Credit card debt often carries higher interest rates and can increase your liability if payments are missed, leading to significant financial strain. Point-of-sale financing typically offers lower initial interest or promotional rates, reducing immediate liability but potentially increasing long-term debt if not managed carefully. Evaluating these options involves considering the interest terms, repayment flexibility, and potential impact on your overall financial liability.

Table of Comparison

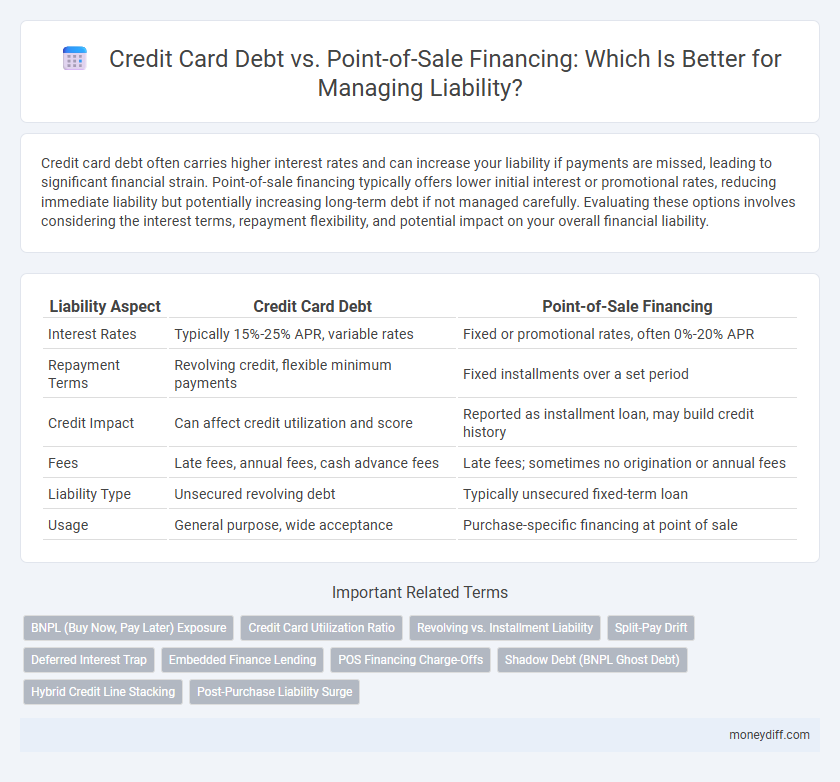

| Liability Aspect | Credit Card Debt | Point-of-Sale Financing |

|---|---|---|

| Interest Rates | Typically 15%-25% APR, variable rates | Fixed or promotional rates, often 0%-20% APR |

| Repayment Terms | Revolving credit, flexible minimum payments | Fixed installments over a set period |

| Credit Impact | Can affect credit utilization and score | Reported as installment loan, may build credit history |

| Fees | Late fees, annual fees, cash advance fees | Late fees; sometimes no origination or annual fees |

| Liability Type | Unsecured revolving debt | Typically unsecured fixed-term loan |

| Usage | General purpose, wide acceptance | Purchase-specific financing at point of sale |

Understanding Liability: Credit Card Debt vs Point-of-Sale Financing

Credit card debt liability involves revolving balances with variable interest rates and potential fees, increasing financial risk if not managed properly. Point-of-sale financing typically offers fixed repayment terms and transparent fees, potentially reducing long-term liability exposure but may encourage higher consumer spending. Understanding the distinct liability structures helps consumers make informed financial decisions and manage debt levels effectively.

Comparing Borrowing Risks: Credit Card Debt and POS Loans

Credit card debt typically carries higher interest rates and potential penalties, increasing borrower liability compared to point-of-sale (POS) financing, which often features fixed terms and lower rates tied directly to the purchase. POS loans may reduce long-term liability by offering structured repayment plans, whereas credit card debt can escalate liability due to revolving balances and variable interest. Consumers should evaluate the total cost of borrowing and repayment flexibility to manage financial risk effectively between these financing options.

Interest Rates and Repayment Terms: Which Liability Weighs More?

Credit card debt typically carries higher interest rates, often ranging from 15% to 25%, compared to point-of-sale financing which may offer promotional 0% APR for a limited period before standard rates apply. Repayment terms for credit cards are revolving and flexible but can lead to prolonged debt if only minimum payments are made, whereas point-of-sale financing usually has fixed repayment schedules spanning 6 to 24 months, encouraging timely payoff. The liability burden of credit card debt often outweighs point-of-sale financing due to compounding interest and extended repayment periods, increasing overall financial risk.

Impact on Credit Score: Credit Cards vs POS Financing

Credit card debt typically has a more significant impact on credit scores due to higher credit utilization ratios and revolving credit reporting, while point-of-sale (POS) financing often appears as installment loans with fixed repayment terms, resulting in varied effects on credit scoring models. Managing credit card balances below 30% of the limit supports a positive credit score, whereas missed POS financing payments can lead to immediate negative marks. Consumers leveraging POS financing should monitor payment schedules closely, as timely installments can potentially build credit, contrasting with credit cards where consistent over-limit balances harm creditworthiness.

Flexibility and Spending Control in Debt Management

Credit card debt offers greater flexibility in repayment terms, allowing consumers to manage cash flow with minimum payments or full balance payments based on their financial situation. Point-of-sale financing often involves fixed repayment schedules tied to specific purchases, which can limit spending control but provide clear timelines for debt clearance. Balancing flexibility and accountability is crucial for minimizing liability risks in personal debt management strategies.

