate social responsibility goals.

Related Important Terms

Green Bond Liabilities

Green bond liabilities represent a subset of traditional financial obligations explicitly tied to financing environmentally sustainable projects, creating measurable positive impacts alongside financial returns. Unlike conventional liabilities, these green bonds impose additional reporting and compliance requirements aligned with sustainable finance standards, ensuring funds are directed toward climate-resilient and low-carbon initiatives.

Transition Finance Obligations

Transition finance obligations focus on funding projects that enable companies to reduce carbon emissions and shift towards sustainable operations, distinguishing them from traditional liabilities that typically represent fixed financial commitments. These obligations require integrating environmental, social, and governance (ESG) criteria into risk management and capital allocation, aligning financial practices with climate transition goals.

Climate Risk-Adjusted Liabilities

Climate risk-adjusted liabilities integrate environmental factors into traditional financial obligations, ensuring money management strategies identify long-term climate-related risks and transition costs. Sustainable finance obligations prioritize investments aligned with climate goals, contrasting with liabilities that must be recalibrated to reflect potential asset devaluations and regulatory changes due to climate impact.

Sustainability-Linked Loan Covenants

Liabilities in traditional finance represent fixed financial obligations, whereas sustainable finance obligations, such as Sustainability-Linked Loan (SLL) covenants, tie repayment terms to the borrower's achievement of environmental, social, and governance (ESG) targets. By integrating ESG performance metrics into loan agreements, SLL covenants incentivize companies to enhance sustainability practices while managing financial liabilities efficiently.

ESG-Indexed Debt Instruments

ESG-indexed debt instruments represent a strategic convergence of liabilities and sustainable finance obligations, embedding environmental, social, and governance criteria into debt servicing and capital allocation processes. These instruments enable organizations to align financial liabilities with sustainability goals, reducing risk exposure while appealing to environmentally conscious investors through performance-linked funding mechanisms.

Net-Zero Financing Commitments

Net-zero financing commitments reshape liabilities by prioritizing sustainable finance obligations that align capital allocation with carbon reduction targets, enhancing long-term financial resilience. Integrating these commitments into liability management fosters transparency and accountability in funding environmentally responsible projects while mitigating climate-related financial risks.

Social Impact-Driven Liabilities

Social impact-driven liabilities prioritize investments that generate measurable social benefits while ensuring financial returns, aligning closely with sustainable finance obligations focused on environmental, social, and governance (ESG) criteria. These liabilities require robust frameworks to quantify social impact alongside risk and return metrics, facilitating responsible money management that supports long-term societal goals.

Regulatory Sustainability Disclosures

Regulatory Sustainability Disclosures increasingly require detailed reporting on liabilities alongside sustainable finance obligations, emphasizing the financial risks and environmental impacts linked to traditional debt and green bonds. Effective money management must integrate these disclosures to ensure transparency, compliance, and alignment with ESG criteria in assessing both conventional liabilities and sustainability-linked financial commitments.

Just Transition Financial Obligations

Just Transition Financial Obligations represent a critical subset of liabilities that prioritize environmental, social, and governance (ESG) criteria within sustainable finance, requiring companies to allocate resources for climate adaptation and social equity during economic shifts. Effective money management in this context ensures liabilities are structured to support decarbonization initiatives and workforce retraining without compromising fiscal stability or long-term financial obligations.

Double Materiality Liability Accounting

Double Materiality Liability Accounting integrates both financial liabilities and sustainable finance obligations by evaluating the impact of environmental, social, and governance (ESG) factors on company liabilities and vice versa. This approach ensures comprehensive money management by accounting for traditional financial risks alongside sustainability-driven obligations, enhancing transparency and long-term risk mitigation.

Liabilities vs Sustainable Finance Obligations for money management. Infographic

moneydiff.com

moneydiff.com