Hidden Fees: A Liability Assessment

Credit card debt often carries hidden fees such as late payment charges, over-limit fees, and high-interest rates that significantly increase financial liability if not managed carefully. Point-of-sale financing may present deferred interest or processing fees that are less transparent but can lead to unexpected debt accumulation. Assessing liability requires a thorough understanding of fee structures in both credit card and point-of-sale options to avoid unforeseen financial burdens.

Consumer Protections: Credit Card vs POS Loan Liabilities

Credit card debt offers stronger consumer protections under the Truth in Lending Act, including dispute resolution rights and limits on liability for unauthorized charges, reducing overall financial risk. Point-of-sale (POS) financing often lacks these robust safeguards, potentially exposing consumers to higher liability and fewer remedies in cases of fraud or billing errors. Understanding the differences in liability protection is crucial for consumers when choosing between credit cards and POS loans for purchases.

Long-Term Financial Impact: Debt Accumulation Risks

Credit card debt often incurs high-interest rates that compound over time, significantly increasing long-term financial liability. Point-of-sale financing may offer lower initial interest rates but can lead to hidden fees and extended repayment periods, escalating total debt. Both options carry risks of substantial debt accumulation if payments are not managed effectively, impacting overall financial health.

Default Consequences: Credit Card Debt vs POS Financing

Defaulting on credit card debt typically results in higher interest rates, late fees, and damage to credit scores, impacting long-term financial liability. Point-of-sale (POS) financing defaults often lead to immediate collection actions and potential repossession of purchased goods, with varying effects on credit reports depending on the lender. Both options carry significant liability risks, but credit card defaults usually generate prolonged financial repercussions compared to POS financing defaults.

Choosing Wisely: Minimizing Liability in Everyday Spending

Choosing wisely between credit card debt and point-of-sale financing is crucial for minimizing liability in everyday spending, as credit cards often carry higher interest rates and can lead to escalating debt if not managed properly. Point-of-sale financing may offer lower initial interest or promotional periods, but hidden fees and rigid repayment terms increase the risk of unintentional liability accumulation. Understanding the specific terms, interest rates, and potential penalties associated with each option empowers consumers to reduce their financial liability and maintain healthier credit profiles.

Related Important Terms

BNPL (Buy Now, Pay Later) Exposure

Credit card debt typically accrues high-interest liabilities affecting consumer balance sheets, while Buy Now, Pay Later (BNPL) exposes users to potentially underreported point-of-sale financing liabilities due to deferred payments without traditional credit checks. BNPL's growing market share increases consumer indebtedness risks as missed payments can escalate financial liability without immediate impact on credit scores.

Credit Card Utilization Ratio

Credit card debt directly impacts the credit card utilization ratio, a key factor in credit score calculations, as high balances relative to credit limits increase liability risk. Point-of-sale financing typically operates separately from credit cards, often resulting in lower utilization ratios and potentially less negative influence on overall credit liability.

Revolving vs. Installment Liability

Credit card debt represents a revolving liability where consumers can carry balances and incur interest on unpaid amounts, while point-of-sale financing constitutes an installment liability with fixed payment schedules and set terms. Revolving credit offers ongoing borrowing flexibility but can lead to higher interest costs over time, whereas installment loans provide predictable liability management through structured repayment plans.

Split-Pay Drift

Split-pay drift in credit card debt increases liability risk by causing unexpected balances to accrue over time, whereas point-of-sale financing typically provides clearer repayment schedules that limit prolonged financial exposure. Managing split-pay drift effectively requires monitoring ongoing payment behaviors to avoid escalating liabilities that can adversely impact credit ratings and financial stability.

Deferred Interest Trap

Credit card debt often carries high interest rates that begin accruing immediately, while point-of-sale financing can advertise deferred interest offers that may trap consumers into paying full interest if the balance isn't cleared within the promotional period. This deferred interest trap significantly increases consumer liability, as unpaid balances convert retroactively to interest charges, amplifying financial risk.

Embedded Finance Lending

Credit card debt typically carries higher interest rates and broader liability exposure compared to point-of-sale financing, which offers embedded finance lending solutions that integrate directly within the purchase process, reducing default risk through tailored repayment options. Embedded finance lending enhances liability management by automating credit assessments and offering real-time payment tracking, improving both consumer experience and lender risk mitigation.

POS Financing Charge-Offs

Point-of-Sale (POS) financing charge-offs exhibit higher liability risks compared to traditional credit card debt due to shorter repayment terms and limited consumer protections, increasing the likelihood of default. Financial institutions report that POS financing defaults contribute significantly to rising non-performing loan balances, necessitating enhanced risk assessment frameworks for liability management.

Shadow Debt (BNPL Ghost Debt)

Credit card debt typically appears on credit reports, impacting credit scores and liability evaluations, whereas point-of-sale financing, especially Buy Now Pay Later (BNPL) plans, often constitutes shadow debt that remains unreported and can obscure overall financial liability. This hidden BNPL shadow debt increases risk exposure as consumers accumulate unpaid balances without clear documentation, complicating accurate credit risk assessment.

Hybrid Credit Line Stacking

Hybrid Credit Line Stacking leverages both credit card debt and point-of-sale financing to optimize liability management by distributing balances across multiple credit sources, potentially reducing interest costs and improving cash flow flexibility. This approach requires careful monitoring of credit limits and repayment terms to avoid over-leverage and maintain a balanced debt portfolio.

Post-Purchase Liability Surge

Credit card debt often leads to a post-purchase liability surge due to high-interest rates and accumulating balances that increase financial burden over time. Point-of-sale financing can mitigate immediate liability spikes by spreading payments, but may result in longer-term obligations that affect credit standing and overall debt management.

Credit Card Debt vs Point-of-Sale Financing for liability. Infographic

moneydiff.com

moneydiff.com